Project Introduction

Friend.tech is a Web3 social DApp based on the Base chain, leveraging the social network and influence of Twitter to allow users to directly interact and communicate with their favorite KOLs. It also utilizes a price curve mechanism, giving value to users' Keys (previously called shares) for investment and speculation, providing a passive income source for users whose Keys are purchased, thus achieving the tokenization and valuation of social relationships.

1. Research Points

1.1. Core Investment Logic

Friend.tech is a decentralized social media application based on the Base chain, allowing users to purchase and sell Keys of any Twitter user using ETH to gain more access and social experience. The project leverages Twitter's large user base and influence, combining NFTs, social tokens, and the innovative concept of quantifying social value, creating a highly interactive and incentivized Web3 social platform. It is expected to become a leader in the Web3 social space, attracting more users and KOLs and driving the development of the Base chain. Its core investment logic is mainly reflected in the following aspects:

Creating a new social model: Allowing users to evaluate and incentivize their own and others' social influence through market mechanisms, thereby improving social efficiency and quality. It also provides users with a new source of income, allowing them to profit from selling their Keys or participating in the trading of other users' Keys.

Low entry barriers and rich incentives to attract user groups: Friend.tech adopts various methods to attract users and lower entry barriers, which is a key factor in its early growth. Built on the strong user base of the mainstream social platform Twitter, it can achieve rapid user acquisition. The platform selects KOLs with the most influential topics as entry points and uses cost-effective and targeted marketing methods. Additionally, the platform's built-in airdrop expectations are attractive. Furthermore, it promotes interaction and dissemination among users through invitation codes and points, forming a social network with positive feedback and self-growth characteristics.

The combination of these methods attracts user groups, which is crucial for Friend.tech to gain early development momentum. The incentive mechanism and low entry barriers reduce user costs, and the marketing strategy achieves precise user acquisition, forming its core competitive advantage. This also makes Friend.tech a typical demonstration in the field of social tokens.

Pricing and trading of personal influence based on the price curve: Friend.tech uses a price curve mechanism to tokenize and trade personal influence. This mechanism design, inspired by practices in AMM, allows price discovery and fluctuations without requiring a large number of transactions. This gives economic value to personal influence. Users' stock prices can automatically discover and adjust based on the price curve under conditions of sufficient liquidity. Even in the case of low trading volume, personal stock prices can be reasonably reflected. This pricing and trading mechanism for influence is the core innovation of Friend.tech compared to traditional social tokens. It enables the evaluation and trading of personal influence and brings new social and economic forms to users. This core investment logic gives Friend.tech differentiated advantages in both technical architecture and business models. It attracts the interest of users and capital, and is a key factor in the project's rapid development. As an important attempt in the field of social tokens, its exploration value in the tokenization of influence is of significant reference significance.

Innovative technical architecture achieves product advantages: Friend.tech has made multiple innovations in its technical architecture, achieving performance and user experience advantages. Firstly, it is built on a Layer 2 chain, achieving low-cost and efficient transactions. Secondly, it uses PWA technology (Progressive Web App) to bypass centralized app stores, enhancing user convenience. Furthermore, the embedded wallet design simplifies the user onboarding process and lowers the entry barriers.

These breakthroughs and integrations in product technology architecture are key to Friend.tech's differentiated competitive advantage over other social tokens. It brings a better user experience and opens up possibilities for the business model. This is the technical foundation for Friend.tech's rapid development and an important part of its core investment logic.

1.2. Valuation

Since the project has not yet issued tokens and is still in the early stage, many data and parameters are not stable and accurate. In addition, the project faces many uncertainties and risks that may affect its future development and value. Therefore, it is currently not possible to accurately value it.

We can also refer to valuation methods for similar projects or platforms, such as BitClout, DeSo, Steemit, etc., to make a preliminary valuation. Generally, the valuation of these projects or platforms mainly depends on the following factors:

1) User scale and activity: Users are the core assets of social media applications. The larger the user scale and activity, the more popular and recognized the application is, and the more social value and network effects it can generate. Therefore, user scale and activity are important indicators of the value of social media applications.

2) Protocol revenue and profit: Protocol revenue and profit are important indicators of the business model and profitability of social media applications. Generally, the main sources of revenue for social media applications include advertising revenue, membership revenue, royalty revenue, and value-added service revenue. The higher the platform's revenue and profit, the more valuable services it can provide to users and gain returns from them.

3) Market value of platform tokens or Keys: Platform tokens or Keys are a core part of social media applications, representing users' trust and support for the application, and reflecting the demand and supply of the application in the market. Therefore, the market value of platform tokens or Keys is an important indicator of the value of social media applications.

We won't continue with specific calculations. We are just providing a rough valuation reference approach. Interested readers can verify it by consulting relevant information.

1.3. Project Risks

The project's risks mainly include: lack of privacy protection, poor product experience, single product functionality, excessive financial attributes, low project credibility, "empty trading" risk, and high barriers for users to access high-quality content, as detailed in the "7. Project Risks" section.

2. Project Overview

2.1. Basic Information

Friend.tech appears very concise from the perspective of acquiring the application. IOS users can open the official website on their phones and add it to the home screen without relying on any third-party downloads. Users need to obtain an invitation code, bind Twitter, and inject at least 0.01 ETH into the Base network to enter the application. The functionality of Friend.tech is essentially no different from WeChat groups and Telegram groups, but the core of Friend.tech lies in the organic entry and exit of group chats. Users can choose to join a group, and by paying the base price, they can obtain group Keys; if they want to leave the group, they can sell the group Keys they own. As the number of people choosing to join a certain group gradually increases, the total amount of group Keys and the base price of each group Key will also increase, meaning that joining a group not only meets social needs but also has investment potential. From an investment perspective, joining a group is an investment in the group and the group owner, so speculative users often choose to buy more Keys of other promising groups or their own groups in the early stages.

2.2. Team Situation

2.2.1. Overall Situation

The project's team is currently relatively small, mainly consisting of two co-founders, Racer and Shrimp, who are both experienced Web3 developers and cryptocurrency enthusiasts with rich project experience and community influence. The project also has other developers and operators, but their identities and backgrounds have not been publicly disclosed.

2.2.2. Core Members

Racer: One of the creators of Friend.tech, he previously created TweetDAO, a DAO organization that grants the right to use its Twitter account by holding NFTs called "TweetDAO Eggs." Racer also co-created Stealcam with Shrimp, a picture-sharing application based on the Arbitrum ecosystem. Racer has over 15,000 followers on Twitter (@0xRacerAlt), and his account is currently set to private.

Shrimp: Another co-founder of Friend.tech, he co-created Stealcam with Racer, a picture-sharing application based on the Arbitrum ecosystem. Shrimp has over 3,800 followers on Twitter (@shrimppepe).

2.2.3. Brief Introduction of Team's Past Projects

TweetDAO and Stealcam share common design concepts and are both explorations of decentralized social media, making them prototype applications for Friend.tech.

TweetDAO was established in April 2022, based on a DAO model, where creators sell NFTs called Eggs, allowing holders to post a tweet from the DAO's Twitter account every day, with no content restrictions. As NFT sales increase, the base price of NFTs also increases accordingly. Currently, the official account of TweetDAO has been deactivated, and information about the website is quite limited.

