Author: Jiang Haibo, PANews

With the launch of the Ordinals protocol and the creation of the BRC-20 token standard, significant changes have occurred in the dynamics of the Bitcoin network. These innovations have led to a sustained high level of unconfirmed transactions in the Bitcoin mempool, increasing the demand for block space and thus boosting miners' income. This year, Bitcoin's hashrate has achieved a growth of over 80%, and these fundamental improvements may be the main reason why Bitcoin has outperformed other cryptocurrencies before the launch of spot ETF narratives.

Due to the rise of BRC-20 assets and the excellent performance of BTC price, the Bitcoin ecosystem has received more attention, with projects like ORDI and RUNE performing well in this round. Below, PANews will categorize and discuss DeFi projects in the Bitcoin ecosystem, with the following data as of November 14th.

Cross-chain or Ethereum-based DeFi Projects

As the most significant cryptocurrency, with a market share of around 50%, bringing Bitcoin security to other chains (mainly Ethereum) has always been a research direction for DeFi projects. Currently, the main BTC-pegged token is still WBTC, but the underlying BTC is centrally custodied by BitGo. In the decentralized field, there are usually cross-chain and synthetic asset methods for minting Bitcoin-pegged tokens on Ethereum. The main decentralized BTC-pegged tokens include tBTC issued by Threshold, renBTC issued by Ren Protocol, and sBTC issued by Synthetix.

tBTC is introduced to Ethereum and other networks by Threshold's decentralized cross-chain bridge, with the current issuance shown on the Threshold official website as 1662.9 tBTC, making it the main decentralized Bitcoin-pegged token. Curve is the main application for tBTC, and the stablecoin crvUSD also supports tBTC as collateral.

The Ren Protocol team was previously acquired by Alameda Research, and due to the bankruptcy of the latter, Ren is currently in the transition period from Ren 1.0 to Ren 2.0, with 304.5 RenBTC issued on Ethereum.

sBTC from Synthetix was also one of the main decentralized Bitcoin-pegged tokens, but its development has not received much attention due to stablecoin sUSD being the more important synthetic asset in the Synthetix ecosystem. Currently, there are 391.5 sBTC issued on Ethereum, with additional issuance on Optimism.

BadgerDAO, which focuses on bringing Bitcoin into DeFi, has recently performed well, providing automated staking services that allow users to deposit WBTC and earn rewards. Additionally, BadgerDAO has a decentralized stablecoin DIGG pegged to the price of Bitcoin. With the development of Ethereum liquidity staking, BadgerDAO also plans to launch a synthetic Bitcoin eBTC collateralized by stETH.

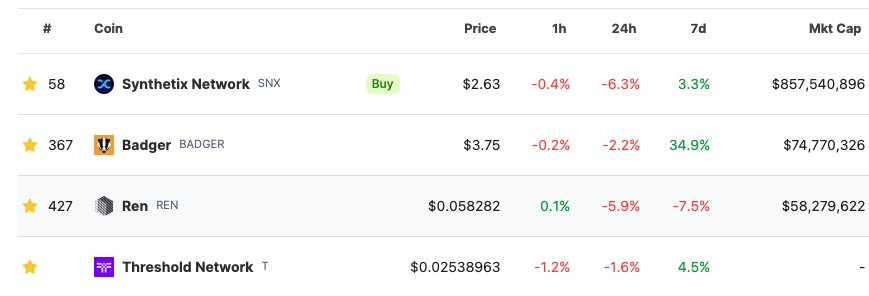

According to CoinGecko data, the native tokens of Threshold, Ren, Synthetix, and Badger have seen price changes of 4.5%, -7.5%, 3.3%, and 34.9% respectively in the past 7 days.

DeFi Projects on Bitcoin Sidechains or Layer 2

Bitcoin does not support full smart contract functionality, only a limited scripting language, and does not have the complex smart contract capabilities of Ethereum. However, it is possible to use sidechain or Layer 2 solutions, including Lightning Network, Rootstock (RSK), Stacks, Liquid, MintLayer, RGB, etc., to carry out DeFi operations within the Bitcoin ecosystem. These projects utilize Bitcoin's security while attempting to increase transaction speed and reduce costs.

