Preface

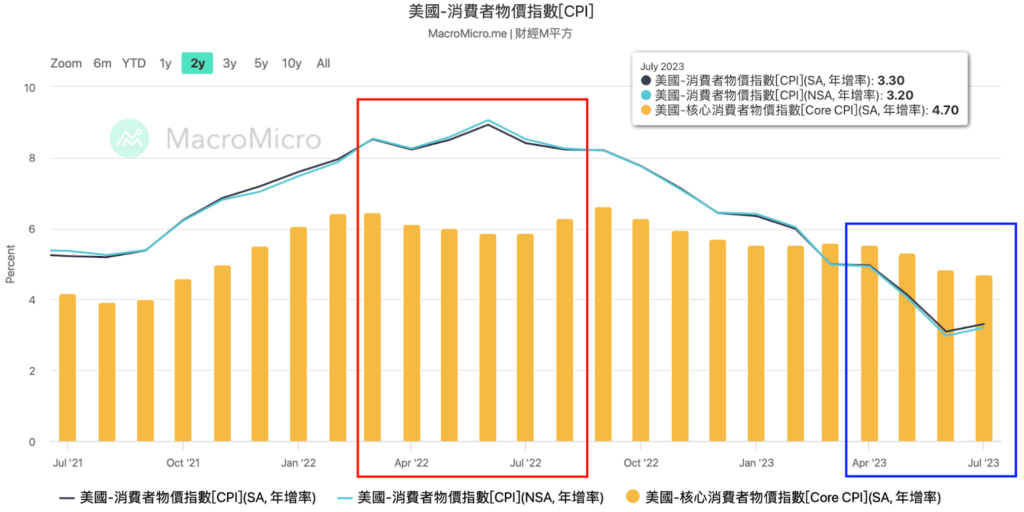

At 10:05 pm on August 25th, Taiwan time, Federal Reserve Chairman Powell delivered a speech at Jackson Hole. As the inflation rate slowed to 3.3% and the perceived end of the interest rate hike cycle, the useful information from this speech can be used to analyze the future trends of monetary policy.

Analysis of the Speech Content

In this speech, Powell broke down "core CPI" into 3 parts and explained them:

Goods Inflation Rate

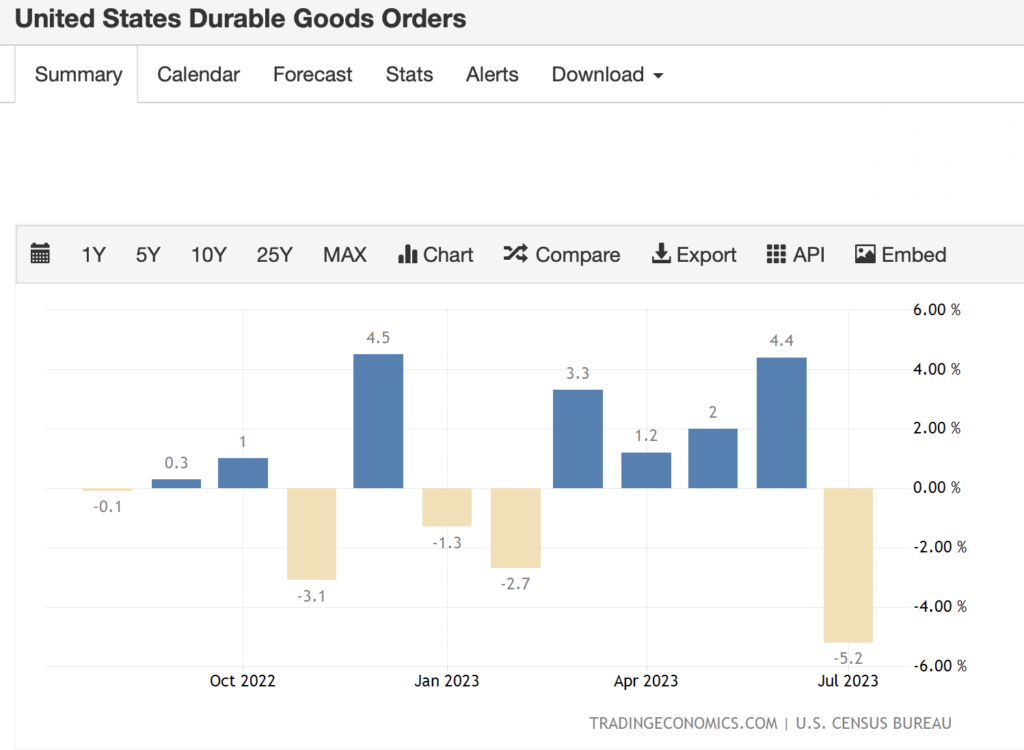

From the data chart below, it can be observed that the durable goods order data for July showed the largest post-pandemic slowdown, dropping to -5.2%. However, this was mainly due to a decrease in aircraft deliveries. Excluding aircraft, the growth of durable goods orders was 0.5%, exceeding the expected 0.2%.