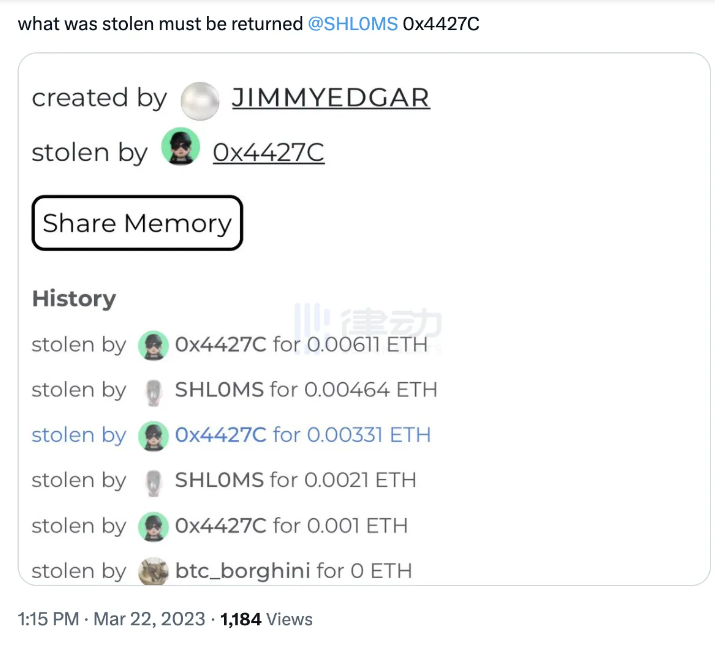

Following TweetDAO, Racer and Shrimp jointly developed Stealcam in March of this year. Stealcam is a picture social application based on Arbitrum, where users can upload pictures and convert them into NFTs. However, the content of the pictures cannot be viewed until other users pay a fee (steal) and obtain unlocking permission (reveal). Stealcam has accumulated over 313 ETH (approximately $500,000) in transaction volume solely through natural growth, without any airdrop expectations or token issuance, and has attracted the entry and likes of crypto OGs, artists, and VC partners.

Project Overview

2.1. Basic Information

The core mechanism of Stealcam is that each "steal" increases by 10% on the basis of the previous "steal" price and adds 0.001 ETH. The income generated by each "steal" will fully refund the purchase cost of the previous "stealer," and the price difference between two "steals" will be distributed among the creator, the previous "stealer," and the protocol, with the creator and the previous "stealer" receiving 45% each, and 10% allocated to the protocol. Stealcam's advantage lies in cleverly combining human voyeurism, celebrity effect, and owner economic models, allowing all participants in a work to profit and promoting price discovery for the work. Although Stealcam's official account has been deactivated, its website is still operational.

Later, the developers decided to reposition Stealcam and created a project called Friend.tech. Shrimp and Racer originally intended to deploy the project on Arbitrum. However, possibly influenced by the popularity and advantages of Base, or because Stealcam received high praise from Jesse Pollak, a core developer of Base, they ultimately chose Base as their underlying protocol.

Evidently, based on Racer's history of creating social products, these projects all have obvious financial attributes and utilize a Ponzi-driven architecture.

2.3. Funding Situation

Friend.tech announced on August 19, 2021, that it had secured seed funding from the crypto venture capital firm Paradigm. The specific amount of funding and valuation has not been disclosed, but it is speculated to be around several million dollars. Paradigm is a venture capital firm focused on the cryptocurrency and blockchain space, with a portfolio including well-known projects such as Uniswap, Compound, MakerDAO, and Optimism, and is also a supporter of the Base network. Matt Huang, a partner at Paradigm, expressed excitement about the team and vision of Friend.tech on Twitter, stating that they believe the project is a significant advancement in crypto social. Paradigm's investment is an important confidence and resource support for Friend.tech.

2.4. Past Development and Roadmap

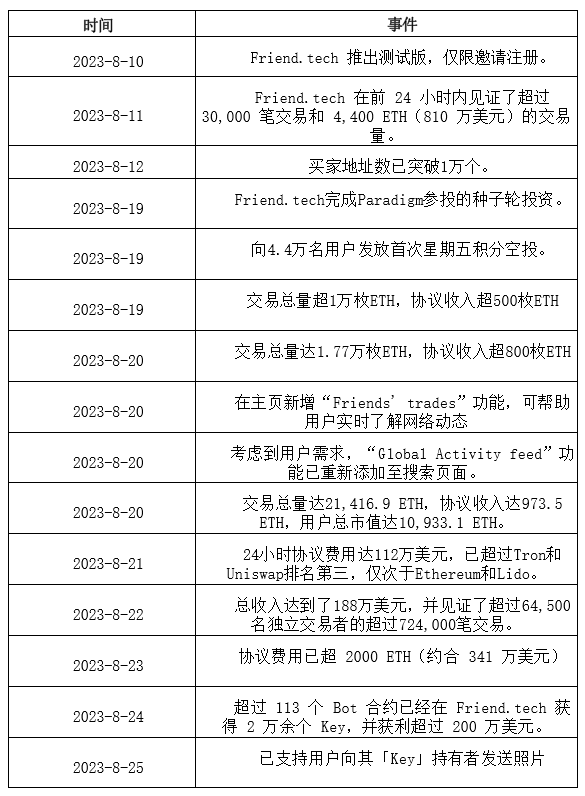

2.4.1. Past Development

2.4.2. Development Plans and Roadmap

The project is currently in the early stages and has not publicly disclosed detailed development plans and a roadmap. However, based on information from its official website and Twitter account, it can be inferred that the project may work on the following aspects in the future:

▪Issuance of platform tokens: The project has not yet issued tokens but has conducted point airdrops, indicating the possibility of token issuance in the future. Platform tokens may serve as the governance and incentive mechanism for the project, allowing users to participate in the construction and decision-making of the platform.

▪Support for more social media platforms: The project currently only supports the trading of Keys for Twitter users but may support more social media platforms in the future, such as Instagram, TikTok, YouTube, etc., to expand its user base and market size.

▪Optimization of user experience and privacy protection: The project currently has some issues with user experience and privacy protection, such as bugs, slow operation, and a lack of privacy policy. These issues may affect user trust and satisfaction, so the project needs to optimize its user experience and privacy protection in the future to improve its product quality and security.

▪Addition of more social features and value-added services: The project currently only provides basic functions of Keys trading and private chat, but may add more social features and value-added services in the future, such as group chat, content sharing, and value-added services, to increase its social value and attractiveness.

3. Project Analysis

3.1. Project Principles

1) The core principle of Friend.tech is to tokenize and monetize the influence of Twitter users' accounts by converting them into tradable Keys.

Friend.tech is based on the idea of tokenizing personal influence and creating a market for social interaction, aiming to address some issues present in traditional social media platforms, such as information overload, spam, low-quality content, and lack of incentives. By allowing users to buy and sell the social influence Keys of other users, Friend.tech introduces a new mechanism to filter out noise, reward quality content, and adjust incentive mechanisms between content creators and consumers.

Additionally, Friend.tech leverages existing Web 2.0 social identities to guide its user base. By requiring users to link their Twitter accounts to access the platform, it can leverage the large and active crypto community on Twitter, avoiding many of the cold start problems faced by new social platforms. Furthermore, by using Base as its Layer 2 solution, it can provide users with fast, low-cost, and scalable transactions without compromising security or decentralization.

Friend.tech itself is not a fan token platform but a platform for trading social influence. Fan tokens are typically issued by celebrities or influential individuals to reward their loyal fans. Keys on Friend.tech are issued by the platform itself and can be bought and sold by anyone. The value of each Key is determined by market demand and supply, rather than by the content creator's own valuation, creating a more dynamic and competitive market for social influence, allowing users to speculate on the future potential of other users and benefit from their growth.

