"Those People Taught Me How to Play Chess and How to Think"

In 1977, in a corner of Lianyungang, Jiangsu Province, that was not particularly noticed, the story of Zhao Changpeng began. He was born into an ordinary family, both of his parents were teachers, but his father, Zhao Shengkai, as a teacher at the University of Science and Technology of China, was labeled as a "capitalist roader" intellectual during the Cultural Revolution, which brought him endless suffering. Forced to leave urban life and sent to a remote village, he experienced the most difficult years of his life there.

At that time, the schools in the countryside were simple and scarce, with only simple stone tables in the classrooms, which was very common in resource-poor rural areas. In winter, the conditions for studying were even more difficult. In this environment, Zhao Changpeng not only experienced the life of poverty, but also learned to seek knowledge in adversity.

At the age of ten, Zhao Changpeng and his family left the countryside and moved to Hefei, a small city and also the location of the University of Science and Technology of China. This new environment was like an oasis of knowledge for Zhao Changpeng. Here, his world began to change. Zhao Changpeng often sat down to listen to debates among senior students, and the topics they discussed ranged from campus life to political issues. These senior students sometimes also taught Zhao Changpeng how to play chess and go. Through these games, Zhao Changpeng not only learned strategy and critical thinking, but also gradually broadened his horizons.

Zhao Changpeng recalled, "Those people taught me how to play chess and how to think. Being with people seven to ten years older than me made my way of thinking different from children of the same age." In such an environment, Zhao Changpeng's way of thinking began to change. He not only learned critical thinking, but also learned how to find his place in a broader world.

In 1984, in search of a better future, Zhao Shengkai left China and went to pursue a doctoral degree at the University of British Columbia in Canada. Five years later, in 1989, the outbreak of the June Fourth Incident made Zhao Shengkai feel the threat of political turmoil once again. For the future of his family, he decided to lead the whole family to immigrate to Vancouver, Canada, and start a new life. Recalling the visa application process, Zhao Changpeng said, "I remember the line outside the Canadian Embassy was as long as three days. We had to take turns to stay in line at night to keep our place."

At the University of British Columbia, Zhao Shengkai continued his academic journey and pursued a Ph.D. in geophysics. This decision was not only for his own academic pursuit, but also for providing a better educational environment for his children.

Humble Growth in a Multicultural Environment

In the multicultural environment of Vancouver, Canada, Zhao Changpeng's teenage years were different from others. The high school he attended was a microcosm of racial integration, with students from different cultures and economic backgrounds. Despite having many Asian classmates, Zhao Changpeng was one of the few students from mainland China. He keenly felt the wealth gap between himself and other students. He recalled that the children from Hong Kong pursued brands and fashion, while his classmates from Taiwan, although equally affluent, showed a more humble attitude. These experiences gave Zhao Changpeng a deeper understanding of different cultures and values, especially the humility he learned from Taiwanese families, which played an important role in his later life and career.

