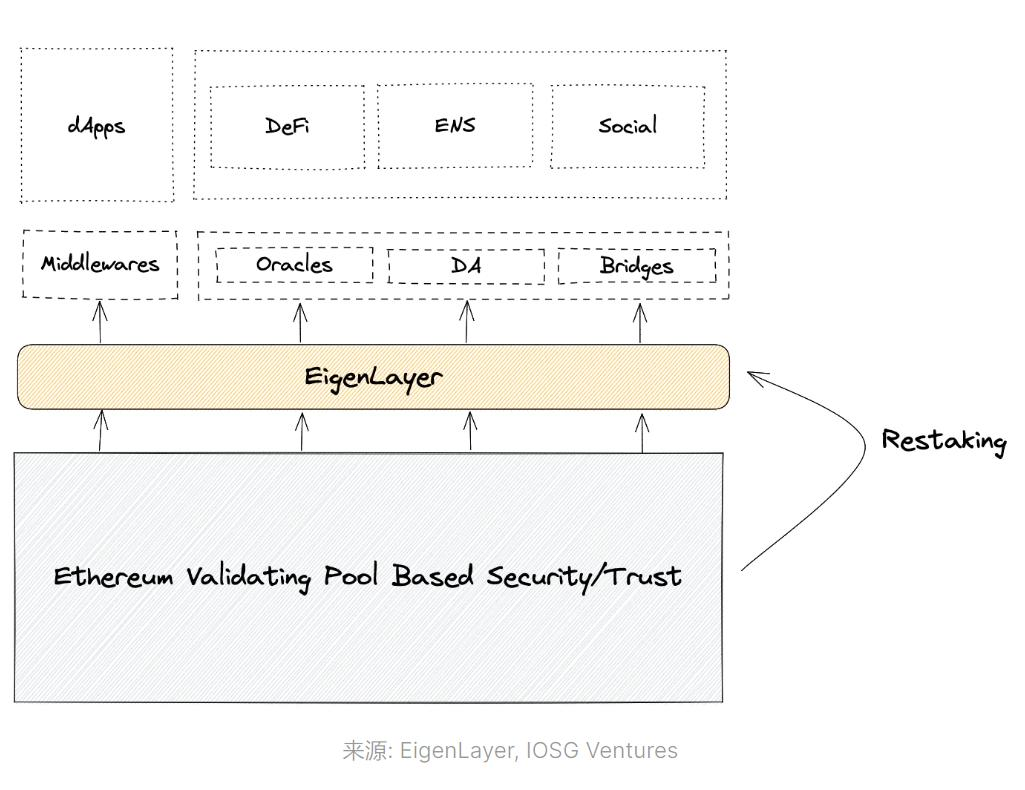

EigenLayer provides a token-based economic security leasing market, providing demand matching services between LSD providers and AVS demanders, and specific pledge security services are provided by dedicated pledge service providers.

Author: Alex Xu

Introduction

With the completion of the Ethereum Shanghai upgrade, many LSD projects have experienced rapid growth in business, and the number of users and net worth of LSD assets has also increased significantly. On the other hand, with the upcoming Cancun upgrade at the end of the year and the opening of the OP stack, today is also a big year for Rollup, and various services around the Rollup module, such as DA layer, shared sequencer, and RaaS services, are also emerging. Based on the concept of Restaking proposed for LSD assets, EigenLayer, which aims to provide services for numerous Rollups and middlewares, has continued to attract attention this year. In March, it completed a large financing of $50 million at a valuation of $5 billion, and its token's OTC price is rumored to have reached an astonishing $20 billion, comparable to the valuation level of public chain projects.

In this article, the author will sort out the business logic of EigenLayer and estimate the project valuation of EigenLayer, attempting to answer the following questions:

- What is the Restaking service, who are the customers, and what problems does it attempt to solve?

- What are the obstacles to promoting the Restaking model?

- Is EigenLayer's valuation of $5 billion, or even $20 billion, expensive or not?

The following content of the article represents the author's phased views at the time of publication, focusing more on commercial evaluation of the project from a business perspective, with less emphasis on technical details. This article may contain factual errors and biases, and is for discussion purposes only, and the author looks forward to corrections from other investment research professionals.