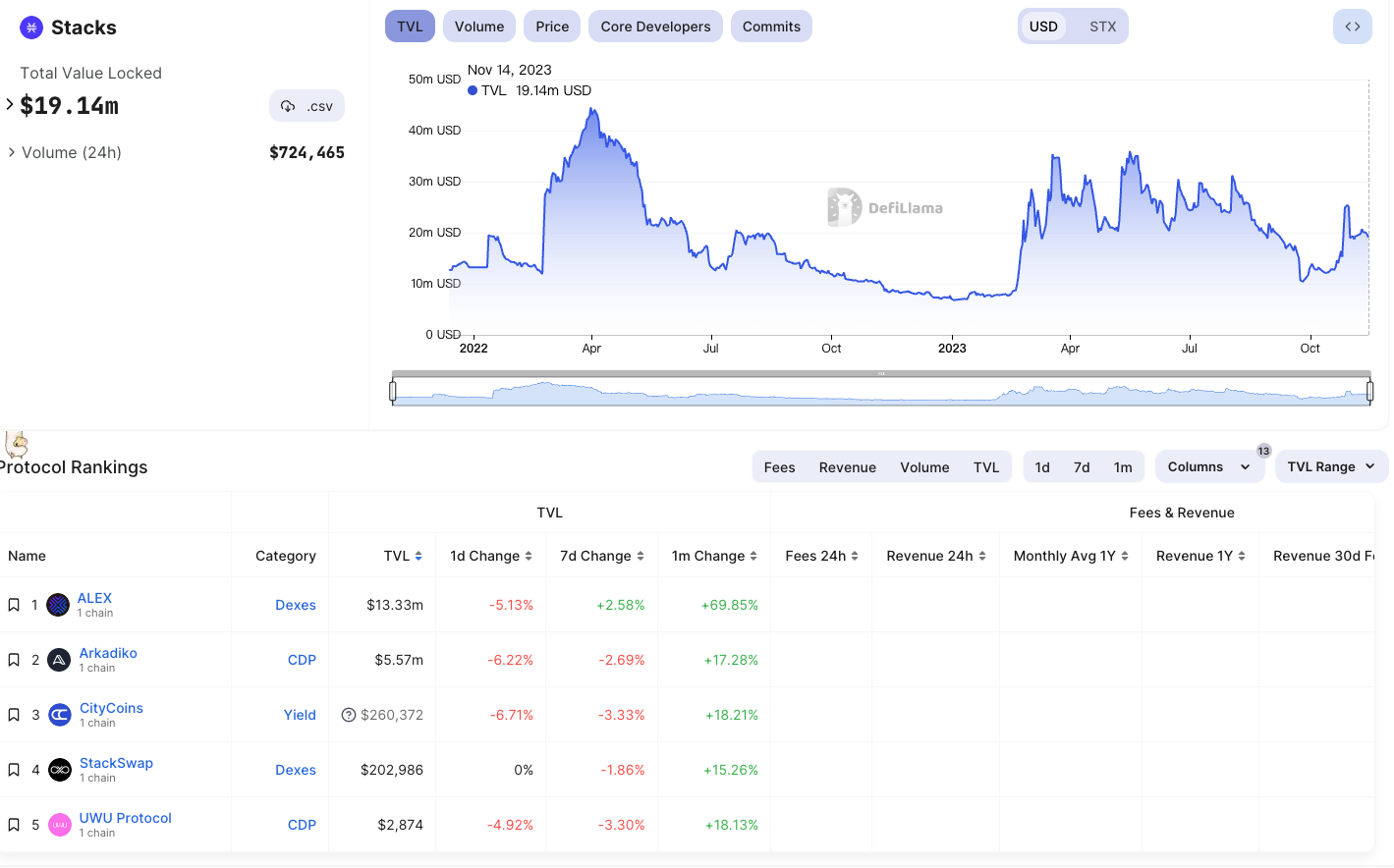

Among these Layer 2 or sidechain projects, the native token with the highest market value is Stacks. According to DefiLlama data, Stacks currently has a TVL of $19.14 million. Within the DeFi projects on Stacks, the decentralized exchange ALEX has the highest TVL at $13.33 million, with a 69.85% increase in the past month.

RSK is a sidechain of Bitcoin that ensures network security by combining the proof of work (PoW) systems of Bitcoin miners and RSK miners, achieving bidirectional anchoring between Bitcoin and RSK.