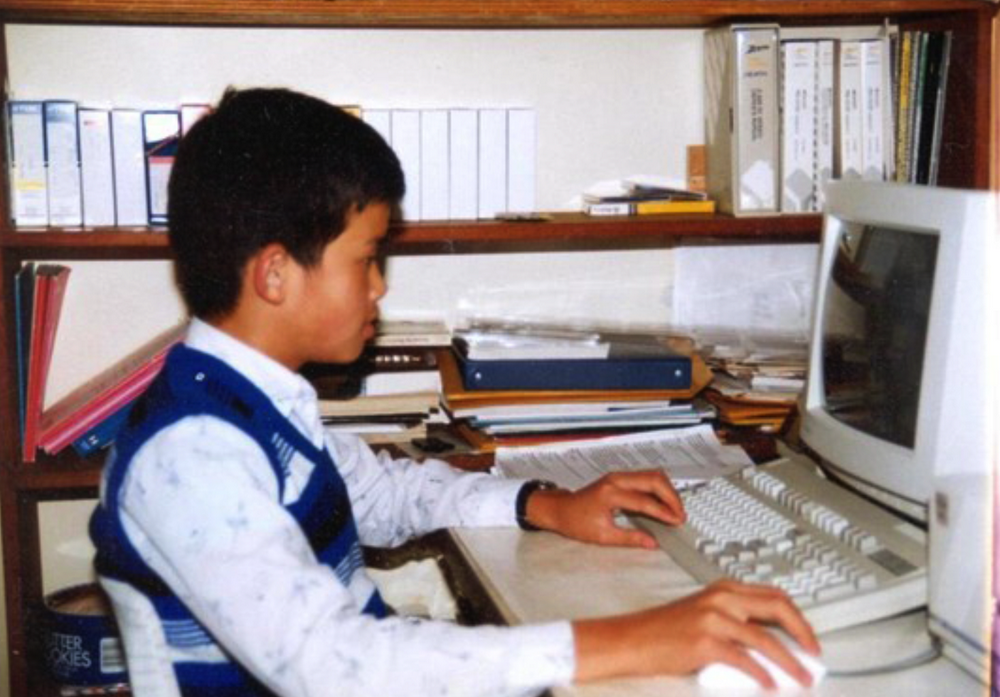

Zhao Changpeng's father, Zhao Shengkai, was his technical and academic mentor. The IBM 286 computer he purchased was not only a tool for Zhao Shengkai's research, but also the starting point for Zhao Changpeng's programming learning. On this computer, Zhao Changpeng not only learned the basics of programming, but also sparked his interest in technology, which played a crucial role in laying the technical foundation for his future founding of Binance and developing trading systems.

At the same time, Zhao Changpeng's work experience during high school had a significant impact on shaping his character. He worked not to try new things or meet his parents' expectations, but truly relied on these part-time jobs to make a living. From a Chevron gas station to McDonald's, these experiences not only cultivated his independence, but also nurtured his work ethic.

Despite later becoming an important figure in the cryptocurrency field, Zhao Changpeng never forgot his roots. He openly shared photos of himself working at McDonald's, showing his respect for the past and his commitment to humility. This attitude formed a sharp contrast with the ostentation and flaunting of some people in the cryptocurrency industry.

In Vancouver, Zhao Changpeng's life, though ordinary, was full of color. As the captain of the volleyball team, he participated in the Canadian National Mathematics Competition. These experiences not only enriched his high school life, but also laid the foundation for his future leadership and problem-solving abilities, earning him the nickname "Champion." This period of life was not only a stage of growth for Zhao Changpeng, but also a crucial period for forming his personal values and worldview. In this multicultural background, Zhao Changpeng learned how to find his place in different environments, laying a solid foundation for his future success on the global stage.

Rich Dad, Poor Dad

In 1995, a young Zhao Changpeng bid farewell to the mild climate of Vancouver and moved 3000 miles away to McGill University, entering the bone-chilling winter and French-speaking Montreal. The underground tunnels of this city seemed to foreshadow the winding and tortuous path that Zhao Changpeng was about to embark on in life.

At McGill University, Zhao Changpeng's academic life was not remarkable. He switched from a biology major to computer science, a transition from interacting with people to conversing with code. His college life seemed peaceful, and his leisure time was spent mostly on ice skating and enjoying pho with friends. At night, the campus computer lab became his refuge, where basic Apple desktop computers witnessed his initial exploration of programming.

However, it was here that Zhao Changpeng began to show his extraordinary talent. In 1999, he collaborated with Professor Jeremy Kubica to publish an academic paper on artificial intelligence—an avant-garde topic that was not widely recognized at the time. In a café in Montreal, Kubica recalled that Zhao Changpeng was the only undergraduate student at his graduate seminar, and his special status and intelligence left a deep impression on him.

At this turning point in his life, Zhao Changpeng read a book that changed his life—"Rich Dad, Poor Dad." This book revealed different paths to hard work and wealth creation through the stories of two fathers. After reading it, Zhao Changpeng began to question his father's traditional view of finding a respectable job. He began to desire to have his own business, rather than just pursuing professional respect.

Zhao Changpeng's father was an exceptionally talented geophysicist. During his work at GeoTech in Ontario, Canada, he worked with geophysicist Jean Legault for six years, creating unforgettable achievements. It was his original code that enabled GeoTech to use software to create three-dimensional inversions of geophysical data, which became a valuable tool for engineers. Even after many years, the company still uses the user manual he wrote. Legault believed that Zhao Shengkai had the ability to achieve great success in the academic or business world, but his humility and focus on the work itself hindered him from reaching higher professional peaks.

