Source: Synced

The arms race of AI technology giants is in full swing, but the venture capital circle seems to be a bit lost. A partner at Sequoia shares his industry insights: the AI industry has a minimum annual scale of 200 billion, wherever the GPU is, there is the opportunity for AI.

Is the AI industry's explosion since last year a speculative bubble or a true technological revolution?

Apart from the AI arms race of large companies, why do startups have almost no opportunity?

These questions are not only pondered by entrepreneurs and users, but also by the world's most influential venture capital institutions seeking their own answers.

David Cahn, a partner at Sequoia Capital and an investor in two star products — Hugging Face and Notion — recently wrote an article sharing his insightful analysis of the social and investment value of the AI industry.

The generative AI wave that started last summer is now in overdrive.

NVIDIA's second-quarter profit level, and profit expectations far exceeding market analysts' forecasts, are propelling the AI wave in a more profound direction.

Because NVIDIA's financial report sent a signal to the market — the demand for GPU and AI model training far exceeds supply.

Before NVIDIA's second-quarter financial report was released, consumer-level products such as ChatGPT, Midjourney, and Stable Diffusion had already broken through the development bottleneck of AI technology.

With the release of NVIDIA's financial report, entrepreneurs and investors saw substantial evidence that AI could generate tens of billions of dollars in net incremental revenue.

Although investors have gained a lot of information from NVIDIA's financial report, and AI investment projects are now advancing at an extremely fast pace, valuations of startup companies are also setting new records.

However, there are still some major unresolved questions: where are all these GPUs being used?

Who are NVIDIA's customers creating value for?

How much value does the entire industry need to create to achieve a balanced state with such a high investment return rate?

How is the entire industry paying for NVIDIA?

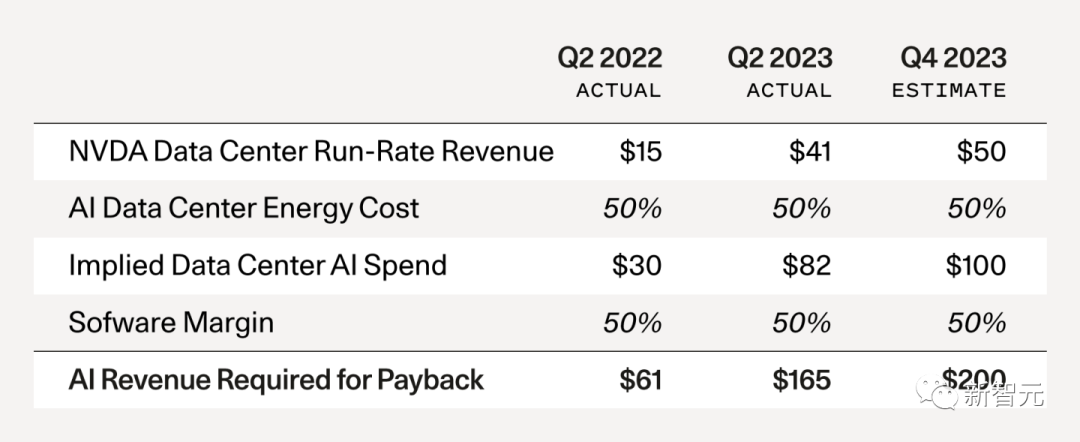

For every dollar invested in building data centers on GPUs, it costs about one dollar in energy to run these GPUs.

Therefore, if NVIDIA sells $50 billion worth of GPUs by the end of the year (based on conservative analyst estimates), this means that the data centers built on these GPUs will cost about $100 billion.

The ultimate users of the GPUs — such as Starbucks, X, Tesla, Github Copilot, or a new startup — also need to make a profit.

Assuming their profit margin needs to reach 50%, it means that these GPUs need to generate $200 billion in revenue annually to recoup the initial capital investment.

This does not include the reasonable profit that intermediate cloud suppliers should receive — the industry's total revenue demand will be even higher to achieve a balanced state.

According to the financial reports of major companies in the AI industry, the expansion of a large number of data centers is mainly borne by various tech giants: Google, Microsoft, and Meta have all reported increased capital expenditures on data centers.

Public financial reports also indicate that ByteDance, Tencent, and Alibaba are also major customers of NVIDIA.

Looking ahead, companies such as Amazon, Oracle, Apple, Tesla, and Coreweave will also become important product and service suppliers.

So, an important question arises: how much of the AI infrastructure construction brought about by these capital expenditures is related to the actual needs of the ultimate customers, and how much is paid in advance for the future needs of the ultimate customers?

This is the most important question arising from this $200 billion.

According to a previous report by "The Information," OpenAI is expected to generate $1 billion in revenue annually.

Microsoft has stated that AI products like Microsoft Copilot are expected to generate $10 billion in AI-related revenue.

Assuming Google will generate a similar scale of revenue from its AI products (such as Duet and Bard), and assuming that Meta and Apple will each generate $10 billion in revenue from AI.

For Oracle, ByteDance, Alibaba, Tencent, X, and Tesla, we estimate that each will generate around $5 billion in revenue.

The key is that even assuming AI can bring in substantial revenue, at the current level of capital expenditure, the entire industry still needs to fill a revenue gap of over $125 billion annually.

Huge Opportunities for Startups

This huge gap provides a huge opportunity for the startup ecosystem.

Sequoia's goal is to "track GPUs" and find the next generation of startups that leverage AI technology to create value for real end customers.

Sequoia wants to invest in these companies.

The goal of this series of analyses in this article is to highlight this gap.

Since 2017, the evolving deep learning technology breakthrough has finally ushered in this wave of enthusiasm.

This is good news. Large-scale capital is entering the AI industry. In the long run, this will significantly reduce the cost of AI development.

Based on past experience and the capital investment in AI infrastructure, in the past, developers needed to purchase local servers to build applications. Now, developers can achieve the same effect at a lower cost using public clouds.

Many AI companies are now investing the vast majority of their venture capital in GPUs.

As today's GPU shortage turns into a surplus, the cost of running AI workloads will definitely decrease in the future.

This will stimulate the development of more AI products and attract more entrepreneurs to the AI industry.

In the history of technological cycles, overbuilding of infrastructure often burns a lot of capital, but at the same time, it will stimulate future innovation by lowering the marginal cost of new product development.

Sequoia expects this pattern to play out again in the AI industry.

For startups, the conclusion is clear: the venture capital circle needs to shift our focus from infrastructure to the value of end customers.

Meeting the needs of end customers is the basic premise of every great business.

To make AI truly impactful, we need to figure out how to use this new technology to improve people's lives.

How can we transform the amazing innovations produced by AI technology into products that customers use, love, and are willing to pay for every day?

The construction of AI infrastructure by tech giants is already in progress.

In the future, AI infrastructure will no longer be a limiting factor for the industry.

Many basic models are currently under development — this will no longer be a problem in the future. And the AI tools currently available are already quite good.

So, the most relevant question regarding this $200 billion in revenue becomes:

What do you plan to do with all this infrastructure? How will it change people's lives?

Reference: Sequoia Capital

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。