The biggest opportunity for cryptocurrency may not be to see it as cryptocurrency, but to see it as a new payment method.

Authors: Will Wang; Diane Cheung

The emergence of blockchain and cryptocurrency technology not only allows people to purchase NFT digital artworks, interact with players in the Metaverse, and make money in GameFi gameplay, but also provides the most essential decentralized peer-to-peer payment solutions. These fast and convenient Web3 payment solutions are changing our current payment methods and even the entire financial market.

Since PayPal launched the stablecoin PayPal USD in August, we have seen many industry giants announcing the expansion of their business scope to Web3 payments or accessing Web3 payment channels, giving a strong sense of a full-scale attack on the Web3 payment business. We can see a series of actions from industry giants in the blockchain payment network, such as MetaMask's fund deposit and withdrawal aggregation solution, X's (formerly Twitter) payment license application, and VISA USDC settlement.

As Web3 payments cover almost all the infrastructure in the industry, including payments, stablecoins, wallets, custody, and trading, understanding the wide range of use cases and potential advantages of Web3 payments is crucial for all Web3 ecosystem participants.

This article will briefly describe the concept and path of Web3 payments, and then from a business perspective and a legal compliance and regulatory perspective, explain why Web3 payments are expected to reshape the cryptocurrency market. I hope this article can be helpful in this regard, and welcome discussions. The full text is about 16,000 words, with an estimated reading time of 30 minutes.

TL; DR

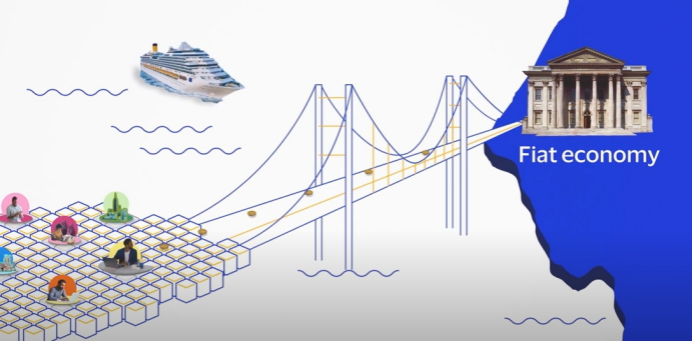

Traditional payments and Web3 payments are not separate, but show a two-way trend. Fiat currency and cryptocurrency interact continuously and gradually merge into stablecoins, central bank digital currencies, and other real-world use cases.

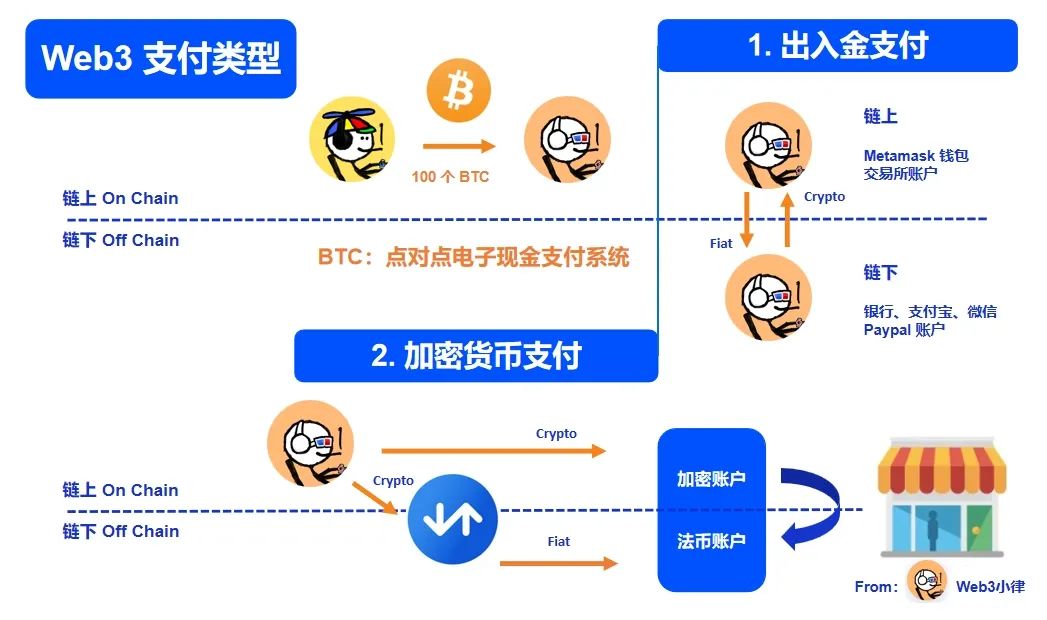

Bitcoin was designed to achieve a decentralized peer-to-peer electronic cash payment system, from which Web3 payments emerged. Currently, Web3 payments can be roughly divided into two categories: fund deposit and withdrawal payments, and cryptocurrency payments (on-chain and off-chain).

Industry giants such as PayPal, Coinbase, and MetaMask are gradually opening up/accessing Web3 payment businesses and scenarios, including wallets, custody, payments, trading, and stablecoins, ultimately gradually covering their entire ecosystems, forming their own closed ecosystems.

The infrastructure of Web3 payments is gradually taking shape, linking wallets, custody, and stablecoins. More important than this is how to build payment scenarios. Imagine how X (Twitter), Telegram, MetaMask, and PayPal will form their own large cryptocurrency ecosystems. In this context, the existing structure of the cryptocurrency market will inevitably change.

Compliance is the foundation of payment business. The complex nature of Web3 payment business across regions and scenarios poses a huge challenge for regulatory compliance. However, with further clarification of cryptocurrency regulation, the adoption of cryptocurrencies is expected to increase, driving the rapid development of the Web3 payment industry.

From the perspective of the monetary system, the BIS believes that the key to the development of digitalized currency is tokenization, which can significantly enhance the capabilities of the monetary and financial systems. The future monetary system is expected to unleash new economic growth drivers through tokenization.

The biggest opportunity for cryptocurrency may not be to see it as cryptocurrency, but to see it as a new payment method. Some people believe that the killer application of Web3 has not yet arrived, but it may have quietly arrived: it is payment!

I. Overview of Web3 Payments

In simple terms, Web3 payments refer to a payment method based on blockchain and cryptocurrency technology, but due to the characteristics of blockchain and cryptocurrency, Web3 payments include more than just payment attributes.

Cryptocurrencies like Bitcoin have multidimensional attributes. They are not only a form of payment, but also an innovative technology, a store of value, and a financial infrastructure, and can also serve as a unit of account to mark value in transactions.

Traditional payments and Web3 payments are not separate, but show a two-way trend. Fiat currency and cryptocurrency interact continuously and gradually merge into stablecoins, central bank digital currencies, and other real-world use cases. Web3 payments are redefining our payment methods and financial systems.

1.1 Traditional Payments

Let's first look at traditional payments. Payment is the act of transferring currency (or currency equivalents) or claims from the payer to the payee, completing the matching of information flow and fund flow to achieve the delivery of funds or goods. The essence of payment is the transfer of funds.

Broadly speaking, payments include cash in paper form and electronic currency form, and there are roughly four ways of fund transfer: cash payment; bank account transfer; debit card transfer; credit card payment. The latter three forms of electronic currency payments require the involvement of centralized financial institutions such as banks to complete fund transfers. If the bank cannot directly complete the payment, the involvement of third-party payment institutions is also required.

According to the different payment currencies, payments can be classified as domestic payments and cross-border payments. As Web3 payments are conducted on the blockchain, they can achieve dual functions of cross-currency (fiat currency vs. cryptocurrency) and cross-regional transactions, and can therefore be classified as a form of cross-border payment.