Zhao Changpeng recalled that his father would study complex mathematical equations in the laboratory or at home in front of the desktop computer every day, completely absorbed in his academic research. However, due to the enormous changes in history and his identity as an immigrant, Zhao Shengkai could only toil on the fringes of the academic world, unable to enjoy the recognition and achievements he could have obtained if he had been born in a different time or place.

As an intellectual, Zhao Shengkai always emphasized the importance of hard work and obtaining a respectable job. The book "Rich Dad, Poor Dad" changed Zhao Changpeng's way of thinking. He began to realize that while professional respect was important, material wealth should not be ignored. This change in mindset prompted him to make a major decision: to give up his studies and embark on a career.

In 2021, Zhao Shengkai passed away in Toronto due to leukemia. When mentioning his father, Zhao Changpeng's tone was filled with deep regret, as if it reminded him of his own youth. Zhao Shengkai immersed himself in his laboratory and computer world throughout his life, which caused him to miss every exciting moment of his son's volleyball matches. "I was the captain of the volleyball team, and we had two games every week, but my parents never watched a single game," Zhao Changpeng recalled.

In this context, Zhao Changpeng began to reflect on the commonality between "Rich Dad, Poor Dad"—the single-minded focus on work. Even for a billionaire, this kind of focus comes with a cost. Zhao Changpeng worried that in his role as a father, he might unconsciously repeat his parents' "neglect." "I do have this trait," he admitted.

Heading to Shanghai

In 2000, after completing a summer internship at the Tokyo Stock Exchange, Zhao Changpeng chose not to return to McGill University. Despite many media reports mistakenly stating that he was a graduate of McGill University, the fact was that Zhao Changpeng had already begun his career before completing his studies. His mathematical and programming abilities quickly gained recognition in the financial industry, especially in New York, where he developed futures trading software for Bloomberg Tradebook, showcasing his technical talent.

However, even financial centers like Tokyo and New York could not satisfy Zhao Changpeng's growing ambitions. The center of the global economy was shifting eastward, and Shanghai became the new business focus. He decided to return to China—setting foot on the mainland for the first time in over a decade.

When Zhao Changpeng arrived in Shanghai in 2005, the city had become the engine of China's economic growth, and its vitality and business opportunities were completely different from the tranquility of Vancouver, Canada. Zhao Changpeng's return coincided with the golden age of technology in the country, and with the rise of domestic technology companies and industry leaders such as Robin Li, Jack Ma, and Pony Ma, he saw unlimited possibilities.

Despite facing some challenges, Zhao Changpeng quickly found success in Shanghai. In 2005, he co-founded Fusion Systems with several other foreigners, a software-as-a-service (SaaS) company providing high-frequency trading systems. At Fusion Systems, he not only applied his mathematical and coding skills but also learned to "think like a salesperson," using his returnee status to bridge the gap between East and West.

However, a late-night poker game in 2013 completely changed Zhao Changpeng's destiny. In this game, he met Li Qi, a top Bitcoin evangelist in China, and Cao Daron, a Chinese venture capitalist educated in the United States, who introduced Zhao Changpeng to the world of cryptocurrency. Zhao Changpeng went all in, selling his apartment in Shanghai and investing $1 million to purchase Bitcoin (at a market price of $600), but lost half of it in the following year's bear market.

"I'm the One Who Brought CZ into Crypto Trading"

The future billionaire left Fusion Systems in 2013 and first joined Blockchain.info, an early website primarily for tracking Bitcoin transactions, as its chief technology officer. A year later, he was hired as the chief technology officer of OKCoin.

Zhao Changpeng's entry into OKCoin was due to an invitation from He Yi, and what no one could have expected was that He Yi would later become a co-founder of Binance and Zhao Changpeng's life partner. Theoretically, He Yi's position as a cryptocurrency pioneer preceded Zhao Changpeng's, and she later said in an interview with Bloomberg, "Even without considering personal relationships, I'm the one who brought CZ into the cryptocurrency trading business."