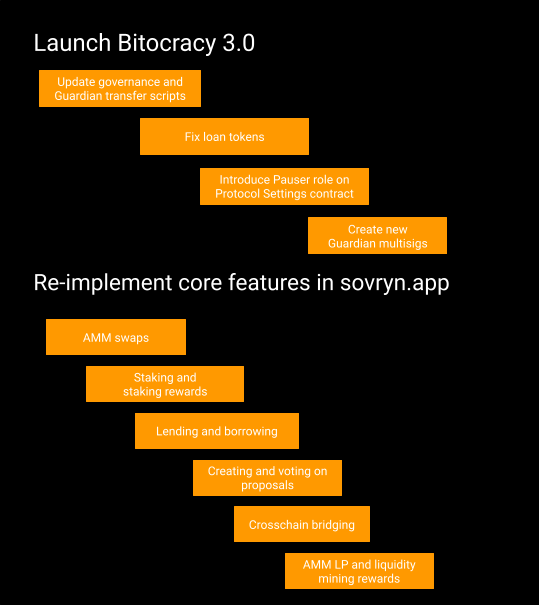

Sovryn is a Bitcoin DeFi platform on RSK, offering a full suite of DeFi services, including the stablecoin DLLR, Sovryn AMM for trading, lending pools, and margin trading. DefiLlama shows that Sovryn's current TVL is $27.23 million. Money On Chain has the RSK-based Bitcoin-pegged stablecoin DoC, and a secondary investment token BPro, allowing users to exchange RBTC for an equivalent amount of DOC, with a current issuance of 3.69 million DOC.

The Bitcoin Lightning Network is a second-layer payment protocol built on top of the Bitcoin blockchain, aiming to achieve fast, low-cost microtransactions while significantly increasing the transaction throughput of the Bitcoin network. This is achieved by creating payment channels, where all transactions within the channel do not need to be immediately recorded on the Bitcoin blockchain, but only when the channel is opened and closed. According to 1ML data, the funds on the Lightning Network are currently $194 million, unchanged in the past 30 days; there are 14,615 nodes, a 1.98% decrease in the past 30 days; and 62,671 channels, a 2.4% decrease in the past 30 days.

10101 Finance is a derivative protocol built on the Lightning Network, enabling the trading of contracts for differences, options, and other derivatives collateralized by Bitcoin, as well as a synthetic stablecoin. The team has previously developed several products based on Bitcoin, including atomic swaps between Bitcoin and Ethereum.

DeFi Functions Based on Specific Protocols like Ordinals

Ordinals directly embed data (such as images, text, etc.) into the witness part of Bitcoin transactions, thus permanently storing non-monetary data on the Bitcoin blockchain. Based on Ordinals, a token standard similar to Ethereum's ERC-20 called BRC-20 has been created, allowing for the creation of unique identifiers representing specific assets or tokens. Through the embedded data from Ordinals, complex financial transaction methods can be carried out on the blockchain in cases where Bitcoin itself does not support smart contracts.

