Author: 0xMingyue Wu on Blockchain

As described in the official documentation of Aerodrome, Aerodrome Finance is the next generation AMM, aiming to serve as the central liquidity hub for Base, combining a powerful liquidity incentive engine, a voting-locked governance model, and a user-friendly experience[1]. Since the official launch of the Aerodrome protocol on August 31, the protocol has attracted nearly $200 million in TVL within just 24 hours, with the native token $AERO's liquidity mining yield reaching an annualized rate of nearly 1000% without compounding. According to Defillama data on September 2, the total TVL of the Base chain on September 2 was $379 million, while the Aerodrome TVL reached as high as $196 million, accounting for 51.7% of the total TVL of the Base chain, which can be said to have taken "half of the country." What "magic" mechanism allows a Dex to achieve such a huge success in a short period of time? This article will start from Ve(3,3) (the core mechanism of Aerodrome) to provide an in-depth introduction to the core mechanism of Aerodrome, the generation of the flywheel, and the development prospects.

1 Game Theory and Flywheel: Ve(3,3)

The Ve(3,3) mechanism originated from Andre Cronje's Solidly protocol in Fantom, but due to the design flaws in the protocol, it is close to a "failure" state. Velodrome, the first major Dex protocol on the Optimism chain, improved the flaws of the Solidly protocol, and Aerodrome inherited the latest features of VelodromeV2. The core mechanism of Aerodrome, Ve(3,3), can be divided into two parts: Ve&(3,3). Ve comes from Curve's veCRV model, and (3,3) comes from OlympusDAO's 3v3 game. The combination of the two attempts to balance the holders and traders in the supply, bringing more protocol income to the projects that join the Ve(3,3) protocol (especially the initial projects), while improving the efficiency of reward distribution when providing leasing liquidity[2]. The following will introduce the ve and (3,3) mechanisms separately.

1.1 veNFT, the Evolution of veCRV

ve is the abbreviation of Voting Escrow, which is the process of exchanging Curve's governance token CRV for VeCRV for staking and locking, in order to obtain more rewards as an LP. In the Aerodrome protocol, there are two protocol tokens: 1) $AERO, 2) $veAERO. $AERO is the protocol token used to reward liquidity providers, following the ERC20 standard, and locking $AERO can obtain $veAERO; $veAERO is wrapped in veNFT, following the ERC721 (also known as NFT) standard. The quantity of $veAERO obtained from locking $AERO is determined by the locking time of $AERO (following a linear correspondence), with a maximum locking time of 4 years. Locking for 4 years can obtain a 1:1 ratio of $veAERO, and similarly, if locked for one year, only 1/4 of the locked $AERO quantity can be obtained, and if the locking time is very short (such as one week), only 1/208 of the locked $AERO quantity can be obtained. After the locking period ends, users can retrieve all of their locked $AERO. Aerodrome will emit a certain amount of $AERO each week, and holders of $veAERO will vote to decide which liquidity pool the $AERO emission will go to.

1.2 (3,3) Game

(3,3) comes from OlympusDAO's (3,3) game theory (derived from Nash equilibrium theory). This term comes from the standard notation in game theory, used to describe an important feature of the game: the strategies and payments of the game participants. In this notation, the first number in the parentheses represents the number of strategies available to the first participant (usually the actor), and the second number represents the number of strategies available to the second participant (usually the opponent).

