"Bitcoin as an investment avenue often sparks debate and discussion. The discussion around the security of cryptocurrency is now more important than ever in the minds of global cryptocurrency investors: Is investing in Bitcoin really valuable? Is it really secure?"

What is Bitcoin?

Since its birth in 2009, Bitcoin has rapidly risen to become the most important cryptocurrency in the world. As a decentralized, secure digital currency, it can facilitate transactions without relying on intermediary institutions such as banks. As Bitcoin matures, investors have shown a high level of interest in it, considering it an ideal choice for diversifying their asset portfolios.

The security of Bitcoin is a topic of ongoing debate and scrutiny. On one hand, Bitcoin provides transparency and security through blockchain technology and encryption algorithms. Transactions are tamper-proof and decentralized, giving it the ability to resist fraud and censorship.

However, Bitcoin also carries some risks that may deter many investors and traders. Therefore, it is important to assess its advantages and disadvantages before making conclusive comments on the security of Bitcoin.

Value of Bitcoin

High growth potential: Bitcoin has experienced tremendous growth, increasing in value over time, attracting investors seeking high returns.

Diversification: Bitcoin is a unique asset class that can help diversify assets and reduce portfolio risk.

Hedge against inflation: Bitcoin is considered a hedge against inflation, and its scarcity makes it a valuable asset.

Global accessibility: Bitcoin is a global currency, easily transferable across borders without the need for intermediary institutions.

Technological innovation: Bitcoin is at the forefront of blockchain technology, capable of transforming various industries. Investing in Bitcoin provides exposure to this emerging technology and its applications.

Risks of Investing in Bitcoin

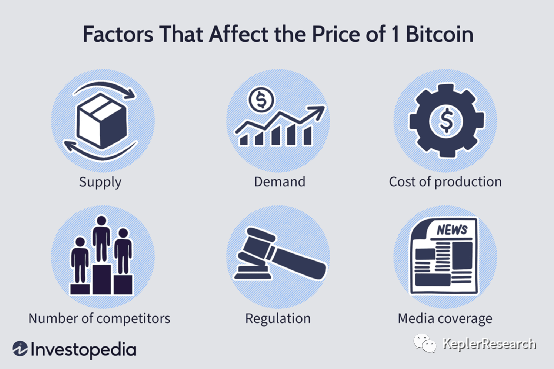

Volatility of Bitcoin: Bitcoin prices are highly volatile, influenced by factors such as supply and demand, regulatory news, and economic stability.

Network threats to Bitcoin: The decentralized nature of Bitcoin brings network security risks, requiring measures to ensure asset security.

Tax implications of Bitcoin investments: Bitcoin is considered a capital asset, and selling profits are subject to capital gains tax.

Intrinsic value of Bitcoin: The value of Bitcoin is purely speculative, driven by investor sentiment and market forces, making it a high-risk investment.

Regulatory environment for Bitcoin: Bitcoin's regulatory environment varies across different regions, requiring an understanding of relevant regulatory dynamics.

Competition in the cryptocurrency space: The existence of thousands of cryptocurrencies poses a competitive threat that may impact Bitcoin's market position and value.

Despite the risks associated with investing in Bitcoin, there are secure methods to mitigate these risks:

Secure storage: Store your Bitcoin in a secure wallet, with cold wallets being considered the safest choice for offline storage.

Prudent investment: Do not invest more than you can afford to lose. The price of Bitcoin may fluctuate significantly, and you may risk losing your entire investment.

Stay informed: Stay updated on upcoming developments and information in the Bitcoin market. This can help you make informed investment decisions.

In conclusion, investing in Bitcoin offers potential returns but also comes with risks. While Bitcoin provides unique investment opportunities, it is also fraught with volatility, regulatory uncertainty, and network security risks. Therefore, it is crucial for investors to understand these risks and take necessary precautions. As the saying goes, "Do not invest more than you can afford to lose."

Note: All content represents the author's personal views and is not investment advice, nor should it be interpreted in any way as tax, accounting, legal, business, financial, or regulatory advice. Before making any investment decisions, you should seek independent legal and financial advice, including advice on tax consequences.

For more content, follow: Public Account KeplerResearch Twitter @kepler008

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。