2) The platform has four main components: Keys, propagation, fees, and points.

A. Keys Growth Model:

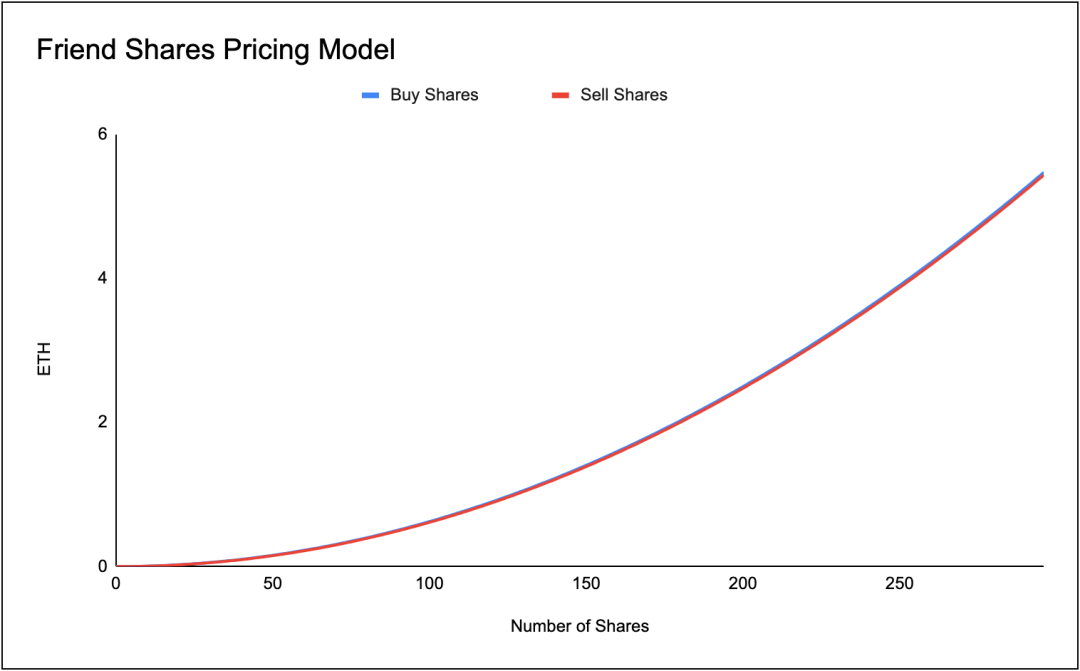

Keys represent ownership and access rights of users on the platform. Users can buy the Keys of other users, chat with them directly, and sell their own Keys to other users. The price of each Key is determined by the supply of Keys, i.e., the quantity of Keys issued by each user. The price formula is:

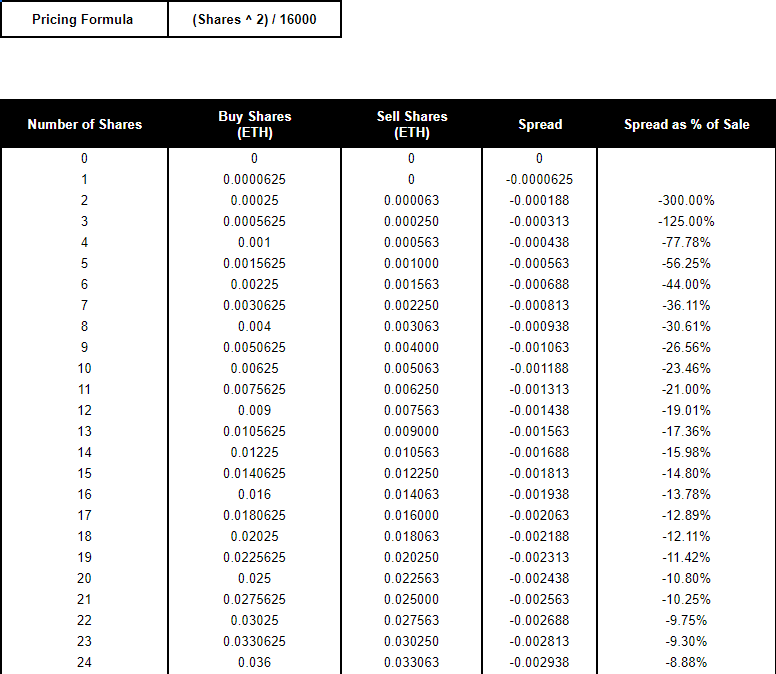

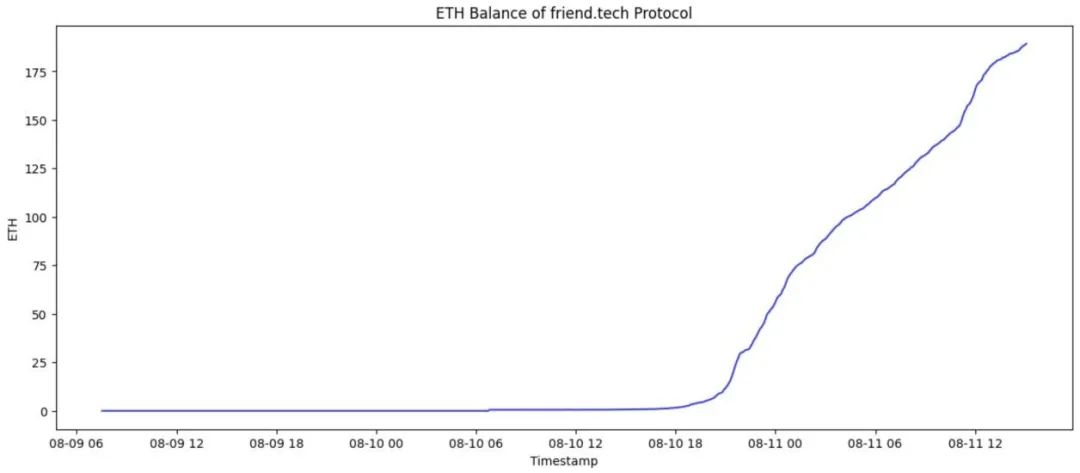

Price (ETH) = (Total Keys^2) / 16000

This means that as the supply of Keys increases, the price of each Key will also increase. The price difference between buying and selling Keys creates an incentive mechanism, allowing users to buy low and sell high, and creates a market for social relationships.

The following is the Keys pricing model table, which is not fully displayed due to space constraints:

B. Propagation

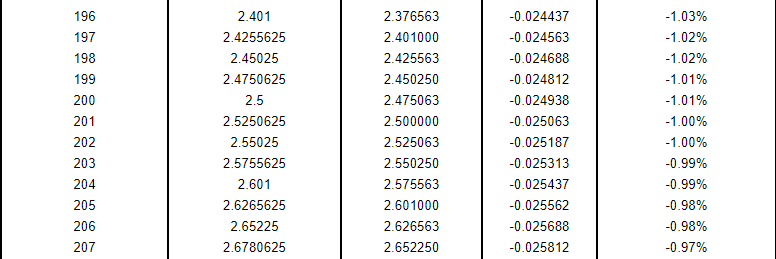

There is a price difference between buying and selling Keys. According to the Keys pricing model table, for example, if we assume that Cobie has 200 circulating Keys, each worth 2.5 ETH (buyable). However, if you want to sell 200 shares of Cobie Keys with a circulation of 200, you will only get 2.47 ETH.

▪The selling price is the buying price minus the quantity you want to sell (i.e., the buying price of the 199th share). Therefore, the seller will lose 0.03 ETH due to the price difference.

