Source: Jiazi Light Years

Author: Zhao Jian

Image source: Generated by Wujie AI

The small country of Singapore is becoming an AI powerhouse.

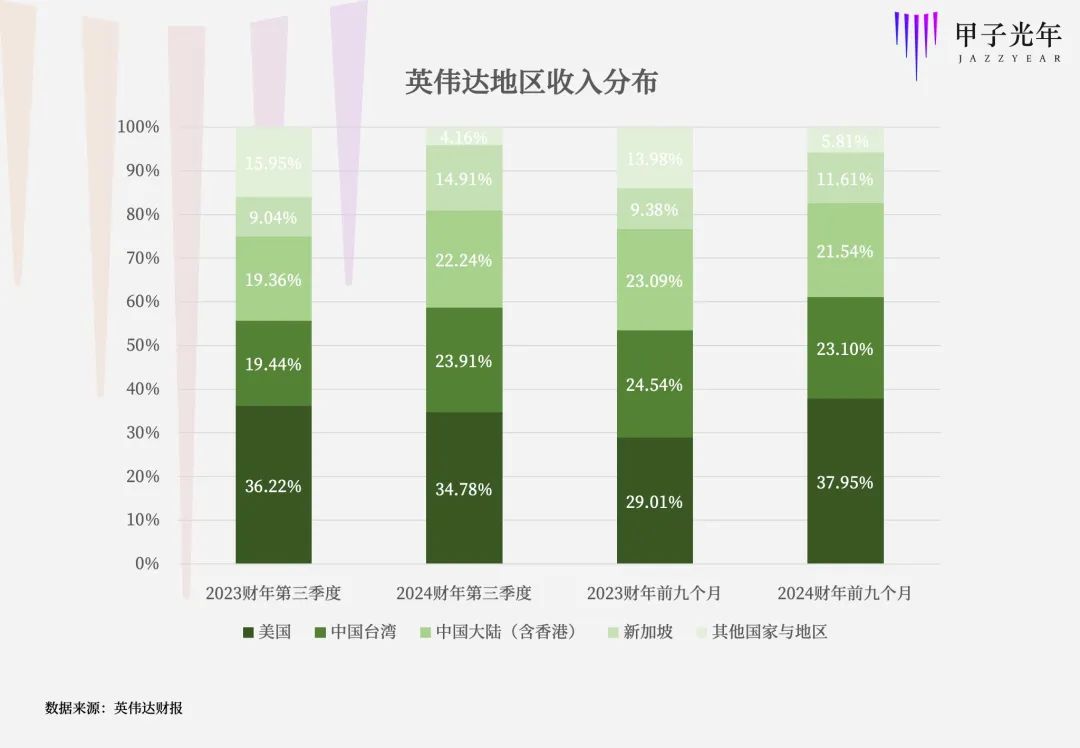

On November 21, 2023, documents submitted by NVIDIA to the U.S. Securities and Exchange Commission (SEC) revealed that approximately 15% of NVIDIA's revenue (about $2.7 billion) in the third quarter of the 2024 fiscal year (corresponding to August to October 2023) came from Singapore, ranking it as NVIDIA's fourth largest market globally, following the United States, Taiwan, and mainland China (including Hong Kong).

It is worth mentioning that this is the first time NVIDIA has disclosed Singapore as a separate consumer market in its financial reports. Prior to this, NVIDIA only disclosed revenue data from the United States, mainland China, and Taiwan, which typically accounted for 70% to 85% of the market share, while other markets including Singapore were categorized as "others."

Recently, NVIDIA CEO Jensen Huang's visit to four Asian countries included Singapore as the first stop in Southeast Asia after Japan, confirming Singapore's strategic position in the Southeast Asian market. Huang announced cooperation with Singapore in the local AI large model field and future infrastructure investments. This marked Huang's return to Singapore after 25 years.

Singapore, a financial, economic, and shipping center in Southeast Asia, has a land area of only 733.1 square kilometers (as of 2021), approximately 1/50 the size of Taiwan Province. Despite being a small territory, it is a major consumer of chips. In the last quarter, Singaporeans spent an average of $600 on NVIDIA chips, while Americans spent only $60 and Chinese spent approximately $3 per capita.

Why has Singapore suddenly become NVIDIA's fourth largest market globally?

1. Quarterly GPU Revenue Quadruples

In the third quarter of the 2024 fiscal year, NVIDIA's total revenue was $18.12 billion, with the top four markets being the United States, Taiwan, mainland China, and Singapore, contributing revenues of $6.302 billion, $4.333 billion, $4.030 billion, and $2.702 billion, respectively.

