Preface

In recent years, long-term investment in Bitcoin has become a hot topic. However, when facing long-term investment in Bitcoin, we often encounter a question: is it better to use Dollar-Cost Averaging (DCA) to gradually invest at regular intervals, or to invest a large sum of money at once (Lump-sum) for better performance?

This article will organize relevant data and information from different perspectives to help investors better understand the different ways of long-term investment in Bitcoin. It will discuss the applicable scenarios, risk management, return expectations, and psychological factors, aiming to provide comprehensive information to readers.

Brief Introduction and Pros and Cons of DCA & Lump-sum

Dollar-Cost Averaging (DCA)

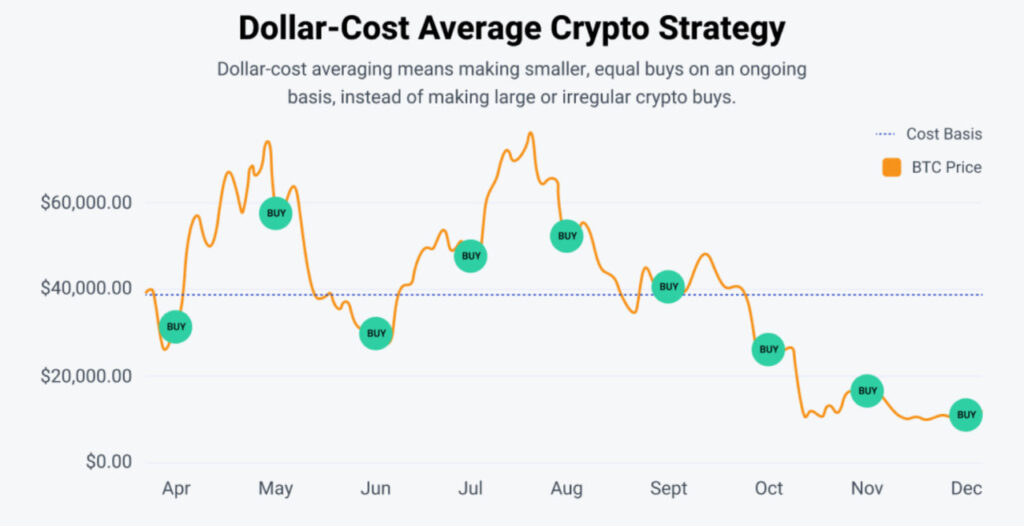

DCA is the so-called regular fixed amount investment. Investors regularly invest the same amount of funds, regardless of market price changes. Similar to the current popular fixed purchase of ETFs, major stock indices, and many countries' pension funds and retirement funds also operate in a similar manner.

DCA Illustration (Image Source: Bitpay)

DCA Illustration (Image Source: Bitpay)

Pros and Cons of DCA

The advantage of DCA lies in spreading the investment, reducing the emotional impact of market fluctuations on investors, lowering the average cost, and being able to capture long-term upward trends. (Assuming that you believe the long-term visibility of the investment target)

The relative disadvantage is that it tests the investor's mentality, wears down trading costs or management fees, and sacrifices the operability and flexibility at market highs and lows. It is also not suitable for short-term traders. In nature, I personally believe that it does not lean absolutely to the left or right, and the judgment should be made based on the current market conditions for fixed amount purchases. More introductions will be made using BTC market data later.

Lump-sum Investment

Lump-sum investment refers to investors investing a lump sum of funds into the market at a single point in time, often jokingly referred to as "going all in". In the case of lump-sum investment, investors invest all funds into the market and purchase shares or assets based on the market price at that time.

Pros and Cons of Lump-sum

Lump-sum provides the opportunity for quick market participation, and if investors can timely capture the low point of the target, they may achieve higher returns. (e.g., bottom fishing)

On the other hand, it also brings greater risks, as short-term market fluctuations can lead to significant losses for investors, and there is also a higher chance of suffering losses if the investment portfolio allocation is not well managed.

Whether it is DCA or Lump-sum investment, both have their pros and cons. The following will focus on BTC and introduce which of these two strategies is more suitable. The following sections refer to the research results of Amdax Asset Management and Swan Capital on DCA & Lump-sum strategies.