▪It can be seen that when the number of circulating shares is small, the price difference as a percentage of the selling price is relatively large. Therefore, if you buy a few shares of someone's Keys and immediately sell them, you may lose a significant amount of funds.

C. Protocol Fees:

Fees are the charges collected by the platform from each transaction. The platform charges a 10% fee for each transaction, with 5% allocated to the holders of group Keys and the remaining 5% going to the treasury. Holders are users who own the Keys of other users and can receive dividends from each transaction involving their Keys. The treasury is the platform's fund for its development, operation, and governance.

D. Points Incentives:

Points incentives are an important means for Friend.tech to transform Twitter users into core users of the application, using potential token airdrop expectations and tangible points to incentivize users. The platform distributed a total of 100 million points during a 6-month testing period, distributed every Friday based on user activity and performance on the platform, with the points not recorded on the chain. Points create an incentive mechanism for users to remain active and engaged on the platform and create an expectation for users to receive tokens in the future.

Summary

The pricing model of Friend.tech is price=S^2/16000, where S is the total number of Keys for a KOL, and price is the price of Keys. This model has several main risks:

Risk of price bubble and collapse: Due to the set price curve, the price of Keys will exponentially increase with the increase of S, which may lead to an excessively high and unreasonable price, forming a bubble. If there is panic or negative news in the market, the price may quickly drop, leading to a collapse. This risk is advantageous for early users who can gain high profits, but disadvantageous for later users who may suffer losses or be trapped.

Risk of price manipulation and exploitation: Due to the set price curve, the price of Keys is sensitive to changes in S, making it susceptible to manipulation or exploitation. Some KOLs or other users may use tactics such as hype, deception, or collusion to attract more users to buy their Keys, driving up the price, and then sell their Keys or exit the platform at the right time to gain high profits. This behavior may damage the platform's reputation and fairness, and lead to losses and dissatisfaction for other users.

Risk of price not reflecting true value: Due to the set price curve, the price of Keys only reflects the quantity of S, not the true value and quality of the KOL. Some KOLs may attract users to buy their Keys based solely on their fame or number of followers, without providing high-quality content or services. This may lead to the presence of low-quality or fraudulent KOLs on the platform, as well as a decrease in user interest and identification with the platform or community.

3.2. Project Operation Process

The operation process of Friend.tech is relatively simple and straightforward. The application is mobile-based, and users need to open the website on their phones and add it to the home screen (iPhone users need iOS 16.6). The following is a simple example illustrating how users can operate on Friend.tech:

- Alice wants to join Friend.tech. She visits the website on her mobile browser, logs in with her email, links her Twitter account @Alice, and deposits 0.01 ETH to activate her account. She also enters an invitation code from Bob to gain full access. She also receives three invitation codes that she can share with others and receive points as a reward. Users can obtain invitation codes in the following ways:

- Obtain from registered users

- Obtain from the platform's official Twitter account @friend_tech or other social media channels

- Obtain through platform activities or contests

After registering on Friend.tech, Alice's Twitter account @Alice is generated as tradable Keys. She initially owns 100 Keys, with 10 locked on the platform and 90 freely sellable or retainable. She sets the initial price of her Keys to 0.01 ETH.

Alice wants to buy Charlie's Keys. She searches for Charlie's Twitter account @Charlie on the platform and finds that his Keys are priced at 0.02 ETH. She decides to buy 10 Keys, so she pays 0.22 ETH (0.2 ETH + 10% fee). 0.01 ETH goes to the protocol, and another 0.01 ETH goes to Charlie. Charlie's Keys decrease by 10, and the price increases slightly. Alice's Keys and price remain unchanged.

After acquiring Charlie's Keys, Alice can engage in private chat with Charlie. She sends three messages to Charlie, waits for a reply, and resets the limit. Charlie replies to Alice, gives her an invitation code, and Alice uses it to receive some points as a reward.

Alice wants to sell some of her Keys to earn a profit. She sees that David wants to buy her Keys for 0.015 ETH. She decides to sell 20 Keys to David, receiving 0.285 ETH (0.3 ETH - 5% fee). 0.015 ETH goes to the protocol. Alice's Keys decrease by 20, and the price decreases slightly. David's Keys and price remain unchanged.

3.3. Project Data

3.3.1. Protocol Data

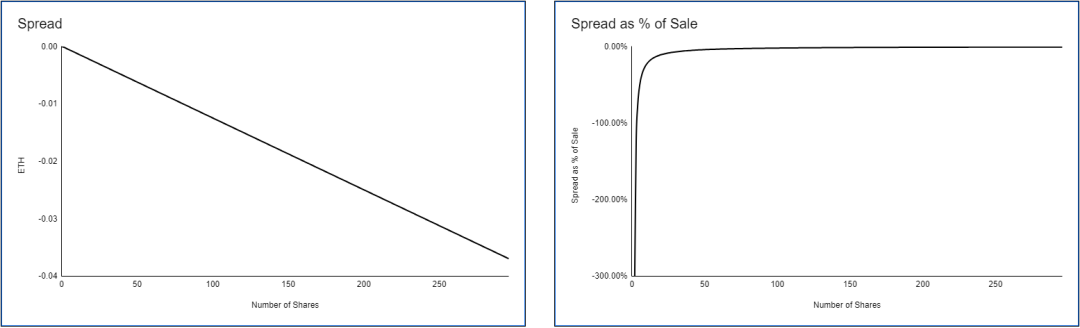

According to CoinDesk, since launching the invitation-only test version on August 10, Friend.tech has attracted over 100,000 registered users and generated over $1 million in transaction fees in the past 24 hours, creating nearly $700,000 in revenue.

The data shows that Friend.tech's data growth can be divided into several stages:

- The first stage is from Aug 10 to Aug 12, the first wave of natural growth, followed by stagnation, mainly due to the scarcity of invitation codes and the trust crisis in Base caused by bald's RUG event.

- The second stage is from Aug 18 to Aug 22, with a very steep growth curve, mainly due to the opening of invitation codes and the market sentiment brought about by Paradigm's investment, reaching its peak on August 21.

The data can be viewed and analyzed using Dune Analytics, reflecting the project's user base, market activity, protocol revenue, and other indicators. As of August 25, 2023, the project-related data for Friend.tech is as follows:

- Active addresses: 115,960

- Total transaction volume: 43,720 ETH

- Total transaction value: $74,408,724

- Total number of transactions: 2,190,360

- Total protocol fee amount: 2161.26 ETH (approximately $3.68 million)

In terms of the number of transactions, it reached its peak on Aug 21 and gradually decreased, stabilizing at around 2 million transactions.

Looking at the Keys holding data, on August 25, Friend.tech's "Keys" price ranking list showed that founder Racer ranks first with 2.91 ETH, with profits estimated at around 90 ETH.

3.3.2. Social Media Data

As of August 25, Friend.tech has shown strong growth on various social media platforms.

- As of August 25, the official account @Friend.tech on Twitter has over 110,000 followers, with over 300 tweets, over 15,000 likes, and over 32,000 retweets.

- One of the founders, Racer's account @0xRacerArt on Twitter has over 15,000 followers, but the account is protected, so specific content cannot be viewed.

- Another founder, Shrimp's account @shrimppepe on Twitter has over 3,900 followers, with over 700 tweets, over 28,000 likes, and over 45,000 retweets.

- The related hashtags #friendtech and #friendtech Keys on Twitter rank 7th and 8th in popularity, with over 21,000 related tweets.

