Source: White Dew Living Room

Author: Bowen

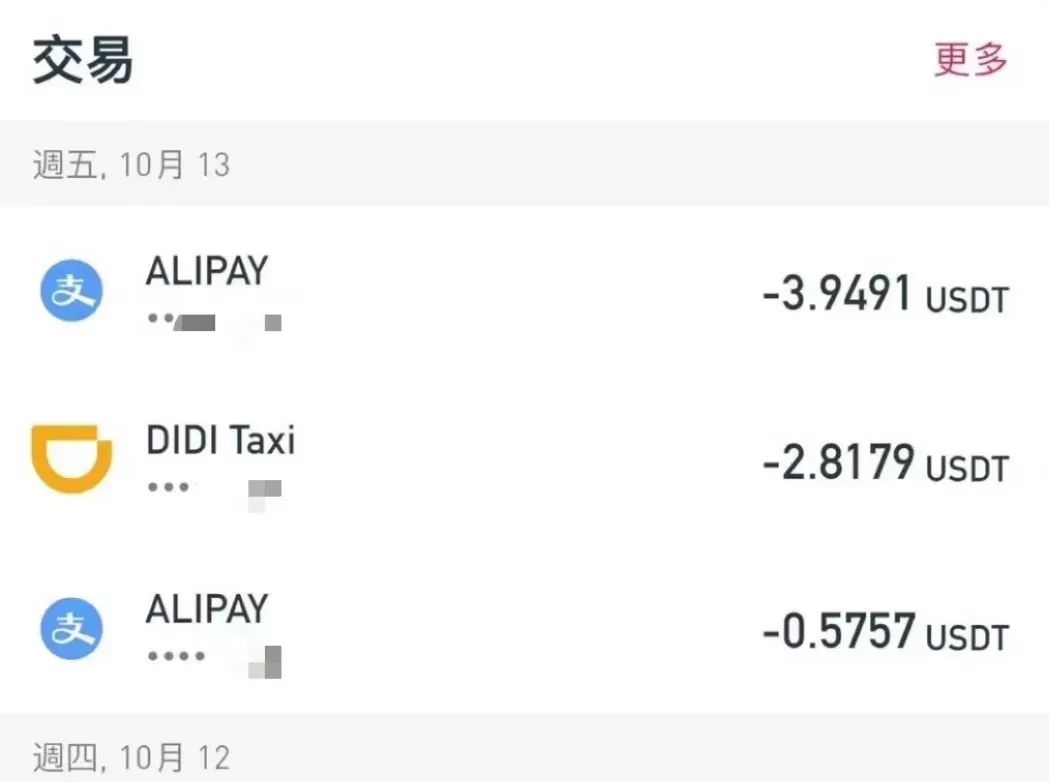

Recently, the app trial of RedotPay, a Hong Kong-based encrypted payment service provider, has lit up my friend circle. After successfully completing the account registration and applying for the encrypted currency virtual card, the smooth and silky user experience made me can't help but exclaim: the future of Web3 is right around us, and it will be integrated into our lives to go further together.

▲ RedotPay user experience

Currently, there are multiple encrypted payment companies involved in the field of encrypted currency virtual cards. Typically, encrypted currency virtual credit cards launched by encrypted currency exchanges (such as Binance) only require corresponding assets in the funding account to be used for consumption and payment in different consumption scenarios through swiping cards, electronic payments, and other methods. The exchanges will charge different levels of fees when users perform payment, withdrawal, exchange, and ATM cash withdrawal (if supported) operations.

Encrypted payment companies issuing independent encrypted currency virtual credit cards require account recharge to activate usage. After recharging and activating, the virtual card can play the same role as a credit card in supported payment scenarios for card swiping consumption. When performing recharge, payment, withdrawal, exchange, and ATM cash withdrawal operations, each encrypted payment company will charge fees according to their own standards.

This article will inventory and compare 9 popular encrypted currency virtual cards to help readers better connect Web3 with the real world.

Binance

Binance Card is similar to a traditional debit card, supported by Swipe. However, unlike recharging the card with fiat currency, the card holds 15 types of digital assets, including BTC, BNB, SXP, and BUSD, and can be directly connected to the funds in the Binance account.

The encrypted currency stored on the Binance Card is automatically converted to local currency at VISA sales points worldwide. However, a significant drawback of the Binance Card is the 0.9% transaction fee for purchases and withdrawals. Fortunately, there is no issuance fee, which helps offset some costs.

The amount of encrypted currency cashback rewards earned through the Binance VISA debit card depends on the amount of BNB tokens staked in the Binance wallet. The only downside to cashback rewards is the need for a certain amount of staked BNB tokens to unlock the highest 8% cashback bonus. Although the transaction fees for using the Binance Card are relatively high, these rewards help offset these costs, especially for individuals holding a large amount of BNB.