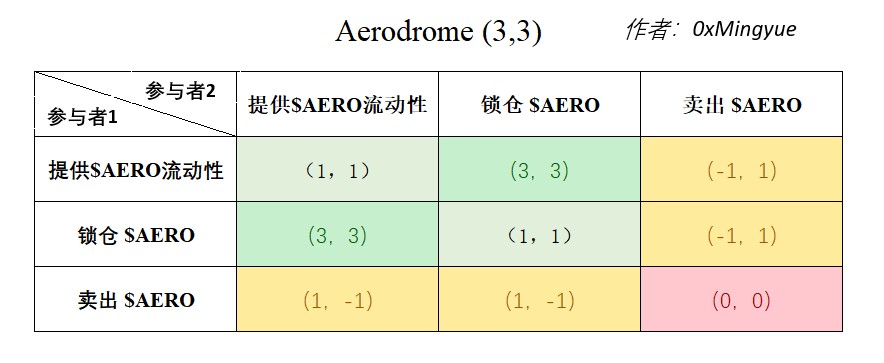

In the Aerodrome protocol, all protocol participants have three choices for the $AERO they receive: 1) provide $AERO liquidity; 2) lock $AERO and obtain $veAERO for long-term holding; 3) sell $AERO. To simplify the multi-party game, the following figure lists the different behaviors of two Aerodrome protocol participants and their profit situations.

Figure 1.1 Aerodrome (3,3) game

The first number in the parentheses represents the profit situation of participant 1, and the second number represents the profit situation of participant 2. A larger number indicates a greater profit, and a negative number indicates a loss. The above figure is drawn based on the author's understanding and is not from the official documentation.

As shown in Figure 1.1, based on the different actions of the two protocol participants regarding the $AERO they receive, there are a total of 9 possible results, which can be broadly categorized into 3 types: 1) cooperation, where both parties lock or add $AERO liquidity to gain more tokens; 2) one party acts maliciously, where one protocol participant sells the $AERO received; 3) both parties act maliciously, a typical case of the "mine and dump" pattern, where both participants sell the $AERO received until the protocol is no longer profitable. In reality, the market is often formed by countless protocol participants working together, and compared to the game between 2 protocol participants, the form is more complex. For almost all ve(3,3) protocols, especially some ve(3,3) protocols without a background, due to the huge annualized returns given to liquidity providers in the early stages, the market force tends to lead to the most common "mine and dump" pattern of result 3), and only those "star" projects, which have gained enough market participation and have balanced points moved to result 1) through external influences (various factors such as market environment, funding, etc.), form a dynamic balance that changes with the entry of new market participants.

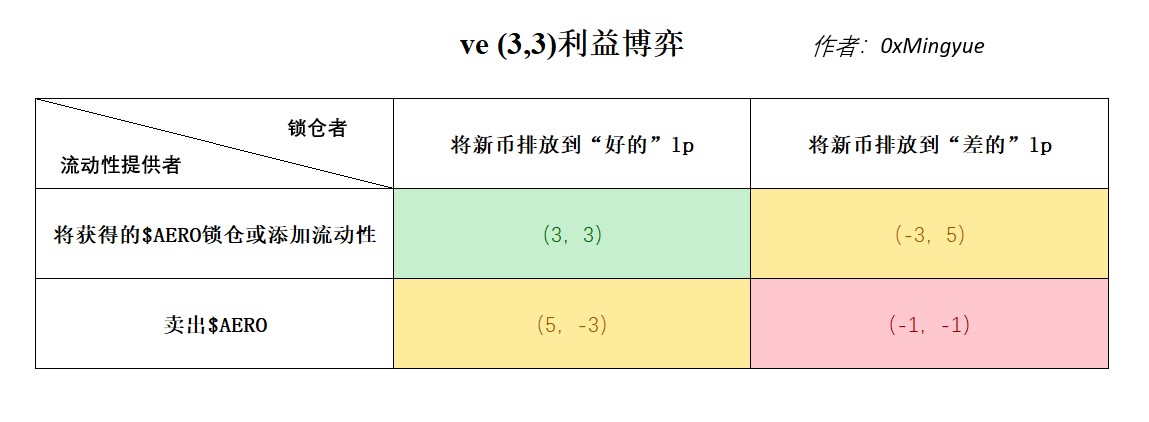

1.3 Viewing the Core Participant Interest Game of Ve(3,3) from the Prisoner's Dilemma

When a ve(3,3) protocol proves its value in the short term and accumulates a large number of lockers, the game has quietly changed. At this point, both liquidity providers and lockers have upgraded to become "stakeholders" of the protocol. In the case of a complex market formed by multiple protocol participants, this section divides all core game members of the protocol into two categories: 1) $AERO liquidity providers; 2) $AERO lockers, long-term holders. The different behaviors of these two types of members will also determine the fate of the protocol, as shown in the following figure.

