Structured Financial Products

In a bear market or a bull market, it is more suitable to focus on financial management rather than trading. Little Bee has been researching financial products on the exchange recently. Today, let's talk about the structured financial products offered by Ouyi.

❖ What are Structured Financial Products? ❖

According to GPT: "Structured financial products are complex financial derivative instruments, usually composed of underlying assets such as stocks, bonds, interest rates, currencies, commodities, or other derivative instruments. The return structure of these products is designed in advance to meet specific risk/return requirements, tax, or other purposes."

Ouyi offers three structured financial management products—Shark Fin, Dual Currency Win, and Snowball.

❖ Shark Fin ❖

Shark Fin has three characteristics: guaranteed returns, high yield opportunities, short investment periods, and support for automatic reinvestment. The entry threshold is low.

➤ Guaranteed Returns

As a structured financial management product, Ouyi's Shark Fin should first invest funds in low-risk and stable-yield products. This is the source of the guaranteed returns of Ouyi's Shark Fin.

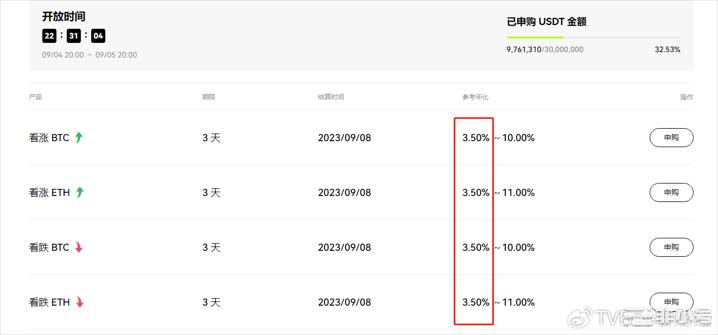

For example, the 3-day Shark Fin product launched on September 4 has a guaranteed annualized return of 3.5%.

In other words, regardless of whether it is a bullish or bearish Ouyi Shark Fin, investors can at least obtain a 3.5% annualized return.

Therefore, describing Ouyi's Shark Fin as a principal-protected financial product is not rigorous enough, because it not only protects the principal but also provides guaranteed returns.

➤ High Yield Opportunities

The high yield opportunities of Ouyi's Shark Fin are achieved through the investment in a product called "European Barrier Options."

Taking the "bullish" BTC to be launched on September 7 as an example, the yield curve is as follows:

If the price of BTC at maturity is lower than $25800, the option will not be effective. When the price of BTC at maturity exceeds $25800, the option becomes effective. $25800 is the knock-in price of this option.

If the price of BTC at maturity exceeds $29600, the option becomes ineffective. $29600 is the knock-out price of this option.

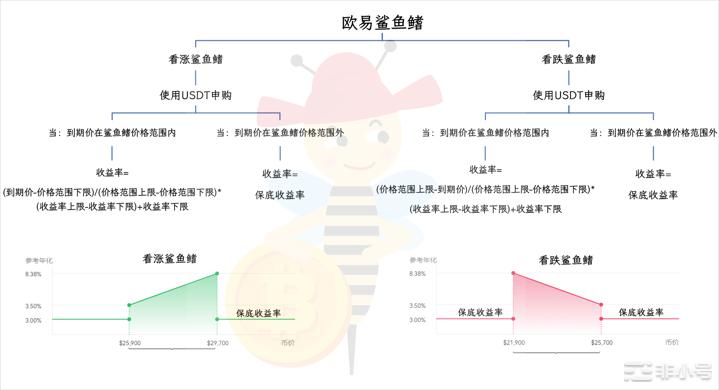

∎ For the bullish Ouyi Shark Fin product:

The knock-in price is the lower limit of the price range.

The knock-out price is the upper limit of the price range.

Its yield curve is like a shark fin, so for ease of understanding, Little Bee refers to it as the price range of the shark fin.

Within the price range of the shark fin, the higher the price, the higher the annualized return for investors.

