Author: Africa Web3 Research Institute

Layout: Xiaolu, Green

Editor: Vand

Nigeria is the second largest user of Bitcoin, second only to the United States, with 22 million cryptocurrency holders, accounting for 10% of the total population.

As the largest economy in Africa, Nigeria suffers from severe inflation, and foreign exchange controls restrict people from using foreign currency to combat inflation. As a result, residents have turned to cryptocurrency to bypass regulations and preserve the value of their assets.

The decentralized and global nature of Web3 is well-suited to local needs.

Nigeria | A Land of Riches and a People in Poverty

This is the West Coast! Nigeria is located on the West Coast of Africa, the largest country in Africa, and uses English. Nigerians are not as poor as we imagine, and most of them do have mobile phones.

One out of every six Africans is Nigerian. The abundant natural resources such as oil and natural gas are distributed across this land. The tropical climate and the Niger River bring abundant water and heat conditions.

Image Source: TechCrunch So despite overall poverty and weak urban development and infrastructure, influenced by low-cost mobile phone brands like Transsion, with prices ranging from 100-200 RMB, local residents can afford them after working hard for a month.

Therefore, the penetration rate of mobile internet is still relatively high, with a broadband penetration rate of 41%; there are 102 million internet users, equivalent to the level in China in 2013.

Vast Disparities, with Money Flowing to the Wealthy

Despite the abundant resources, residents' incomes are not high. According to World Bank data, there are 95.1 million people living in poverty, accounting for half of the total population.

However, the combined wealth of the top five billionaires in Nigeria amounts to $29.9 billion, while the average worker earns only 18,000 naira per month, equivalent to 267.48 yuan.

Image Source: United Nations Official Website

Dapp Ecosystem Lacks Prosperity, but Cryptocurrency Enters the Wallets of 22 Million People

In Chainalysis' 2022 Global Cryptocurrency Adoption Index, Nigeria ranks 11th, and it ranks 17th in peer-to-peer (P2P) exchange trading volume (similar to Binance, which is a P2P exchange).

It is estimated that there are currently over 22 million cryptocurrency holders, accounting for 10.3% of Nigeria's total population. In 2020, Nigeria ranked third in Bitcoin trading volume among the top 10 countries, with a trading volume exceeding $400 million, following only the United States and Russia.

Image Source: News

Sentiments of Overseas Expatriates Flow into Crypto Accounts

English is the official language of Nigeria, so it is estimated that 21.7 million Nigerian citizens reside overseas to escape their underdeveloped homeland. This accounts for one-tenth of Nigeria's total population.

As a result, the large number of expatriates brings in a significant amount of remittances. In 2018, expatriates remitted $24.31 billion; in 2019, $23.81 billion; and by 2020, it had decreased to $17.21 billion. The declining remittance amount may be due to expatriates starting to use cryptocurrency, as BTC cannot be regulated.

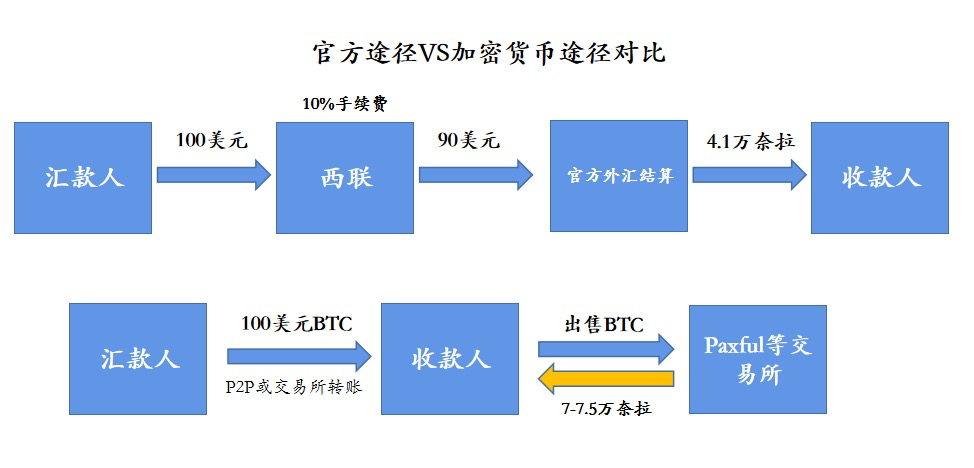

Before the advent of cryptocurrency, the main services for these expatriates were provided by Western Union and MoneyGram, the two major cross-border remittance service providers.

After working abroad for a year, one's salary sent back home is still subject to being deducted by local capitalists for a month!

Western Union and MoneyGram account for 65% of offline remittance withdrawal points. Due to the monopoly position of these two banks, remittance fees often reach 10%, and it often takes 2-3 days to remit.