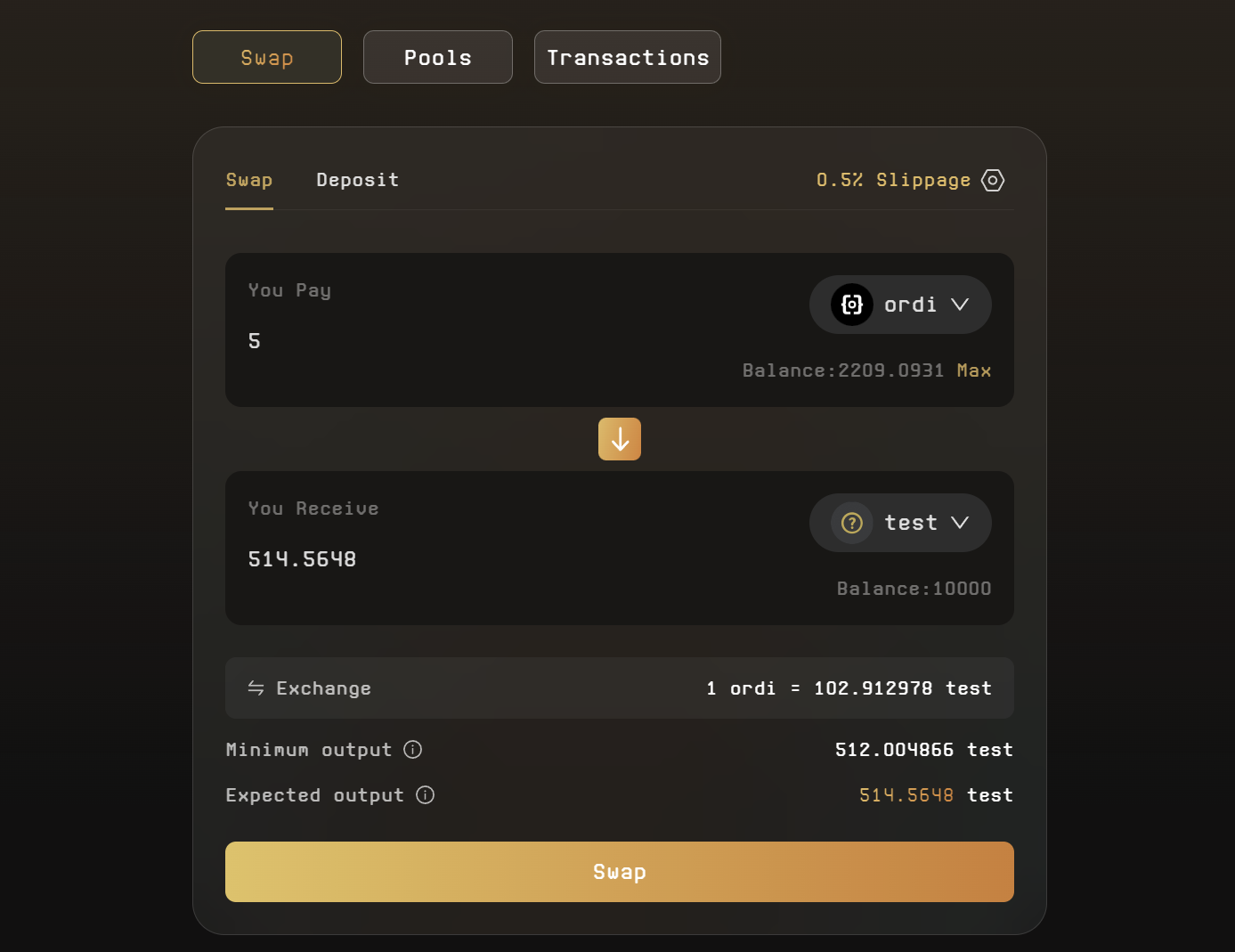

Based on the brc-20 protocol, Unisats has established a brc20-swap that allows users to provide liquidity and trade using the brc20 protocol, claiming it to be the first native Ordinals trading module running on the Bitcoin mainnet using the brc20 protocol. The brc20-swap implements the functionality of an automated market maker, similarly conducting trades based on the x * y = k formula used by Uniswap V2, with a 0.3% fee, of which liquidity providers receive 5/6 of the fee, and the remaining 1/6 is collected as platform fees in the form of the brc-20 asset SATS.

However, OKX CEO and others have questioned the decentralization of brc20-swap, and achieving fully decentralized DEX exchanges presents challenges. Although Unisats' brc20-swap inscription trading is designed to support decentralized participation and deployment, the question of whether it can achieve fully decentralized exchanges remains to be debated due to Bitcoin network's lack of support for smart contracts.

Additionally, there are other protocols similar to Ordinals, such as Atomicals, Pipe, and Runes, which may also achieve similar functionality.

Other DeFi Projects Built on Bitcoin

In addition, there are some projects attempting to implement basic DeFi functions on Bitcoin, which is a challenging but potentially huge area.

For on-chain exchanges on native Bitcoin, THORChain is the main venue. It is a decentralized liquidity network with interoperable blockchains that support cross-chain token swaps. Its feature is not to anchor or wrap assets, but to directly allow users to swap tokens on different Layer 1 blockchains.