In 1986, He Yi was born in a remote village in Sichuan Province, where both of her parents were teachers. While children of the same age were still in kindergarten, He Yi had already started first grade. During her childhood, He Yi was lonely, which gave her more time to read books at home, including various books belonging to her parents. It could be said that He Yi was somewhat precocious—she not only enjoyed reading but also consistently ranked first in exams. In 2006, at the age of 20, while studying psychology in Beijing, she was preparing to take the qualification exam to become a psychological counselor, but soon realized that it was not a lucrative industry. She then took on the role of a class teacher at a university where a friend was studying. In 2012, after her teaching stint, He Yi encountered a turning point in her life when a friend who worked as a director suggested that she try being a host. Surprisingly, He Yi stood out among a group of models, actors, and hosts, and was selected as an outdoor host for travel programs on Travel Channel, traveling across the country with the production team. Later, she joined Beijing TV as the host of "New Discoveries in Beijing."

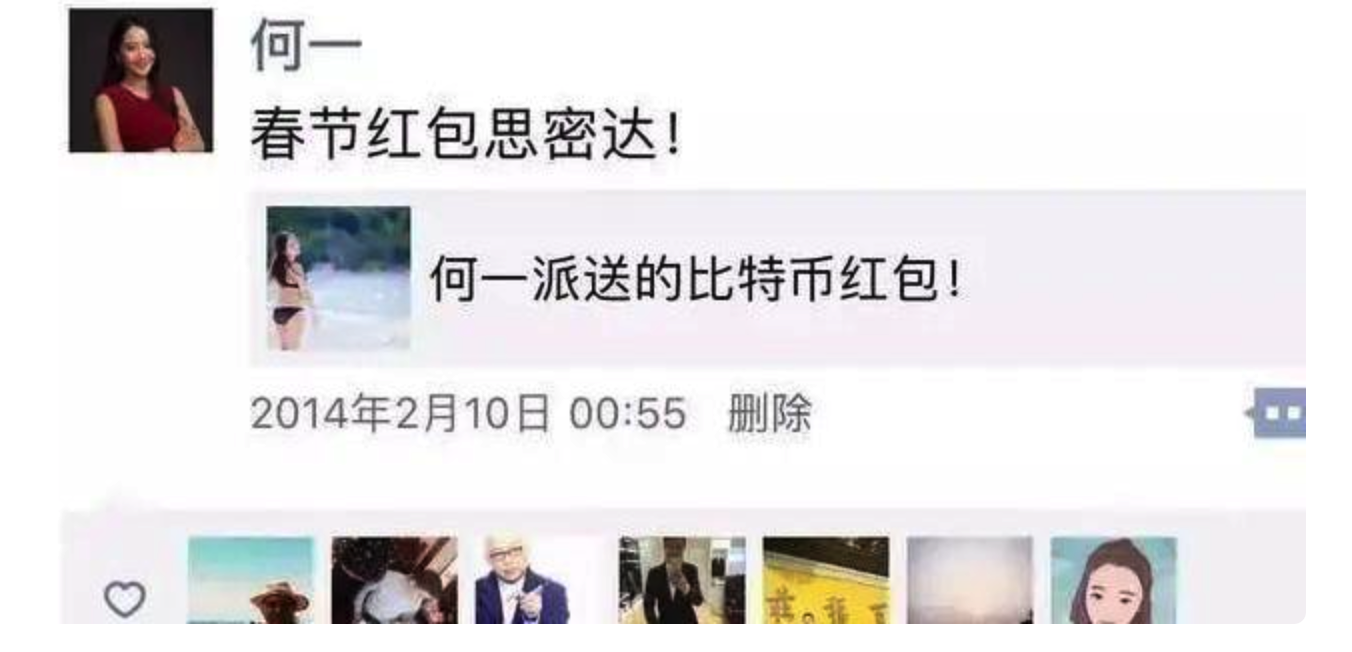

In November 2013, when the price of Bitcoin had just reached $1100 and OKCoin had just opened, the exchange was preparing to launch a Bitcoin red envelope giveaway during the Spring Festival. At that time, OKCoin's investor Maigang approached He Yi and asked if she could help OKCoin distribute a red envelope and promote it for free in her social circle. At that time, He Yi didn't even know what Bitcoin was, so she immediately searched the internet to learn about it. After some research, she found Bitcoin to be fascinating and decided to help distribute the red envelopes. As a result, she joined OKCoin as vice president, responsible for brand building and marketing.