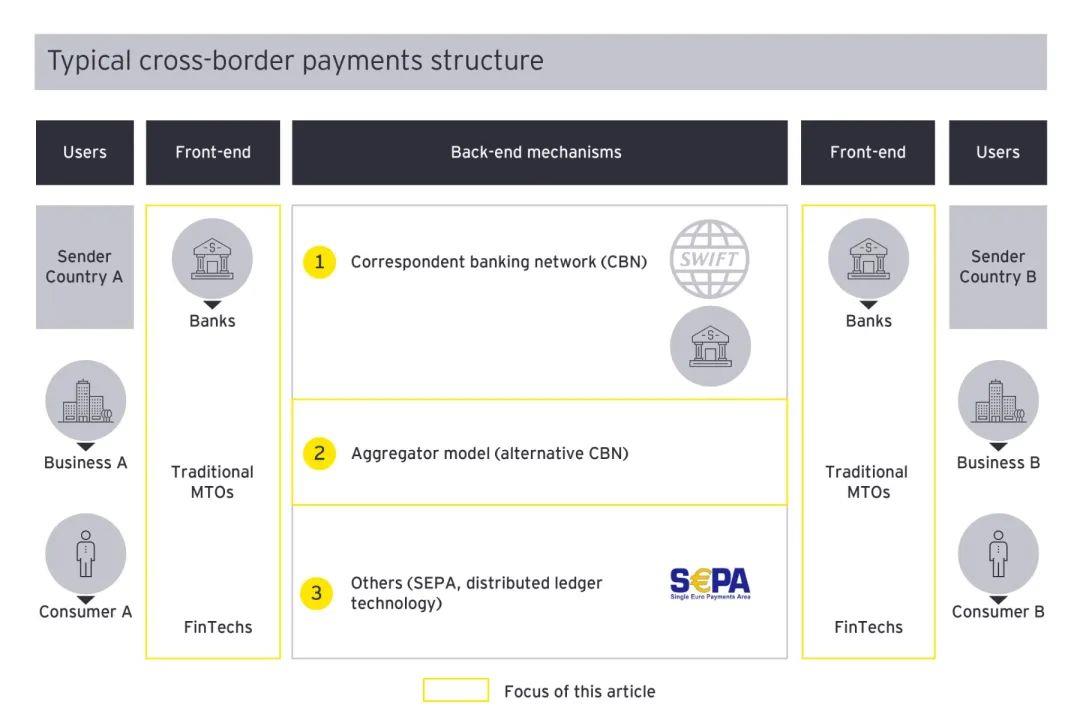

There are many participants in the cross-border payment industry chain, including customers, commercial banks, third-party account/acquiring payment institutions, clearing institutions, and merchants. The entire industry chain can be roughly divided into three levels: the first level is users and merchants, which are the source and terminal of payments; the second level is payment service institutions, such as banks and third-party payments; the third level is the cross-border payment network, which is the bottom support of cross-border payments, such as SWIFT and SEPA.

The following is the architecture of cross-border payments:

According to the type of cross-border payment service providers, they can be divided into bank telegraphic transfers, specialized remittance companies, bank card clearing institutions, and third-party payment institutions. The following comparison is based on blockchain settlement for Web3 payments.

1.1.1 Interbank Cross-Border Payments

Early cross-border payments were mainly conducted through banks, such as the early appearance of bank telegraphic transfers, mainly used for cross-bank transactions, import and export trade, and other cross-border payments. This payment method requires a complex bank network and may take several days or even weeks to complete. This process may involve the exchange of multiple currencies, and the fees are relatively high.

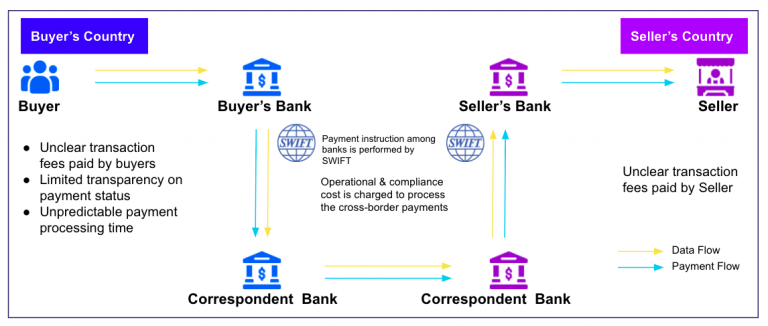

Traditional bank cross-border payments mainly rely on the SWIFT network, which does not hold funds for users or manage accounts, but provides a communication information network and exchanges standardized financial messages. SWIFT can be understood as a network connecting almost all major banks globally to complete foreign exchange transactions using the same language. However, the drawback of SWIFT is that if a payment passes through multiple intermediary banks, encounters anti-money laundering checks, etc., it is easy to experience delays or even payment failures, as well as exchange losses.

As shown in the above diagram, when the receiving bank and the paying bank have established a commercial account relationship, the funds paid by the user will be transferred directly through the bank's commercial account to complete the payment, and the bank will charge the corresponding fees; when there is no commercial account relationship between the receiving bank and the paying bank, an intermediary bank is needed to complete the payment. The intermediary bank will charge additional fees, and the time for the payment to arrive will also be extended due to the increase in transaction parties.

Bank cross-border payments are a heavily regulated business, and regulatory policies vary from country to country and region to region, which also imposes certain limitations on cross-border payments. In addition, bank cross-border payments mostly have strict KYC/AML requirements and require users to open accounts before completing transactions, resulting in relatively high costs.

1.1.2 International Card Organizations

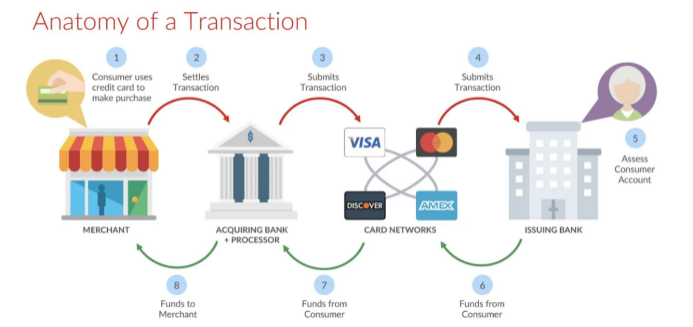

Similar to SWIFT, international card organizations are also a major network for traditional cross-border payments, but they focus more on merchant collection scenarios (deducting funds from the buyer's account). The collection methods are diverse, and the exchange process is completed directly during the payment process, settling the local currency for merchants.

Card organizations are international regional payment information processing networks. There are currently six major card organization networks worldwide: VISA, Mastercard, China UnionPay, American Express, JCB, and Discover. Cross-border payments processed through international card organizations usually take at least T+1 day or longer to complete, meaning it takes at least T+1 day to reach the merchant's account. International card organization payments also require licensing to operate and are subject to different regulatory policies in various countries.

1.1.3 Third-Party Cross-Border Payments

With the development of e-commerce and internet technology, electronic transfers have become a popular cross-border payment method. This type of cross-border payment is generally provided by non-bank institutions (such as Alipay, PayPal, etc.) as third-party payment institutions offering all or part of the fund transfer services. These third-party payment institutions play an important role in cross-border e-commerce retail, remittances, import and export business, and overseas mobile payments.

Third-party cross-border payments require access to international card organizations or banks for clearing and settlement to complete the payment. The currency exchange process in cross-border payments is mainly completed through banks, and third-party payments usually have custody functions, meaning that the payment funds can be held in the third-party payment account and transferred to the seller's account after the transaction is confirmed.

In a cross-border e-commerce scenario, as shown in the above diagram, the user side is the starting point of fund transfer, and the third-party payment institution connects the user's bank account with the issuing bank's credit/debit card. After the user makes a purchase, the user's funds are transferred to the payment channel and settled with the card organization. After settlement, the third-party payment institution transfers the funds to the merchant. In offline shopping scenarios, an acquiring agent is needed to connect the merchant with the third-party payment institution.

Traditional payments have been developed for a long time and currently cover most application scenarios with extensive functionality. However, cross-border payments face practical issues such as high costs, slow speed, restricted access, and lack of transparency. According to a survey by the Federal Reserve, user pain points mainly focus on two aspects: the need to improve payment speed, as the current payment deadlines do not meet user needs, and the demand for periodic real-time payment scenarios.

1.2 Web3 Payments

Although current payment methods are rapidly digitizing, the involvement of numerous participants makes the fund transfer process very cumbersome, resulting in significant friction costs and high overall costs. Improvements in the payment experience have always been constrained by various intermediaries, banks, and technology companies.

Bitcoin was designed to achieve a decentralized peer-to-peer electronic cash payment system. In 2008, Satoshi Nakamoto released the Bitcoin whitepaper against the backdrop of the global financial crisis, hoping to change the traditional bank-centric financial system and achieve decentralization of the entire financial system. Since the birth of Bitcoin on January 9, 2009, it has opened the way for the widespread use of cryptocurrencies.

