Sam (Altman) saves Sam (Bankman-Fried), and FTX, which made a big bet on Anthropic before the global AI wave, has seen its valuation skyrocket in the past year and a half, almost becoming the "hope of the entire village" for FTX creditors.

By Frank, Foresight News

Reality is often more dramatic than fiction. Just as the three-way game between Sam Altman, Microsoft, and OpenAI continues to flip, and the global audience is overwhelmed, OpenAI's clients have already begun to prepare for the future:

According to The Information, over 100 OpenAI clients contacted Anthropic over the weekend and considered switching to Anthropic's AI services. Even OpenAI, which is facing the problem of collective employee resignations, has started to contact Anthropic to discuss a merger (the latest news is that Anthropic has rejected the proposal).

Against this backdrop, Anthropic, a AI startup created by former core employees of OpenAI, has officially emerged. As one of the strongest competitors to ChatGPT, backed by two giants, Google and Amazon, it has become a popular candidate to replace OpenAI.

However, little known is the deep connection between Anthropic and the crypto world. In its $580 million Series B financing completed in April 2022, FTX (led by SBF) invested a staggering $500 million, making it the second largest investment in the FTX/Alameda investment portfolio and now the most hopeful asset for FTX creditors to recover funds.

Who is Anthropic?

You may not have heard of Anthropic, but you must have heard of or used its chatbot, Claude. Yes, Anthropic is to Claude as OpenAI is to ChatGPT.

As an artificial intelligence startup founded in San Francisco in 2021, Anthropic's two co-founders, Daniela Amodei and Dario Amodei, are former employees of OpenAI—both were core developers of GPT-2 and GPT-3.

Just as Microsoft has invested heavily in OpenAI, Anthropic also has two giants backing it—Google and Amazon:

As early as February of this year, Google announced a $300 million investment in Anthropic, followed by a $4 billion investment from Amazon in September.

In October, Google once again increased its investment in Anthropic by an additional $2 billion to support its large-scale model competition with OpenAI.

This means that in less than a year, Anthropic has raised about $6 billion in financing from Google and Amazon, and with such strong support, it has become one of the most powerful challengers to OpenAI.

Boycott by FTX/Alameda

In April 2022, Anthropic completed a $580 million Series B financing, with FTX contributing a total of $500 million, including a lead investment from SBF himself, as well as participation from FTX's co-chief engineer Nishad Singh and former Alameda CEO Caroline Ellison.

As mentioned in the article "Testimony in Court: Sam, Alameda, and FTX in the Eyes of SBF's Ex-Girlfriend," Ellison withdrew $10 million from the company's funds for personal investment in Anthropic, so this portion of the equity will be recovered by FTX creditors for misappropriation of client funds when dealing with the remaining assets of FTX.