By then, she was already well-known as a travel show host and had served as a judge on reality TV shows to promote OKCoin. He Yi recalled that in the same year (2014), she hired Zhao Changpeng as the chief technology officer because of his extensive experience in engineering trading systems and his experience working at Bloomberg LP, the parent company of Bloomberg News. Both Zhao Changpeng and Xu Mingxing had technical backgrounds, but they often had disagreements due to differences in decision-making logic and cultural backgrounds. As a result, Zhao Changpeng left OKCoin in 2015. After leaving the company, Zhao Changpeng had a major falling out with OKCoin, and the outcome of their dispute was not very dignified. In a lengthy 1600-word Reddit post, Zhao Changpeng detailed how, under Xu Mingxing's guidance, the company used bots to increase trading volume, falsified reserve proof, and had opaque finances. In response, Xu Mingxing accused Zhao Changpeng of falsifying academic qualifications and engaging in other fraudulent activities.

He Yi felt caught in the middle and chose to resign.

Due to the existence of a two-year non-compete agreement, He Yi was unable to join a cryptocurrency-related company, so she was recommended by Zhang Ling, an investment manager at IDG Capital, to join a technology company as vice president. At that time, the technology company was at its peak, having developed popular products such as Yizhibo, Xiaokaxiu, and Miaopai. At the time, Song Joong-ki became popular in China with "Descendants of the Sun," and his influence and the large fan base behind him were coveted by many live streaming platforms. He Yi secured a collaboration with Song Joong-ki among many live streaming platforms, propelling Yizhibo to become a leading live streaming platform.

Who is Chen Guangying

After leaving OKCoin, Zhao Changpeng founded BijieTech, another software-as-a-service company providing software for exchanges and trading platforms. Over the next two years, BijieTech's technology became the cornerstone of 30 Chinese exchanges and later became the driving force behind Binance.

Chen Guangying graduated from Shanghai University of Finance and Economics with a degree in accounting. Zhao Changpeng had known Chen Guangying since 2010, when she was working at a friend of Zhao's liquor store, supplying liquor for Zhao Changpeng's "poker nights" in Shanghai. Later, Chen went to work in backend management at a large commercial bank, responsible for HR, accounting, and daily operations.

In 2015, when BijieTech was established, Zhao Changpeng approached Chen Guangying and asked if she would be willing to join the company in a backend management role. Since most team members were engineers at the time, and the Chinese government had many restrictions on foreign-owned and joint venture enterprises (Zhao Changpeng being a Canadian citizen), having Chen on board as the nominal legal representative would be much more convenient.

Chen Guangying agreed to this arrangement and gradually gained Zhao Changpeng's trust, later becoming the gatekeeper of Binance's treasury. However, little did anyone know that this arrangement would cause a huge stir in the entire cryptocurrency industry. Because Guangying's name appeared in BijieTech's early documents, opponents of Binance seized the opportunity to spread a conspiracy theory, claiming that Chen Guangying might be the secret owner of BijieTech and even Binance, prompting Forbes to write an investigative report on the matter. In a later blog post, Zhao Changpeng wrote, "Chen Guangying and her family have been harassed by the media and netizens. If I had known that this would have such a negative impact on her life, I would not have asked her to do something that seemed harmless at the time."

In 2015, the cryptocurrency market was still in a deep bear market, but another tulip-like frenzy was unfolding in the "stamp card" field. Investors were lured into investment chat rooms by so-called "stamp teachers" and "wealth advisors" to invest in seemingly promising collectibles, often resulting in huge financial losses. While BijieTech did not directly participate in these stamp scams, its technology inadvertently facilitated the spread of this fraudulent activity. This situation raised high alert from the Chinese government. In early 2017, the government swiftly introduced new regulations to restrict the unchecked growth of these digital platforms. By August of the same year, a large number of stamp and collectibles exchanges were forced to close. Most of BijieTech's clients went out of business.

Digital Nomads

Due to his experience at OKCoin, Zhao Changpeng understood the logic of the entire cryptocurrency exchange and the industry's operation, and began considering starting a company that did not involve cash and focused solely on digital asset trading. By not having any ties to financial institutions, former colleague Ver believed this would reduce risk and regulatory scrutiny. At the same time, the significant rise in cryptocurrency prices attracted millions of new investors to the field and gave rise to a new fundraising model within the industry—Initial Coin Offerings (ICOs).

