Source: carl

Editor: Techub News-Junge

Regulation of OTC in Hong Kong is imminent. Recently, Hong Kong Customs and the Treasury Bureau have both stated their intention to strengthen the regulation of OTC, and some industry professionals have also expressed their support for regulation.

However, Techub News found during on-site visits that most offline OTC shops in Hong Kong are currently operating normally, with little sense of the impending regulation.

Is it the calm before the storm? How will OTC regulation be implemented, and what impact will it have on the industry? These are the current focus of industry attention.

1. Imminent Regulation of OTC

In the President Commercial Building in Mong Kok, Hong Kong, there are 2 over-the-counter (OTC) virtual currency exchange shops and multiple cryptocurrency ATMs, which are frequented by Ahua (pseudonym).

Ahua, a veteran in the coin circle from Shenzhen, often uses Hong Kong's offline OTC and ATMs for cash withdrawals due to the ease of withdrawing funds in Hong Kong compared to the mainland.

He said, "Hong Kong and Shenzhen are completely different. Buying and withdrawing coins is so convenient, and there is no risk. Many people from Shenzhen come to Hong Kong for cash withdrawals. Mong Kok, Tsim Sha Tsui, and Causeway Bay have many OTC shops."

However, recent events in Hong Kong have made Ahua somewhat worried. "OTC may be regulated by the Hong Kong government, and it may not be so convenient then."

Recently, He Peishan, Commissioner of Hong Kong Customs, stated that after the JPEX incident exposed regulatory loopholes, Hong Kong must address the money laundering risks brought by cash-to-cryptocurrency shops. "Regulating these off-exchange trading shops involves two aspects: combating money laundering and terrorist financing, and protecting investors."

Regarding OTC regulation, the Hong Kong Treasury Bureau also stated that the government and regulatory agencies will review regulatory measures from time to time and consider introducing appropriate measures in response to market developments.

Since the JPEX case in September, several OTC merchants such as Lin Zuo, Coingaroo, Crypto Leopard, and Dongji, have been arrested by the Hong Kong police for suspected conspiracy to commit fraud. The regulatory gap in OTC has also become the focus of public opinion, leading to the suspension of operations by several OTC merchants.

Convenient cash withdrawals and deposits at OTC physical stores are channels for many retail investors to trade virtual currencies and withdraw funds. According to industry estimates, there are over 100 OTCs in Hong Kong, with OTCs processing billions of dollars in cash transactions annually.

Tang Yi, Co-Chairman of the Hong Kong Blockchain Association HKBA.club, stated that OTC is very common in Hong Kong, with many small stores and ATMs, and licensed entities such as OSL and HashKey also provide offline OTC services. After the JPEX incident, it is inevitable for the Hong Kong government to regulate the OTC industry, and relevant government departments have expressed their intention to strengthen regulation, including KYC (Know Your Customer), CTF (Counter-Terrorist Financing), and AML (Anti-Money Laundering).

Several OTC executives have expressed their support for the Hong Kong government's regulation of the industry.

According to media reports, Li Donghan, co-founder of OTC "One Bitcoin," stated during an interview that they voluntarily set rules, requiring KYC for transactions over 120,000 RMB; they also established a database and continuous monitoring system to detect suspicious wallets, and the store will refuse transactions involving suspicious wallets and report to the Joint Financial Intelligence Unit.

Lin Yinhuan, founder of another OTC "Crypto HK," also expressed a desire to obtain a license and hopes for clearer enforcement guidelines. He has studied the regulatory frameworks of multiple regulatory agencies and learned that the Money Service Operator (MSO) license from the Customs and Excise Department is not applicable, and the Securities and Futures Commission's framework for virtual asset service providers requires a high threshold for establishing automated systems, which OTCs do not have as they do not hold customer assets.

2. Most OTCs are operating normally

On one hand, there is the imminent strengthening of regulation, while on the other hand, the OTC industry remains calm.

Recently, Techub News visited several offline OTC shops and cryptocurrency ATMs in Hong Kong and found that most of them are operating normally. A shop owner with nearly 10 OTC branches confirmed to Techub News that all their branches are operating normally and have not been affected by the JPEX case.

OTC promotional advertisement

Another OTC shop employee told Techub News that although their business has not been affected, they have seen a significant decrease in the number of customers, most of whom are from the mainland.

According to Chainalysis data, mainland China remains the world's fourth-largest cryptocurrency trading market. However, unfriendly cryptocurrency policies in the mainland have created many obstacles for cryptocurrency users, with transactions not being legally protected, occurrences of frozen accounts, and even police investigations. Hong Kong's open attitude towards the cryptocurrency industry and convenient OTC services provide a good channel for mainland cryptocurrency users to deposit and withdraw funds.

According to media reports, the founder of Crypto HK previously stated that during the epidemic, mainland Chinese customers accounted for less than 5% of their total customers, but by July of this year, the proportion of mainland Chinese customers had increased to around 50%.

The aforementioned shop employee stated, "OTC is a market necessity. As long as banks cannot provide convenient cryptocurrency deposits and withdrawals, OTC will definitely exist. If offline stores are not allowed, they can completely do online business, as it is all peer-to-peer transactions."

"We have many stable customers, and our main business is online," the employee said.

OTC is divided into two modes: online and offline. Most OTC transactions are completed online rather than at physical OTC stores. For many merchants, physical OTC stores are more of a storefront, convenient for some retail transactions, and more importantly, to expand a stable base of online users.

The aforementioned employee stated that the OTCs affected by the JPEX incident are actually only a small part. "We only engage in simple OTC transactions and do not engage in promotional activities similar to JPEX's high returns, so we do not get involved in fraud and are very safe."

