❖ Annualized Yield ❖

The market's focus is on the Mingwen ecosystem, and it's been a long time since we've seen such a beautiful annualized yield:

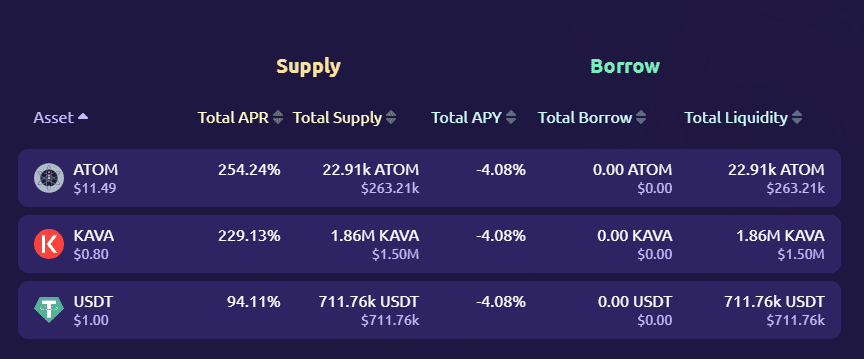

It only supports three mainstream coin assets: USDT, ATOM, and KAVA. Among them, the annualized yield of $USDT is nearly 100%, and the annualized yields of $KAVA and $ATOM exceed 200%.

This generous annualized yield comes from the lending protocol - Hover's Genesis Pool.

❖ Hover Genesis Pool ❖

The hover Genesis Pool started accepting deposits on November 21 and will continue to do so until the first quarter of 2024 when the protocol is fully launched. Users can participate in the Genesis Pool to receive generous early bird rewards. After this initial stage, the pool will close deposits and only support withdrawals.

Participants in the Genesis Pool will share 30,000,000 $HOV rewards, accounting for 3% of the total $HOV supply.

Defilama data shows that the hover.market Genesis Pool has been open for 20 days, and the TVL has exceeded $2.44 million.

❖ About Hover ❖

➤ About

Hover is a decentralized lending market based on kavaEVM.

➤ Innovation

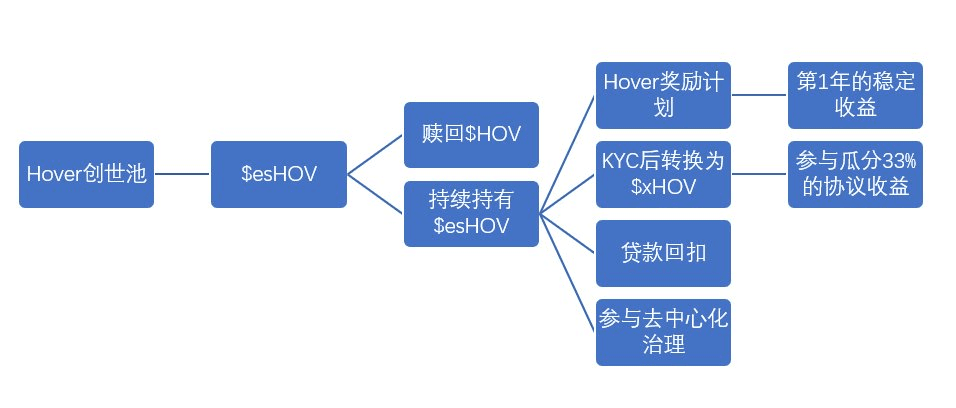

First, the Hover ecosystem has launched a three-generation token model.

Staking $HOV to obtain $esHOV allows participation in ecosystem governance, obtaining loan returns, participating in the Hover reward program, and receiving stable returns in the first year, among other benefits.

$esHOV holders can convert it to $xHOV through KYC, obtaining additional protocol returns.

Second, as a decentralized lending platform, another innovation of Hover is the jump interest rate model.

When less than 80% of a market's funds are lent out, moderate interest rates are used. If more than 80% of a market's funds are lent out, the Hover protocol initiates an increase in interest rates to attract more deposits and suppress lending, thereby regulating the market.

For a detailed interpretation of Hover's products and ecosystem, refer to the previous article by Xiaomifeng:

https://www.aicoin.com/article/358005.html

➤ Audit and Security

The Hover contract audit report was issued by WatchPug. It includes 1 unresolved moderate risk and 1 low risk, 1 medium risk, 3 low risks, and 1 GAS-related risk that have been fixed. There are no high or critical risks.