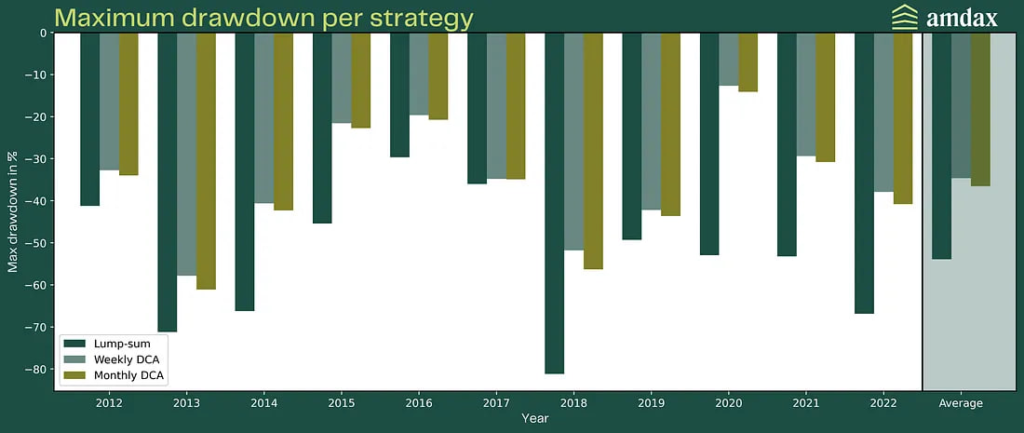

Considering Maximum Drawdown & Calmar Ratio

Maximum drawdown and Calmar ratio are important performance indicators. Maximum drawdown is the maximum decline observed in the investment portfolio over a given time period. The

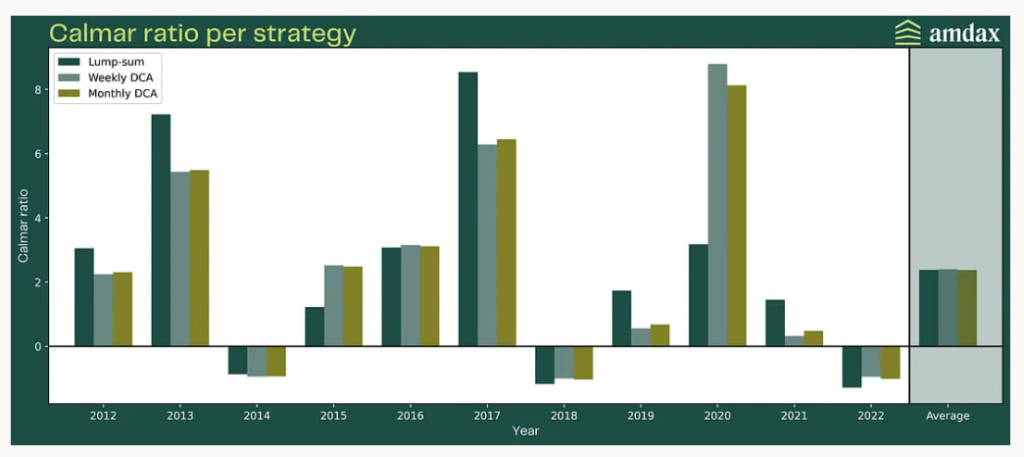

Calmar ratio represents the average return of the investment portfolio relative to the maximum drawdown. The higher the value, the better the risk-return performance of the portfolio. It is somewhat similar to the Sharpe ratio and Treynor Ratio in finance.

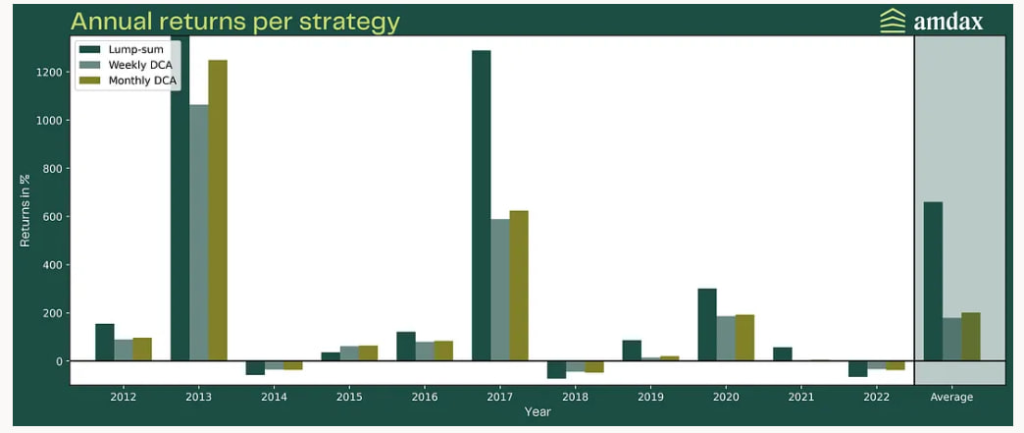

From the results in the following figure, considering the annualized return of these two strategies and breaking down DCA into weekly and monthly investments, Lump-sum usually shows more extreme returns, both positive and negative. In particular, the returns in 2013 were outstanding (the return rate that year exceeded 5,400%, which is not fully included in the figure for readability). In addition, the average annual return of Lump-sum strategy is more than three times that of DCA.