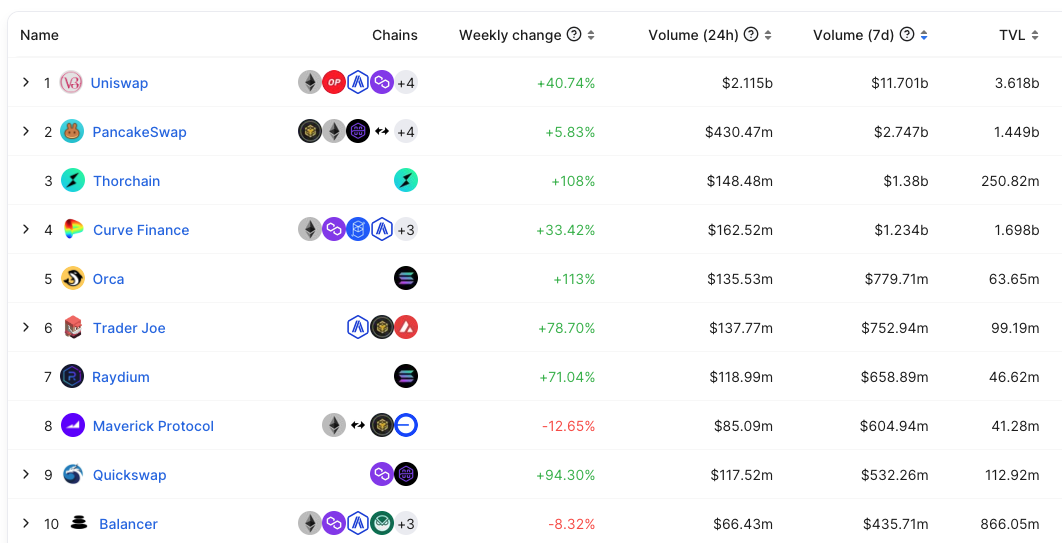

In the past 7 days, THORChain's trading volume was $1.38 billion, ranking third among all DEXs. Currently, THORChain's TVL is $250 million, up 106.7% in the past month. Its native token RUNE is also one of the best-performing assets recently, with the current price of RUNE at $4.84, up 39.3% in the past 7 days.

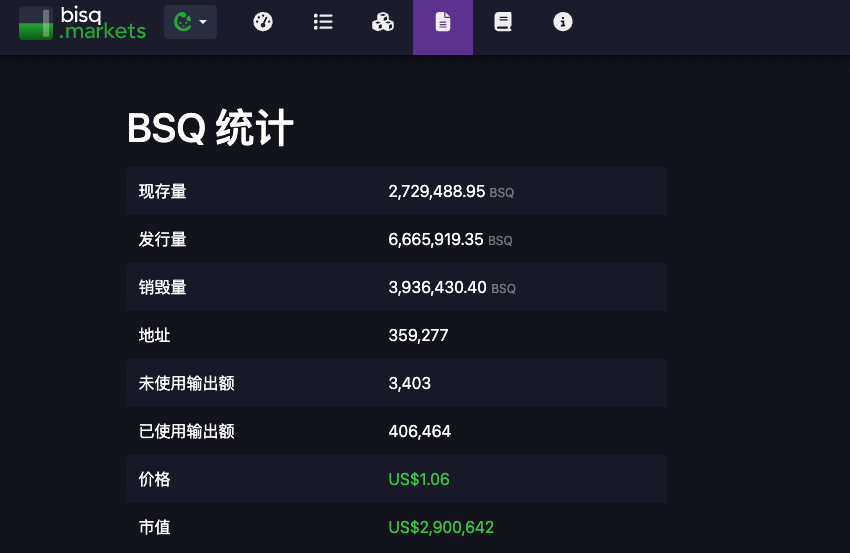

Bisq Network is a DEX that allows users to exchange Bitcoin for fiat or other cryptocurrencies in a trust-minimized manner, operated by a DAO. Bisq issues BSQ as an incentive for contributors, and traders can also receive discounts on transaction fees by holding BSQ, with the current market value of BSQ at $2.9 million.