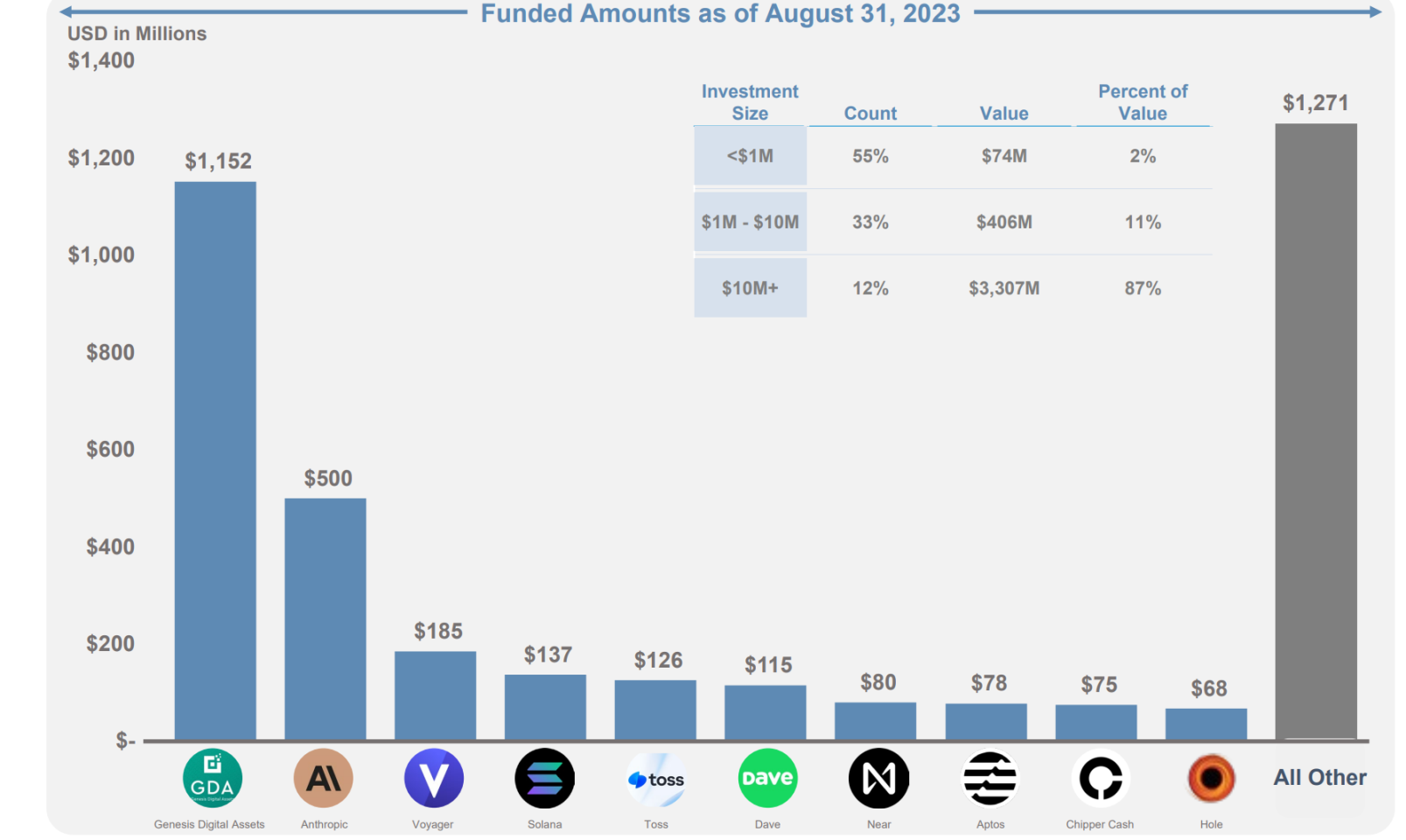

According to previously disclosed court documents, as of August 31 of this year, FTX's Portfolio investment totaled $3.787 billion, with the top 10 investments accounting for 66% of the remaining token, equity, fund, and loan investments, including:

Genesis Digital Assets ($1.152 billion), Anthropic ($500 million), Voyager ($185 million), Solana ($137 million), Toss ($126 million), Dave ($115 million), NEAR ($80 million), Aptos ($78 million), Chipper Cash ($75 million), and Hole ($68 million), among others.

Excluding Genesis and Voyager, which are also in bankruptcy, the other projects with investments of over $100 million, Solana, Toss, and Dave, remain.

FTX has already accelerated the sale of SOL, depositing approximately 6 million SOL (approximately $330 million) to exchanges, and currently holds 42.2 million SOL (approximately $2.19 billion) in locked assets, which will begin to unlock next year, with most remaining locked until 2027 or 2028.

FTX's $126 million investment in the South Korean fintech company Toss and its $115 million investment in the banking transaction app Dave are mainly in the form of equity investments, and in the current liquidity environment, they are not expected to be quickly recovered.

In this context, FTX has made a big bet on Anthropic before the global AI wave, and its valuation has skyrocketed in the past year and a half, almost becoming the "hope of the entire village" for FTX creditors.

Skyrocketing Valuation of Anthropic and Rising FTX Credit

As the FTX bankruptcy process continues to progress, with billions of dollars in assets being recovered and new restructuring plans favorable to users, the expectation of FTX credit prices has also been on the rise in recent times.

From a data perspective, starting in October of this year, the OTC trading valuation of FTX credit has exceeded $0.50, indicating that the market expects that about half of the user assets will be recovered.

As of the latest news on November 18, the quotes for larger FTX creditors have risen to $0.60 to $0.65, an increase of 30% compared to about a month ago, indicating a more optimistic market expectation.

In this context, the skyrocketing valuation of Anthropic in the AI wave has provided hope for the recovery of assets for small and medium-sized FTX creditors.

FTX community partner Benson Sun stated, "Usually, claim buyers tend to prefer buying large size claims at once because the legal fees are relatively low, so small and medium-sized creditors do not have much advantage in terms of price. But after the news about Anthropic came out, now the secondary market for claims feels a bit of FOMO. Claim buyers are even starting to buy small and medium-sized claims."

So the question is, how much has Anthropic's valuation increased after FTX's investment?

When FTX participated in the Series B financing in April 2022, the specific valuation was not disclosed. However, after Google's $300 million investment in Anthropic in February 2023, several media outlets, including The Verge, reported a corresponding valuation of around $3 billion for Anthropic, representing a 10% equity stake.

This means that FTX's $500 million investment in 2022 likely had a valuation similar to $3 billion (the market predicts around $3 billion).

Based on this, in October, Anthropic announced plans to raise funds at a valuation of $20-30 billion from investors, including Google.

In other words, FTX's $500 million equity asset, if valued at the latest (proposed) financing valuation, has at least increased by 7-10 times, reaching $3.5 billion to $5 billion. It's no wonder that FTX stopped selling the $500 million original shares in June this year.

The ongoing drama of OpenAI has further heightened the imagination of Anthropic, providing further upside potential for the compensation amount obtained by FTX creditors.

At present, Anthropic is not only a strong competitor to OpenAI and an alternative AI service for OpenAI clients, but also the second largest investment in the FTX/Alameda investment portfolio, and the biggest hope for asset recovery for FTX creditors, especially small and medium-sized creditors.

The future is always beyond imagination. It now appears that FTX's significant bet on Anthropic before this wave of AI revolution can be considered a "masterstroke." With the global AI wave sweeping through, the valuation has at least increased by 7 times, becoming the biggest unexpected joy for FTX creditors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。