Title: Is Bitcoin Being Replaced by a "16-Year Historical Cycle"?

Author: Jeroen van Lang

Translator: Frank, Foresight News

Everyone has heard of the 4-year bull-bear cycle that Bitcoin is going through, but have you ever thought that Bitcoin might experience an even larger cycle? Can this larger cycle reflect the way humans adopt new technologies? Have we seen something similar before, such as the internet?

In this article, we will delve into a new theory that suggests Bitcoin is undergoing a larger 16-year cycle, which can help us predict the direction of Bitcoin prices in the coming years.

Bitcoin's Regular "4-Year Cycle"

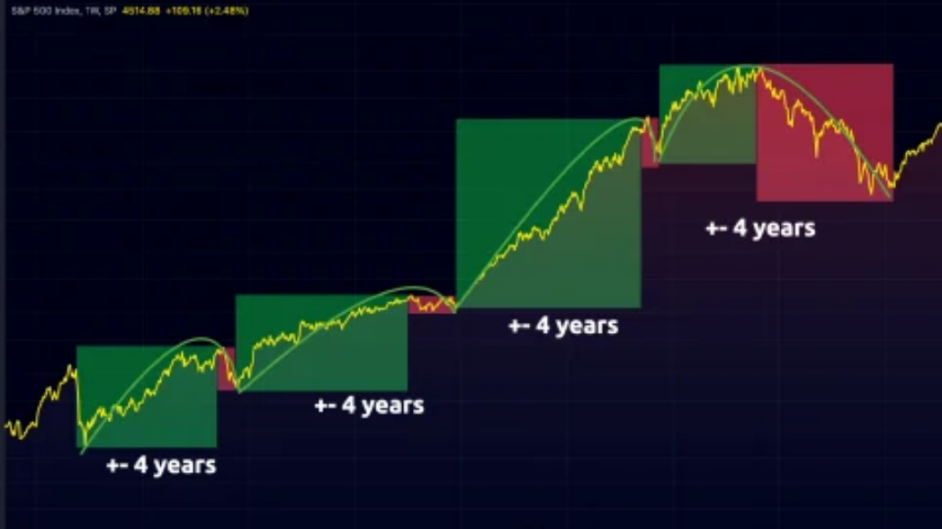

Bitcoin tends to go through a 4-year cycle, divided into an upward trend and a downward trend.

In a regular 4-year cycle, it typically includes 3 years of an upward trend, followed by 1 year of a downward trend (also known as a bear market). So far, Bitcoin has completed 4 such cycles, demonstrating incredible accuracy and attracting the attention of market participants.

Internet Cycle

One cannot ignore the similarities between the market structure of the S&P 500 index in the internet cycle and the Bitcoin cycle. Conventional financial markets also go through distinct 4-year cycles, with most cycles being in an upward trend, and the downward trend (also known as a bear market) being brief.