Business Logic of EigenLayer

Before formally sorting out the business of EigenLayer, let's first introduce several high-frequency terms that will appear in the text:

- Middleware: Middleware refers to the services between blockchain underlying services and Dapps. In the Web3 domain, typical middlewares include oracles, cross-chain bridges, indexers, DIDs, DA layers, etc.

- LSD: Liquid Staking Derivatives, such as Lido's stETH

- AVS: Actively Validated Services, which refers to a distributed node system that provides security and decentralization guarantees for projects, with the most typical being the PoS system of public chains

- DA: Abbreviation for Data Availability, data availability mainly refers to other projects (such as Rollups) being able to back up their transaction data on the DA layer to ensure that all historical transaction records can be accessed and restored from the DA layer when needed in the future

Business Scope

EigenLayer provides a token-based economic security leasing market.

The so-called token-based economic security refers to various Web3 projects needing the main service providers (validators) of the network to participate in the project by staking tokens to ensure the project's smooth operation and possess permissionless and decentralized properties. If the validators fail to fulfill their obligations, their staked tokens will be confiscated.

As a platform, EigenLayer, on the one hand, raises assets from holders of LSD assets, and on the other hand, uses the raised LSD assets as collateral to provide convenient and low-cost AVS services to middlewares, side chains, and Rollups with AVS demands. EigenLayer provides demand matching services between LSD providers and AVS demanders, and specific pledge security services are provided by dedicated pledge service providers.

In addition, EigenLayer's parent company has also developed a DA layer, providing data availability services for Rollups or application chains that need DA layer services. This product is called "EigenDA," and EigenDA will have business synergy with EigenLayer.

The pain points that EigenLayer hopes to address are:

- For various project parties: Reduce the high cost of independently building their own trust network, directly pay for the staked assets on the EigenLayer platform + node operators, without the need to build their own.

Source: EigenLayer Whitepaper

For Ethereum: Expand the usage scenarios of Ethereum's LSD, making ETH a security collateral for more projects and increasing the demand for ETH.

For LSD users: Further improve the capital efficiency and returns of LSD assets.

Business Users

The users served by EigenLayer involve three parties, each with different demands:

LSD asset providers: The main demand of these users is to obtain additional income from Ethereum's LSD assets beyond the basic PoS rewards, while being willing to stake their LSD assets as collateral for node operators, facing the potential risk of confiscation.

Node operators: Obtain LSD assets through EigenLayer to provide node services to project parties in need of AVS services, and earn income from the node rewards and fees provided by the project parties.

AVS demanders: Refers to project parties in need of security provided by AVS but hoping to reduce costs (such as a Rollup or cross-chain bridge that uses LSD assets as collateral for node operators). They can purchase such services through EigenLayer without the need to build their own AVS.

The main demand for EigenDA comes from various Rollups or application chains.

Details of EigenLayer's Business

Users can stake tokens on the Ethereum network, including stETH, rETH, and cbETH tokens, into the EigenLayer market. Pledge service providers are responsible for matching users' tokens with corresponding security network demanders to provide AVS services to these project parties. The underlying assets of AVS are the tokens staked by users on EigenLayer, and project parties need to distribute a certain "security fee" to users.