Investing in the bullish BTC on September 7:

If the BTC maturity price is $25000, a guaranteed annualized return of 3% is obtained.

If the BTC maturity price is $30000, a guaranteed annualized return of 3% is obtained.

If the BTC maturity price is $29000, a high annualized return can be obtained.

High annualized return for the bullish Ouyi Shark Fin:

=(Maturity price - Price range lower limit)/(Price range upper limit - Price range lower limit)*(Return upper limit - Return lower limit) + Return lower limit

=(29000-25800)/(29600-25800)*(8.38%-3.5%)+3.5%

=7.61%

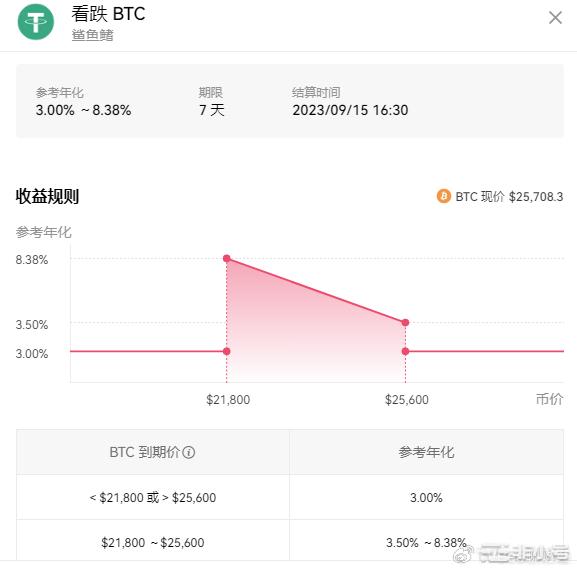

∎ For the bearish Ouyi Shark Fin product:

The knock-in price is the upper limit of the price range.

The knock-out price is the lower limit of the price range.

Within the price range of the shark fin, the lower the price, the higher the annualized return for investors.

Investing in the bearish BTC on September 7:

If the BTC maturity price is $26000, a guaranteed annualized return of 3% is obtained.

If the BTC maturity price is $20000, a guaranteed annualized return of 3% is obtained.

If the BTC maturity price is $22000, a high annualized return can be obtained.

High annualized return for the bearish Ouyi Shark Fin:

=(Price range upper limit - Maturity price)/(Price range upper limit - Price range lower limit)*(Return upper limit - Return lower limit) + Return lower limit

=(25600-22000)/(25600-21800)*(8.38%-3.5%)+3.5%

=8.12%

➤ Investment Period

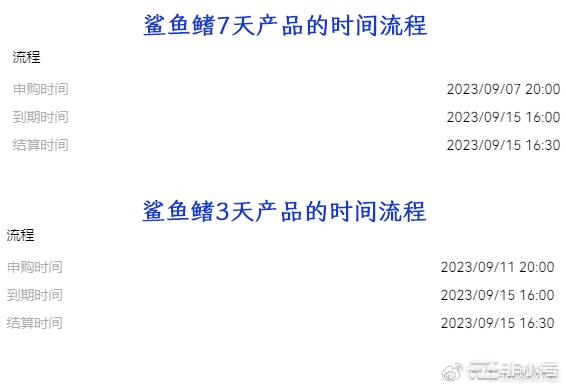

Currently, Ouyi's Shark Fin includes bullish BTC, bullish ETH, bearish BTC, and bearish ETH, with 3-day and 7-day options, totaling 8 types.

The 3-day options are available for sale every Monday, usually in the evening, and are settled on the 4th day.

The 7-day options are available for sale every Thursday, usually in the evening, and are settled on the 8th day.

The investment period is short and will not tie up funds for too long. In addition, the 7-day Shark Fin product from Ouyi supports reinvestment, allowing users to manually enable the automatic reinvestment feature. This allows investors to participate in short-term Shark Fin investments for 3 days, as well as consecutive 1-2 week Shark Fin investments, providing flexibility.