Cryptocurrency ATM

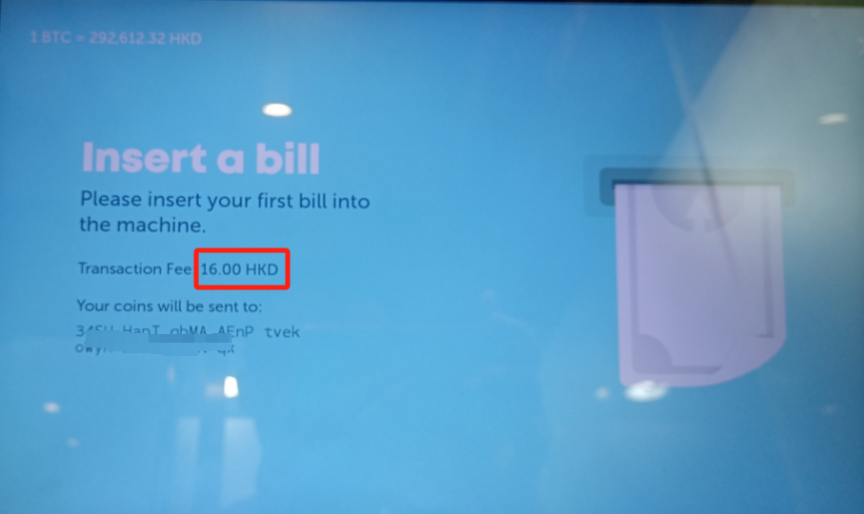

Techub News experienced several OTCs and ATMs, which were very convenient. KYC is generally not required, and transactions only take a few minutes to complete. OTC shops often offer exchange rate discounts, while ATMs charge varying fees, usually several tens of Hong Kong dollars.

A certain ATM, with a fixed fee of 16 HKD

Since Hong Kong's issuance of the Virtual Asset Declaration in October last year, the number of local cryptocurrency users in Hong Kong has rapidly increased.

An OTC shop employee told Techub News that another important customer group for physical OTC stores is users who are not very familiar with cryptocurrency trading, mainly from Hong Kong, and often older in age.

Tang Yi, Co-Chairman of the Hong Kong Blockchain Association HKBA.club, stated that many people in Hong Kong conduct transactions using USDT and often need to exchange USDT for Hong Kong dollars, US dollars, and other fiat currencies. OTCs in Hong Kong provide them with convenient services, and in Hong Kong, they can easily exchange cryptocurrencies for fiat currencies of countries such as Dubai, South Korea, and Japan.

However, behind the emergence of OTCs in Hong Kong are high profits and multiple risks.

Tang Yi stated that the biggest risk for OTCs is third-party fraud, which is common in the Hong Kong OTC trading industry, affecting over 20% of OTC businesses. Many OTC operators often have to assist the police in handling this type of case.

In addition, many OTC merchants are involved in money laundering cases. Recently, Bitrace's analysis of Tron addresses with obvious OTC business characteristics found that nearly 3.5 billion risky USDT had flowed into these addresses in the past 2 years.

3. Regulation is not difficult, but caution is required

Hong Kong's OTC Regulation is Inevitable, with a Focus on How to Regulate

Mura founder and lawyer Wu Wenqian told Techub News that he suggests Hong Kong should refer to the regulatory policies of the United States, Dubai, and others to implement a licensing system for the OTC industry. For example, OTC shops should be required to apply for exchange licenses, and users should undergo KYC verification to reduce the risk of money laundering.

"Furthermore, OTC regulation will be more favorable for compliant exchanges holding licenses, and will help promote the healthy development of compliant exchanges," Wu Wenqian said.

Chen Lexi, founder of Zhongzhu Global Group, suggested that OTC should be regulated by customs, and the existing MSO license should be extended to virtual assets. Transactions over 8000 RMB should require real-name registration, and there should be a designated person receiving AML training and a mechanism for reporting suspicious transactions.

Li Donghan, co-founder of "One Bitcoin," expressed a desire to start with industry self-regulation, planning to establish an association with major stakeholders to jointly develop KYC and AML standards. OTCs that meet the standards can join, and they also hope to share suspicious wallet databases with the industry to intercept the source and implement two-way data exchange with law enforcement agencies.

However, many industry professionals also hold a conservative attitude towards OTC regulation.

An industry analyst told Techub News that the market demand in mainland China and the relatively flexible regulation in Hong Kong have created a unique OTC ecosystem in Hong Kong. If Hong Kong implements strict OTC regulation, allowing only local residents to register and use licensed cryptocurrency exchanges, it will severely impact the industry by excluding mainland Chinese users.

In fact, overly strict regulation may not be effectively implemented, as OTC is fundamentally a peer-to-peer primitive trading method.

"The difference lies in whether OTC is successfully incorporated into the legal regulatory framework or is regulated and excluded to the gray area," the industry analyst said.

Wu Wenqian also believes that the formulation of OTC regulatory rules in Hong Kong should be cautious: "Regulating OTC is actually easy to achieve technically, but OTC plays an important role in ensuring industry liquidity. If compliance regulation is carried out in a traditional manner, it may greatly reduce industry liquidity. The most difficult part is often finding a balance between regulation and the market."

The future development of Web3 in Hong Kong may be worth learning from, according to Kong Jianping, a director of Cyberport.

He stated that there are two contradictions in Hong Kong's development of Web3: the government has introduced encouraging policies, but there have been many instances of "coin speculation" and "platform collapses"; the government hopes to attract more outstanding developers and entrepreneurs, but often many illegal organizations such as pyramid schemes cause losses to investors through promotion and advertising.

"However, we also see that the technology exploited by illegal activities is often cutting-edge, which reflects that Web3 will only get better. As long as the Hong Kong government continues to promote and support Web3, the rest can be left to entrepreneurs," Kong Jianping said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。