Singapore's demand for NVIDIA's computing power surged in the last quarter. In the third quarter of the previous fiscal year, Singapore contributed only $536 million in revenue to NVIDIA, accounting for 9.04%. However, in the third quarter of the current year, Singapore's contribution to NVIDIA's revenue reached 14.91%.

During the same period, NVIDIA's overall revenue only grew by 200%, with mainland China's revenue growing by 250%, while Singapore's revenue grew by 400%. Singapore has leaped from being categorized as "other countries and regions" to becoming NVIDIA's fourth largest market.

Who is buying NVIDIA's chips?

NVIDIA does not directly disclose customer names. In its financial report, NVIDIA stated that end customers usually do not directly purchase from NVIDIA, but rather from NVIDIA's customers, including original equipment manufacturers, system builders, system integrators, retailers/distributors, automobile manufacturers, and tier-one automotive suppliers. In the third quarter of this year, sales from Customer A accounted for 12% of total revenue, and in the first nine months, sales from Customer B accounted for 11% of total revenue, both of which fall under the computing and networking department.

The computing and networking department is NVIDIA's largest department, which includes the popular data center acceleration computing platform. In the third quarter of this year, NVIDIA's data center revenue reached $14.514 billion, a 279% year-on-year increase.

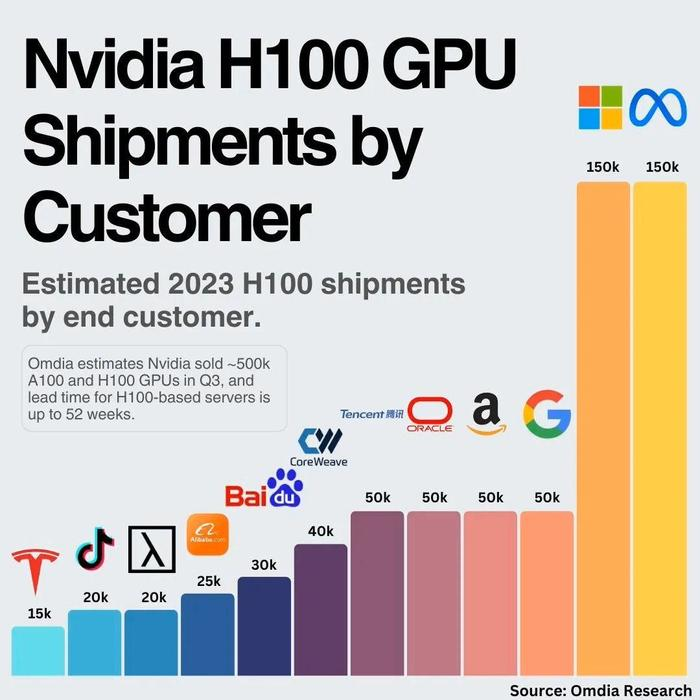

The H100 is currently NVIDIA's most powerful chip on the market (an even more powerful H200 is expected to be released in the second quarter of 2024) and is an indispensable "AI fuel" for data center construction. According to Omdia Research, in the third quarter, Meta and Microsoft purchased the most H100 chips, with 150,000 units each, followed by Google, Amazon, Oracle, Tencent, CoreWeave, Baidu, Alibaba, Lambda Labs, ByteDance, and Tesla.

NVIDIA H100 shipment volume, image from Omdia Research

Although it is not possible to directly associate the list of these tech giants with the Singapore market, almost all of the cloud service providers in this list have built and operated data centers in Singapore.

Could data centers be the main source of computing power demand in Singapore?

2. Small Territory, Data Center Powerhouse

"A small country using these chips for what? Of course, to build data centers!" Sang Shin, a former executive at Temasek and GIC, said on LinkedIn. He previously served as the Director of Digital Innovation at Temasek and the Head of Digital Strategy and Architecture at GIC, and is now the founder of the AI startup FoFty.

Despite its small land area, Singapore is a data center powerhouse.

According to a report by Cushman and Wakefield, Singapore ranks third globally and first in the Asia-Pacific region in the data center market. Tied for first place are Northern Virginia and Portland in the United States, and Hong Kong, China ranks fourth.

Due to its strong infrastructure, excellent international and regional connectivity, low risk of natural disasters, and widespread application of digital technology, Singapore has become a data center hub in the Asia-Pacific region, hosting 60% of the region's data centers. Many large tech companies from China and the United States have chosen to build data centers in Singapore, including Google, Amazon, Microsoft, IBM from the United States, and Alibaba, Tencent, and ByteDance from China, among others.

According to a report by the Singapore Economic Development Board (EDB), one-third of the Fortune Global 500 companies have regional headquarters in Singapore.