➤ Entry Threshold

The minimum purchase amount is 10 USDT, and the maximum weekly purchase limit for a single main account is 1,500,000 USDT.

❖ Dual Currency Win ❖

➤ High Sell and Low Buy

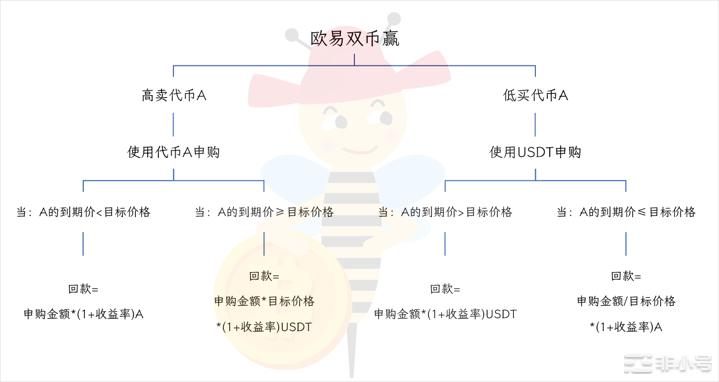

Ouyi's Dual Currency Win products include two directions: high sell and low buy.

High sell includes high sell BTC, high sell ETH, high sell LTC, high sell BCH… and many other currencies. High sell requires the use of the corresponding tokens to participate, with BTC used for high sell BTC, ETH used for high sell ETH…

Low buy uses USDT to participate.

➤ Target Price and Yield

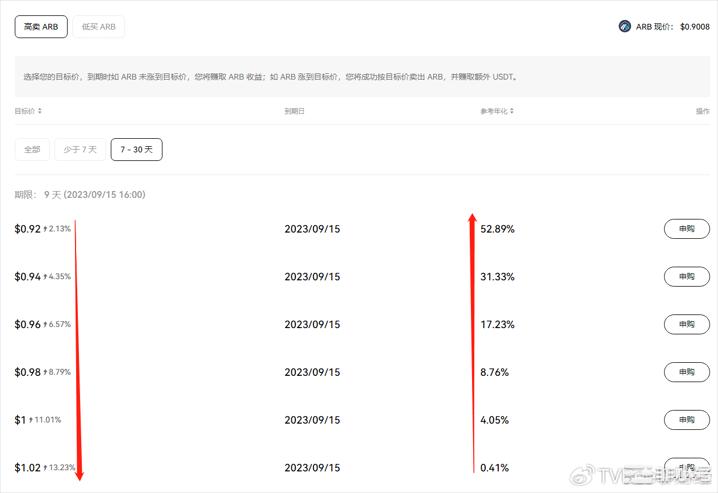

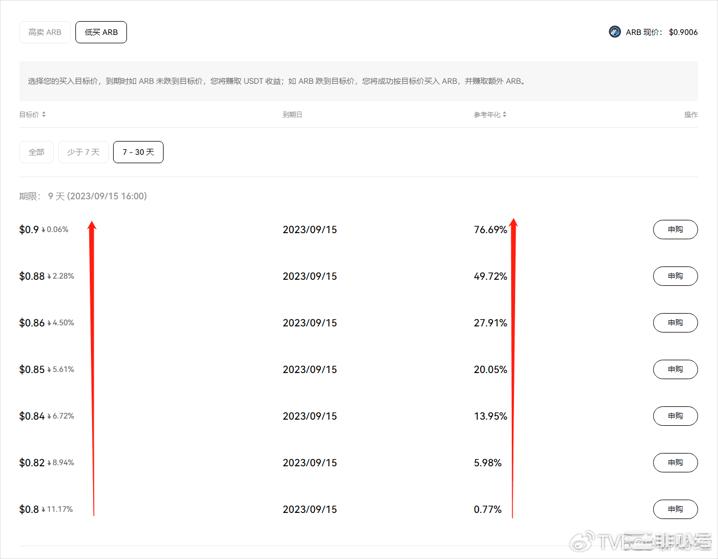

Whether it is high sell or low buy, even for products with the same term, Ouyi's Dual Currency Win products also include multiple products.