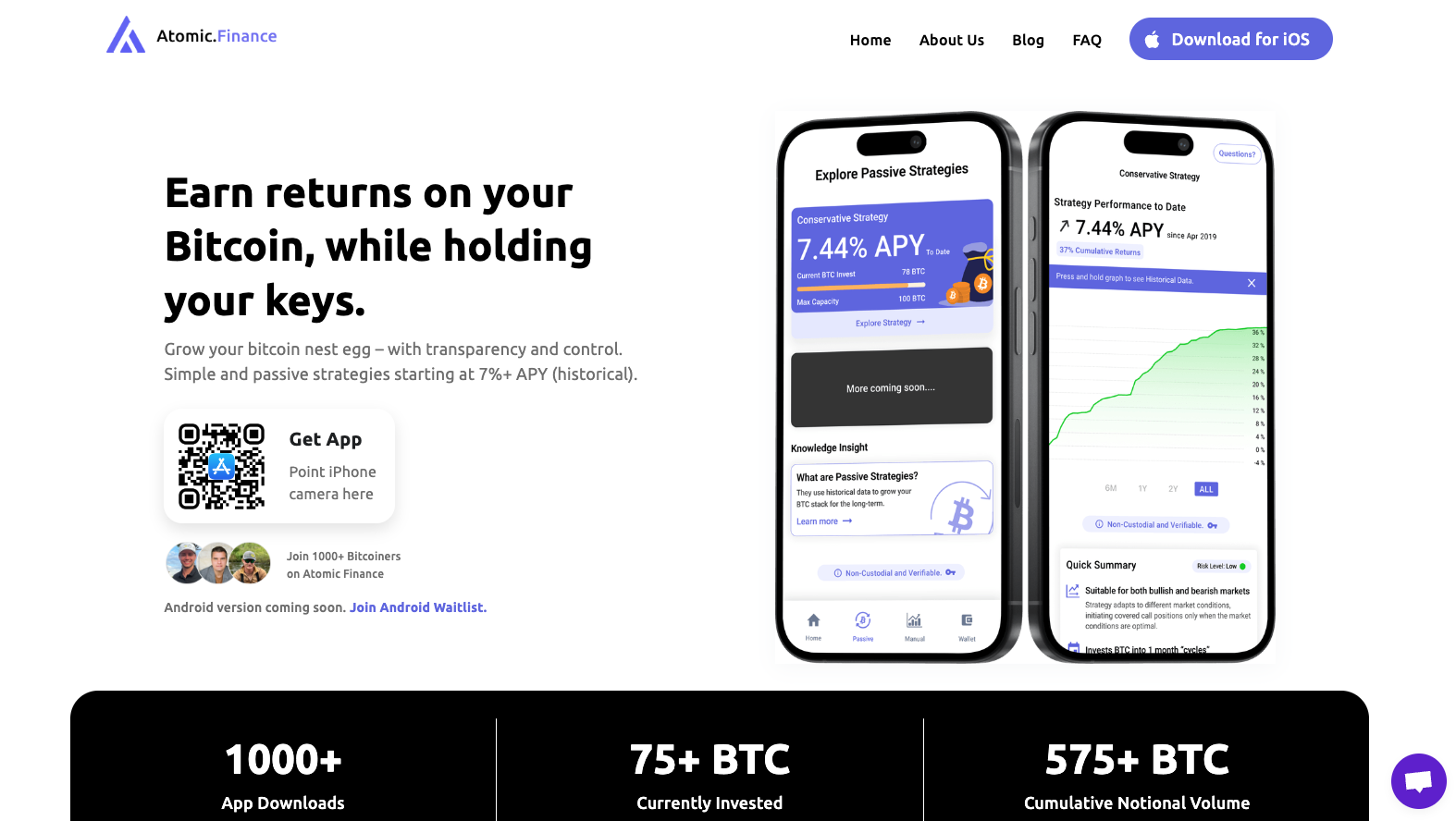

Atomic Finance combines Bitcoin's underlying technology and innovative contract mechanisms to implement DeFi functions on Bitcoin through Bitcoin's script language and discrete log contracts (DLCs). Bitcoin holders can more effectively utilize their assets to generate income while maintaining the security and decentralization of their assets. Currently, the app has been downloaded over 1000 times, with an investment amount exceeding 75 BTC.

Conclusion

As the largest cryptocurrency by market value, the development of applications on the Bitcoin network has never ceased. The above summarizes four types of solutions for developing DeFi applications on Bitcoin and lists representative projects.

Currently, protocols like Ordinals built on the Bitcoin network account for a large number of transactions. Other solutions, such as RGB and Taproot, are also seen as promising technical routes by many.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。