However, data centers are heavy consumers of electricity. Singapore currently has over 70 operational data centers with a total power capacity exceeding 378 megawatts, accounting for over 7% of Singapore's total electricity consumption.

In order to fulfill its environmental obligations under the 2015 Paris Agreement and address the challenge of reducing carbon emissions, Singapore authorities issued a "ban" on data centers in 2019, suspending the construction of new data centers and beginning to vigorously develop green energy such as solar and hydrogen, and exploring the application of green energy and liquid cooling technologies in sustainable data centers.

After "cooling off" for three years, Singapore lifted the ban in January 2022. In July 2022, the Singapore Economic Development Board and the Infocomm Media Development Authority (IMDA) announced a pilot program allowing the construction of new data center projects that meet the requirements.

The emergence of ChatGPT at the end of 2022 has added fuel to the recovering data center market in Singapore. GPU-driven accelerated computing data centers have become an indispensable engine for the development of generative AI industries. The biggest beneficiary, of course, is NVIDIA. NVIDIA CEO Jensen Huang once confidently stated, "We are in the first year of a decade-long intelligent transformation of data centers."

In July 2023, Singapore authorities allocated approximately 80 megawatts of new capacity to four data center operators, marking the first capacity allocation after the relaxation of the data center ban. These four operators are U.S. data center operator Equinix, Microsoft, Chinese data center operator GDS, and a consortium composed of Australian data center operator AirTrunk and ByteDance.

Singapore hopes to continue its position as a leader in data centers in the Asia-Pacific and global markets in this new wave of generative AI. An article in Lianhe Zaobao titled "Singapore's Opportunities in the Globalized Computing Power Center" stated that after AI leads a new wave of technological explosion, computing power will become an "upstream resource" in the global economic cycle. If Singapore can seize the opportunity to become a regional and global computing power center, it will play an important role in the regional and global high-tech industry chain.

In addition to data center construction, Singapore is also increasing its investment in artificial intelligence. A professional who graduated from Nanyang Technological University in Singapore told "Jiazi Light Years" that artificial intelligence has always been a direction supported by the Singapore government.

On December 4, 2023, the Singapore government released an updated National Artificial Intelligence Strategy 2.0 (NAIS 2.0), with the goal of doubling the number of local AI professionals in the next three to five years to over 15,000 and establishing a "flagship" website to nurture the country's AI community.

Deputy Prime Minister Heng Swee Keat spoke at the launch ceremony of NAIS 2.0 on December 4, 2023. Image source: CNA/Davina Tham

Recently, Jensen Huang visited Japan, Singapore, Malaysia, and Vietnam, discussing cooperation and investment with local governments and major enterprises. Huang stated that NVIDIA will deepen its cooperation in the field of artificial intelligence in Singapore and is currently working with the Infocomm Media Development Authority to create a large language model in 11 languages to develop local artificial intelligence for use by Singaporean researchers, startups, and the AI industry.

NVIDIA already has a supercomputer in Singapore but hopes to do more in Singapore, including building a larger supercomputer and "possibly investing in a significant AI flagship website."

Huang also discussed the demand for AI chips and systems in Singapore, stating that the first wave was initiated by the world's largest internet and cloud service providers, and NVIDIA sees the next wave rapidly rising, with the core demand coming from countries building sovereign AI infrastructure, followed by industries, companies, and departments building AI factories.

An obvious trend is that the demand for data centers and AI, the two major computing power requirements, has driven a large deployment of GPUs in Singapore.

However, is this the only reason?

3. GPU Transfer Station

Will the local data center construction and artificial intelligence in Singapore consume all of NVIDIA's chips? The answer is no.

In fact, the construction of data centers in Singapore has strict carbon emission standards.

Singapore authorities require that proposals for data center construction must invest in hydrogen or solar energy panels, have a power usage effectiveness (PUE) of 1.3 or lower, obtain platinum certification with the Singapore BCA-IMDA Green Mark, and use "cutting-edge technology and sustainable best practices." In addition, proposals should enhance Singapore's international connectivity and its status as a regional center, and make significant contributions to Singapore's broader economic goals.

This is why the first batch of data center construction capacity was allocated to four strong companies: Equinix, Microsoft, GDS, AirTrunk, and a consortium with ByteDance.

The head of a Chinese company's AI research institute in Singapore told "Jiazi Light Years," "Due to the restrictions on carbon emissions, the actual demand for local data center construction in Singapore is not as high as one might think. The chips purchased in Singapore are very likely to be resold to other Southeast Asian countries for data center construction."