The difference between products lies in the different target prices and yields. For Ouyi's "high sell" Dual Currency Win products, the lower the target price, the higher the yield:

For Ouyi's "low buy" Dual Currency Win products, the higher the target price, the higher the yield:

An example of the repayment calculation for Ouyi's Dual Currency Win products:

∎ For a "high sell ARB" product with a target price of $0.95 and a maturity yield of 1.52% (annualized yield of 22.55%), using 1000 ARB for investment.

If the price of ARB at maturity is <$0.95,

Repayment

=Purchase amount*(1+yield)ARB

=1000*(1+1.52%)ARB=1015.2 ARB

If the price of ARB at maturity is ≥$0.95,

Repayment

=Purchase amounttarget price(1+yield)USDT

=10000.95(1+1.52%)USDT

=964.44 USDT

∎ For a "low buy ARB" product with a target price of $0.85 and a maturity yield of 1.7% (annualized yield of 25.31%), using 1000 USDT for investment.

If the price of ARB at maturity is >$0.85,

Repayment

=Purchase amount*(1+yield)USDT

=1000*(1+1.7%)USDT=1017 USDT

If the price of ARB at maturity is ≤$0.85,

Repayment

=Purchase amount/target price*(1+yield)ARB

=1000/0.85*(1+1.7%)ARB

=1196.47 ARB

The yield of Ouyi's Dual Currency Win products for a certain token fluctuates with the price of the token. Additionally, some products will be automatically delisted and relisted. For example, if ARB rises from $0.85 to $0.89, the high sell ARB product with a target price of $0.89 will be automatically delisted.

In addition, Dual Currency Win products for BTC and ETH with a term of 2 days or more support redemption.

➤ Product Principle (This section can be skipped)

Investing in Dual Currency Win products is essentially selling options contracts. Here are some examples:

∎ For a "high sell ARB" product with a target price of $0.95 and a maturity yield of 1.52% (annualized yield of 22.55%).

• Investor (option seller), the obligation of the option is to sell ARB at $0.95 at maturity.

• Counterparty (option buyer), the right of the option is to buy ARB at $0.95 at maturity.

If this were a futures product, the transaction would be completed at maturity. However, this is an options product.

• If at maturity, the price of ARB is higher than $0.95, assuming the price of ARB is $1 at this time, the counterparty (option buyer) would be willing to buy ARB worth $1 at $0.95, and the investor (option seller) would have to sell ARB at $0.95 and receive USDT.

• If at maturity, the price of ARB is lower than $0.95, assuming the price of ARB is $0.9 at this time, the counterparty (option buyer) would not be willing to buy ARB worth $0.9 at $0.95, so the transaction would not be executed, and the investor (option seller) would continue to hold ARB.

• Because the investor (option seller) of Dual Currency Win products only has obligations and no rights, and is quite passive, they will receive a certain return. This is the source of the yield of Dual Currency Win products.

∎ For a "low buy ARB" product with a target price of $0.85 and a maturity yield of 1.7% (annualized yield of 25.31%).

• Investor (option seller), the obligation of the option is to buy ARB at $0.85 at maturity.

• Counterparty (option buyer), the right of the option is to sell ARB at $0.85 at maturity.

• If at maturity, the price of ARB is lower than $0.85, the counterparty (option buyer) would be willing to sell ARB at $0.85, and the investor would buy ARB at $0.85.

• If at maturity, the price of ARB is higher than $0.85, the counterparty (option buyer) would not be willing to sell ARB at $0.85, so the transaction would not be executed, and the investor would continue to hold USDT.

This concludes the translation of the provided content.

• If at maturity, the price of ARB is higher than $0.85, the counterparty (option buyer) abandons the execution of the trade, and the investor (option seller) retrieves the ARB.

• The investor (option seller) of Dual Currency Win earns a profit.