Therefore, it can be considered relatively healthy from the perspective of the order block. However, looking at other details, such as the automotive sector, the overall monthly growth rate of used car prices has remained negative since April this year, driven by the chip shortage caused by the Ukraine-Russia war. This has led to a rapid decline in the inflation rate of durable goods. However, data tracked by vAuto showed that retail sales of used cars in July increased by 6% compared to June, indicating that consumer demand has not weakened significantly under high interest rate conditions.

Housing Inflation Rate

Real estate is very sensitive to interest rates. Powell mentioned that after the start of the QT cycle, the housing market cooled down. However, from the CPI, it was only in April 2023 that a significant slowdown in rent was observed, while QT began in early 2022. Therefore, the slowdown in rent growth in the past year has lagged behind in the CPI, so special attention needs to be paid to how rent affects the inflation rate. (Since most rental contracts are signed annually, rent is usually updated annually. Therefore, changes in house prices and rents will definitely lag behind in inflation data.)

The current increase in August to over 4% has also repriced the 30-year mortgage rate to 7.09%, the level of 2001.

Recent economic data shows that the momentum of the US economy remains strong -> Strong momentum indicates that the economic environment still has some resilience -> The Fed can further raise interest rates if inflation continues to hover in the 3-3.5% range -> US bond yields rise (the market believes that there will not be a quick rate cut, as a rate cut is not only based on a decline in inflation, but also on a cooling of economic activity due to high interest rates) -> This drives up mortgage rates -> Not only will the demand side decrease, but the supply side (including inventory) will also decrease accordingly.

The main issue is that mortgage rates are fixed. For example, buyers who purchased new homes in 2021 did so with an average mortgage rate of 3.2%. It is now unlikely that they will sell and buy new homes at a much higher rate of about 4%. This has led to an increase in existing housing prices, coupled with sellers' reluctance to sell properties, potential buyers will be forced to exit the market. This is not only an obstacle to slowing inflation to a growth rate of 2%, but also unhealthy for the liquidity of the US housing market (only waiting for mortgage rates to return to normal). However, before that, the contraction of housing market liquidity is expected to effectively help slow down inflation.

Service Inflation

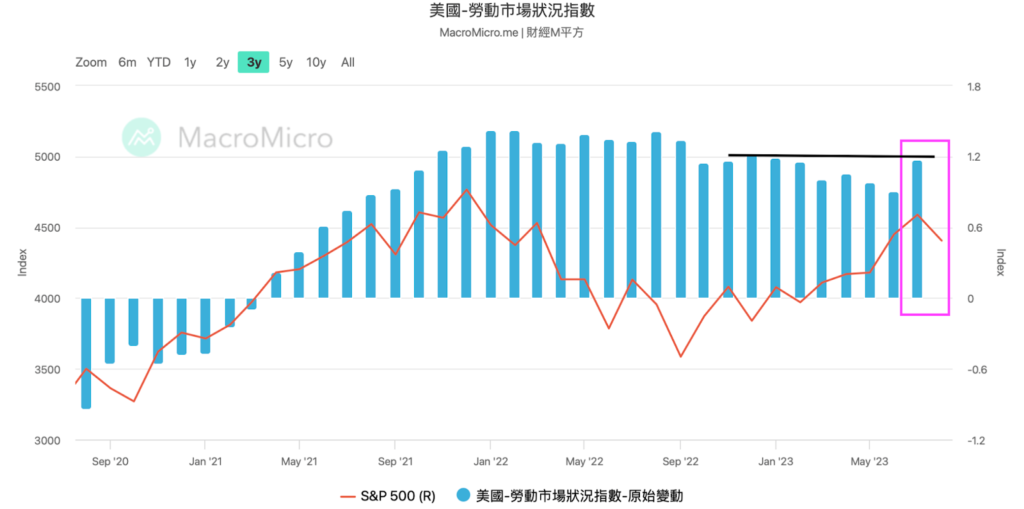

Here, service inflation refers to excluding the housing part. Service inflation not only accounts for 28% of the CPI weight, but also more than half of the core PCE weight. From a macro perspective, service inflation has been declining since it peaked in September of last year. However, Powell emphasized that service inflation is less sensitive to interest rates and is more related to the dynamics of the labor market. The year-on-year growth rate of services, excluding housing data, slightly rebounded in the July data; on the other hand, the labor market conditions index for this month showed the largest increase in recent months, indicating that the US labor market is still tight.