In addition to Twitter, Friend.tech has gained strong momentum on multiple social platforms including Telegram and Discord. The high heat of user discussions reflects positive word-of-mouth effects.

4. Token Economic Model Analysis

4.2.1. Total Token Supply and Distribution

The project has not yet issued tokens but has conducted point airdrops, indicating the possibility of token issuance in the future. The project plans to distribute a total of 100 million points during a 6-month testing period, distributed every Friday, with the points not recorded on the chain. The distribution of points will be based on user activity before each Thursday, and on August 19, Friend.tech completed its first point airdrop. Although the specific rules for points are not clear, transaction volume is likely the most important indicator.

After the testing phase, points will have special uses, but specific details have not been disclosed. The community speculates that points are related to airdrops and may be exchangeable for platform tokens in the future, but the specific exchange ratio and timing have not been determined. The total supply and distribution of platform tokens have also not been disclosed, but may follow the practices of other social token platforms such as BitClout and DeSo, allocating a portion of tokens for incentives and reserves for the founding team, investors, partners, and another portion for community, ecosystem, development, and rewards.

4.2.2. Token Value Capture

The token value capture mechanism of Friend.tech has not been publicly disclosed, so analysis can only be based on some assumptions and speculations. One possible mechanism is to use tokens as a vehicle for platform governance and revenue rights, allowing token holders to participate in platform decision-making and management, and receive dividends from platform revenue. Another possible mechanism is to use tokens as a means of consumption and incentives on the platform, allowing users to buy and sell Keys with tokens and receive rewards or discounts from transactions. Regardless of the mechanism, the balance of token demand and supply, as well as the liquidity and stability of the tokens, need to be considered.

4.2.3. Core Token Demanders

1) Twitter Users: Twitter users are tokenized entities on the Friend.tech platform. They can increase their income and influence by accepting Friend.tech's invitation and sharing a certain percentage of transaction fees. The demand for tokens by Twitter users may come from their desire to purchase Keys from other Twitter users or to participate in platform governance and revenue.

2) Keys Buyers: Keys buyers are the main consumers on the Friend.tech platform. They can use ETH or tokens to purchase Keys from Twitter users and engage in private chats and profit sharing. The demand for tokens by Keys buyers may come from their desire to receive more transaction rewards or discounts, or to participate in platform governance and revenue.

3) Keys Sellers: Keys sellers are the main suppliers on the Friend.tech platform. They can sell Keys from Twitter users for ETH or tokens and extract profits or minimize losses. The demand for tokens by Keys sellers may come from their desire to exchange for other assets or to participate in platform governance and revenue.

5. Industry Space and Potential

5.1. Track Status

5.1.1. Project Classification

Friend.tech can be classified as a subcategory of SocialFi, specifically creator economy. This category includes social applications and protocols that focus on creators and utilize blockchain technology to achieve functions such as content creation, distribution, monetization, and copyright protection. These projects have the following characteristics:

- Users own their data and identity, free from control and censorship by centralized platforms.

- Users can participate in platform construction and governance through token incentive mechanisms, benefiting from the platform's value growth.

- Users can express preferences and trust for other users through token transactions, forming closer social relationships.

5.1.2. Market Size

SocialFi is an emerging market, dependent on its ability to attract and retain users, as well as create and distribute value. There are currently no unified data and standards to measure its size and potential. Estimating its market size needs to consider several factors:

1) Web2 Social Media Market Size

According to the 2022 report from We Are Social, there are 5.32 billion mobile users, 5 billion internet users, and 4.65 billion active social media users globally, accounting for 58.7% of the global population. High crypto-concentrated applications like Telegram have 500 million global users with 80 million daily active users; Discord has 300 million global users with 150 million monthly active users; Twitter has over 1.3 billion registered users, with 330 million monthly active users. In the past year, there have been over 332 million tweets related to NFTs globally, 17 times the volume during the "work from home" period. GWI's latest research shows that global internet users now spend an average of 6 hours and 53 minutes online every day. 64% of Generation Z internet users use Instagram daily, followed by WhatsApp (59%) and Facebook (45%). Social media is almost a rigid demand for every user. The exposure of Web3 is gradually increasing in 2022, and according to a16z statistics, there are roughly 30-50 million Web3 users.

2) Web3 Social Media User Demand

Web3 social media user demand refers to the needs that decentralized social networks and applications can meet. It can serve as a driving force and potential for the socialfi market size. Web3 social media user demand mainly includes user data ownership and privacy protection, fair and transparent content creator earnings, social capital portability and interoperability, and the development of Web3 social technology.

From the above data, it can be seen that the market size of SocialFi is still relatively small, but it has huge growth potential. With the development and popularization of blockchain technology, as well as the increasing demand and awareness of users for data privacy and freedom of expression, decentralized social platforms are expected to become the mainstream trend of future social media.

5.2. Development History of SocialFi

SocialFi refers to social networks and applications based on blockchain technology and decentralized thinking. They aim to address some of the issues present in Web2 social media, such as platform monopolization of user data, unfair content creator earnings, and immovable social capital. The development of SocialFi can be divided into two stages: SocialFi 1.0 and SocialFi 2.0.

5.2.1. SocialFi 1.0

SocialFi 1.0 refers to the enlightenment period of Web3 social projects before 2022. These projects utilized blockchain technology and formed three major value propositions to differentiate themselves from centralized social media, aiming to solve traditional social media problems: 1) data ownership; 2) profit distribution/incentive mechanisms; 3) user authorization (privacy/security). They were primarily token-driven, achieving value sharing and incentive mechanisms between users and platforms, but also exposed some issues such as poor user experience, lack of product differentiation, and social graph dependence on platforms. Projects in this stage can be divided into three periods:

1) Around 2017, a large number of blockchain + social projects emerged. Representative projects include Steem, Voice, ONO, QunQun, GSC, YeeCall, NRC, SwagChain, Huobi Chat, TTC Protocol, and other star projects.

2) After 2020, the DeFi era began, and NFTFi and GameFi successively emerged. Under the influence of open finance concepts and liquidity mining, SocialFi 1.0 also began to transition from "Social + Finance" to "Social + DeFi".

3) Around 2021, a wider range of Web3 players joined the new wave of the era, and applications with more social and entertainment attributes began to emerge (especially with Axie's popularity in 2021, which also drove some attention to social media). In terms of the speed of change in the blockchain world, SocialFi is also experiencing rapid changes.

5.2.1.1. Structure of SocialFi 1.0

In terms of capital enthusiasm and demand, the mainstream narratives and investment opportunities of SocialFi 1.0 mainly focus on three areas:

1) Infrastructure tools, middleware, and protocol categories:

Representative projects include Mask Network, RSS3, 5Degrees, Mem Protocols, Likecoin, Snapshot, Lens Protocols, Collab Land, CyberConnect, Project Galaxy, and others. They primarily serve developers and platforms, focusing on technological innovation and moats. These projects have various articles describing them to different extents, and a few noteworthy projects include:

POAP: A representative project that proposed the concept of on-chain behavior memory before V God's SBT narrative. It is an NFT on-chain certificate application that records each person's on-chain life imprints. Whenever a user engages in related online and offline activities, they have the opportunity to receive a uniquely designed badge as certification, which also becomes a traceable, indivisible, and unchangeable digital collectible on the chain.

Project Galaxy: It is a qualification for on-chain behavior, opening up a new space for the social graph protocol of SocialFi 1.0, leading to a new wave of hotspots, with a wave of similar projects following suit.