Bitcoin payments allow direct transfers between users without the need for banks, clearing centers, and electronic payment platforms, thus avoiding high fees and cumbersome transfer processes. Any user with a device connected to the internet can use it without permission.

As the acceptance of cryptocurrencies continues to increase, it is inevitable that cryptocurrencies will interact with fiat currencies in the real world. Here, institutions that provide fund deposit and withdrawal services play the role of banks providing foreign exchange services in cross-border payments, facilitating the exchange between cryptocurrencies and fiat currencies.

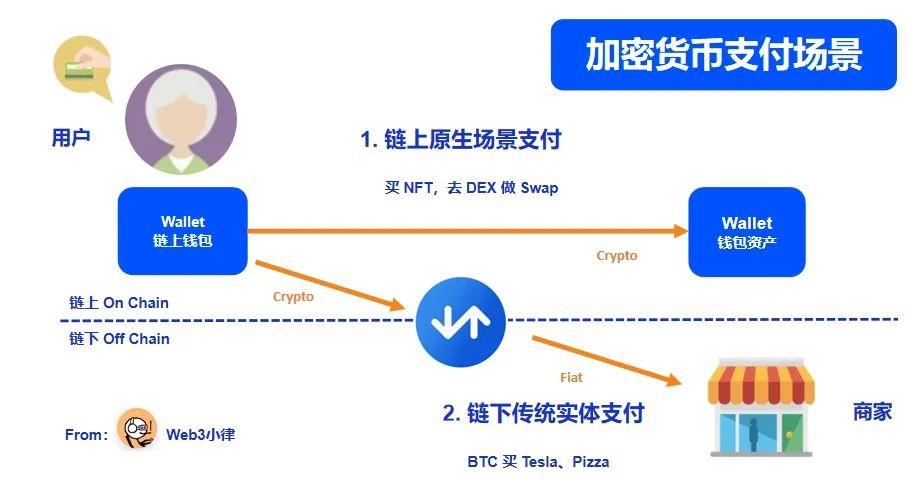

Currently, Web3 payments can mainly be divided into two payment methods:

(1) Fund Deposit and Withdrawal Payments (On Ramp & Off Ramp), which involves payments when exchanging between fiat currency and cryptocurrency;

(2) Cryptocurrency Payments, including (2.1) On-Chain Native Asset Payments, which involve interactions between addresses on the blockchain or between cryptocurrencies and on-chain assets (such as purchasing NFTs with cryptocurrency, swapping different cryptocurrencies); and (2.2) Off-Chain Traditional Entity Payments, which involve payments when purchasing other goods/services with cryptocurrency as a currency equivalent.

Web3 payments connect fiat currency and cryptocurrency through fund deposit and withdrawal payments, and enable the circulation of cryptocurrency assets through cryptocurrency payments, forming a complete payment loop.

As cryptocurrency payments are conducted on the blockchain, they are not significantly restricted by geographical factors, and the regulation of cryptocurrency payments in various jurisdictions is gradually being improved. However, fund deposit and withdrawal payments themselves involve fiat currency payments and will therefore be subject to existing financial regulations.

1.3 Advantages of Web3 Payments Compared to Traditional Payments

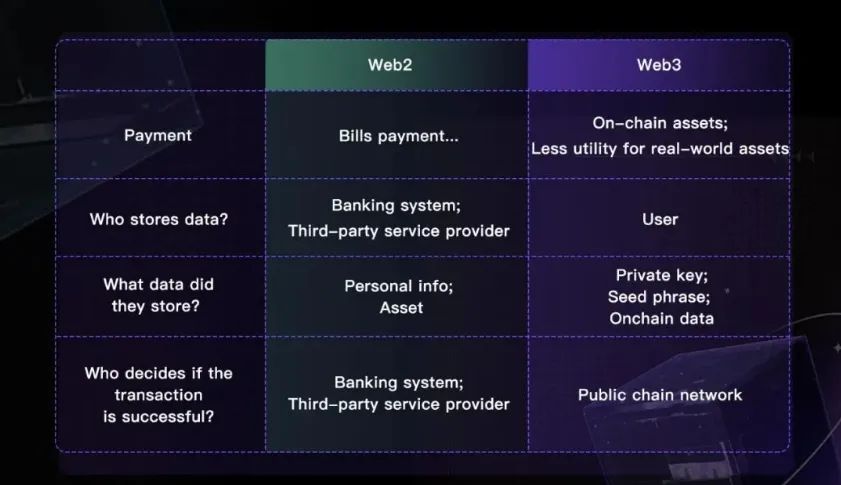

Traditional payments are based on an account-based payment system, with the transfer of value recorded in the accounts of intermediary institutions (such as banks, third-party payment companies). Due to the involvement of numerous participants, the fund transfer process is very cumbersome, resulting in significant friction costs and high overall costs.

In contrast, Web3 payments are based on a value or token-based system, with the transfer of value stored by users themselves in the distributed ledger of the blockchain. Web3 payments are based on the blockchain network as the main infrastructure, allowing cryptocurrency to be transferred between the sender and receiver, and can address issues such as high costs, low efficiency in cross-border transfers, and high overall costs in traditional payments.

What are the advantages of Web3 payments compared to traditional payments?

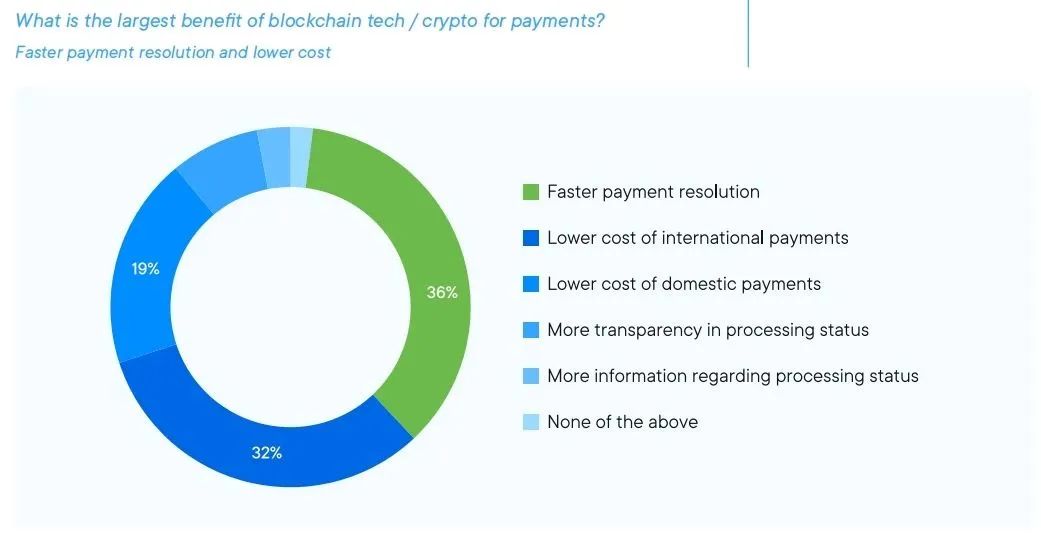

First, leveraging blockchain technology can effectively reduce the trust costs between transaction parties, making payments more direct, efficient, and secure. Smart contract functionality can enable programmable payments and automated execution, improving payment efficiency and trustworthiness.

Second, cryptocurrency payments currently have a significant advantage in terms of timeliness compared to traditional payments, especially in cross-border payments. This feature will be a key driver for the development of cryptocurrency payments and a major force driving the upgrade of traditional cross-border payment technologies.

In addition, based on its decentralized nature, Web3 payments simplify processes built on centralized clearing institutions, reduce friction costs, and significantly improve cross-border payment efficiency, accelerating the speed of clearing and settlement.

All signs indicate that traditional cross-border payments and Web3 payments are not completely separate, and both are forming a two-way trend in various aspects. This is reflected in the application of blockchain technology in the traditional payment industry, with traditional payment participants such as SWIFT, VISA, and PayPal exploring Web3 payment solutions in addition to the ongoing practice of CBDCs in multiple countries. It is also reflected in Web3 payment projects actively cooperating with traditional financial institutions and third-party payment institutions, as well as exploring the accelerated application of compliant stablecoins.

Although Web3 payments still face challenges in terms of technology, user acceptance, security, and compliance, Web3 payments have significant implications for the cryptocurrency industry and the entire traditional financial system.