Product Progress

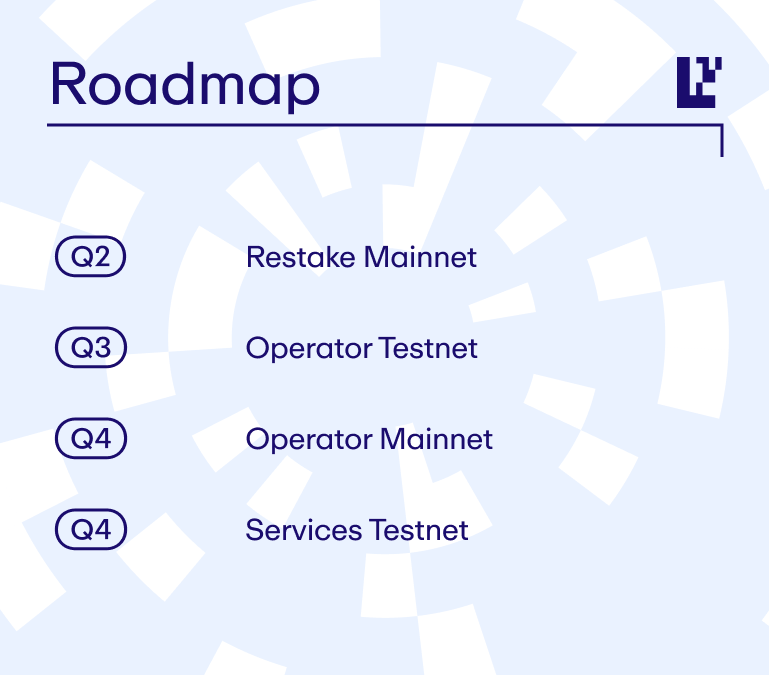

Currently, EigenLayer has only launched the restake function for LSD, and has not yet developed node operation staking and AVS services based on LSD assets. In the two deposit activities for LSD assets that have been open to the public, the deposits quickly reached the limit (the depositors are mainly seeking potential airdrop rewards from EigenLayer). Users can also directly deposit 32 integer units of ETH to participate in Restake. With the current deposit restrictions, EigenLayer has accumulated approximately 150,000 staking ETH.

Image source: https://app.eigenlayer.xyz/

According to EigenLayer's official roadmap, the main task for the third quarter is the development of the Operator test network, and the development of the AVS service test network will officially begin in the fourth quarter.

https://docs.EigenLayer.xyz/overview/readme/protocol-features/roadmap

The first explicit user of EigenDA is the rollup project Mantle, which is based on the OP virtual machine fork. Mantle is currently using the test version of EigenDA as its DA.

Token Economic Model

EigenLayer is a token-based project, but its token information and token model have not been determined and disclosed.

EigenLayer's Team and Financing Background

Core Team

Founder & CEO: Sreeram Kannan

Associate Professor of Computer Engineering at the University of Washington, and also the founder and controlling shareholder of Layr Labs, the parent company behind EigenLayer. He has published over 20 blockchain-related papers. He completed his undergraduate studies in telecommunications at the Indian Institute of Science, obtained a master's degree in mathematics and a Ph.D. in information theory and wireless communications from the University of Illinois at Urbana-Champaign, and then worked as a postdoctoral researcher at the University of California, Berkeley. He is currently a professor at the University of Washington and the head of the UW-Blockchain-Lab.

Founder & Chief Strategy Officer: Calvin Liu

Graduated from Cornell University with a major in philosophy and economics, and has worked for many years in data analysis, enterprise consulting, and strategic work. He worked as the head of strategy at Compound for nearly 4 years before joining EigenLayer in 2022.

COO: Chris Dury

Master of Business Administration from New York University Stern School of Business. He has extensive experience in project management of cloud services products. Prior to joining EigenLayer, he served as Senior Vice President of Product at Domino Data Lab (a machine learning platform) and held positions as General Manager and Director at Amazon AWS, leading various cloud service projects for game developers. He joined EigenLayer in early 2022.

Data source: https://www.linkedin.com/company/eigenl/

The EigenLayer team is rapidly growing, with a current staff of 30+, most of whom are based in Seattle, USA.

Layr Labs is the parent company behind EigenLayer, founded by Sreeram Kannan (founded in 2021). In addition to EigenLayer, it also has two other projects, EigenDA and Babylon (which also provide cryptographic economic security services, but mainly serve the Cosmos ecosystem).

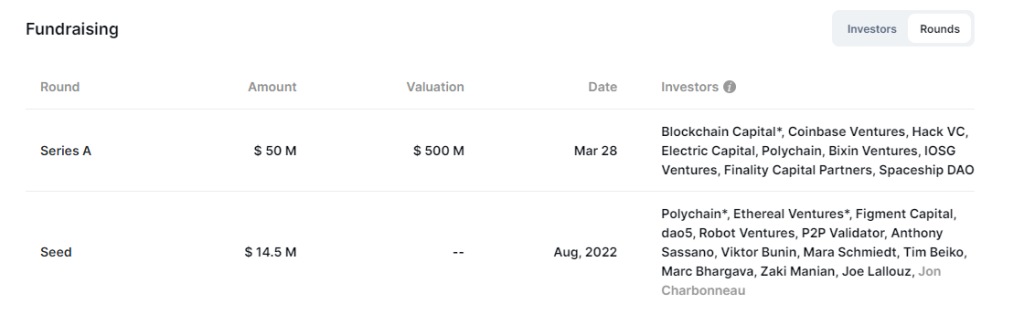

Financing Situation

EigenLayer has completed two public financings, a $14.5 million seed round in 2022 (valuation unknown) and a $50 million Series A round in March 2023 (valuation of $5 billion).