Figure 1.2 Prisoner's Dilemma of Aerodrome Liquidity Providers and Lockers

The first number in the parentheses represents the profit situation of participant 1, and the second number represents the profit situation of participant 2. A larger number indicates a greater profit, and a negative number indicates a loss. The above figure is drawn based on the author's understanding and is not from the official documentation.

As shown in Figure 1.2, the different behaviors of these two core participants will also lead to three different results: 1) win-win; 2) one party gains; 3) both parties lose. 1) Lockers and liquidity providers cooperate, with lockers directing the newly emitted $AERO to liquidity providers who make positive contributions to the protocol, and liquidity providers locking the newly obtained $AERO or continuing to provide deeper liquidity, leading to positive development of the protocol, improvement of the fundamentals, and a win-win situation for both parties; 2) One party acts maliciously, where either the locker directs the $AERO emission to some malicious MEME tokens, or the liquidity provider sells all of the $AERO obtained, resulting in gains for the malicious actor and long-term loss of protocol value; 3) Both lockers and liquidity providers act maliciously, leading to a rapid deterioration of the protocol's fundamentals and a rapid loss of protocol value.

This situation is similar to the "prisoner's dilemma." For individual liquidity providers or lockers, the most rational choice they can make is to act maliciously. At this point, the Nash equilibrium point in this game is at the point where the entire system incurs the greatest loss, far from the Pareto optimum[4].

How to break the "prisoner's dilemma"? From the perspective of lockers, ve(3,3) protocols usually establish a whitelist mechanism at the protocol level to prevent lockers from acting maliciously; from the perspective of liquidity providers, the protocol usually provides locking rewards to liquidity providers. When liquidity providers obtain a larger amount of locked tokens and become the main force of lockers, the game between liquidity providers and lockers is no longer a zero-sum game, and for their own benefit, liquidity providers will make greater contributions to the protocol. At this point, the Nash equilibrium point shifts to the Pareto optimum where the protocol's interests are maximized.

2 Operation of the Flywheel: Upward Spiral and Death Spiral

The previous section specifically explained the game theory of ve(3,3). So what "magic" allowed the Aerodrome protocol to attract $200 million in TVL in just one day? In this section, I will explain the "flywheel" mechanism of Aerodrome.

2.1 Flywheel Effect and the Mystery of Attracting Funds

The name "flywheel effect" comes from the mechanical field of flywheels. A flywheel is a rotating device, and as its rotation speed gradually increases, it becomes more difficult to stop or change direction. In business, this concept means that once a company or organization has established some competitive advantages, these advantages will accumulate and strengthen like a rotating flywheel.