II. Main Paths of Web3 Payments

Currently, Web3 payments can mainly be divided into two payment methods:

(1) Fund Deposit and Withdrawal Payments (On Ramp & Off Ramp);

(2) Cryptocurrency Payments (including on-chain native asset payments and payments between on-chain and off-chain traditional entities).

Web3 payments connect fiat currency and cryptocurrency through fund deposit and withdrawal payments, and enable the circulation of cryptocurrency assets through cryptocurrency payments, forming a complete payment loop.

Due to the relatively small volume of native assets in the cryptocurrency market and the limited payment scenarios, most of the discussions within the Web3 industry regarding payments are currently related to the exchange between fiat currency and cryptocurrency.

2.1 Fund Deposit and Withdrawal Payments

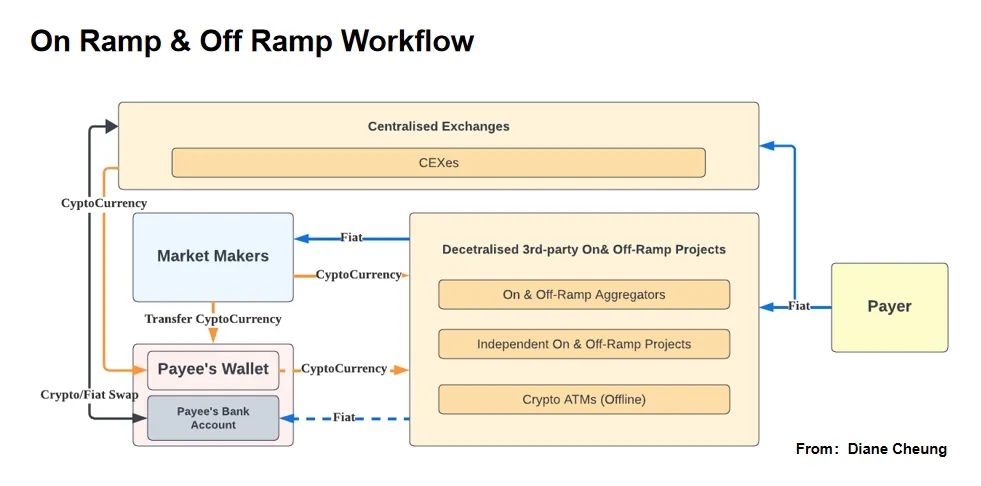

Fund deposit and withdrawal (On Ramp & Off Ramp) is an important bridge connecting fiat currency and cryptocurrency, forming a complete payment loop. Apart from OTC/P2P fund deposit and withdrawal methods, other fund deposit and withdrawal processes require the involvement of third-party payment institutions.

2.1.1 Fund Deposit and Withdrawal Payment Process

The fund flow behind fund deposit and withdrawal payments: Users transfer fiat currency through payment channels to liquidity providers behind third-party payment institutions (Crypto Liquidity Providers), and these liquidity providers are more like merchants in traditional third-party payment scenarios. They transfer cryptocurrency "goods" on-chain to the user's address, while providing cryptocurrency liquidity to third-party payment institutions. The process is reversed for fund withdrawals.

These liquidity providers are typically centralized exchanges (such as Coinbase Prime, Binance, Kraken) or stablecoin issuers (such as Tether and Circle), or cryptocurrency-friendly banks (such as the now-defunct Silvergate Bank and Signature Bank). Liquidity providers are crucial in the fund deposit and withdrawal process, serving as the bridge between fiat currency and cryptocurrency.

2.1.2 Main Fund Deposit and Withdrawal Payment Methods

A. Centralized Exchanges

Since centralized exchanges also have the nature of currency transfer, their functions partially overlap with those of payment institutions. They apply for relevant cryptocurrency/payment licenses similar to those of payment institutions, so most centralized exchanges also have fund deposit and withdrawal payment functions.

Additionally, as centralized exchanges can also act as liquidity providers, most of them have their own fund deposit and withdrawal payment business sections. Users can directly purchase cryptocurrencies using debit/credit cards or bank transfers, such as Binance Pay, Coinbase Pay, and other similar services.

Centralized exchanges provide a payment interface for both parties to the transaction, allowing them to choose to use different accounts within the same custodial wallet or non-custodial wallets, with the former incurring lower fees due to not involving gas.

Furthermore, in jurisdictions with stricter regulations, centralized exchanges need to integrate independent fund deposit and withdrawal payment institutions as the underlying payment channels to facilitate user fund deposit and withdrawal. This operation also applies to decentralized exchanges, such as Uniswap, which has integrated independent fund deposit and withdrawal payment institutions like Moonpay and Paypal to support user fund deposit and withdrawal.

B. Independent Fund Deposit and Withdrawal Payment Institutions

Independent fund deposit and withdrawal payment institutions are payment institutions with cryptocurrency transfer capabilities (which may also include cryptocurrency-friendly banks) and need to obtain relevant licenses for cryptocurrency/payment operations in their operating jurisdictions.

Currently, MoonPay is the leading project in cryptocurrency fund deposit and withdrawal, positioning itself as the "PayPal for Web3" with over 5 million registered users. MoonPay supports cryptocurrency payments in over 160+ countries and regions, and the exchange of over 80 cryptocurrencies and 30+ fiat currencies. It holds payment business licenses in most jurisdictions.

In terms of payment methods, MoonPay currently supports credit/debit cards, mobile payments, account-to-account payments, and other channels. Users can input the on-chain address and cryptocurrency amount to complete the payment. Coinbase provides liquidity to MoonPay, and its comprehensive fund deposit and withdrawal functions and first-mover advantage have quickly captured the majority of the European and American markets where credit card usage is prevalent, supporting its $3.5 billion valuation.

Additionally, we have seen traditional payment giant Paypal, leveraging its strong payment channels, partnering with stablecoin issuer Paxos to launch the PYUSD stablecoin, aiming to enter the Web3 payment market. Previously, cryptocurrency-friendly banks such as the now-defunct Silvergate Bank and the forcibly closed Signature Bank are also important fund deposit and withdrawal payment channels.

C. Other Fund Deposit and Withdrawal Payment Methods

Other fund deposit and withdrawal payment methods are essentially payment products based on the integration of the above two payment methods.

Aggregated payment products integrate multiple independent fund deposit and withdrawal payments, allowing users to access different rates and quotes from various independent fund deposit and withdrawal payments for transactions. MetaMask is the most typical aggregated payment product, and other well-known projects include TransitSwap and KyberSwap.

Cryptocurrency retail terminals (ATMs) and point-of-sale (POS) systems. With the development of the cryptocurrency industry, cryptocurrency retail terminals for offline purchases have emerged. Cryptocurrency ATMs allow users to purchase cryptocurrency directly with cash, with ATM providers purchasing liquidity from third-party suppliers and paying users. This payment method is characterized by its anonymity, as users almost do not need to provide identity verification or only need minimal personal information to purchase cryptocurrency, but its drawback is the high transaction fees (5%-20%). Bitcoin Depot is a leading project in this field.

Cryptocurrency POS systems provide another channel for offline cryptocurrency payments, allowing users to pay with cryptocurrency at POS terminals, with merchants receiving fiat currency directly. This type of payment also requires licensing, but the withdrawal fees are lower compared to ATMs. Pallapay is one of the projects providing such solutions.

Overall, there are multiple ways for users to choose Web3 payments, but fund deposit and withdrawal payments involve the exchange between fiat currency and cryptocurrency, and operators generally need to apply for operating licenses based on their operating regions. The costs incurred by payments vary slightly due to differences in payment method business models.

In addition to fund deposit and withdrawal payments, some centralized exchanges and payment institutions issue debit and credit cards in collaboration with card organizations such as Visa and Mastercard, combining fund deposit and withdrawal payments with cryptocurrency payments.

2.2 Cryptocurrency Payments

As the acceptance of cryptocurrencies continues to increase, Web3 payments are also entering traditional markets such as e-commerce (for online shopping), the gig economy (for contracts and freelancers), cross-border remittances, travel bookings, and online gaming (for in-game item exchanges). It involves using cryptocurrencies for online consumption and remittances, rather than relying on outdated infrastructure from traditional banks or third-party payment institutions.

Currently, cryptocurrency payments mainly fall into two categories: payments between off-chain traditional entities and on-chain native asset payments.

