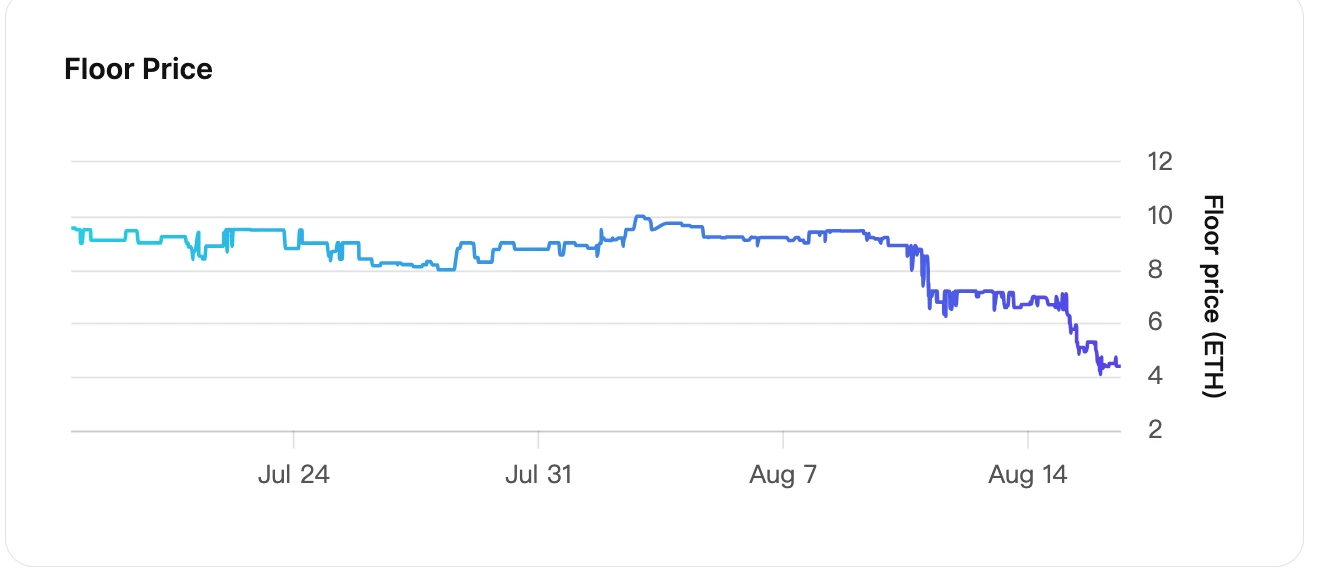

"Degods flip Azuki!" Just as the floor price of DeGods surged above 9 ETH against the trend, the community was jubilant as DeGods replaced Azuki as the top blue-chip project. However, its price quickly collapsed within a few days. Currently, the floor price on Blur is temporarily at 4.28 ETH, having dropped by more than half from its peak. Hundreds of DeGods were liquidated overnight in the Blur lending process.

The NFT industry's "last whale" Ma Ji, Huang Licheng, was once again forced to become a buyer. Currently holding 324, it seems that the downward spiral trend has not stopped.

After the NFT industry was drained of its last loyal liquidity by Azuki's series of operations, DeGods, which migrated from Solana to Ethereum and released a series of positive news, seemed to ignite a glimmer of hope. However, this glimmer of hope turned to ashes in just a few months.

Will the NFT industry never be good again? What kind of narrative can help the NFT industry break free from its fleeting nature?

The Past and Present of DeGods

DeGods is an NFT project launched in 2021, with an initial mint price of 3 SOL. The project initially proposed an innovative "PaperHand Bitch Tax (PHBT)" mechanism, which gained popularity and rose to 15 SOL. However, the mechanism received mixed reviews, and the DeGods community later voted to cancel the paper hand tax mechanism.