On June 24, 2017, Zhao Changpeng began working on the creation of Binance and initiated the ICO for Binance Coin (BNB). The total supply of BNB was 200 million, with 100 million allocated for the ICO, 80 million held by the team (with locked holdings to be released gradually over the years), and the remaining 20 million held by angel investors. Zhao Changpeng invited He Yi to dinner and showed her the Binance project whitepaper. In July, Zhao Changpeng founded Binance and invited He Yi to join as a partner. She helped rewrite parts of the ICO whitepaper and agreed to join, becoming a co-founder and CMO of Binance.

Originally thought to operate outside of government regulation by only facilitating coin-to-coin trading and avoiding fiat currency trading, the time for Binance in China was running out. As early as 2013, China had first restricted banks from handling cryptocurrency transactions. In an effort to curb capital outflows, combat financial fraud, and tighten control over the national financial system, the Chinese authorities banned ICOs for the first time on September 4, 2017, and began shutting down cryptocurrency exchanges. In response to this move, Zhao Changpeng secretly and nervously migrated data hosted on over 200 Alibaba servers to Amazon Web Services and other servers within a few weeks. This effort was successful, and Zhao Changpeng and other Binance employees moved to Tokyo, ending his 12-year career as an entrepreneur in China.

From the beginning, Zhao Changpeng and Binance seemed destined to dance on the edge of global financial regulation. They preferred to operate outside of government regulation, making it difficult for them to settle in any country for the long term.

In 2018, a scam event triggered by fake Google ads caused countless customers to lose their funds on Binance. Although Binance was not directly responsible for these losses, the event drew high scrutiny from Japanese regulatory authorities. They demanded that Binance register as a formal exchange, which was clearly an unacceptable condition for Zhao Changpeng. As a result, he decided to move his cryptocurrency empire to Malta, where Prime Minister Joseph Muscat had an open attitude towards cryptocurrencies and welcomed related businesses to establish themselves.

However, Binance's time in Malta was also short-lived. Ultimately, Binance announced that it would no longer seek a physical headquarters and instead opted for a headquarters-less operating model. The level of decentralization was so high that, for a period of time, it seemed that even Zhao Changpeng himself was consciously avoiding the internet, as if he and his empire had become a global entity without a fixed address.

"We're Not Just Defending, We're Fighting for the Industry"

In 2017, shortly after the founding of Binance, Zhao Changpeng began engaging with Sequoia Capital. In negotiations in August, Sequoia set a valuation of 500 million RMB for Binance and planned to invest 60 million RMB, taking a 10.714% stake. On August 25, the two parties reached a term sheet and signed a contract on September 1. At the same time, Sequoia agreed to provide a bridge loan worth about 30 million RMB to Binance's Japanese subsidiary. In the term sheet signed by both parties, they agreed to an exclusive cooperation and further negotiations on financing, with the exclusive cooperation deadline set for March 1, 2018, totaling 6 months.

However, three days later on September 4, the situation changed dramatically as the Chinese authorities banned ICOs and began shutting down cryptocurrency exchanges, causing a sharp drop in coin prices. At that time, the entire market was in despair, with exchanges clearing out and projects returning funds. Due to the lack of confidence in cryptocurrency exchanges, Sequoia had to reassess whether to continue investing in Binance, and thus the funds were never disbursed.

Two weeks later, Bitcoin began a strong rebound, and the cryptocurrency market entered a full bull market. Binance made a lot of money during this process, solely from fees and listing fees. As a result, Binance was no longer in a hurry. On December 14, Binance informed Sequoia that existing shareholders and angel investors believed that the valuation offered by Sequoia in the Series A financing was too low. At the same time, Binance contacted another investor, IDG Capital, which was willing to invest at a Series B valuation of $400 million. On December 17, Sequoia attempted to present a new proposal to Binance. However, in the early hours of December 18, Binance informed Sequoia that existing shareholders and founders were not very receptive to this new proposal.