2.2.1 Cryptocurrency Payments - Payments between Off-Chain Traditional Entities

According to a report from PYNMTS and BitPay in 2022, the report surveyed over 2,330 online merchants with annual sales exceeding $250 million. Approximately 85% of large retailers (with annual revenue exceeding $10 billion) currently offer cryptocurrency as a payment method. Among all surveyed merchants, half already accept cryptocurrency payments, and among those not yet accepting cryptocurrency payments, 42% are planning to do so. The report also found that most merchants use non-native cryptocurrency wallets to support cryptocurrency payments, such as PayPal and Venmo.

To meet the growing demand for Web3 payments, leading payment giants such as Mastercard, Visa, PayPal, Stripe, and Venmo have partnered with cryptocurrency companies to provide cryptocurrency as a payment method to millions of users. Most major retailers, such as Overstock, Microsoft, Expedia, and Starbucks, have also integrated cryptocurrency payments, allowing their customers to directly use cryptocurrency to purchase digital and physical goods. Other major companies include popular streaming platform Twitch, Norwegian Air, Etsy, and Burger King.

In terms of payments between off-chain traditional entities, we can simulate a scenario where a user makes a cryptocurrency purchase and the merchant receives fiat currency. The fund flow involves first converting the cryptocurrency to fiat currency through a third-party payment institution using fund deposit and withdrawal methods, and then making the fiat currency payment to the merchant.

The most common solution currently is the issuance of cryptocurrency bank cards. Centralized exchanges or wallet companies typically collaborate with card organizations like Visa and Mastercard to issue cryptocurrency debit/credit cards. Users can use these cards for online and offline transactions if they hold cryptocurrency in their platform accounts. During actual payments, the card issuer first converts the cryptocurrency to local fiat currency through fund withdrawal payment channels before paying the merchant. An example of this is Crypto.com's collaboration with Visa to issue the Crypto.com Visa Card. In addition to fiat currency payments, it also provides users with the ability to make on-chain cryptocurrency payments.

2.2.2 Cryptocurrency Payments - On-Chain Native Asset Payments

Regarding on-chain native asset payments, users make payments in cryptocurrency, and merchants accept cryptocurrency. This method should not be simply understood as peer-to-peer payment transfers based on blockchain technology, but also needs to consider the trust issues encountered in real-world payment scenarios, which require the involvement of third-party payments.

For example, in an online shopping scenario where trust is established (such as a trust chain among friends), transactions can be completed directly through blockchain peer-to-peer transfers, including user payment, merchant shipment, and user receipt. However, in an online platform without a trust basis, who ensures that the merchant will ship the goods after the transfer, and that the received goods match the actual order?

Similarly, while we can use blockchain networks to make peer-to-peer transfers with family and friends, how do we handle transactions with strangers? Therefore, a set of account systems needs to be linked to the settlement system on the blockchain to facilitate offline goods circulation and on-chain payment settlement.

As a result, third-party payment institutions providing cryptocurrency payment products are needed to address the above issues. This includes the cryptocurrency payment protocol, payment core system, front-end product interaction, and corresponding support modules as shown in the diagram. We can see that Ripple and Stellar are exploring in this area.

Visa recently introduced a settlement solution based on the stablecoin USDC, applied in the case of Crypto.com. In the scenario where a user makes a cryptocurrency purchase and the merchant receives fiat currency, Crypto.com needs to convert the user's cryptocurrency payment into fiat currency and then make the payment to the merchant through traditional payment channels. Settlement through traditional payment channels means increased participation, transaction costs, complexity, and limitations for Crypto.com, especially outside of banking hours.

With Visa's USDC settlement solution, the need for currency exchange and traditional payment steps in transactions is eliminated, allowing for real-time, global settlement 24/7/365 directly through the blockchain. This flexible settlement method, without the need for currency exchange, has opened up new business scenarios for Crypto.com, such as cryptocurrency payment gateways for merchants and blockchain-based cross-border payments.

Cross-Border Remittances and Cost Reduction

Visa's USDC settlement solution can also be used for cross-border remittances. The current $1 trillion cross-border remittance market is plagued by high costs associated with traditional payment methods, which charge up to 8% of the transaction amount to the sender. Web3 cross-border remittance products like Strike's Send Globally, which utilize Bitcoin's Lightning Network, provide an affordable alternative to traditional cross-border remittances, with fees ranging from 0.01% to 0.1% of the transaction amount.

This settlement method, combined with the application of stablecoins, can reduce traditional cross-border payment costs by 80%. This means that for a $500 remittance, the transaction cost for on-chain cryptocurrency payments and fund deposit and withdrawal payments is only $4.8, significantly lower than the average cost of around $20 for traditional cross-border remittances. In 2022, the cross-border remittance market is estimated to save $40 billion to $64 billion in costs annually through Web3 payments.

Industry Giants' Layout in Web3 Payments

Industry giants are gradually opening up/accessing Web3 payment businesses and scenarios around their core businesses such as transactions, payments, communications, and social media, including wallets, custody, payments, trading, and stablecoins, ultimately covering their entire ecosystem and forming a logical loop. The following outlines the layout of PayPal, Coinbase, and MetaMask in this regard.

3.1 PayPal's Layout in Web3 Payments - Payments, Wallet Custody, and Stablecoins

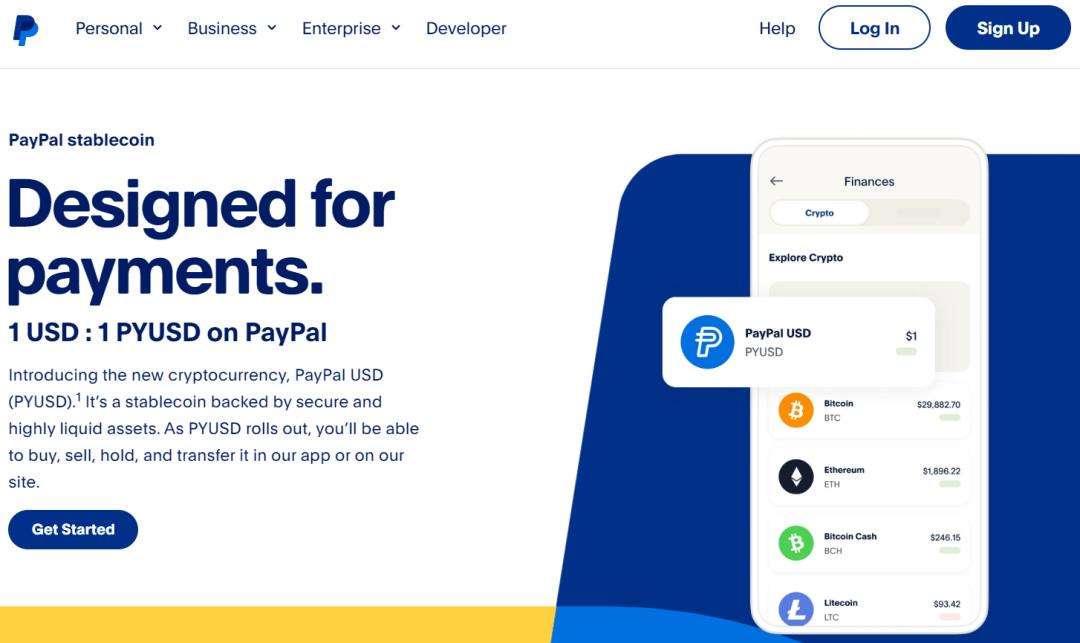

In the previous article "Paypal's Stablecoin Expected to Lead the Cryptocurrency Industry into the Mainstream", we introduced the PYUSD stablecoin launched by Paypal on August 7, 2023. As the only stablecoin supported in the Paypal ecosystem, it will be used to connect Paypal's existing 431 million users, providing a seamless bridge between fiat currency and cryptocurrency for Web2 consumers, merchants, and developers.

3.1.1 Implementation Path of Fund Deposit and Withdrawal Services

By examining the Paypal CryptoCurrency user agreement, we can see that the PYUSD stablecoin plays a crucial role in bridging Web2 & 3 payments, Paypal accounts, and cryptocurrency custody wallet accounts.

As shown in the above image, Paypal uses PYUSD stablecoin as a bridge for exchanging between fiat and cryptocurrency. Whether it's fund deposits, withdrawals, or cryptocurrency payments, the process is completed through the USD - PYUSD - Crypto Asset chain, and vice versa. For example, in a scenario where cryptocurrency is used to pay for merchant services, the cryptocurrency is first sold for PYUSD/USD and then used for payment to the merchant in PYUSD/USD.