Some well-known investment institutions include:

Data source: rootdata.com

In the same period in 2023, its parent company Layr Labs also completed an equity financing of nearly $64.48 million. For details, see their filing with the SEC: https://www.sec.gov/Archives/edgar/data/1936115/000156761923004289/xslFormDX01/primary_doc.xml

Market Size, Narrative, and Challenges of the Restaking Business

Market Size Forecast

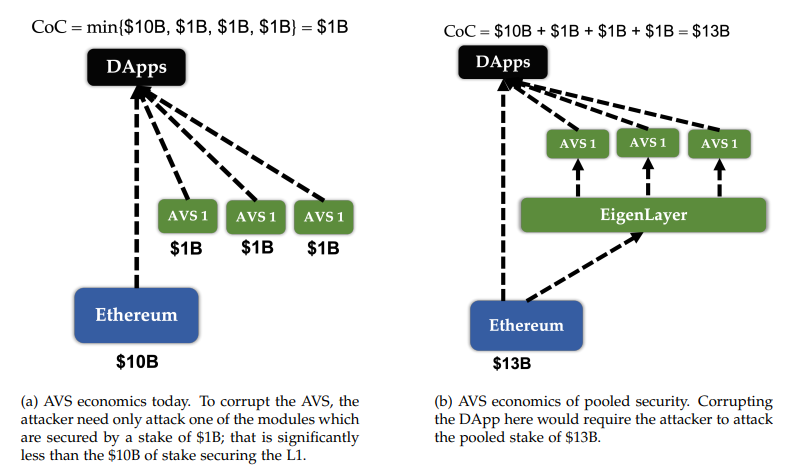

EigenLayer has proposed the novel concept of restaking, providing "cryptoeconomic security as a Service" for a client base that includes middlewares (oracles, bridges, DA layers) as well as sidechains, application chains, and Rollups. The goal is to reduce the decentralized network security costs for these projects compared to building their own trust networks.

In theory, any project that requires token staking for admission, uses game theory to maintain network consensus, and aims to maintain decentralization is a potential user. The specific size of this market is difficult to estimate accurately at present, but optimistically, it could reach a market size of billions of dollars within 3 years.