CyberConnect: It is a decentralized social graph protocol with social modules such as "follow button" and "follower list", with all social graph data publicly available, but ownership and management rights are in the hands of the users.

Lens Protocol: It is a decentralized social graph protocol that initially only established social connections, and each design requires high gas fees. In order to improve user experience and address whether there is a need for middleware beyond The Graph to handle on-chain community relationship graph databases and other issues, Lens Protocol provides new solutions as it enters the phase of SocialFi 2.0.

2) Decentralized content social media (Media DApp)/NFT subscription platform tools.

This category mainly consists of platforms that provide social applications for creator economy, IM instant messaging, and DID/reputation scenarios, such as Bluesky, BitClout, BBS Network, Monaco Yacht, Subsocial, myMessage, ShowMe, Theta decentralized video, Audius decentralized audio, Joystream, Mirror, Cent, Yup, Matataki, SWAGG, Entre, Nafter, Mastodon, and others. They primarily serve users and creators, focusing on product design and user experience. These projects have various articles describing them to different extents, and some narratives worth paying attention to include:

Decentralized content social media includes content creation + media platforms running on public blockchains. Unlike traditional completely independent centralized social media platforms, where data servers are controlled by specific companies, commonly used platforms like WeChat, Weibo, Instagram, Facebook, TikTok, etc., are also like this, and the data does not truly belong to us. In contrast, decentralized projects in this category to a large extent enable anyone, anywhere to run nodes, access backends, create applications, and manage feed streams.

Monaco Planet: The Twitter of the Web3 field (content mining), and also the only domestic project with three arrows in the game (further fueling the investment boom of SocialFi 1.0 at the time). Users can socialize on Monaco by posting videos, images, and text, and engage in activities such as liking, commenting, sharing, NFT display, and Staking to earn the platform's native token MONA. One of the reasons for Monaco's initial popularity was the issuance of Yacht NFTs. Only users who purchased Yacht NFTs could obtain Monaco's early access codes and sharing codes (leveraging the traffic effect of Web3), leading to a community explosion after the launch of Monaco Beta, with invitation codes being traded for over a hundred dollars. However, due to the overly simplistic algorithm for token acquisition, the platform was unable to maintain high-quality content for an extended period, leading to overly singular social content driven by the pursuit of attention, weak token value capture, and ultimately encountering a reputation crisis despite its soaring popularity. However, as a content media platform, the project pioneered a new path for the creator economy in the subsequent SocialFi 2.0 related fields.

(3) Social Token Issuance Platforms:

Early projects in SocialFi 1.0 were mainly focused on token issuance, with the core value of SocialFi at the time being Social Tokens. Representative projects were categorized based on different token types: Personal Tokens, Community Tokens, and Social Platform Tokens, each with its own representative projects. Social tokens are personal tokens issued by users carrying proprietary information and established access permissions, while community tokens issued by organizations are used to establish connections between members. Governance platform tokens serve as the foundation of the organization.

Personal Tokens: Personal tokens are individual tokens issued by users with exclusive information and access permissions. Token holders can enjoy early fan benefits, such as discounts, priority participation, obtaining goods, NFTs, and are also a symbol of user engagement and identity. Early creators or entrepreneurs can derive economic income from these tokens. Some representative projects include: 1) RAC: Fan tokens launched by Grammy Award winner DJ RAC (André Allen Anjos) on Ethereum. 2) ROLL (Creator Token): Roll is one of the veteran social token issuance platforms. Under its issuance model, Roll creates ERC-20 tokens representing users, issuing personal social tokens for content creators. 3) RALLY (Creator Token): Individuals can issue their own tokens on the RALLY platform. RALLY itself is a social platform token and a very typical project in SocialFi, which will be detailed later.

Community Tokens (Social Platform Tokens): Community tokens (social platform tokens) are issued by organizations to facilitate connections between members. Governance platform tokens serve as the foundation of the organization. Token holders have the rights of all personal token holders, plus governance rights in DAO and influence in the ecosystem, as well as income sources from renting assets or providing services. Some representative projects include Karma DAO, Friends with Benefits, Forefront, Flamingo, DeepDAO, and others.

Minting and Distribution of Platform Tokens: The minting and distribution of platform tokens represent the governance capabilities of social platforms, derived from transaction or platform destruction mechanisms, as well as financial gains from the growth of social tokens issued on the platform. Some representative projects include Chilliz, Zora, CircleUBI, Fyooz, and others.

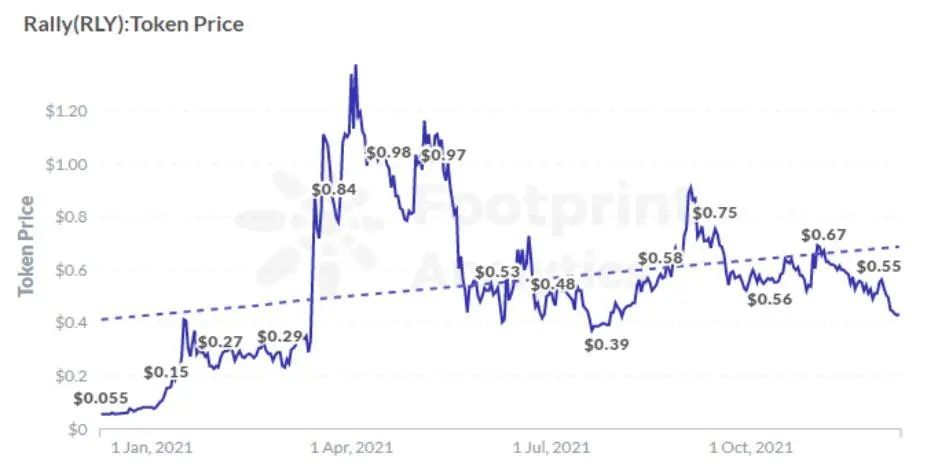

Looking at the trends of FWB and RLY, both experienced some ups and downs. Footprint Analytics data shows that the price of FWB surged from $17.69 to $190.69, an increase of 977%, and received investment from a16z in October. However, similar projects like FWB and RLY experienced a downturn after October, and in the first half of 2022, they returned to their original state, indicating that social tokens still require more value capture and user experience optimization.

5.2.1.2. Issues and Limitations of SocialFi 1.0

1) Overly Singular User Profile: Projects in SocialFi 1.0 were more focused on addressing existing issues in Web3 social media and lacked consideration for interactive layer thinking, user understanding, user profiles, and demographics. The user base at this stage mainly consisted of users focused on earning money, with a heavy emphasis on "earn x to earn" and experience, similar to the profile of DeFi players. They were active in DAO communities, emphasizing contributions and participation in DAO community governance. This stage lacked a large number of traditional Web2 users, users focused on product quality and details, and those concerned about product profit distribution, as well as the inability to attract outstanding creators and social media users from traditional platforms.

2) Data Silos and Lack of Composability: Projects in SocialFi 1.0 were typically based on their own blockchain networks or sidechain networks, creating their own social graph protocols and data structures. This made it difficult for users to migrate and interconnect their social capital, such as followers, friends, and fans, between different platforms, resulting in user lock-in and isolation, limiting user choice and value.

3) Incomplete Value Capture Model: The current manifestation of Fi in SocialFi 1.0 is relatively limited, mainly focusing on waiting for rewards for content creation, maximizing profits for creators. Another approach is "Write to Earn," focusing on content but requiring a high level of algorithmic mechanism. If the platform's algorithm is overly simplistic, it can lead to users creating low-quality content just to earn incentives, resulting in homogenization of the content on the homepage. The low quality of content and social interaction, the need to incentivize high-quality content, improve token reward algorithms, and optimize the value capture model are urgent issues to be addressed.