The fiat currency payment service uses Paypal accounts, while for cryptocurrency, Paypal creates a Cryptocurrencies Hub cryptocurrency wallet under the Paypal account. This wallet is custodied by the issuer of PYUSD, Paxos, meaning that users surrender their assets (private keys). The Paypal user agreement explicitly states: "You will not hold the digital Crypto Assets themselves in your Crypto Asset balance / You do not own any specific, identifiable, Crypto Asset."

Therefore, we can see that Paypal has established a framework for Web3 payments by bridging the payment channels between fiat and cryptocurrency, issuing stablecoins as a medium of exchange, and building a Paypal account wallet system, forming a logical loop within its own ecosystem.

Based on this framework, Paypal can also leverage its advantages in the payment industry to support fund deposits for external entities such as MetaMask and Ledger, as well as support external entities like Kraken, a centralized exchange. Additionally, in the fund withdrawal feature announced by Paypal on September 12, it also supports wallets, DApps, and NFT marketplaces.

With the channels, tools, and infrastructure in place, the key is how to guide Paypal's existing 431 million users into Web3 and lead Web3 into true mass adoption.

3.1.2 Traditional Payment Companies Ready to Make a Move

We can see that Paypal's approach is highly suitable for traditional payment companies to replicate. Traditional payment companies like Stripe and Square have already been involved in fund deposits and currency exchange services. For example, Stripe announced the provision of cryptocurrency deposit services in December 2022, and Block (Square's parent company) offers BTC trading services through its Cash App, in addition to its basic peer-to-peer payment functionality.

Since traditional payment companies have already established compliance processes and licensing for local payment services, it's only a matter of time and pace for them to engage in Web3 payments. On the other hand, new entrants like X (formerly Twitter) are actively applying for money transmission licenses (MTL) in various states in the United States to meet compliance requirements.

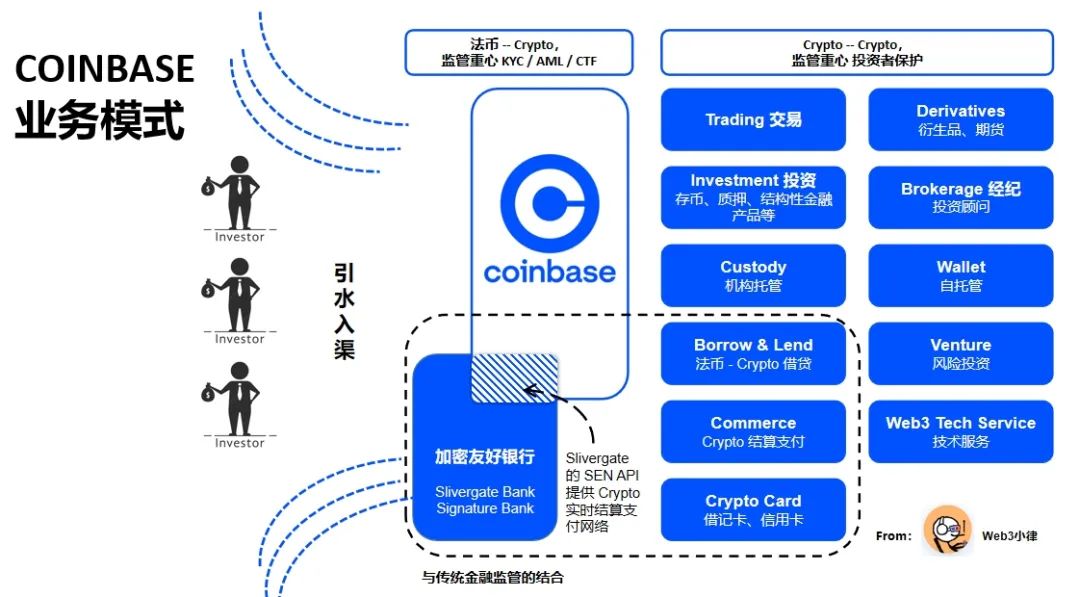

3.2 Coinbase's Layout in Web3 Payments - Trading, Custody, and Payments

As the most compliant centralized exchange globally, Coinbase's numerous compliance paths are worth emulating. We can see that Coinbase's layout in Web3 payments allows it to form a logical loop within its own ecosystem, covering fund deposit and withdrawal payment channels, Commerce merchant payment solutions, stablecoin trading mediums (USDC), cryptocurrency custody wallets and non-custodial wallets, as well as the exchange's core trading functions.

3.2.1 Trading as the Core, Payments as the Auxiliary

While the primary purpose of centralized exchanges obtaining payment licenses is for the compliance of their own trading business, these licenses also open up fund deposit and withdrawal services as well as payment channels. Due to regulatory uncertainties, over-reliance on third-party fund deposit and withdrawal payment channels, such as the previously collapsed Slivergate Bank and the regulated bankruptcy of Signature Bank, may lead to business instability. Therefore, we see that many exchanges have their own payment business sections, such as Binance Pay, Coinbase Pay, and XXX Pay.

In the Licenses & Disclosures section, we can see that Coinbase has obtained money transmission licenses (MTL) in most states in the United States. In particular, Coinbase obtained the BitLicense from the New York State Department of Financial Services (NYDFS) in 2017, becoming the first regulated Bitcoin exchange in the United States to provide buying, selling, receiving, and storing Bitcoin services locally in New York State.

Outside the United States, Coinbase is actively expanding into overseas markets and has also obtained an EMI license in the UK, VASP licenses in Ireland and Germany, and a DPT license in Singapore. As a result, Coinbase, through its trading business and payment channels, gradually covers numerous jurisdictions globally.

In addition to obtaining compliance licenses, Coinbase has also launched an enterprise-level cryptocurrency payment service called Coinbase Commerce. This is a blockchain-based merchant payment solution that helps online businesses accept cryptocurrency payments. The service allows merchants to accept payments in mainstream cryptocurrencies such as Bitcoin, Bitcoin Cash, DAI, and Ethereum. The goal of Coinbase Commerce is to enable businesses to quickly and flexibly conduct business with global customers.

3.1.1 Acquisition of Circle Internet Financial by Coinbase

According to a report on August 21, Coinbase is acquiring a portion of Circle Internet Financial's shares. This means that Coinbase and Circle will have greater strategic and economic consistency in the future development of the cryptocurrency financial system, in order to compete with rivals such as USDT and PYUSD. At the same time, Coinbase can expand the use cases for USDC beyond cryptocurrency trading business, potentially extending into areas such as forex and cross-border transfers through Web3 payments. Therefore, USDC = USD Coinbase.

3.2.2 Custody Business and Non-Custodial Wallets

Coinbase Custody Trust Company, LLC, regulated by the New York State Department of Financial Services, is the main company providing custody services for Coinbase. In the competition for Bitcoin spot ETF applications, various asset management companies, including Blackrock, Fidelity, VanEck, ArkInvest's 21 Shares, Valkyrie, and Invesco, have designated Coinbase as their partner. Once the SEC approves these applications, the substantial assets under management of these companies will be custodied on Coinbase.

According to CoinGecko, Nasdaq estimates that 56% of the $129 billion worth of Bitcoin trading in the United States as of August this year is conducted on Coinbase. With the development of Bitcoin spot ETFs, this proportion is expected to further increase, making Coinbase the biggest winner in this competition.

As for the non-custodial wallet Coinbase Wallet, since users independently control their assets (private keys) and interact directly with the payment system, Coinbase Wallet, similar to MetaMask, is not defined as a Money Services Business (MSB) by FinCEN.

3.3 MetaMask's Web3 Payment Layout - Wallet and Aggregation

Over the past year, MetaMask has continuously introduced new features. The MetaMask Portfolio DApp currently aggregates functions such as Sell, Buy, Stake, Dashboard, Bridge, and Swap, allowing users to manage assets conveniently and perform unified on-chain asset operations. MetaMask has also recently launched the Snaps version, integrating third-party blockchain plugins.

MetaMask's natural advantage lies in its nearly 30 million monthly active users, with a total user base of 100 million and associations with 17,000 DApps, with daily interactions reaching 244,000 times. According to CoinGecko, as of August this year, MetaMask has been downloaded 22.66 million times.