Subsequently, DeGods introduced the $DUST ecosystem and DeGods staking, allowing people to obtain DUST tokens by burning NFTs and staking DeGods. Within 24 hours of the mechanism's launch, 50% of the total supply of DeGods was staked. Soon, during the peak of Solana NFT hype, DeGods had its moment of glory, becoming a well-known blue-chip project on Solana with a price increase of over 300 SOL.

As the market gradually weakened, DeGods launched its second season project, y00ts, in August 2022. y00ts introduced the ⓨ mechanism, a way similar to copyright ⓒ, applied to the features of y00ts. A 5% royalty fee was charged each time a specific feature was sold.

Despite price fluctuations, DeGods' sustained innovation kept it relatively strong. However, when Solana was affected by the FTX collapse, with SOL prices plummeting and activity declining, DeGods officially voted to migrate to the Ethereum network in March 2023, while y00ts migrated to Polygon. Polygon even paid $3 million for this migration (although the project recently migrated back to Ethereum, and reportedly the $3 million has been returned to the team).

Despite ongoing community controversies, with many criticizing its founder for being unattractive and disrespectful to users, such as the mandatory 33.3% fee for NFTs on Solana after migration, it cannot be denied that the DeGods team at Dust Labs has shown continuous innovation and delivery capabilities. Subsequently, DeGods launched Blur and was supported by the Blend lending protocol. The founder of Blur frequently interacted with the DeGods team, and during the Ordinals craze, 535 DeGods were permanently engraved on BTC and cooperatively auctioned. The community has remained active, and while other top blue-chip projects have plummeted, its price has remained relatively stable.

Season Three: A Repeat of the Azuki Incident?

After the Azuki incident, liquidity in the NFT market was further drained, and blue-chip prices continued to decline. However, DeGods experienced a new wave of counter-trend minor increases due to the news of the third season update.

On August 1, the DeGods team announced that the third season update would be released on August 9. Founder Frank tweeted that the content of the third season of DeGods would present the current series' features in a completely new style/aesthetic. He also stated that the third season of DeGods would adopt a non-random "reveal" mode to avoid the common occurrence of massive sales of low-rarity NFTs after the reveal. He emphasized that the aesthetic style of the third season would not be similar to the original DeGods, and it was expected to be more popular with the public.

In the current narrative drought, the descriptions of DeGods and its successful model in the second season project y00ts have reignited hope among users who still believe in NFTs. Its trading volume surged briefly, and the floor price also rose from nearly 8 ETH to above 9 ETH.

However, the actual information released for the third season of DeGods disappointed the community. The third season consists of 20,000 NFTs, including four series: Original DeGods, DeadGods, DeGods III, DeGoddesses, and four pieces of generated art. Additionally, female characters were added, and some unpopular NFT elements were removed.

This upgrade also comes with an additional requirement: payment of 333 DUST (approximately worth $800, as mentioned earlier, can be obtained by staking DeGods).

While this third season may not be as perfunctory as the Azuki incident, it still lacks innovation. It merely adds a few small changes to the PFP traits and alters the image style. In the current tense market, which cannot withstand panic selling, users are truly unable to accept it. Suddenly adding 20,000 pieces of work may have extended value in a bull market, but in a bear market, it is undoubtedly diluting value. Not to mention the need to pay tokens.

The day after the announcement, a whale (0x88…7589) sold about 200 DeGods on Blur in the early hours, instantly smashing the floor price by 25.84% to around 6.5 ETH.