On December 27, Sequoia unilaterally applied for an injunction in a Hong Kong court, prohibiting Binance from negotiating with other investors, and the Hong Kong court approved the injunction. Binance protested the injunction, believing that Sequoia's unilateral application for the injunction was an abuse of the legal process. This was the first round between Binance and Sequoia, and the result was that the Hong Kong court approved the injunction, prohibiting Binance from negotiating with other investors. It wasn't until April 2018 that the situation changed, and Binance's defense was that "negotiations with IDG were for Series B financing and were not within the scope of the Series A financing signed with Sequoia." The Hong Kong High Court announced in a judgment that it would revoke the injunction, but the matter was not officially settled until the end of 2018, which meant that Binance could continue negotiating financing with investors. This was the second round between Binance and Sequoia, and Binance emerged victorious, but the time cost was enormous.

Out of dissatisfaction with Sequoia's actions, in June 2019, Zhao Changpeng sued Sequoia for compensation and posted nearly 10 tweets in a row on Twitter:

- The arbitration tribunal rejected all of Sequoia's litigation requests;

- I won, the case was very destructive, the injunction prevented it from raising funds for Binance at the end of 2017, which was a critical time for the market;

- Previously, the injunction and Sequoia's serious allegations were made public, but because the arbitration was confidential, I could not publicly defend myself.

- The Hong Kong court later determined that Sequoia's behavior in obtaining the injunction was an abuse of the legal process. At the end of last year, the arbitration tribunal finally determined that all of Sequoia's claims were completely unfounded.

- Sequoia China bore $2.4 million in related legal fees, but lost the case. Even after winning the lawsuit, I was not allowed to make the results public, so I had to counter-sue to publicize the results.

- I had to advance $779,000 in legal fees myself, which was something most entrepreneurs could not do. Most entrepreneurs also could not obtain additional funding for their startups in the face of impending litigation.

- Many startups have no choice but to succumb to the unfair terms or practices adopted by venture capital firms, especially a very well-known venture capital firm;

- We're not just defending, we're fighting for the industry;

- Fortunately, there are other options for entrepreneurs today. Welcome to use blockchain-based fundraising activities.

Facing the top investment firm Sequoia Capital, Zhao Changpeng did not back down: "I think the current discourse should be in the hands of entrepreneurs. Good projects and good teams will never lack funding." In the end, Zhao Changpeng not only did not take Sequoia's investment, but also did not take IDG's investment.

The Fork in the Road of Life

During the cryptocurrency boom from 2020 to early 2022, Zhao Changpeng and SBF were the two most influential figures in the field. Their backgrounds and experiences had obvious similarities. Most notably, they both came from scholarly families. However, Zhao Changpeng's father, although a scientist, had always been on the fringes of academia. In contrast, SBF was the son of two law professors at Stanford University, with access to the highest level of resources and environment in academia. Despite similar starting points, their life trajectories presented completely different pictures.

SBF was accused of embezzling user funds and a series of fraudulent activities, ultimately leading to imprisonment. Meanwhile, Zhao Changpeng voluntarily sought reconciliation with regulatory authorities, admitted to violating US anti-money laundering laws, paid a fine, resigned from the CEO position, and further increased Binance's compliance (US regulators did not accuse Binance of embezzling any user funds or engaging in any market manipulation).

"I made a mistake, and I must take responsibility," Zhao Changpeng wrote on the social media platform X (formerly Twitter), "This is the best for our community, Binance, and myself." At the same time, Zhao Changpeng is already a father of two children.

Author's note: This article is written based on public information and has not been reviewed by the parties involved. If there are any errors or omissions, please contact the author @hicaptainz for corrections.

References:

- https://www.businessinsider.com/zhao-changpeng-binance-billionaire-crypto-mcdonalds-fast-food-wealth-lifestyle-2022-10#zhao-is-pleading-guilty-to-anti-money-laundering-charges-and-will-step-down-from-his-role-as-ceo-of-binance-10

- https://macleans.ca/longforms/who-is-changpeng-zhao-canadas-crypto-king/

- https://www.binance.com/en/blog/from-our-ceo/who-is-guangying-chen-and-is-binance-a-chinese-company-2386330931319516973

- https://www.fortunechina.com/lingdaoli/c/2023-04/14/content_431130.htm

- https://36kr.com/p/2302714847357959

- https://m.thepaper.cn/baijiahao_11766431

- https://www.theblockbeats.info/news/43070

- https://www.tuoluo.cn/article/detail-43282.html

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。