Crypto.com

Crypto.com is a global digital asset service provider offering a wide range of products that users can operate on an easy-to-use and intuitive mobile app. Its users can use its VISA debit card to purchase, trade, sell, store, earn, borrow, and pay bills with encrypted currency. Similar to Binance, customers using the card for encrypted currency consumption can earn up to 5% cashback rewards on purchases.

There is no annual fee for using the Crypto.com prepaid card, but there is a $4.95 issuance fee. In addition, a 2% ATM withdrawal fee is charged when withdrawals exceed the limit, recharge fees range from 1% to 2.99%, and a $4.95 monthly inactive fee is charged after 12 months of non-use of the card.

To apply for the Crypto.com VISA debit card, applicants must download the Crypto.com app, complete identity verification (KYC), purchase and stake CRO tokens (unless applying for the Blue Card). Customers who do not stake CRO tokens can still apply for and use the Crypto.com card. However, they are not eligible for additional benefits and card cashback, which is a disadvantage for individuals who do not hold a large amount of CRO tokens. Therefore, the card is mainly recommended for those who have already invested in CRO tokens.

Users can recharge the card with 23 types of encrypted currency, including ADA, BTC, and DOGE. In addition, users can add dollars, euros, pounds, or Singapore dollars to the card using PayPal or debit/credit cards.

Bybit

In February 2023, Bybit launched the Bybit Card. Positioned as a flexible fiat currency exchange channel, it uses Mastercard as its payment processor. Although the Bybit Card was recently launched, it has been well received due to its transparent pricing structure. Unlike others, the Bybit card does not require staking. Currently, only one version of the Bybit Card is available, but the team is working to add various VIP levels, which will provide more rewards than the standard card.

Customers who complete KYC verification in the UK and Europe can register to receive a free Bybit virtual card; there is a $10 issuance fee for the physical card used for ATM withdrawals, which is currently in the reservation-only stage.

To ensure that its customers are not surprised by any unexpected fees, Bybit has opted for a simple pricing structure. Any transaction made with the card will incur a 0.9% encrypted currency exchange fee, plus Bybit's 0.1% transaction fee, resulting in a total cost of 1% per transaction. In addition, a 0.5% foreign exchange fee is charged for transactions made outside the card's currency.

Through Bybit's fund wallet, customers can recharge the card with five types of encrypted currency: Bitcoin, XRP, Ethereum, Tether, and USD stablecoin. In addition, the card supports pounds and euros as fiat currency. During the application process, users must select one fiat currency and one encrypted currency to complete card support.

Bybit cardholders can earn loyalty points, which can be redeemed for various experiences and rewards provided by Bybit partners. Although there is not much information about the loyalty program, it is expected to work similarly to other point-based credit cards.

BitPay

Founded in 2011, BitPay is considered a pioneer in the Bitcoin and blockchain industry. Its prepaid Mastercard allows users to load Bitcoin and other top encrypted currencies onto the card. These assets can then be converted into fiat currency (such as USD) for spending at millions of merchants worldwide that accept Mastercard. In addition, cardholders making purchases will automatically receive rewards.

The BitPay card supports 8 types of encrypted currency, including Bitcoin, Ethereum, and Bitcoin Cash, as well as seven stablecoins such as DAI, USDC, and BUSD.

Cardholders can use contactless payments, PIN payments, and even withdraw up to $6,000 per day from compatible ATMs. In terms of limits, the BitPay card has a maximum daily spending limit of $10,000 and a maximum balance limit of $25,000. When withdrawing from ATMs, a maximum of 3 withdrawals can be made per day, with each withdrawal amounting to $2,000.

No credit check is required when applying for the Bitpay encrypted card, and it will not affect credit scores, making it very easy to obtain. Although there is no annual fee or issuance fee, there is a $2.50 ATM withdrawal fee and a 3% foreign exchange fee when used outside the United States. In addition, there is a $5 monthly fee if the user has been inactive for more than 90 days.

Coinbase

The Coinbase debit card directly connects the physical card to the Coinbase wallet for spending encrypted currency or USDC. The stored encrypted currency is converted into USD, GBP, or EUR, allowing purchases or withdrawals at any VISA-accepting location worldwide.

While any supported encrypted currency can be used, users must select specific assets as their payment preference. Coinbase cardholders can then earn rewards when using the card for purchases. New U.S. cardholders can choose to receive 4% cashback in XLM or 1% in BTC on all purchases. Cashback is not paid automatically and may take 1 to 5 days to appear in the wallet after the transaction is completed.