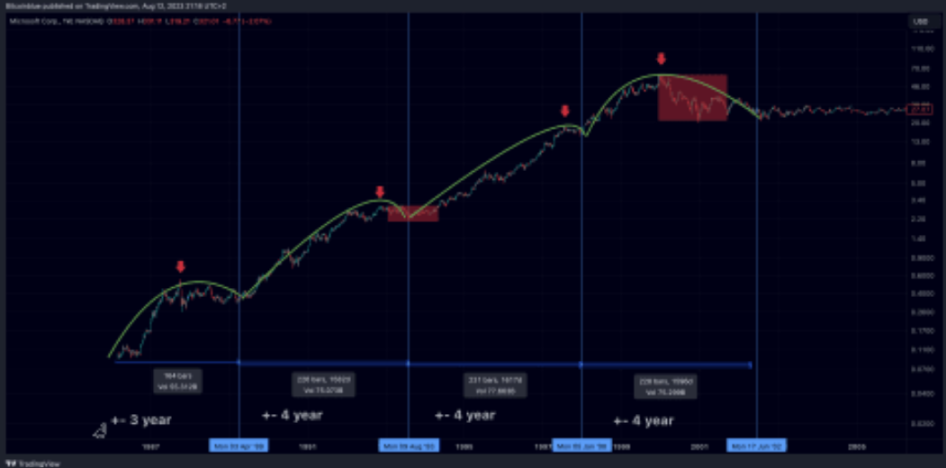

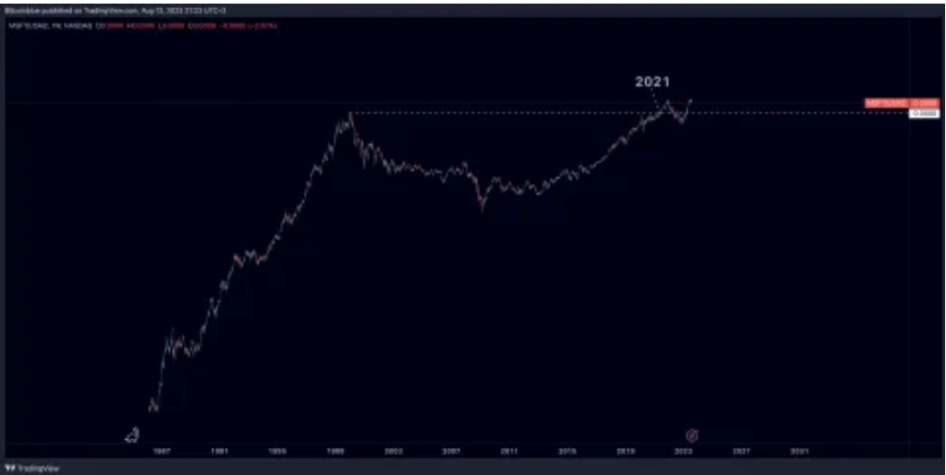

From my perspective, the internet cycle began around 1986, as that was the moment when Microsoft went public, becoming one of the largest companies in this internet cycle.

The first 3 4-year cycles of Bitcoin appear very similar to the first 3 4-year cycles of the S&P 500 index starting from 1986.

This really piqued my interest because both periods are based on the adoption of a new technology that changed the way we perceive and use information in our society.

For example, personal computers and the internet have completely changed our lives to the point where it is almost unimaginable to be disconnected from the internet for more than 24 hours. In the future, it will also be unimaginable not to own and use any Bitcoin, so we are still in the early stages of adoption.

So, can the development structure of the internet cycle help us determine the potential cycle path of Bitcoin? First, I want to emphasize a fact that, in my view, market cycles are one of the best ways to use rough price predictions to determine the best times to enter and exit specific markets, but I really want to emphasize the word "rough."

Because there is a saying: "History does not repeat itself, but it often rhymes," and I think this also applies to cycles. Nothing can 100% replicate anything that happened before, but it can give us a rough estimate of what might happen.

As you can see in the development structure of the internet cycle, the first 3 4-year cycles are very similar, a long-term bull market, followed by a brief but sometimes mild bear market or adjustment.

Only the last 4-year cycle is different, with the situation completely reversed. It began with an accelerated rise in prices, but it did not last long, and then entered a multi-year bear market.

Will Bitcoin make a similar move? Disappointing those expecting a regular 4-year cycle and surprising most people, eventually entering a long bear market lasting several years?

Microsoft is replicating a similar path—it started with 3 normal 4-year cycles, followed by a reversed 4-year cycle, leading to a long bear market for an asset that had been in a strong bull market for many years.

Microsoft reached its bull market peak in 2000, marking a long-term high price of about $60. It was not until 2015 that this price record was broken again.

This means that it took 15 years from that high point to fully recover and surpass that level again. If we consider the supply of currency, Microsoft actually took longer to recover and broke the previous high in May 2021, 21 years later.

Both the charts of Microsoft and the S&P 500 index truly demonstrate the magnitude of the adjustment after a long bull market.

From a personal perspective, it is hard to imagine experiencing a long bear market for an asset that has been in an upward trend for most of the time. So, could Bitcoin possibly experience a similar situation?