➤ Product Comparison

∎ Compared to Leveraged Contracts

Dual Currency Win products have an advantage in that they ignore price fluctuations before maturity. For example, if Little Bee now believes that the price of BTC will drop to $25000 on September 22 when the Federal Reserve announces its interest rate decision, then Little Bee can buy the "low buy BTC" Dual Currency Win with a target price of $25000 and a maturity date of September 22. The price fluctuations before this time are ignored. This is much safer than leveraged contracts, where price fluctuations may lead to liquidation or trigger stop-loss orders. By comparison, the risk of Ouyi's Dual Currency Win is lower.

∎ Compared to Limit Order Trading

There are two differences between Ouyi's Dual Currency Win and limit order trading.

First, in limit order trading, as long as the order price is reached and there is a counterparty, the sale and purchase can be executed. However, in Dual Currency Win, the sale or purchase may only occur at maturity, depending on the price situation. For "high sell" Dual Currency Win, even if the price at maturity reaches the target price, it will be sold at the target price, even if it is much higher. For "low buy" Dual Currency Win, even if the price at maturity falls below the target price, it will be bought at the target price.

Second, in limit order trading, a small fee must be paid. However, Ouyi's Dual Currency Win products not only do not incur trading fees but also provide some yield. If the target price is reached, the sale or purchase will be executed, and a yield will be obtained. If the target price is not reached, the original capital will be recovered, and a certain yield will also be obtained.

➤ Product Risks

Dual Currency Win products are not principal-protected products and carry a certain investment risk.

∎ Example 1, "high sell" BTC, target price $27000, yield 5%. Subscription amount 1 BTC.

• Scenario 1: At maturity, BTC price is $26500

Repayment increases by 0.05 BTC

Specific profit or loss depends on the cost of BTC

• Scenario 2: At maturity, BTC price is $28000

Repayment = $27000*(1+5%) = $28350 USDT

Profit or loss = $28350 - $28000 = $350 USDT

• Scenario 3: At maturity, BTC price is $28500

Repayment = $27000*(1+5%) = $28350 USDT

Profit or loss = $28350 - $28500 = -$150 USDT

∎ Example 2, "low buy" BTC, target price $24000, yield 5%. Subscription amount $24000 USDT.

• Scenario 1: At maturity, BTC price is $25000

Repayment increases by 5% of $24000 = $1200 USDT

• Scenario 2: At maturity, BTC price is $23000

Repayment = $24000/$24000*(1+5%) = 1.05 BTC

Profit or loss = 1.05 - $24000/$23000 = 0.0065 BTC

• Scenario 3: At maturity, BTC price is $22000

Repayment = $24000/$24000*(1+5%) = 1.05 BTC

Profit or loss = 1.05 - $24000/$22000 = -0.04 BTC

❖ Snowball ❖

Ouyi's Snowball product is an American option with knock-in and knock-out prices, including bullish BTC and bearish BTC options.

Due to the relatively high entry threshold for Ouyi's Snowball, it requires contacting the Ouyi team to make a purchase. Little Bee will provide a brief introduction.

∎ Bullish BTC

Participation requires USDT, with an entry threshold of 100,000 USDT

Term of 28 days

Knock-in price: significantly lower than the initial price

Knock-out price: slightly higher than the initial price

• Scenario 1: Before maturity, neither the knock-in nor knock-out price is reached (highest profit scenario)

Repayment amount = Principal(1+term/365annualized yield) USDT

• Scenario 2: Before maturity, BTC rises to the knock-out price (second-highest profit scenario)

Repayment amount = Principal(1+number of days held/365annualized yield) USDT

• Scenario 3: Before maturity, the knock-in price is reached, but the knock-out price is not, and the price at maturity is higher than the initial price (principal protected)

Repayment amount = Principal USDT

• Scenario 4: Before maturity, the knock-in price is reached, but the knock-out price is not, and the price at maturity is lower than the initial price (short-term loss)