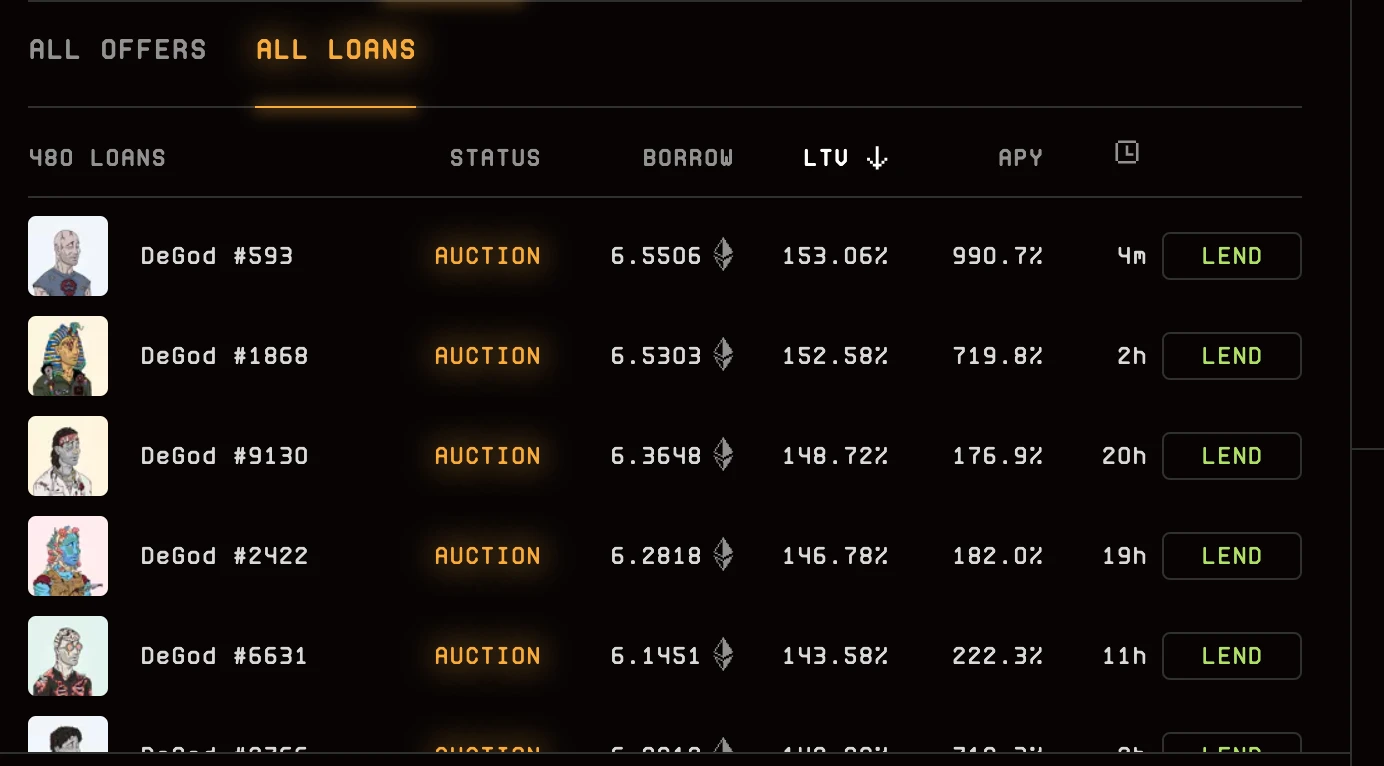

The following days saw a continuous acceleration of the decline, with the floor price falling below 5 ETH in the early hours of yesterday. Over 200 DeGods were unable to cover their debts and entered liquidation, forcing the whale to take over. Currently, the floor price on Blur is temporarily at 4.28 ETH.

Speculative Expectations = Sudden Plunge upon Implementation?

This sudden plunge upon delivery seems all too familiar in the world of NFTs.

During the previous NFT bull market, "speculative expectations" were a powerful tool. An ambiguous message, a collaboration with a high-profile figure, or a grand airdrop—every new expectation, every narrative overlay, was a window for price escalation of small images.

In the current cold bear market, every excessive speculative hype has become a "poisoned chalice."

Valuations that were originally supported by narratives that could barely hold up, when manifested as "changing image designs to raise funds again," result in users' hopes being dashed once more, a lack of willingness to buy, followed by panic selling and a downward spiral.

When the NFT market will warm up again remains uncertain, but it is sincerely advised to project parties with funds and capabilities: do not consume your community at this time, as it will push you into the abyss of death.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。