In the foreseeable future, MetaMask is expected to aggregate into a super wallet traffic entry point, allocating wallet traffic to distribute to various DApps, offering significant business opportunities.

3.3.1 Introduction of "Sell" to Enable Fund Withdrawal Function

On September 5, MetaMask introduced the new "Sell" feature, allowing users to exchange cryptocurrencies for fiat currency through the MetaMask Portfolio and send funds to a bank account. For compliance reasons, this feature is currently only available in the United States, the UK, and parts of Europe, and supports the exchange of USD, EUR, and GBP. MetaMask plans to expand this feature to other native tokens on Layer2 networks in the near future.

3.3.2 Independent Third-Party Payment Company Moonpay

MoonPay is a leading cryptocurrency fund deposit and withdrawal project with over 5 million registered users. It supports cryptocurrency payments in over 160 countries and regions, and the exchange of over 80 cryptocurrencies with more than 30 fiat currencies. MoonPay currently supports payment channels such as credit and debit cards, mobile payments, and account-to-account payments. Uniswap has also included Moonpay as one of its fund deposit channels.

By aggregating independent third-party payment companies like Moonpay, MetaMask can enable fund deposit and withdrawal payment channels, non-custodial wallets, and various transaction functions aggregated on its portfolio page (Swap, Bridge, Stake), essentially forming a logical loop.

3.3.3 Snaps Version

On September 13, MetaMask released its Snaps version, which supports wallet integration for non-EVM (Ethereum Virtual Machine) chains such as Solana, Sui, Aptos, Cosmos, and Starknet. Currently, 34 Snaps are in the testing phase. In simple terms, MetaMask is open-sourcing some features to allow third-party developers to expand the MetaMask wallet in the way they want, aiming to provide users with a more personalized or diverse trading experience.

In the past, when users wanted to interact with various public chains, they had to download corresponding wallet plugins, which not only resulted in a poor user experience but also indirectly increased security risks. Now, MetaMask has opened a set of Snaps API access specifications, allowing third-party public chain wallet providers to break through technical barriers to access. MetaMask is only responsible for auditing the access, while other development work is completed by third-party developers.

As a result, users only need to download the MetaMask wallet and install third-party public chain plugins to freely navigate various public chain networks, with a greater assurance of security. This is a very clever move in ecosystem integration, once again consolidating its leading position in plugin wallets.

MetaMask's natural advantage lies in its nearly 30 million monthly active users. In the foreseeable future, we can expect MetaMask to aggregate into a super wallet traffic entry point, allocating wallet traffic to distribute to various DApps, offering significant business opportunities.

4. Web3 Payment Regulatory Compliance

Due to the openness and innovation of cryptocurrencies, it is difficult to uniformly define their attributes, and most jurisdictions do not yet have a complete regulatory framework specifically for cryptocurrencies. In practice, regulatory compliance for Web3 payments not only requires compliance with cross-border payments and currency transfer businesses but also compliance with cryptocurrency businesses. Additionally, the natural global circulation of cryptocurrencies presents an exceptionally complex global multi-jurisdictional compliance challenge for Web3 payments, posing a significant challenge for regulatory authorities in various jurisdictions.

Nevertheless, some jurisdictions are actively exploring Web3 payments. For example, crypto-friendly countries like Switzerland have clearly defined "Payment Tokens," and Singapore has also defined "Payment Tokens" and recently released a stablecoin regulatory framework. The EU's MiCA legislation also provides a clear definition of "Electronic Money Tokens." The continued clarification of these regulatory definitions will give cryptocurrencies a legitimate and effective status, further driving the development of the Web3 payment industry and leading the Web3 industry towards Mass Adoption.

Compliance is the foundation for traditional giants, so we see that when they engage in Web3 payment business, they initially limit their business to specific regions. For example, MetaMask's "Sell" fund withdrawal service (supported by Moonpay) is currently only available in the US, UK, and parts of Europe, and Paypal's stablecoin is currently limited to US users. Although participation in Web3 payment projects is subject to compliance requirements such as licenses, qualifications, and permits, this is also a major barrier for project participants.

Due to the complex nature of Web3 payments involving cryptocurrencies, payments, asset custody, stablecoins, and anti-money laundering/counter-terrorism financing, it is exceptionally complex. The following will briefly outline the legal regulations related to Web3 payments in major jurisdictions to see how the giants are building legal compliance barriers.

4.1 United States

The main regulatory agency for Web3 payments in the United States is the Financial Crimes Enforcement Network (FinCEN) under the US Department of the Treasury. FinCEN is primarily responsible for supervising and implementing anti-money laundering (AML), combating the financing of terrorism (CFT), and customer due diligence (KYC) aspects, as well as collecting and analyzing financial transaction information to track suspicious individuals and activities.

FinCEN's authority comes from the Bank Secrecy Act (BSA), which considers cryptocurrencies as "currency." In 2019, FinCEN issued guidance (Application of FinCEN’s Regulations to Certain Business Models Involving Convertible Virtual Currencies), which provides regulations related to cryptocurrency payments.

The 2019 guidance defines "money transmission" as the act of receiving currency (or value that substitutes for currency) from one party and transmitting it entirely or partially to another party. This definition includes "currency substitutes" such as money orders, stored value cards, and cryptocurrencies. In most cases, any "company" engaged in money transmission business to US users will meet the definition of "Money Service Business" (MSB) under the BSA and FinCEN regulations, and must comply with the BSA and FinCEN regulations and fulfill compliance obligations.

In summary, the 2019 guidance determines whether a company is an MSB based on:

(1) Control of user assets (private keys): Centralized exchanges and custodial wallet providers that offer services to US users, as they can control user assets (private keys), are considered MSBs. However, non-custodial wallets like MetaMask, and decentralized exchanges (DEX) that only provide matching services, where users independently control assets (private keys) and interact directly with the payment system, or only provide communication or network access services to support currency transfer services, are not considered MSBs.

(2) Nature of the business's money transmission: Payment companies that provide services to US users, such as Moonpay, Paypal, Stripe, and Square, are engaged in money transmission business and are considered MSBs.

"Companies" classified as MSBs not only need to comply with the BSA and FinCEN regulations and fulfill compliance obligations but also need to obtain money transmission licenses (MTL) from various states in accordance with state money transmission laws. While obtaining an MSB license in the US is relatively easy, obtaining an MTL license takes a long time and requires substantial legal consultation fees, typically taking about two years and costing millions of dollars.

BitLicense, created by the New York State Department of Financial Services under the New York Financial Services Law, is a cryptocurrency license used to regulate cryptocurrency institutions and related trust companies (a New York State limited purpose trust company) within the state. Licensed entities must comply with the BitLicense compliance and regulatory framework, including consumer protection, anti-money laundering compliance, and cybersecurity guidelines. Entities that have previously obtained BitLicenses include XRP II, Circle Internet Financial, Gemini Trust Company, and itBit Trust Company.

This is why we see news that X (formerly Twitter) is actively applying for money transmission licenses (MTL) in various states in the US. X wants to become like WeChat, and this will undoubtedly involve WeChat's payment system. For payment companies that have already obtained licenses in various states, this will be a core barrier for them to operate Web3 payment business in the US.

4.2 United Kingdom

Companies wishing to engage in Web3 payment business in the UK need to obtain an Electronic Money Institution (EMI) license issued by the Financial Conduct Authority (FCA) in the UK. We see that Coinbase obtained an EMI license in 2018 and operates cryptocurrency businesses in the EU region.

Interestingly, the decentralized lending platform Aave, headquartered in London, also obtained an EMI license in 2020. This move is reportedly aimed at providing compliance guarantees for Aave to attract more users to DeFi, possibly also due to the strict consumer protection compliance requirements in the UK.

Before Brexit, holders of EMI licenses in the UK were not subject to restrictions on time or activity areas in the European Economic Area (EEA) and could provide any form of service. After Brexit, more companies will turn their attention to the more neutral-friendly Ireland.

4.3 Ireland / European Union

In 2021, Ireland introduced a registration system for Virtual Asset Service Providers (VASPs), with the Central Bank of Ireland reviewing companies to ensure they can meet AML/CTF requirements. After Coinbase obtained an EMI license authorized by the Central Bank of Ireland, Coinbase Ireland Limited obtained a VASP license in Ireland in 2022, allowing Coinbase to issue electronic money, provide electronic payment services, and process electronic payments for third parties.

