Web3 incubators and accelerators have subtle differences, but their collaboration with Web3 entrepreneurial projects can drive the industry forward.

Author: Philipp Sandner, Professor at the Frankfurt School Blockchain Center, Writer, Investor

Translation: angelilu, Foresight News

Startups often face high failure rates due to issues such as lack of funding, operational difficulties, and poor product-market fit. When facing these problems, it is crucial for startups to seek guidance from experts or mentors, and the rise of incubators and accelerators provides viable solutions to address these issues.

Incubators and accelerators originated in Silicon Valley in the mid-21st century, providing support to entrepreneurs including mentorship, funding, and networking opportunities. Most entrepreneurial projects in the Web3 technology era aim to accelerate mainstream adoption of Web3 through technologies such as distributed ledgers. So, what are the differences between Web3 accelerators and incubators? And how do they support Web3 projects? This article will delve into these topics.

Background of Web3 Venture Capital

Before delving further into this topic, it is important to emphasize the differences in shaping the venture capital and innovation landscape in the Web3 domain compared to traditional domains. Web3 emerged after the financial crisis, with Bitcoin laying the foundation for industry development, and Ethereum's launch in 2015 marking the early stage of the Web3 industry. The industry has made significant progress since 2020, but the tasks ahead remain challenging. The novelty of Web3 requires broader validation to spread the concept of trustless and decentralized Web3.

The Web3 industry operates in distinct cyclical patterns, experiencing a boom and bust cycle approximately every four years, largely influenced by the Bitcoin halving schedule, with factors such as fraud, exit scams, regulatory pressure, or macroeconomic conditions acting as catalysts within the cycle.

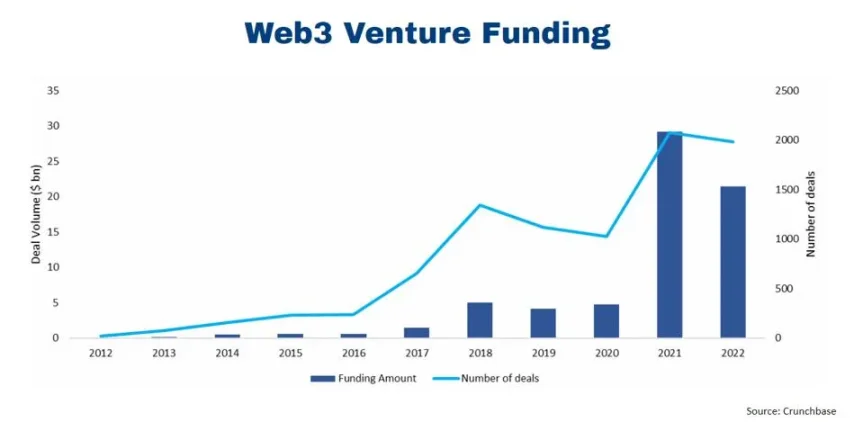

In this context, the Web3 venture capital field also exhibits significant volatility. According to annual data provided by Crunchbase, capital inflows decreased by nearly 80% in the first half of this year, plummeting from $16 billion to $3.6 billion. This indicates that capital flows tend to follow the trajectory of the cycle.

Figure 1: Volatility of Web3 venture capital activities (pre-seed, seed, and venture capital)

Success in entrepreneurship requires more than just funding

However, those focused on Web3 know that funding is just one of several prerequisites for the success of Web3 projects. In addition to financial support, the secret to success also requires the right team composition, unwavering resilience, the continuous establishment of social networks, ongoing product improvements, and perhaps a bit of luck. It is within the complex interplay of these factors that the role of incubators and accelerators emerges. Venture capital firms realize that in the Web3 industry, simply investing funds may not necessarily create the "next unicorn," and they need to provide multidimensional guidance and support.

Incubators and accelerators both provide assistance and support to entrepreneurial projects, but there are also some subtle differences:

Incubator:

- Description: Incubators focus on helping companies in the early stages of entrepreneurship, providing guidance, training, networking opportunities, and sometimes funding.

- Focus: Incubators aim to help startups develop or refine their Minimum Viable Product (MVP) and achieve product-market fit.

- Content: Incubators provide workshops and training led by experienced startup experts, covering topics such as idea validation, MVP creation, and business models, as well as imparting entrepreneurial mindset.

- Startup stage: Incubators are most suitable for startups with ideas and initial research foundations or those facing challenges.