4) Lack of Product Design Differentiation: Projects in SocialFi 1.0 often imitated or borrowed product design and functionality from Web2 social platforms, resulting in a lack of leveraging the advantages and innovation of blockchain technology and decentralized thinking. This led to a lack of differentiation in product design and severe homogenization, making it difficult to establish unique features and competitiveness.

5.2.2. SocialFi 2.0 in Progress

In 2022, the SocialFi field underwent significant transformations. With more and more native Web3 users and traditional players entering the scene, major projects conducted meaningful explorations based on the three major value propositions mentioned earlier, reshaping the industry landscape of SocialFi 1.0, and actively attempting to address the issues exposed by early projects. After the ups and downs of SocialFi 1.0 and the dominance of protocols in 2022, we are willing to refer to the period of the rise of Web3 social projects as the era of SocialFi 2.0 in 2023.

5.2.2.1. Three Important Developments in 2022

1) Introduction of SBT

SBT, or Soul-Bound Token, is a non-transferable token account bound to a user's wallet, serving as the user's identity and credit system in Web3. It is also the core concept of DID/reputation tracks. Carv and Dequest are two projects that empower game players using SBT.

2) Value of Data

In Web3, data is empowered through ownership, incentivization, and composability, achieving user privacy protection and value creation. However, it also faces challenges related to data sources, forms, and monetization. With the accumulation of more on-chain data, future SocialFi 2.0 will have more potential scenarios, such as Web3 intelligent airdrops, IDO, and DAO governance. However, in the short term, user social behavior still occurs in Web2. Based on this contradiction, potential scenarios may involve the combination of Web2 & 3 data to create a collection of cross-platform social data (Social Data) for use in Web3 application scenarios.

3) Rise of Social Protocol Ecosystem

The vigorous development of social graph protocols like Lens partially addressed the two major issues exposed by SocialFi 1.0, achieving user data ownership, composability, and a positive value capture cycle. Users no longer need to worry about losing content, fans, and income due to algorithm and policy adjustments on individual platforms. They own their account data and enjoy various benefits, but they also face challenges related to data silos and disputes over social protocols.

5.2.2.2. Dual Structure of Internal and External Circulation in SocialFi 2.0

SocialFi 2.0 can be divided into two types of projects: foundational/ToB-end projects and application/ToC-end projects. They form the dual structure of internal and external circulation in SocialFi 2.0.

1) Foundational/ToB-end Projects:

Foundational/ToB-end projects refer to those providing infrastructure and tools such as data layers, protocol layers, and privacy layers, primarily serving developers and platforms, focusing on technical innovation and moats. Investment strategies are more focused on SaaS tools and platform logic. Representative projects include Farcaster, Lens, XMTP, Satellite IM, and others.

2) Application/ToC-end Projects:

Application/ToC-end projects refer to those providing functional projects in the creator economy, IM instant messaging, and DID/reputation scenarios, primarily serving users and creators, focusing on product design and user experience. Investment strategies are more focused on product logic and user orientation. Representative projects include Lenster, Phaver, Notifi, Dialect, Swapchat, Beoble, and others.

5.2.2.3. Development Direction and Opportunities in SocialFi 2.0

The development direction and opportunities of SocialFi 2.0 can be viewed from the following aspects: 1) Interoperability and interchangeability of social graph protocols; 2) Value realization of refined user behavior data; 3) Better user experience design tools; 4) More decentralized media content platforms; 5) Content search servers.

5.2.3. Emergence of Friend.tech

By reviewing the entire development process of SocialFi, we can accurately position Friend.tech and determine whether its emergence conforms to the development laws of the entire SocialFi. Through this process, we can see that Friend.tech belongs to the application/ToC-end projects and can be considered a representative of the development of SocialFi to the 2.0 stage. It focuses more on landing scenarios compared to the 1.0 stage, but still faces issues such as user education and product polishing. It provides a sample for the practical exploration of social tokens on platforms like Twitter and will drive the development of Web3 social towards productization and commercialization. Its emergence can be seen as an innovation and exploration in Web3 social, as well as a transformation and challenge. Its ability to find a product-market fit and achieve growth will be of significant reference value for the development of SocialFi.

6. Preliminary Value Assessment

6.1. Core Issues

At which stage of operation is the project? Is it in the mature stage or in the early to mid-stage of development?

Friend.tech is currently in a relatively early stage. It has not yet disclosed its whitepaper, token economic model, governance mechanism, and has not conducted token issuance or public offering. The project can currently only be accessed via mobile and requires an invitation code for registration. It has not yet formed a complete ecosystem or collaborated with other platforms or projects. Therefore, we believe that the project is in the early stage of development, with significant room for growth and potential.

Does the project have reliable competitive advantages? Where do these competitive advantages come from?

- Innovation: Friend.tech is the first decentralized social application to tokenize Twitter users and allow users to chat privately and share earnings, breaking the limitations and rules of traditional social media, providing users with a novel and interesting social experience.

- User-friendliness: Friend.tech provides a simple, efficient, aesthetically pleasing, and secure user experience. It does not require downloading applications or paying high gas fees, only requiring connection to the Base network via a Coinbase wallet or other compatible wallets and a deposit of at least 0.01 ETH for registration and use.

- Market Fit: Friend.tech meets the current market demand and trends in the cryptocurrency field, using blockchain technology to protect user data ownership and privacy, achieve content immutability and transparency, and promote user participation and contribution through token incentive mechanisms. It has also attracted the interest of many non-crypto individuals, bringing innovation and vitality to the crypto social field.

What are the main variable factors in the project's operation? Are these factors easy to quantify and measure?

▪ The number of users joining the platform and creating or purchasing tokens or keys. This reflects the demand and popularity of the platform and its tokens. ▪ The amount of fees generated by the platform from user transactions. This reflects the platform's income and profitability. ▪ User engagement and activity levels on the platform and X. This reflects the quality and value of content and community on the platform and its tokens.

These variables can be quantified and measured using metrics such as daily active users (DAU), monthly active users (MAU), total value locked (TVL), average revenue per user (ARPU), retention rate, and others.

What is the project's management and governance approach?

The project currently does not have a clear management and governance approach, but it may achieve decentralized management and governance through platform tokens in the future. Platform token holders can participate in platform decision-making through voting or proposals, influencing the platform's development direction and key parameters. The project may refer to the practices of other social token platforms such as BitClout and DeSo, establishing a DAO organization composed of token holders, content creators, community leaders, developers, and other participants to achieve platform autonomy and collaboration.

7. Project Risks

1) Lack of Privacy Protection:

Friend.tech requires users to link their Google or Apple accounts and connect their Twitter accounts during registration. This approach may infringe on user privacy and lead to misuse or data leaks. Currently, Friend.tech has not provided clear privacy policies and data collection practices, nor has it explained how it protects users' personal information and transaction records.

2) Poor Product Experience:

Friend.tech's website and application have technical issues and functional deficiencies. For example, the website only has one page and does not provide information about the project's roadmap, founders, or whitepaper. The application frequently experiences delays and crashes, can only be accessed via mobile (although there are methods to access it via computer), and requires users to create a new wallet address and cross-chain to the Base network, which is cumbersome and inconvenient. These issues affect user experience and satisfaction.