Similarly, after obtaining the UK EMI license, Moonpay obtained VASP registration from the Central Bank of Ireland in 2023. The CEO stated, "We believe that registering as a VASP in Ireland first and ultimately applying for registration under the EU MiCA will provide a huge competitive advantage for the company to enter the EU market in compliance."

The European Union's Markets in Crypto-Assets Regulation (MiCA) has been approved by the European Parliament and is expected to take effect in 2024. In general, MiCA applies to all entities involved in the issuance of crypto-assets and the provision of crypto-asset-related services in the EU, including issuers of various crypto-assets (Crypto-Assets), such as E-Money Tokens, Asset-Referenced Tokens, and other Tokens, as well as providers of various crypto-asset services and service providers, including wallet custody services, deposit and withdrawal services, exchange services, asset management services, investment advisory services, and more.

MiCA fills the gaps in the current EU financial regulatory framework and, once implemented, will create a unified crypto-asset regulatory framework within the EU, directly impacting a crypto-asset market with 27 countries and a population of 450 million. Since obtaining a VASP license in one EU member state allows operations throughout the EU, Lithuania, with the most lenient crypto-asset regulatory policies in the EU, has attracted many centralized exchanges and payment institutions for registration.

4.4 Hong Kong

With the introduction of the VASP system in Hong Kong, all centralized crypto-asset exchanges operating in Hong Kong or actively promoting their services to Hong Kong investors, regardless of whether they provide security token trading services, will need to be licensed and regulated by the Securities and Futures Commission of Hong Kong.

At the same time, the VASP system requires "prudent custody of client assets" for the operation of centralized exchanges, meaning platform operators must hold client funds and crypto-assets through a wholly-owned subsidiary in trust (TCSP trust license). This requirement is to ensure independent custody of investor assets and prevent self-dealing.

The TCSP license, Trust or Company Service Providers, is required for custody of crypto-assets as traditional banks can only hold fiat currency assets. This has created new business scenarios for TCSP trust licenses.

The Hong Kong High Court has previously ruled in the case of Re Gatecoin Ltd [2023] HKCFI 914 that crypto-assets are classified as "property" and are "capable of being held on trust." Therefore, any company engaged in crypto-asset custody business needs to apply for a TCSP license. Exchanges such as OSL, Hashkey Group, Gate.io, as well as wallet infrastructure and digital asset custody service providers like Liminal, have recently obtained TCSP licenses.

Under the Anti-Money Laundering Ordinance, any entity operating or intending to operate a currency service in Hong Kong must apply to the Hong Kong Customs for a Monetary Service Operator license (MSO). For Web3 payment businesses, service providers offering crypto-related services such as currency exchange or remittance services in Hong Kong need to obtain an MSO license issued by Hong Kong Customs.

4.5 Singapore

The Monetary Authority of Singapore (MAS) is the central bank and comprehensive financial regulatory authority in Singapore, responsible for regulating the Web3 industry. Referring to the MAS's "A Guide to Digital Token Offerings" released in May 2020, it is clear that security tokens and payment tokens are regulated by two specific regulations, while utility tokens are not regulated.

For payment tokens, under the Payment Services Act, which took effect in January 2020, providing digital payment token (DPT) services in Singapore, including direct trading services for DPT (such as buying, selling, fiat currency exchange, and crypto-to-crypto exchange) and services that facilitate DPT transactions (such as exchanges, custodians, wallet services, etc.), requires a license.

The application for this license is relatively difficult, and in recent years, there has been a particularly cautious attitude towards the crypto field. However, Singapore offers an indefinite exemption period for DPT operations, allowing operations to proceed without a license. In 2022, institutions such as Circle, Paxos, Blockchain.com, Coinbase, Luno, Digital Treasures Center, Crypto.com, and Genesis have successively obtained DPT licenses.

V. Vision for the Future of Web3 Payments

From a market perspective, this is still a promising blue ocean market. According to statistics, there are currently 1.7 billion people worldwide without bank accounts but in need of financial services. These innovations have witnessed a surge in crypto payments in countries with high inflation, a lack of banking services for most of the population, or where the traditional financial system is considered unreliable. The fact that there are over 420 million cryptocurrency owners globally is enough to show that the cryptocurrency industry is not just a speculative industry but a thriving and rapidly growing industry.

From the perspective of innovative development, to meet the growing demand for cryptocurrencies, Layer 2 continues to innovate and optimize scalability solutions, stablecoins address the volatility of cryptocurrencies, compliance asset management solutions from wallet service providers and custodians address asset security issues, and Web3 payment companies provide deposit and payment solutions to address merchant receipts and mobile payment issues. These thriving technological innovations have laid a solid foundation for Web3 to move towards Mass Adoption.

Looking back at the implementation paths of giants such as Paypal, Coinbase, MetaMask in Web3 payments, and their strong traffic and scene entry points, and imagining the exclusive advantages of players like X (Twitter), Telegram, who are currently making a strong push. It is not difficult to see that after breaking through the basic functions of wallets, custody, stablecoins, and payments, the giants will each form their own large Web3 encrypted ecosystem. In this context, the existing pattern of the cryptocurrency market, mainly dominated by exchanges, is bound to change.

In addition to the giants' large Web3 encrypted ecosystems, the interoperability of Web3 products is also a point of transformation. Take Web3 wallets as an example. Web3 wallets are tools closely integrated with the DApp ecosystem, providing direct access and use of DApps. Currently, users of the OKX Web3 wallet can access over 5500 DApps, with over 500 DApps already integrated into the wallet. Not to mention MetaMask, with nearly 30 million monthly active users, and the MetaMask Portfolio DApp, which has aggregated functions such as Sell, Buy, Stake, Dashboard, Bridge, and Swap.

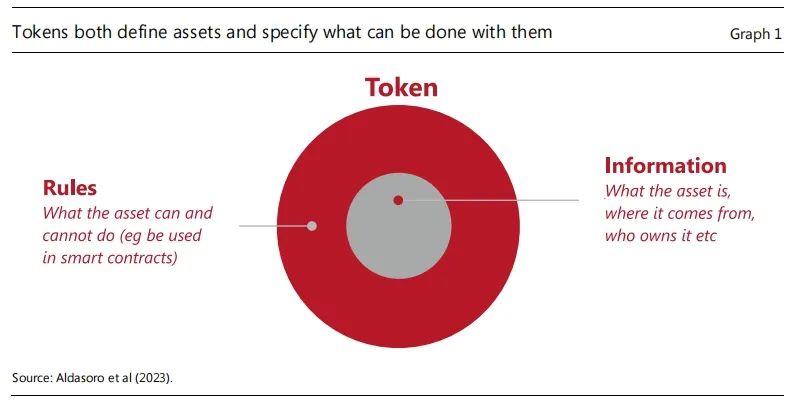

From the perspective of the monetary system, the BIS stated in the "Blueprint for the Future of the Monetary System" that the current monetary system is on the verge of another major leap. After digitization, the key to the development of the monetary system is tokenization—the process of digitally representing claims of rights on programmable platforms, which can be seen as the next logical step in digital record-keeping and asset transfer.

The future monetary system will use tokenization to improve the old monetary system and support the new monetary system. By using new intermediaries (a unified ledger) to serve end-users, it eliminates the artificial intervention and reconciliation arising from the separation of traditional message transmission, clearing, and settlement, thereby eliminating delays and uncertainties. Tokenization can significantly enhance the capabilities of the monetary and financial systems, and the future monetary system is expected to unleash new economic growth potential through tokenization, which is impractical in the inherent friction of the current monetary system.

This tokenization is not only the recent hot trend of Real World Asset (RWA) tokenization but can also be the tokenization of the currency itself. Tokens not only define assets but also wrap the payment logic of the tokens through their programmability, thereby defining what the assets can be used for.

VI. Conclusion

Undoubtedly, in the near future, Web3 payments will become commonplace, possibly completely replacing existing payment methods, both within enterprises and between individuals. At the same time, traditional finance will also be interconnected through Web3 payment finance and trade, highlighting the efficiency advantages of asset expression, circulation, trading, programming, and regulation.

The greatest opportunity of cryptocurrencies may not be as cryptocurrencies but as a new payment method. Some believe that the killer application of Web3 has not yet arrived, but it may have already quietly arrived: it is payments!

Digitization and tokenization will give new value to the traditional monetary system, overcoming boundaries that were previously impossible to break. The world economy may change forever as a result.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。