Intersection of Cycles

So, let's look at these cycles in relation to Bitcoin's predictions and how we can prepare for these outcomes. First, it is interesting that there is a date that predicts the same result in both the regular 4-year cycle and the 16-year cycle:

The regular 4-year cycle suggests that we will maintain an upward trend until 2025, followed by a year of decline. This is a typical 4-year cycle that we have seen 3 times in Bitcoin's history.

According to the 16-year cycle, we may follow a path similar to the dot-com bubble mentioned above—Bitcoin will peak in the first half of the cycle, so no later than the end of 2024, and then continue to decline for several years, entering 2026 to form a new low.

How to Identify Cycle Tops

One of the best indicators that Bitcoin traders can use is the Bitcoin funding rate, which essentially shows whether most market participants in the derivatives market are short or long on Bitcoin.

I found this indicator to be very useful for identifying the top of the Bitcoin price, as in a healthy bull market, when the funding rate is negative, the price tends to rise. In a bear market, when the funding rate is positive, the price often falls.

Therefore, we can use this indicator to identify the market conditions in which the market is trading and whether there are any changes. When Bitcoin enters a bear market in 2022, the first signal is a drop in Bitcoin prices accompanied by a negative funding rate, which typically does not occur in a healthy bull market.

Another way to find cycle tops is through time judgment. When Bitcoin is at the top of the 16-year cycle and we break through a range, it is likely that a cycle top will occur.

Only by re-entering and rising back to that level can this signal be invalidated. To look for potential cycle tops, you can observe the Bitcoin cycle progress bar.

Once the yellow dot enters the red zone, it means that according to that specific cycle, we are in the top period. Again, it is important to note that cycles can help provide a rough estimate of potential outcomes, but they often do not unfold very accurately and leave room for interpretation.

Other Influencing Factors

In addition to these cycles, there are more factors that affect the price of Bitcoin.

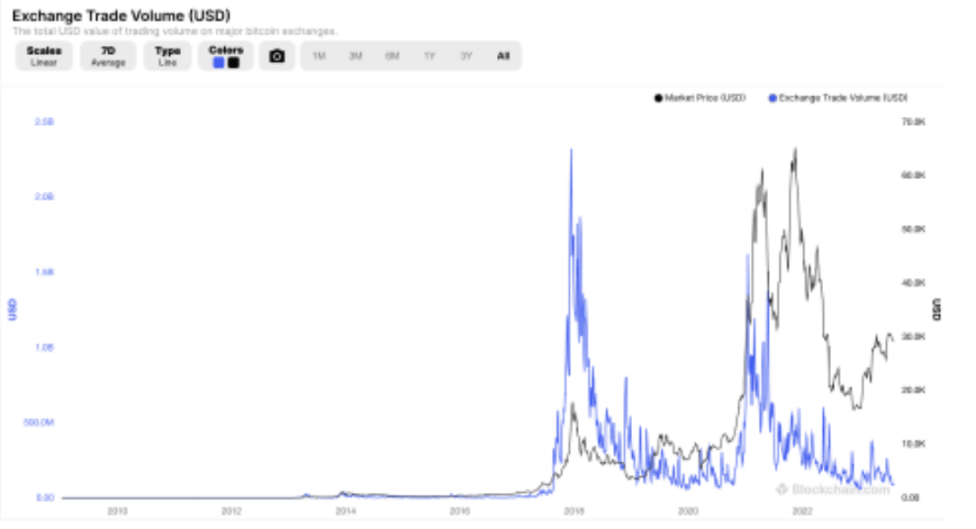

In fact, the Federal Reserve's "big easing" that began in 2020 greatly stimulated many investors to seek risk assets like Bitcoin with the preference for risk after the Fed began injecting massive amounts of money into the economy.

It is clear that after the Fed started injecting a huge amount of money into the economy, the prices of Bitcoin and the financial markets started to rise, until the easing stopped in 2022, causing Bitcoin to enter a year-long decline. These fundamental economic changes are likely to have an impact on the way Bitcoin and these cycles unfold.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。