Conclusion

In this public speech at Jackson Hole, Powell once again emphasized the target of restraining inflation to 2%. Although the data shows that inflation has indeed slowed down, the overall economic situation in the US remains robust. This may be why Powell's speech seemed somewhat hawkish this time. He compared pre-pandemic economic data with the current situation and indicated that now is definitely not the time for the Fed to ease monetary policy, and that the federal interest rate is likely to rise further.

In the current US economic situation, I subjectively believe that there are two main reasons why Powell chose to use stricter standards to scrutinize these economic data.

Point 1: The CPI data released in July showed a slightly higher growth rate compared to the previous month, and based on the comparison with the high base period last year (high energy and used car market prices), the inflation growth rate in recent months has fallen sharply. As the energy and used car sectors began to slow down in the second half of last year, the high base period effect on this year's inflation data has diminished. From the data on the books, it seems that it will be increasingly difficult to restrain inflation in the coming months.

As shown in the following chart:

Point 2: From various economic data, it can be seen that the US economy is still resilient and consumer activity remains active in an environment of such high interest rates. Of course, the Fed does not want to cause a hard landing in order to restrain inflation, but from the current market dynamics, the effects of raising interest rates seem to be reflected only in recent inflation data, while real economic activity does not seem to be feeling the effects of the US economy being restrained under high interest rates. It is not difficult to imagine how immediately easing monetary policy would affect inflation.

Supplement

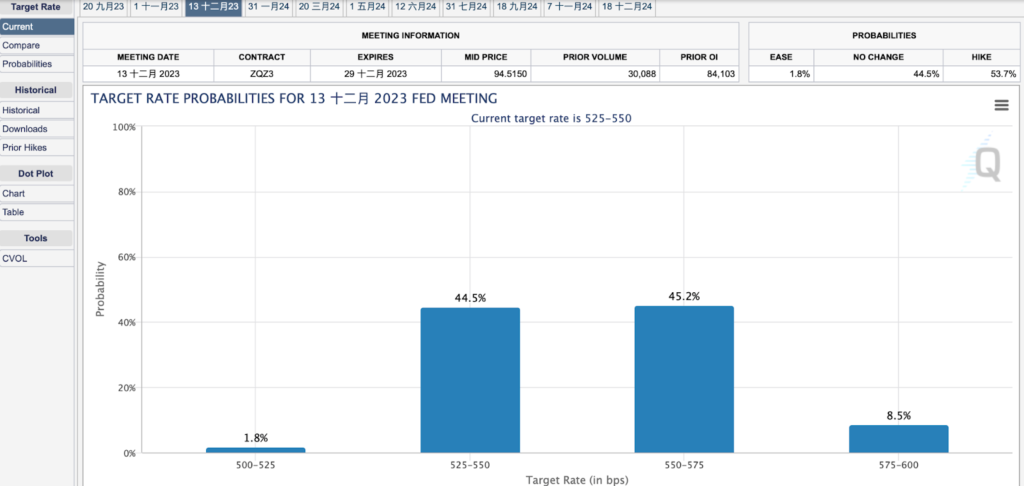

After Powell's speech at Jackson Hole, the CME FedWatch Tool's expectations for future FOMC rate hikes, here I use the probability of the federal interest rate rising to 5.50% - 5.75% by the end of 2023 and the probability of pausing rate hikes, which is basically the same. This means that the probability of another rate hike in September's FOMC is very high.

As shown in the following chart:

Learning Discussion Group

Dear readers, you may be thinking, "Where can I learn and access such in-depth analysis methods and valuable information?"

No need to look any further! In addition to the high-quality content on our website, we also invite friends who want to learn about investing in cryptocurrencies and cryptocurrencies to join our "DA Trader Alliance" VIP group, where there are many enthusiastic traders to exchange and discuss with.

Click the link to fill out the form! 🔗 https://datatw.io/vip/ Once approved, you will be able to join this joyful and high-quality cryptocurrency community!

Get ready to embark on an exciting investment learning journey with us!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。