Image Source: Internet

In addition to being affected by the 10% transaction fee, users are also restricted by the local government's foreign exchange controls, and the exchange rate is also unreasonable.

The Nigerian government has strict control policies on foreign exchange, with an official exchange rate of 1 US dollar to 460 naira, while the parallel market (black market) allows 1 US dollar to be exchanged for 765 naira. Therefore, BTC serves as an intermediary for black market currency exchange, allowing recipients to exchange for more naira through BTC.

Image Source: Africa Web3 Research Institute

Inflation and Currency Depreciation Drive Funds into Cryptocurrencies such as BTC

Every African is plagued by inflation, especially in Nigeria, where the average CPI growth rate is over 10%, reaching 17% in 2021, and a 21% year-on-year increase in inflation in January 2022.

Typically, currency depreciation accompanies inflation, and since 2013, the naira has depreciated by nearly 70% against the US dollar, falling from $0.0062 to $0.0021. Therefore, the enthusiasm for cryptocurrency assets is unstoppable!

Image Source: Google Finance

Although in February 2021, the Central Bank of Nigeria emphasized that cryptocurrencies "violate existing laws" and prohibited commercial banks from engaging in cryptocurrency transactions, it has been difficult to suppress Nigerians' enthusiasm for cryptocurrency. Tens of millions of Nigerian residents, especially young people, have been converting their naira into Bitcoin and USDT.

Image Source: TED

Banking System Collapse Leads People from Web2 to Web3

By the end of 2020, only 64% of Nigerian adults were aware of financial services.

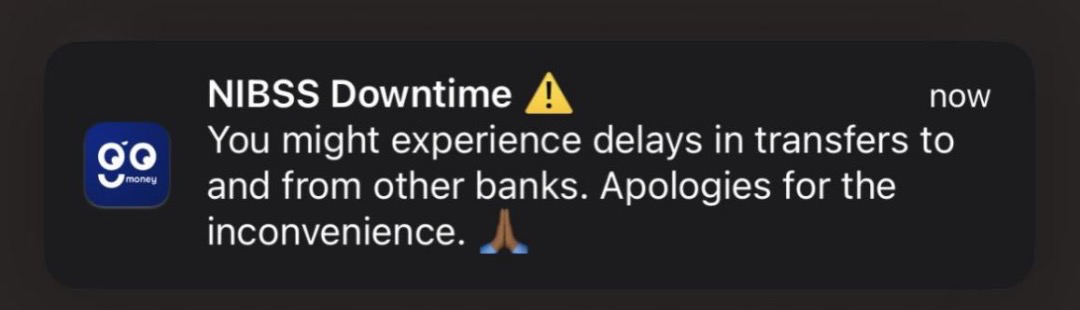

The banking infrastructure in Nigeria is very weak and has come close to collapse. In January 2022, there were errors in interbank transfers, which later evolved into internal transfer problems within banks.

Many remitters' money may face the risk of being irretrievable. The direct cause of this banking crisis was Nigeria's "cashless policy," where banks had insufficient new cash reserves, and the pressure to withdraw salaries at the end of the month and the Nigerian general election led to a huge demand for withdrawals, resulting in the paralysis of bank operations.

Image Source: TED

Image Source: Feedback from local netizens

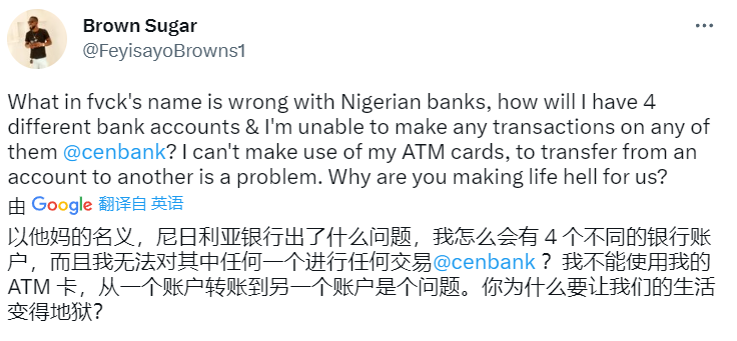

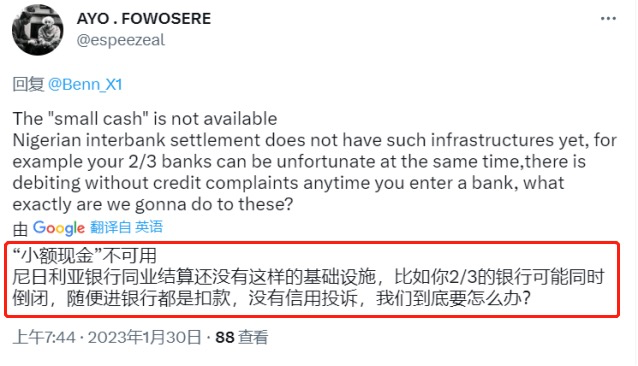

Such incidents are not isolated. The Nigerian Inter-Bank Settlement System (NIBSS) frequently experiences similar problems, and NIBSS is very outdated, with most ATMs being outdated products from Europe and the United States.