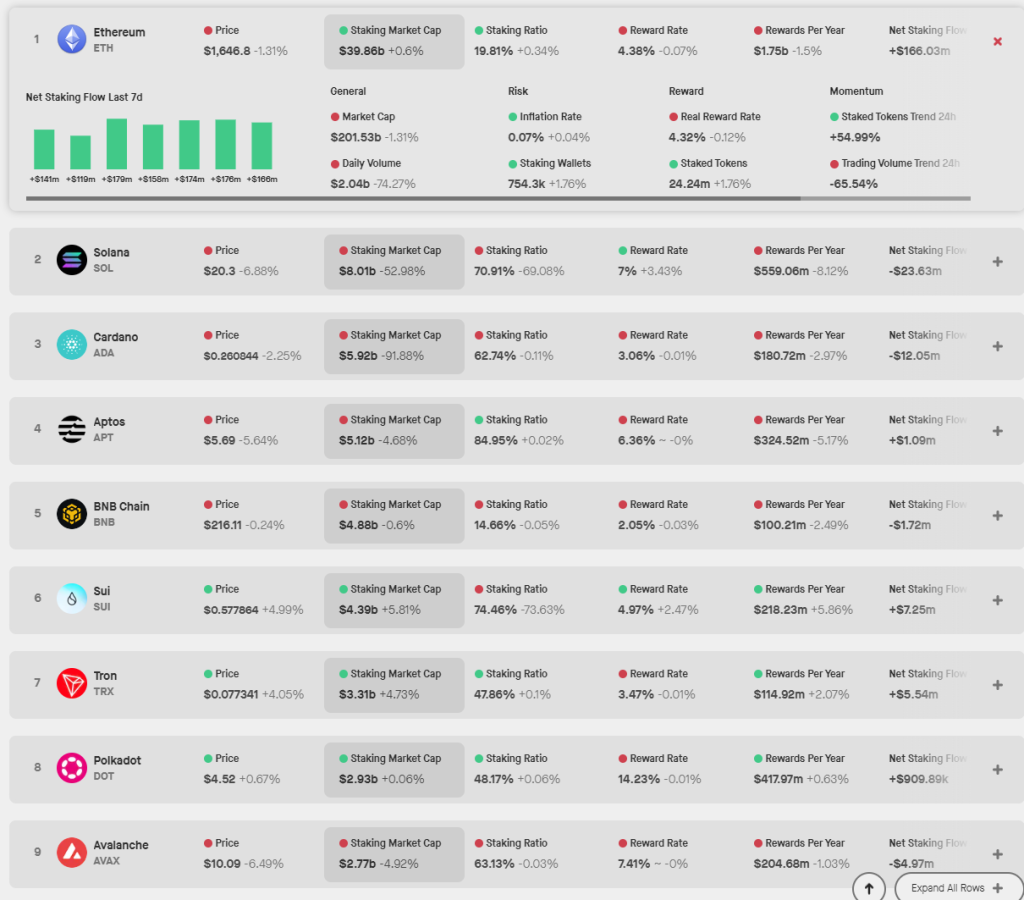

Considering that the current staked value of ETH on Ethereum is $42 billion and the total market value of projects is around $200 billion (as of August 30, 2023), the total on-chain funds on the Ethereum network are in the range of $300-400 billion. Taking into account that EigenLayer's main clients are likely to be relatively small and new projects, the size of the staking business for EigenLayer's services should be in the range of $10-100 billion in the short term.

Narrative for Business Promotion and Expected Growth

Demand Side:

- The arrival of the Cancun upgrade and the opening of the OP Stack have led to rapid development of small and medium-sized Rollups and application chains, increasing the overall demand for low-cost AVS.

- The trend of modularization in public chains, Rollups, and application chains has increased the demand for cheaper DA layers outside of Ethereum. The expansion of EigenDA increases the demand for EigenLayer, creating synergy between the businesses.

Supply Side:

- The increase in the staking rate and the number of staking users on Ethereum provides an abundant supply of LSD assets and holders who are eager to improve the capital efficiency and returns of their LSD assets. In the future, EigenLayer also hopes to introduce LSD assets beyond ETH.

Issues and Challenges

For AVS demanders, how much cost reduction can be achieved by purchasing a combination of pledged assets and professional validation nodes on the EigenLayer platform? It is difficult to say. Using Ethereum's LSD assets as collateral does not mean inheriting the security of Ethereum's $40 billion PoS staking. The economic security of the project is determined by the total amount of rented LSD assets on EigenLayer and the quality of the validation nodes. While this may be faster and more convenient than building an AVS from scratch, the cost savings may not be significant.

Using assets other than their own tokens as collateral for AVS may weaken the project's token scenario. Although EigenLayer supports a mixed collateral model of the project's own tokens + EigenLayer, it still poses significant obstacles to adoption.

Projects using EigenLayer to build AVS may be concerned about becoming passive in the long-term development due to their dependence on EigenLayer. In the future, once the project matures, it may switch to using its own tokens as collateral for network security.

Projects using LSD as collateral for security need to consider the credit and security risks of the LSD platform, adding an additional layer of risk.

Competitors

Restaking is a relatively new concept pioneered by EigenLayer, and there are few followers of this model at present. However, for EigenLayer, the main options for its potential clients are whether to build their own security network or outsource it to EigenLayer. Currently, EigenLayer needs more client examples to prove the superiority and convenience of its solution.