3) Limited Product Functionality:

Currently, aside from buying and selling keys, Friend.tech's only function is chatting. If users do not buy others' keys, the application is essentially empty and cannot be used. This is a barrier for potential users who want to try the platform. Providing some free content for users to browse would significantly increase user activity and engagement. Additionally, Friend.tech does not provide channels and mechanisms for cultivating fans and communities, lacking real demand and network relationships. The initial novelty does not determine user retention and conversion, making the product more like a financial tool than a social platform.

4) Overemphasis on Financialization:

The bonding curve for Friend.tech's keys (previously called shares) trading is set too steep, leading to a rapid surge in key prices, which is a barrier for later users. This may limit individual KOLs to attract a small scale of fans on the platform, and these fans are likely speculators rather than genuine supporters. If key prices decline or KOLs fail to fulfill their promises to "shareholders," these speculators may sell their keys or exit the platform. Therefore, overemphasizing "earning money" may not be sustainable in the long term.

5) Low Project Credibility:

Friend.tech's timing of release attracted a lot of attention and participation during a downturn in the market and a lack of interesting narratives. However, this has also raised questions about whether the project is truly innovative, has long-term value, or will become another "RUG" project. Currently, Friend.tech has not demonstrated its true social value and creativity, nor provided a clear plan for its future development direction and vision. These factors increase the project's uncertainty and risk.

6) Risk of "Empty Trading":

Friend.tech's design may lead to the possibility of "empty trading." It strictly limits the scale of each trading item through the price curve mechanism, reducing the potential for a massive price bubble. However, each trading item itself forms a small-scale Ponzi situation, which can be easily manipulated by a few individuals. Friend.tech can provide a large number of similar trading items. This high liquidity but easily manipulable design may lead to a new form of "empty trading." There may be a large amount of trading activity between users, but minimal actual fund flow and value transfer. Without sufficient regulation and constraints, this new trading mechanism may trigger seemingly prosperous but fundamentally false trading activities. The possibility of "empty trading" is one of the risks that Friend.tech needs to be vigilant about. It needs to establish necessary regulatory and constraint mechanisms to prevent trading activities from completely detaching from the actual asset value, thus becoming a new moral risk.

7) High Barrier for Users to Access Quality Content:

The distribution of KOLs on Twitter is uneven, with a focus on Europe and the United States, and Chinese language as a secondary focus. This may result in a lack of diversity and inclusivity in content and communities on the platform, and may also affect the platform's scalability and popularity. To some extent, Friend.tech has turned its social function into a game of NFT ownership, requiring users to spend more effort to select and hold high-quality KOL "keys" to access better content and community experiences. This sets a high barrier for users to access quality content, as they need to observe which KOLs have a large influence and active communities on Twitter, and predict which KOLs have the long-term commitment to participate. This requires users to invest more time and effort in deep analysis. Each user's time and attention resources are limited, and following too many KOLs can lead to selection bias. Users need to bear high search costs and risks to access truly high-quality content.

This high-barrier model also restricts the development space of Friend.tech's product itself and fails to attract more ordinary users unfamiliar with blockchain. If it cannot effectively lower the barrier for users to access quality content, it will pose a threat to the platform's commercial sustainability.

8. Reflection

The success of traditional social products does not solely rely on financial incentive mechanisms such as WRITE-to-Earn to attract users; the continuous output of high-quality content is also crucial. X-to-Earn social models with heavy financial attributes like Friend.tech can stimulate user activity in the short term, but in the long run, over-reliance on financial attributes while neglecting content experience and social attributes raises suspicion about user stickiness. This is similar to many GameFi projects that overly rely on the Play-to-Earn model; after the initial incentive mechanism is exhausted, user willingness to participate significantly decreases. However, we can also see some opportunities and potential in Friend.tech:

1) Exploring the Linkage of NFT and Community Value Realization

Friend.tech's equity model has limitations in expanding community scale. However, this also inspires the possibility of value transfer between NFTs and communities. If PFP NFTs or NFT PASS cards exist directly as community keys, the cultural attributes behind them can be transferred to non-shareholders through NFTs. The actual value of the community will, in turn, affect the price of NFTs, becoming a component of their base price. This bidirectional value linkage between NFTs and communities meets investment needs and actual social needs.

Therefore, there is an opportunity to explore the combination of Friend.tech's equity model with NFT collections to further amplify community value and provide stable value support for NFTs. This is a potential development opportunity for Friend.tech.

2) Subdivision of Social Scenarios Bringing Quality Community Users

Friend.tech has certain inherent advantages in the private community chat scene. Users in such scenarios typically have closer relationships, as opposed to scattered social connections. Communities like LaserCat have proven the existence of demand for this type of social group. Friend.tech can land in similar user groups and, compared to open platforms like Twitter, can more easily acquire high-quality and highly sticky core users. Compared to comprehensive tools like Discord, Friend.tech's product efficacy is still relatively single. In the future, there is a need to continue optimizing group chat functionality to enhance user experience and stickiness.

Overall, segmenting social scenarios and providing differentiated experiences are important opportunities for further development of Friend.tech. Effective polishing of the core community can bring about platform effects, which will be a key path to gaining competitiveness.

3) Leading the Development of Social Tracks, Promoting the Commercialization of Fan Economy Scenarios

The emergence of Friend.tech may drive a new round of attention and development in the social track. Among these, the fan economy is a direction with significant potential. The fan economy inherently comes with a strong user base and payment capability. The business model pioneered by Friend.tech provides an example for its user growth. In the future, exploration can be conducted in live streaming, short videos, and other scenarios, and appropriate thresholds can be designed for payment conversion. At the same time, providing appropriate free content can reduce user learning costs and attract a wider user base. It may be considered to let KOLs decide the form of the bonding curve to match different content quality and target users, which can increase the autonomy and flexibility of KOLs and also enhance the platform's diversity and competitiveness. Simplifying the entry point for traditional users is also a necessary condition for expanding the user base.

If convenient product experience, effective incentives for creators, and the import of a large number of traditional KOLs can be achieved, it is possible to redefine the fan economy and become a representative social application of Web3, creating truly groundbreaking applications.

4) Expanding Core Functions and Ecosystem, Driving the Evolution of Web3 Social

Currently, as a social platform, Friend.tech's core functionality is still relatively single. In the future, there is a need to continue improving basic social functions such as profile editing, external website links, etc., to enhance user experience. At the same time, successful experiences from Web2 social platforms can be drawn upon to add features such as posting, community interaction, and incorporate token economic design such as DeFi to achieve value distribution. This is also its superiority over Web2. In addition, strategic cooperation with other social projects can lead to faster feature iteration and ecosystem improvement.

Overall, Friend.tech has important opportunities to drive the maturity and evolution of blockchain social applications. The key is to start from the user, improve functionality, enrich the ecosystem, and ultimately become a leading social platform in the Web3 world.

9. References

https://twitter.com/friendtech Friend.tech Official Twitter

https://dune.com/cryptokoryo/friendtech Friend.tech Data Dashboard

https://www.coindesk.com/web3/2023/08/11/is-friendtech-a-friend-or-foe-a-dive-into-the-new-social-app-driving-millions-in-trading-volume/ Is Friend.tech a Friend or Foe? A Dive into the New Social App Driving Millions in Trading Volume

https://www.panewslab.com/zh/articledetails/5upll7es.html Arbitrum Image Social App Stealcam Goes Viral: Perfect Combination of Voyeurism and Owner Economy, Cryptocurrency OGs Collective Thumbs Up

https://www.theblockbeats.info/news/44507?from=telegram Tracing the 7-year Evolution History of SocialFi from Steemit to friend.tech

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。