From a risk perspective, the Amadex team collected results for each year since 2012. They found that Lump-sum had larger drawdowns and consistently higher risks than DCA. Especially in years of severe collapse (such as the COVID-19 pandemic in March 2020), the difference in drawdowns was quite significant. On average, the Lump-sum portfolio fell by about 20%.

Through the comparison of these two charts, the Calmar ratio can be derived.

From the presentation of the results in the following figure, this ratio shows very large fluctuations in all years. Sometimes the DCA strategy is more effective than the Lump-sum strategy, and sometimes the opposite is true. On average, the ratios of the three strategies are actually the same.

Comparing the Two Strategies Using Different Amounts and Time Scales

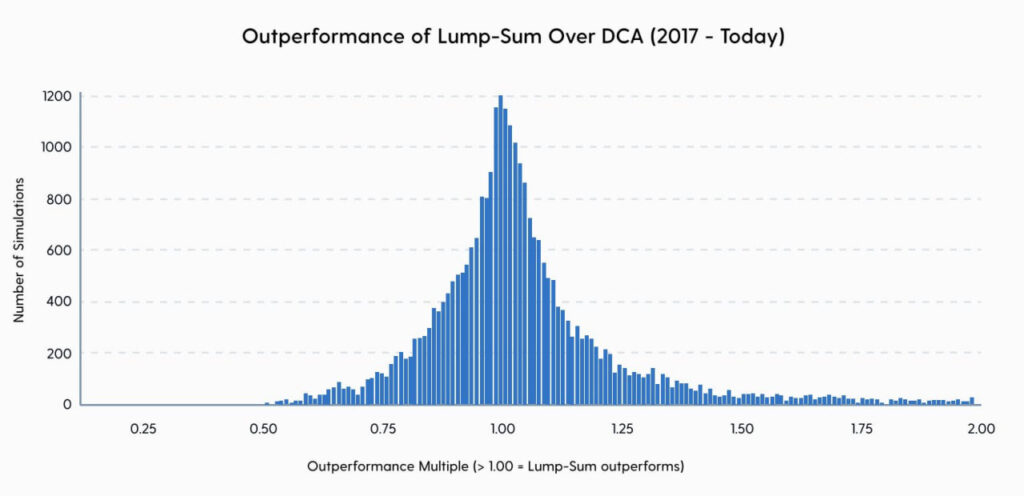

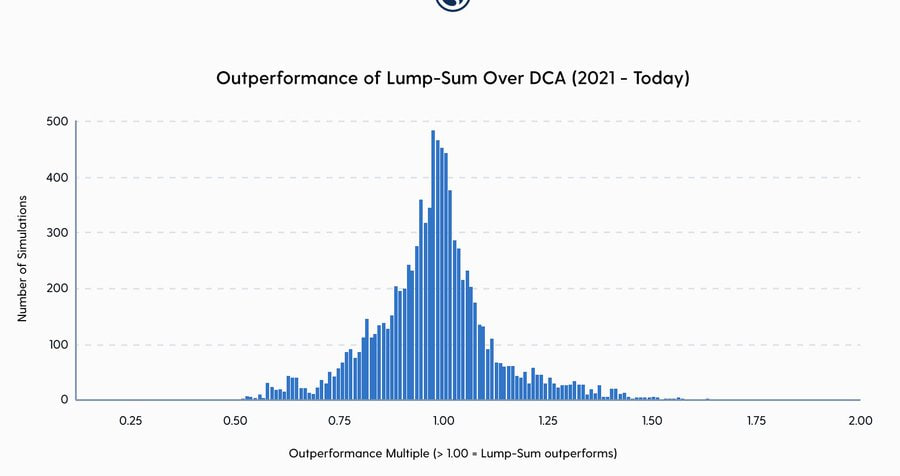

Swan Capital used BTC price data from the past six years to simulate the comparison of strategies on a daily basis. The following basic assumptions were made.

Based on basic human behavior, if an investor has already decided to buy Bitcoin, they are likely to buy some Bitcoin first (similar to the feeling of trying something new), even if they have planned to use the DCA strategy.

• 0% upfront payment: This means the investor did not invest any funds in advance and then invested the entire $10,000 in equal proportions using the DCA strategy.

• 25% upfront payment: This means the investor invested $2,500 and then invested the remaining $7,500 in equal proportions using the DCA strategy.

• 75% upfront payment: This means the investor invested $7,500 and then invested the remaining $2,500 in equal proportions using the DCA strategy.

• 100% upfront payment: Equivalent to Lump-sum.

Time interval assumptions:

• Daily (10, 15, and 30 days)

• Weekly (4 and 8 weeks)

• Monthly (6 and 12 months)

From the distribution chart below, a value greater than 1 indicates that Lump-sum outperformed DCA, while a value less than 1 indicates the opposite. Overall, Lump-sum is approximately 9% better than DCA in increasing the level of funds.