Valuation Estimation

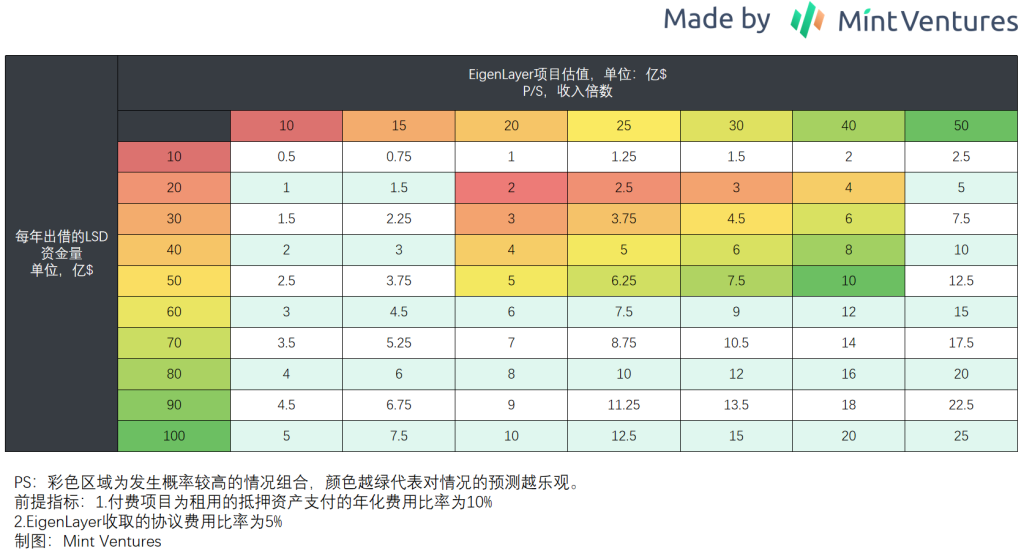

As a new business project, EigenLayer lacks clear benchmark projects and market valuations. Therefore, we can estimate the project's valuation based on the projected annual protocol revenue and PS.

Before making a formal estimate, we still need to make a few assumptions:

- EigenLayer's business model mainly involves collecting a commission from the security service fees paid by AVS service users. 90% of the service fees go to LSD depositors, 5% to node operators, and EigenLayer's commission rate is 5% (consistent with Lido).

- AVS service users pay an average of 10% of the annual security service fee for the LSD capital they lease.

The reason for choosing 10% is that the annual staking rewards for most mainstream POS projects are generally in the range of 3-8%. Considering that many users of EigenLayer are likely to be newer projects, the initial incentive rate may be higher. Therefore, the author has chosen 10% as the average security service fee rate.

PoS reward rates for major L1 chains, data source: https://www.stakingrewards.com/

Based on these assumptions, the author has calculated the following valuation range for the project, with the colored areas representing the author's high-probability valuation range. The greener the color, the more optimistic the prediction.

The reason the author judges the range of "LSD asset annual lending volume of 20-50 billion" and "PS in the range of 20-40 times" to be the high-probability valuation range is as follows:

- The current total staked value of PoS tokens for the top ten public chains is around $73 billion. If we include Aptos and Sui, it's nearly $82 billion, but most of the staking for these two projects comes from unreleased team and institutional tokens, so the author has excluded these outliers. The author assumes that EigenLayer's LSD share can account for approximately 2.5-6.5% of the total PoS staking market (note that this is a rough estimate), corresponding to a market value of $20-50 billion. Whether a 2.5-6.5% share is reasonable is open to interpretation.

- A PS value of 20-40 times is anchored to Lido's current PS of 25 times (as of August 30, 2023, based on the fully diluted market value). Newer narratives may enjoy a higher premium.

According to the above calculations, a valuation range of $2-10 billion may be a reasonable range for EigenLayer. For primary investors who have invested at a valuation of $5 billion, considering various restrictions on token unlocking, they may not have left themselves much of a safety margin. If the rumors of investors wanting to buy EigenLayer tokens at a valuation of $20 billion are true, caution is even more important.

Of course, it should be noted that the above valuation is a calculation for the entire EigenLayer project. The specific market value of the token will depend on its specific ability to capture business, such as:

- What percentage of protocol revenue will be attributed to token holders?

- Besides buybacks/dividends, does the token have a relatively rigid use case in the business, increasing demand for it?

- Will EigenDA share the same token as EigenLayer, providing more scenarios and demand for the token?

If points 1 and 2 are not sufficiently empowered, it will further weaken the intrinsic value of the EigenLayer token. If there are unexpected surprises in point 3, it will add value to the token.

In addition, the market value of EigenLayer at its debut will also depend on the market's bullish or bearish environment at that time.

Let's wait for the market's answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。