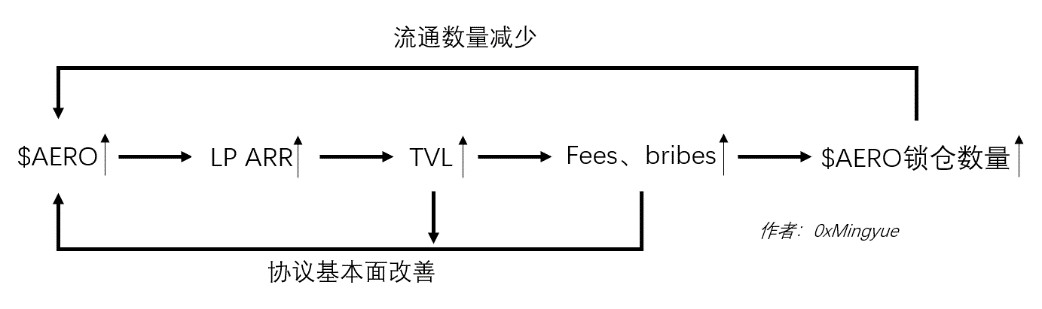

In Aerodrome, the fundamental aspects (TVL, trading volume, and total external protocol bribes) and the protocol token $AERO form the two levels of the flywheel. Imagine that when the price of the protocol token $AERO rises, liquidity providers' earnings increase, leading them to provide more liquidity; optimized liquidity depth and increased trading volume result in increased protocol revenue, prompting more people to choose to lock $AERO to earn protocol income; as the protocol's visibility increases, more external protocols participate in the protocol's operation. All of these (fundamentals) will continue to drive the rise of the $AERO token, leading to an upward spiral of the protocol's value, as shown in the following figure.

Figure 2.1 Aerodrome Positive Flywheel (Price Positive Feedback)

When Aerodrome was officially launched on August 31, the Aerodrome team provided nearly 7% of $AERO emissions to the $AERO-USDC pool by controlling its $veAERO. Due to the extremely small circulating supply of $AERO on August 31, when the first $AERO transaction occurred, $AERO was priced. At that time, due to the huge LP earnings and the small LP pool, the LP APR (not APY, APR is non-compound annualized) of the $AERO-USDC pool reached as high as 10,000% at 8:01 on August 31 (this number is what the author saw, theoretically, due to the very small pool and high rewards, the APR can be even higher). At this time, the huge earnings from providing liquidity triggered a scarcity of the $AERO token, prompting liquidity providers to buy more $AERO to provide liquidity, thereby driving up the price of $AERO. The rising price of $AERO leads to liquidity providers earning more, creating a positive flywheel. In just one day on August 31, the Aerodrome protocol attracted $200 million in TVL, accounting for half of the total locked value of the Base chain.

2.2 Upward Spiral and Death Spiral: How to Break?

As Aerodrome achieves attention with the upward spiral, it's worth considering when this spiral will end. We all know that money doesn't come out of thin air, so in this mining feast (earning $AERO rewards by providing liquidity), where does the money flow in the short term?

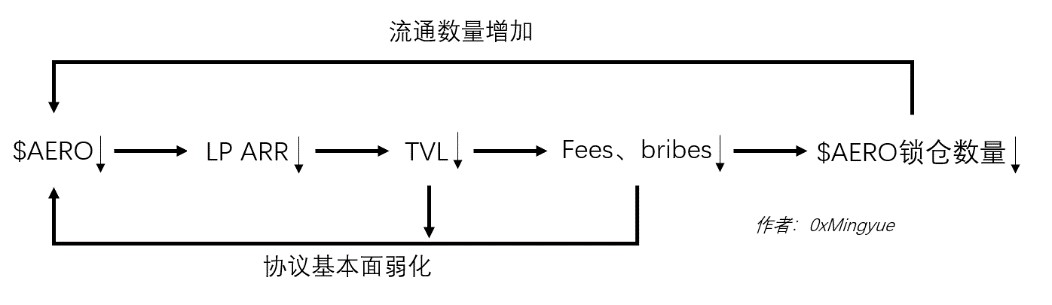

Since the $AERO tokens obtained by providing liquidity are emitted linearly, the circulating $AERO in the market will gradually increase. When it reaches a critical point, savvy market participants will find that as the depth of the $AERO-USDC liquidity pool increases, liquidity mining rewards are no longer profitable. At this point, these market participants choose to sell the $AERO they hold, leading to a decrease in the price of $AERO. When the selling pressure and buying pressure reach a balance, the upward flywheel is broken, and the price of $AERO no longer rises. At this point, the earnings from the $AERO-USDC liquidity pool also no longer change. As more $AERO is released over time, when the selling pressure exceeds the buying pressure, the price of $AERO will fall, leading to a downward spiral, as shown in the following figure.