In a LinkedIn post by Sang Shin, a former executive at Temasek and GIC, Henry Goh, Chief Operating Officer of MACROKIOSK, a Malaysian enterprise marketing company, expressed a similar view: "These chips may not necessarily be consumed or used in Singapore, but are resold by entities in Singapore and redistributed throughout Asia (excluding China)."

Henry Goh stated that NVIDIA only has one ASEAN office in Singapore, which means that all ASEAN countries will purchase chips through that office. MACROKIOSK operates in this manner.

He also stated that if this is indeed the case, only NVIDIA officials can answer why Singapore is reflected in the financial report instead of Southeast Asia.

Southeast Asia is currently a hotbed for investment, and the demand for data center construction is soaring. According to a report by Cushman and Wakefield in the first half of 2023, "The suspension of Singapore's IT capacity has led to unmet market demand, which has spread to nearby markets such as Johor in Malaysia. Johor is developing a large number of data center projects and has promised land reserves. Similarly, the large data center in Jakarta, the capital of Indonesia, is driven by its central geographical location in Southeast Asia, and the country's huge population growth has maintained its attractiveness to major investors and operators."

It is worth noting that due to the U.S. ban, the Chinese market is naturally excluded from the resale system in Singapore.

On October 17 of this year, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) issued new regulations on the export ban of chips, further escalating sanctions against Chinese semiconductors. As a result, Chinese customers will be unable to purchase high-performance chips such as NVIDIA's A100, A800, H100, H800, L40, and L40s.

However, Chinese companies' overseas operations are not currently affected. The head of the AI research institute in Singapore mentioned earlier told "Jiazi Light Years" that their AI research institute in Singapore can purchase chips from NVIDIA through normal channels. However, compared to the huge market demand in mainland China, the demand for these overseas businesses may be negligible.

NVIDIA does not want to give up the Chinese market, not only because China is NVIDIA's third largest market, contributing 22% of revenue in the last quarter, but also because this ban may force Chinese chip companies to grow faster and become competitors to NVIDIA.

After being choked by NVIDIA's GPU cards, Chinese AI companies are not too pessimistic but are gradually achieving domestic substitution.

At the Huawei Full Connect Conference in September of this year, Huawei released a new architecture for the Ascend AI computing cluster, claiming to support training of large models with over a trillion parameters and provide a second choice for global customers in terms of computing power. iFlytek is an important large model customer for Huawei, and its chairman, Liu Qingfeng, publicly supported Huawei, stating that the Huawei Ascend 910B can already compete with NVIDIA's A100.

It is understood that Huawei's Ascend AI computing centers deployed with the Ascend 910A chip are expected to expand with the new Ascend 910B chip by the end of this year. Multiple sources in the industry have revealed to "Jiazi Light Years" that the full set of domestic intelligent computing clusters based on the Ascend 910B chip is being deployed in relevant intelligent computing centers. "In some large model tests, both 910A and 910B can compete with NVIDIA's A100, and 910B's performance will be even better," revealed a person in charge of a local intelligent computing center.

During an interview in Singapore, Jensen Huang also publicly stated that Huawei, Intel, and the growing number of semiconductor startups pose a serious challenge to NVIDIA's dominant position in the AI accelerator market.

In addition to Huawei, a number of domestic chip startups are gradually maturing and are gradually introducing their AI chip products to the market for customer validation. At the AICC AI Computing Power Conference held in November, a chip wall specifically showcased the computing cards, acceleration cards, training cards, and inference cards of various chip companies.

Domestic chip products, photographed by "Jiazi Light Years"

There is a significant gap between Chinese chips and NVIDIA, not only in terms of the products themselves but also in terms of the ecosystem. At the year-end ceremony of the 2023 Jiazi Gravity hosted by "Jiazi Light Years," Yu Yi, COO of Shanshi Awakening, stated that most domestic manufacturers, if they were to develop their own ecosystem or software, their R&D personnel might not even know how to use it.

A technical director of a domestic large model company told "Jiazi Light Years" that the biggest challenge in adapting to domestic computing power lies in algorithm adaptation, which requires a huge amount of engineering work and may take 2 to 3 months. For large models with extremely fast algorithm iteration speeds, this is a time cost that AI companies cannot bear.

However, if NVIDIA chips are not available, it will force algorithm companies to collaborate with domestic computing power companies in the ecosystem, identify problems in practice, iterate products, and in the long run, accelerate and promote the healthy development of the ecosystem.

If large models are the next industrial revolution, this is both a dangerous challenge and a huge opportunity for domestic computing power and models.

Reference: One tiny country drove 15% of Nvidia’s revenue – here’s why it needs so many chips, CNBC

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。