- Product: Startups do not necessarily need to develop a product at the incubation stage, and individuals can even apply without an idea.

- Equity: Startups typically retain the majority of equity, with incubators requiring 4-15% equity.

- How to participate: Entrepreneurs can apply for incubator programs based on their skills, ideas, or startup projects, with or without participation fees.

- Team: Typically, individuals and teams can apply for incubators, and they will be matched with suitable individuals in the incubation program to complement their strengths.

- Ultimate goal: The main goal of incubators is to help startups achieve product-market fit and establish a stable foundation.

Accelerator:

- Description: Accelerators focus on helping startups that already have an MVP, accelerating their business development into the next growth stage.

- Focus: Accelerators primarily focus on aspects such as marketing, customer acquisition, and product optimization, helping companies further expand and develop.

- Content: Accelerators provide training and guidance in marketing, business strategy, financial management, legal affairs, and opportunities to connect with potential investors and clients, led by industry experts, successful entrepreneurs, and venture capitalists.

- Startup stage: Accelerators are most suitable for startups that have validated their business model and have initial revenue.

- Product: During the accelerator stage, startups must have developed products or services that have already been market validated.

- Equity: Accelerators typically require more equity, with equity requirements ranging from 6-20%.

- How to participate: Startups can apply to join accelerators based on their MVP, initial business plans, and market potential. Accelerators typically provide seed investment to help startups further develop.

- Ultimate goal: Accelerators focus on helping startups scale up and prepare for further investment.

According to the views of the Blockchain Founders Group, the above can be summarized as follows: incubators focus on nurturing early-stage startups and helping them achieve product-market fit, while accelerators focus on scaling up startups that have already achieved product-market fit. Both types of programs provide similar resources such as guidance, training, networks, and potential funding, tailored to their respective goals. The choice between incubators and accelerators depends on the stage of the entrepreneurial project and its growth objectives. Additionally, for Web3, there are different types of accelerators and incubators. For example, technology-focused VCs may also allocate some attention to Web3, and over time, many projects solely focused on Web3 have emerged.

Value provided by incubators and accelerators to entrepreneurs

Figure 2: Overview of how accelerator and incubator programs provide value to entrepreneurs

- Guidance: Entrepreneurs will be paired with experienced mentors who will provide personalized guidance, share their own experiences and insights in the Web3 domain, and help startups address challenges and make informed decisions.

- Industry expertise and workshops: Participants will gain professional knowledge and insights into the Web3 industry, gaining in-depth understanding of industry trends, technologies, and market dynamics, enabling them to make strategic choices that align with the unique requirements of the Web3 domain. Industry experts provide in-depth training and answers, covering various topics such as decentralized applications, smart contracts, token economic models, product-market fit, customer identification, growth strategies, and team building, providing participants with practical skills and knowledge.

- Technological tools and infrastructure: Web3 incubators and accelerators provide cutting-edge technology, software platforms, and development tools for early-stage startups. These are customized for the complexity of decentralized technologies and can expedite the technology development process.

- Partnerships and networking opportunities, and increased confidence from VCs in later-stage funding: By establishing connections with other entrepreneurs, industry professionals, and potential investors, participants can form strategic partnerships and strengthen their startup ecosystem. The credibility gained from connecting with reputable incubators or accelerators can also enhance the attractiveness of startups to venture capitalists during the funding stage. A survey involving 900 venture capitalists conducted by Harvard Business Review found that nearly 70% of investment deals originated from their professional networks.

- Competitive atmosphere among members inspires everyone to give their best: A healthy competitive atmosphere within the project encourages startups to push themselves, drive innovation, and motivate participants to step out of their comfort zones.

- Capital/Financing: Early-stage startups receive initial funding or investment to provide the necessary financial foundation to drive their Web3 projects forward and initiate growth.

- Market research and intelligence: Carefully planned market research and intelligence enable startups to refine their product strategies, target specific user groups, and anticipate emerging trends in the constantly evolving Web3 domain.

- Incubator/Accelerator brand can enhance confidence of potential clients (i.e., the reputation of the startup): The renowned brand of an incubator or accelerator gives credibility to startups, enhancing the trust of potential clients, users, and stakeholders, increasing their willingness to engage with and invest in the startup's products.