View the original audit report:

https://1083214283-files.gitbook.io/~/files/v0/b/gitbook-x-prod.appspot.com/o/spaces%2FsMejAYcEclUBJe5Na8xo%2Fuploads%2FIyyYTFGG56ptYklJeysU%2FHover_Audit_Report_by_WatchPug.pdf?alt=media&token=70ca09e4-9cce-4521-9b37-8413cddc8d96

Hover has partnered with Ledger Works to obtain continuous monitoring and security alert services. Ledger Works' DeFi lending financial risk management comprehensive system uses computational rules, deterministic and simulation models to establish a set of continuous monitoring risk parameters for target digital assets.

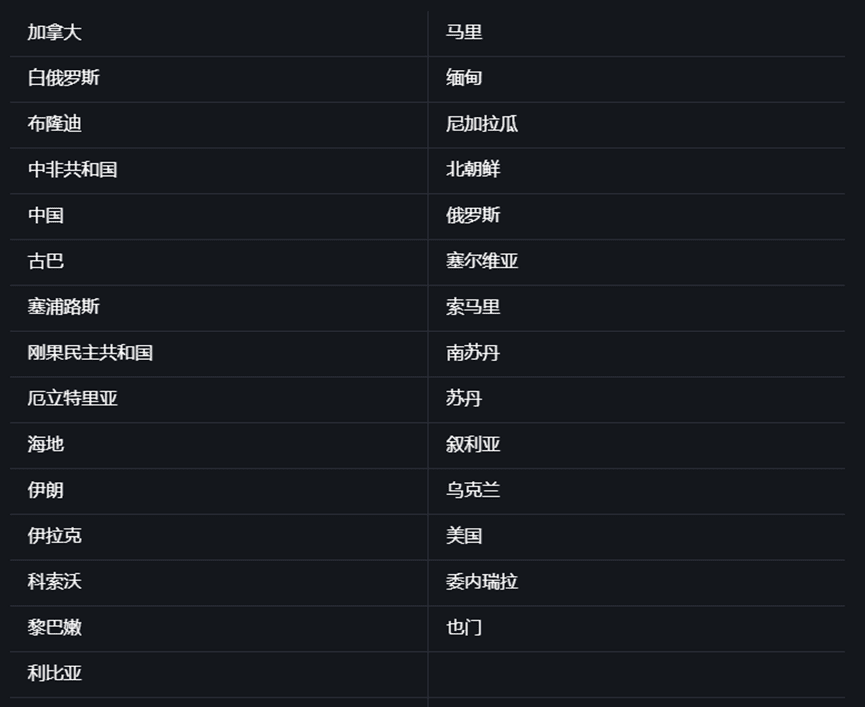

❖ IP Restrictions ❖

IP from the following regions is restricted:

❖ Genesis Pool Returns

Hover Genesis Pool returns are distributed in the form of $esHOV.

➤ Redeeming $esHOV for $HOV

$esHOV represents the staking rights of HOV. It can be redeemed at a 1:1 ratio after 180 days.

If redeemed within 15 days, 50% of it will be destroyed.

The calculation of redemption days and quantities is as follows (the deducted portion is destroyed):

➤ $esHOV Earnings Model and Uses

If $esHOV is not redeemed for $HOV, it will have an earnings model and other uses.

(1) Earnings Model 1: Hover Reward Program

Holding $esHOV allows participation in the Hover reward program, providing stable returns in the first year, including 10% of public offering returns and 0.75% allocated by the Hover ecosystem.

(2) Earnings Model 2: Obtaining Protocol Returns after KYC

$esHOV holders, through the Hover system's KYC certification, can convert $esHOV to $xHOV and participate in sharing 33% of the protocol income. Protocol income refers to the interest income generated by Hover as a lending platform.

(3) Use 1: Loan Rebates

Holding $esHOV allows for fee rebates when taking out loans. In the event of a forced liquidation of a loan, fee rebates can also be obtained.

(4) Use 2: Participation in Decentralized Governance of the Hover Ecosystem

In summary, the financial model provided by the Hover Genesis Pool can be short-term or longer-term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。