Repayment amount = Principal/initial price BTC

∎ Bearish BTC

Participation requires BTC, with an entry threshold of 5 BTC

Term of 28 days

Knock-in price: significantly higher than the initial price

Knock-out price: slightly lower than the initial price

• Scenario 1: Before maturity, neither the knock-in nor knock-out price is reached (highest profit scenario)

Repayment amount = Principal(1+term/365annualized yield) BTC

• Scenario 2: Before maturity, BTC rises to the knock-out price (second-highest profit scenario)

Repayment amount = Principal(1+number of days held/365annualized yield) BTC

• Scenario 3: Before maturity, the knock-in price is reached, but the knock-out price is not, and the price at maturity is lower than the initial price (principal protected)

Repayment amount = Principal BTC

• Scenario 4: Before maturity, the knock-in price is reached, but the knock-out price is not, and the price at maturity is higher than the initial price (short-term loss)

Repayment amount = Principal*initial price USDT

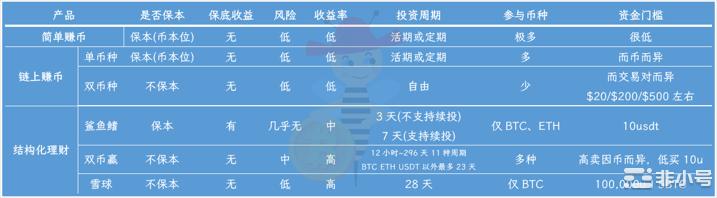

❖ Comparison ❖

Simple Coin Earning and On-chain Single Coin Earning are more suitable for some altcoins, as BTC, ETH, and stablecoins do not have a competitive advantage in terms of yield.

Dual Coin Earning is a form of liquidity mining, with limited support for "trading pairs," and it carries a certain level of risk and offers low yields.

Snowball is suitable for investors with a larger capital scale.

Dual Currency Win has higher yields and risks, and the products are more complex, supporting more cycles and tokens, making it more like an options trading product.

Shark Fin products have obvious advantages, with low entry thresholds, guaranteed returns, high yield opportunities, and extremely low risk. The short investment period and support for reinvestment make it a relatively ideal financial product.

Shark Fin is a very suitable financial product for the current market conditions. Many investors have already entered the market and are preparing to buy the dip. Idle USDT can be used to participate in Ouyi's Shark Fin for 3 days, 7 days, or half a month (7 days + automatic reinvestment), allowing for flexible short-term financial gains.

On the other hand, short-term trends are unpredictable at the moment. By participating in Ouyi's Shark Fin, investors can even obtain guaranteed returns even if their judgment is contrary to the market direction.

Simultaneous Investment in Both Bullish and Bearish Shark Fin Financial Products:

In fact, investors can simultaneously participate in both bullish and bearish Shark Fin products. This way, part of the funds can earn guaranteed returns by betting against the market direction, while the other part of the funds can potentially earn higher yields if the coin price fluctuates significantly.

For example, if the current price of BTC is $25750:

Bullish BTC: At maturity, if the price is between $25800 and $29700, the annualized yield is 3.5% to 8.38%

Bearish BTC: At maturity, if the price is between $21800 and $25700, the annualized yield is 3.5% to 8.38%

Little Bee can invest half of the funds in bullish Shark Fin and the other half in bearish Shark Fin.

• At maturity, if $25700 < BTC price < $25800, only the guaranteed annualized yield of 3% can be obtained.

• At maturity, if BTC price > $29700 or BTC price < $21800, only the guaranteed annualized yield of 3% can be obtained. (This scenario has a low probability)

• At maturity, if BTC price exceeds $25800, half of the funds invested in "bearish BTC" can earn an annualized yield of 3%, while the other half invested in "bullish BTC" can earn a yield of over 3.5%. The specific annualized yield calculation can be found above.

• At maturity, if BTC price falls below $25700, half of the funds invested in "bullish BTC" can earn an annualized yield of 3%, while the other half invested in "bearish BTC" can earn a yield of over 3.5%. The specific annualized yield calculation can be found above.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。