Evolution of Web3 Incubators and Accelerators

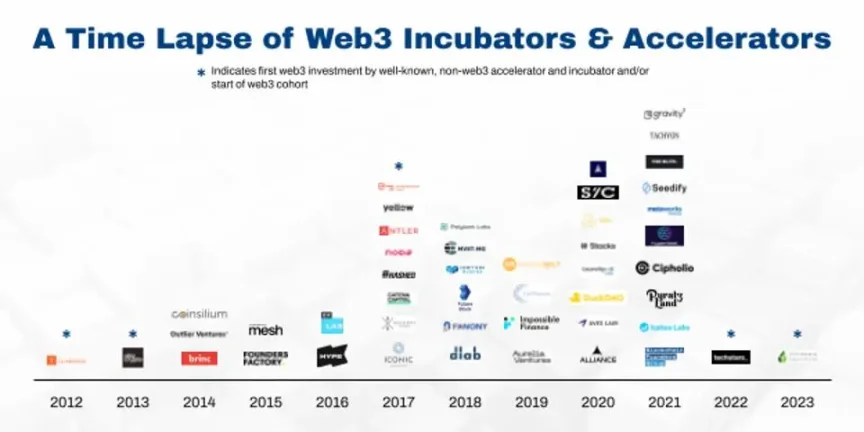

Figure 3: Evolution of Web3 accelerators and incubators

The leftmost image shows the initial appearance of accelerators and incubators, and over time, they also made investments related to blockchain. With the first large-scale cryptocurrency boom and bust cycle from 2017 to 2018, more and more accelerators and incubators emerged. In 2021, due to capital surplus and hype around topics such as Bitcoin, DeFi, and NFT, 2021 became the year with the most Web3 industry accelerators and incubators.

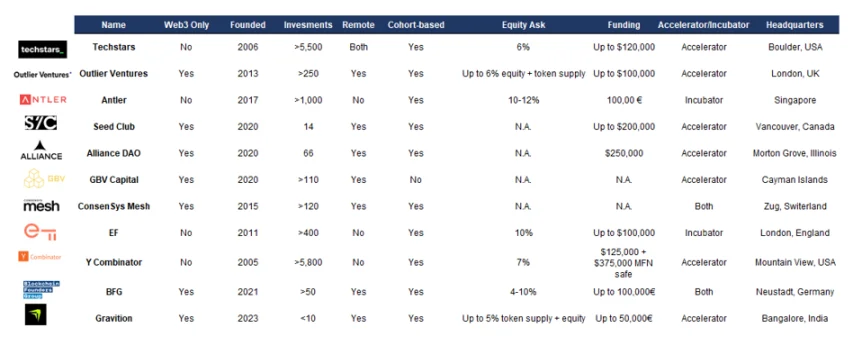

Overview of Leading Web3 Incubators and Accelerators

Figure 4: Overview of leading accelerators and incubators

"The Web3 domain needs specialized incubators and accelerators because they recognize that Web3 entrepreneurs need a tailored guidance program. No two entrepreneurs will have the exact same entrepreneurial journey, and helping founders identify and effectively leverage their strengths, while assisting them with most tasks related to entrepreneurship, is invaluable to many. Given the novelty of Web3, identifying smart and passionate individuals, and then guiding them in the right direction to find the best Web3 business strategy, is a great way to drive industry growth."

—Max Cheng, Blockchain Founders Group

Conclusion

In the dynamic Web3 domain, incubators and accelerators play a crucial role in shaping the success of startup companies. Faced with the challenges of the Web3 domain, these entities provide tailored guidance and resources, guiding startups to avoid common pitfalls and take bold and innovative actions.

Incubators and accelerators originated in the mid-2000s in Silicon Valley and have now become important pillars of the venture capital world. Now, as Web3 technology dominates headlines and reshapes industries, these entities are adjusting their focus to embrace distributed ledger technology, and this article emphasizes their role in accelerating mainstream adoption of Web3 and supporting the success of Web3 startup projects.

Furthermore, the volatility of Web3 investment fluctuates sharply with hype and cyclical cycles, and this characteristic does not provide stable support for the development of Web3 startups. Incubators and accelerators are meeting this challenge, providing not only funding but also tailored guidance, industry insights, connections, and technological tools to help startups thrive in uncertainty.

In this complex ecosystem, the collaboration between startups, incubators, and accelerators can drive innovation, connect promising entrepreneurs, shape entrepreneurial spirit, and promote growth in the Web3 domain. Professional support is crucial for Web3 startups, and the innovative guidance provided through the collaboration of incubators and accelerators is driving continuous advancement in the Web3 industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。