Furthermore, the reconciliation system between banks is outdated, with banks sending Excel spreadsheets to corresponding bank institutions for manual reconciliation, and any slight errors will affect the security of customer funds.

Image Source: Twitter

In addition to the poor bank transfer system, the high non-performing loan ratio and the large spread between deposit and loan interest rates also put depositors in an insecure position.

On June 10, 2022, The Condemnation Report reported that in March, the savings deposit interest rate in Nigerian banks was 1.28%, while the highest loan interest rate was 26.61%, with a difference of 25.33%. Faced with an inflation rate of 16.8%, this is a serious exploitation of depositors.

At the same time, in 2020, the non-performing loan ratio in the Nigerian banking industry reached 6%, higher than the global average. During the same period, China's non-performing loan ratio was 1.92%, and the United States' was 0.96%. For depositors to bear such risks in the face of such low interest rates is clearly unfair.

Image Source: Twitter

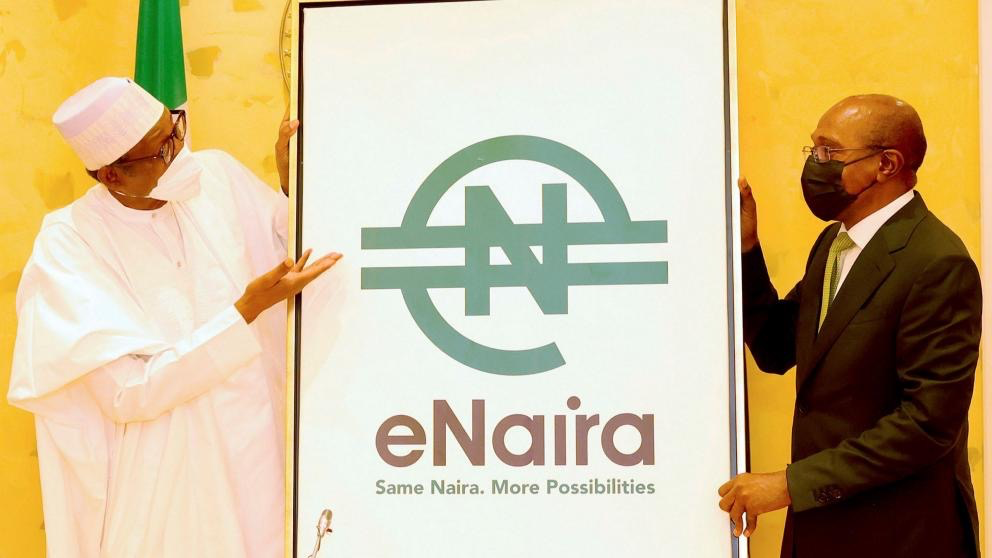

The Nigerian government has made attempts to change this situation through digital currency.

On October 25, 2021, Nigerian President Buhari announced the issuance of the digital currency e-Naira, making Nigeria the first African country to issue a digital currency. However, the centralized e-Naira stablecoin has not changed the financial situation in Nigeria. After a year of vigorous promotion by the government, the usage rate of e-Naira is only 0.5%, with a total transaction amount of only $9 million.

The biggest problem facing e-Naira is the lack of trust from the public in any government measures. Users would rather use cryptocurrency than e-Naira.

Image Source: NY TIME

Nigerians can only choose Web3. Only Web3 can meet the needs: as long as they have access to the internet, they can enjoy financial services used by global elites.

For the average Nigerian, the oil is not theirs, the land is not theirs, the skyscrapers are not theirs, the money in the bank could disappear, only the tokens in their wallets are truly theirs.

Web3 is Changing Africa, and Africa is Changing Web3

If we only focus on the fluctuating prices and candlestick charts, then Web3 may just be an investment or speculation tool. But if we explore the value of Web3 for the people of Africa, we will find that Web3 is also a form of "social welfare."

In this world, the over one billion people in Africa are overlooked by the mainstream, facing common issues such as inflation, mobile payments, and employment.

Web3 is the top student that can bring a solution, from payments to finance, all of which can be spread through the internet, transcending governments and geography. As a result, Web3 will bring about a significant increase in users. While cryptocurrencies have emerged from the West and the East, perhaps "Africa" is the true "cradle" of cryptocurrency growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。