Figure 2.2 Aerodrome Negative Flywheel (Price Positive Feedback)

Currently, many ve(3,3) tokens in the market are in a downward spiral, with one example being the CHRONOS protocol on Arbitrum, as shown in the following figure. Its project token $CHR has dropped from its high point of $1.81 at the opening on May 4 to the current price of $0.0168 in just 4 months, a decrease of 99%.

Figure 2.3 $CHR Token Price Candlestick Chart

Although Aerodrome has a seemingly reliable team and a partnership with Base, its token $AERO may still struggle to escape the downward spiral. How to break this downward spiral? In fact, the parent protocol of Aerodrome, Velodrome, has already provided an answer, and the core of this answer is to increase the lock-up rate, firmly linking the interests of protocol participants with the development of the protocol. Since its launch on June 1, 2022, Velodrome has maintained a high lock-up rate, reaching as high as 79.03% on September 2, according to official Velodrome Discord statistics[5].

3 ve(3,3) Development Plan: Regaining the Upward Spiral

In this section, we will discuss some methods to increase the lock-up rate of the protocol, allowing the protocol to regain the upward spiral.

3.1 Providing Lock-up Rewards

Providing one-time rewards to protocol lockers at the time of lock-up is the most straightforward approach, as Velodrome has done. Since its launch in June 2022, Velodrome has provided new protocol lockers with almost 15% lock-up return, thanks to funding from the Optimism Foundation. From the current perspective, Velodrome has been successful, with its TVL on the Optimism chain surpassing all major protocols such as Uniswap and Curve.

3.2 Launchpad: Empowering Lockers

When I speculated in June of this year why Binance did not list the token of the star project Velodrome on the Optimism network, a co-founder of Velodrome said something in Discord that surprised me—when some centralized exchanges expressed interest in listing the $Velo token and sought cooperation with the team, the team's response was: "We welcome you to list $Velo, but we will not provide support." At first, I was puzzled by the team's behavior, but later I realized the reason behind it: CEX price manipulation often leads to a large influx of short-term speculators into the protocol. They do not participate in the operation and game of the protocol, but only engage in price speculation. For ve(3,3) tokens, price speculation is fatal—price speculation leads to an increase in circulating tokens and a decrease in lock-up volume, which means that after price speculation, the downward spiral from the high price often signifies the death of the protocol.

This also made me realize the grand narrative of ve(3,3) protocols. A successful ve(3,3) protocol firmly holds the pricing power in the hands of the protocol, serving other protocols and acting as an alternative liquidity solution; it is a new type of impermanent loss compensation plan, using protocol tokens to provide liquidity providers with earnings; in a favorable market environment, it will have a launchpad that rivals mainstream CEXs—Launchpad.

ve(3,3) provides a certain protocol token reward to liquidity providers, giving ve(3,3) DEXs inherent new coin listing capabilities—newly listed protocols do not need to hire any market makers, they only need to import the rewards from the ve(3,3) protocol into their token's liquidity pool, and users will provide liquidity to that pool. In this way, the ve(3,3) protocol can also empower lockers through Launchpad, thereby increasing the lock-up rate and improving the protocol's health.

4 Conclusion and Outlook

This article started with the ve(3,3) mechanism, briefly introduced the game theory of ve(3,3), and then discussed the inherent principles of the flywheel leading to the upward and downward spirals, providing some methods to address the downward spiral of the protocol. The vision of ve(3,3) is so grand, and different ve(3,3) protocols often make minor modifications to their mechanisms. Due to the author's limited time and ability, there may be errors and incomplete descriptions in the article, and I welcome valuable feedback from readers.

I have learned from various sources that there are still many ve(3,3) protocol participants who do not know how to maximize their earnings in such protocols, and now there are many external protocols thriving based on ve(3,3) protocols, such as Sonne Finance, Tarot, Extra Finance, fbomb, USDR, etc. I still hope to write an article on how these protocols are growing based on ve(3,3) protocols, as well as the current status of these protocols. Stay tuned!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。