Although there are no direct issuance or spending fees, currency exchange incurs a spread fee of approximately 2.49%. In addition, there is a 1.5% ATM withdrawal fee.

Users can link the card to Google Pay for quick, secure spending of encrypted currency. Its ease of use and high security features make it the best card for beginners, as anyone with a Coinbase account can use it.

Nexo

Nexo has introduced a Bitcoin debit card for its users to spend their encrypted currency just like using a traditional debit card. The card works slightly differently from other encrypted currency debit cards, using a credit line instead of directly selling encrypted currency. When users apply for a credit line using the company's encrypted currency-based loan products, the card receives funds. The benefit of using the loan is that customers can enjoy a higher level of protection without selling Bitcoin.

The Nexo card has been integrated with global payment provider Mastercard, allowing the debit card to be used at over 40 million merchants worldwide. Transactions made with the debit card are processed in the local fiat currency and do not incur foreign exchange fees.

To obtain a credit line, customers must stake one of the 63 supported encrypted currencies. Nexo will then provide credit in one of the supported 43 fiat currencies. Users can then choose when to repay the loan.

Purchases made with the Nexo card can earn a fixed instant cashback bonus of 2%. Unlike Binance and Crypto.com, these cashback rewards are paid to all transactions without the need to stake any tokens. However, this 2% cashback rate only applies to rewards obtained with the company's NEXO token. Bitcoin rewards offer a lower bonus rate of 0.5%.

Nexo does not charge fees per transaction, but instead charges interest rates based on the user's borrowed funds. The interest rates vary from 0% to 13.9% depending on the loan term, loan-to-value ratio (LTV), and amount. Although there are no fees for ordering a physical card, customers must have a minimum of $500 worth of gold loyalty status and portfolio on Nexo. Overall, Nexo offers an excellent way to spend encrypted currency on a debit card, in addition to its main service of earning interest on encrypted currency deposits.

Wirex

The multi-currency Mastercard introduced by Wirex in 2018 has been expanded to over 5 million customers worldwide. The card supports 9 fiat currencies and 59 encrypted currencies, including Bitcoin, Ethereum, and XRP, making it a reliable encrypted currency debit card for international travelers.

Although the card has no maintenance fees, purchasing encrypted currency and fiat currency incurs a 2.99% transaction fee. In addition, recharging the card with Bitcoin incurs a $10 fee; Ethereum incurs a variable gas recharge fee; and other networks require a $5 payment.

An important advantage of using the Wirex Bitcoin debit card is the ability to interchange stored fiat and encrypted currency on the card for daily expenses and bill payments, with a daily spending limit of up to $50,000. In addition, customers can earn up to 8% cashback rewards by paying with Wirex's native token WXT.

Despite Wirex's high transaction fees, the company offers generous rewards and supports a wide range of assets, making it a powerful Bitcoin debit card.

OneKey

OneKey is a 100% open-source hardware wallet that supports storage for over 1000 encrypted currencies, including Bitcoin, Ethereum, USDT, BCH, XRP, Tron, LTC, Dash, and more.

OneKey has introduced 4 user levels that offer different rates and services, with the option to upgrade to the corresponding user level through payment. The OneKey Card does not set a spending limit and has no monthly fees. By participating in user referral activities and meeting certain conditions, users can upgrade their user level for free.

The biggest difference with other popular encrypted currency virtual cards is that OneKey has successfully integrated with many domestic payment scenarios, including but not limited to WeChat, Alipay, and Pinduoduo. However, due to regulatory pressure, as of September 31, OneKey Card has stopped accepting new user applications from countries or regions including mainland China, Iran, North Korea, Syria, Russia, North Macedonia, Sudan, Venezuela, and Zimbabwe.

RedotPay

RedotPay was established in Hong Kong in 2023, focusing on encrypted wallet and payment solutions. It is the only VISA authorized platform in Hong Kong with a U.S. MSB license.

RedotPay is full-featured, currently offering virtual cards (online), physical cards (offline), and mobile applications (e-wallet) that can be linked to services such as Apple Pay and Alipay. Compared to its peers, RedotPay has lower fees, with no recharge fees, monthly management fees, or additional fiat currency exchange fees; balances can be withdrawn at any time with no exchange fees. With basic KYC, the single transaction limit for payments and withdrawals can reach 1000U; with advanced KYC, the maximum single transaction limit can reach 100,000U.

Currently, RedotPay only offers one card type, with no fees for upgrading to different levels of cards. Users can now choose to recharge and activate the card with Bitcoin, Ethereum, USDC, or USDT, with the potential to expand to more encrypted currency types in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。