If the time range is narrowed down to the recent bear market, DCA will naturally outperform Lump-sum.

Conclusion

Through the above introduction, I observed several key conclusions about these two strategies in relation to BTC.

❶ The Lump-sum investment strategy performs better overall in Bitcoin compared to the Dollar Cost Averaging (DCA) strategy.

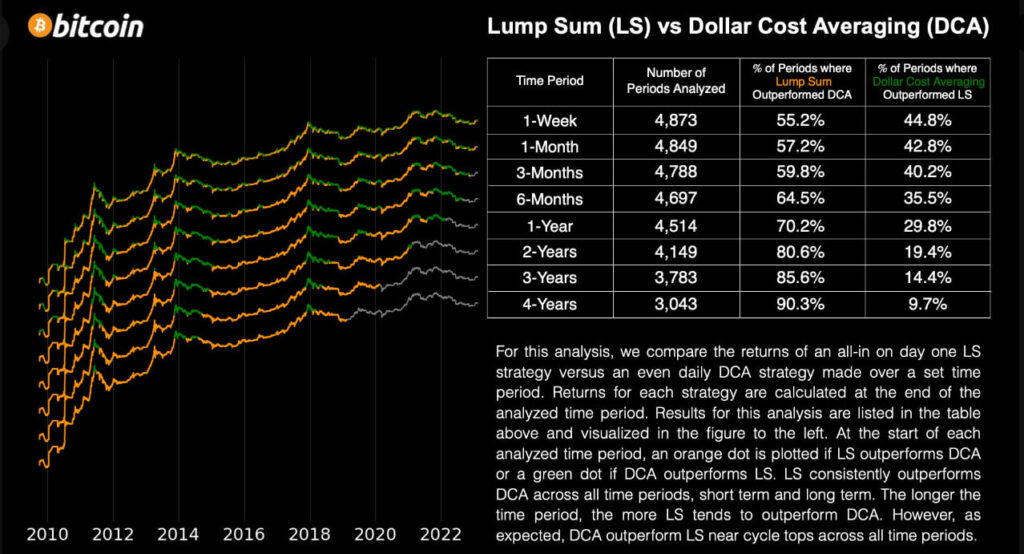

This chart shows the performance and distribution of LS and DCA at various time scales (Source: @w_s_bitcoin)

This chart shows the performance and distribution of LS and DCA at various time scales (Source: @w_s_bitcoin)

❷ Historical data shows that Lump-sum investors accumulate more Bitcoin than DCA investors.

❸ Early investment in Bitcoin, whether Lump-sum or choosing daily DCA instead of weekly or monthly DCA, can lead to better long-term returns.

❹ The DCA strategy does not provide substantial benefits in protecting investors from downside risk or volatility risk. This may be due to the price behavior characteristics of BTC, which exhibits sharp upward price fluctuations and tends to trend sideways or downward over long periods.

❺ These data indicate a fact, which is that it is better to invest in BTC as early as possible. Excessive waiting may lead to missing significant and short-term price fluctuations, which account for a large part of investor returns, and these price fluctuations are unpredictable.

Finally, although these data attempt to faithfully reproduce the market's appearance and characteristics, there cannot be 100% correct results. Readers can still make choices based on their own risk aversion and preferences, and the most important thing is to take the first step, after all, only knowing how to stick to yesterday, who knows what tomorrow will be like?

Note

Conclusion ❹ mentions the downside risk, which is one of the risks defined in investment studies. Risks are categorized as upside and downside. Upside risk refers to the situation where the actual price is higher than the predicted price, while downside risk refers to the situation where the actual price is lower than the predicted price. This means that any incorrect prediction in investment studies is categorized as a risk.

The BTC price behavior characteristics mentioned in conclusion ❹ can be referred to in the previous weekly report here.

References

https://nakamotoportfolio.com/static/docs/DCA_Lumpsum.pdf

https://medium.com/amdax-asset-management/lump-sum-or-dollar-cost-averaging-42c8f5bb9938

Learning and Discussion Groups

Dear readers, you may be thinking, "Where can I learn and see these in-depth analysis methods and valuable information?"

No need to look any further! In addition to our website's high-quality content, we also invite friends who want to learn about investing in cryptocurrencies and cryptocurrencies to join our "DA Trader Alliance" VIP group, where there are many enthusiastic traders discussing and exchanging ideas.

Click the link to fill out the form! 🔗 https://datatw.io/vip/ Once approved, you will be able to join this most enjoyable and high-quality community for cryptocurrency enthusiasts!

Get ready to embark on an exciting investment learning journey with us by taking action now!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。