Bitwise Asset Management has announced its plan to launch “the first publicly-offered cryptocurrency index exchange-traded fund (ETF).” A registration statement has been filed with the U.S. Securities and Exchange Commission. The fund will track the returns of the company’s Hold 10 Index which aims to capture 80% of the total market capitalization of the cryptocurrency market.

Bitwise to Launch Crypto Index ETF

Bitwise Asset Management announced Tuesday that it has filed a registration statement for “the first publicly-offered cryptocurrency index exchange-traded fund (ETF).”

The San Francisco-based company already manages “the world’s first privately-offered cryptocurrency index fund, the Bitwise Hold 10 Private Index Fund,” it described. The open-ended private placement fund was launched on November 22 last year and is only open to accredited investors, the company noted:

The new ETF will be called the Bitwise Hold 10 Cryptocurrency Index Fund. It aims to track the returns of Bitwise’s Hold 10 Index, a market-cap-weighted index of the 10 largest cryptocurrencies, rebalanced monthly.

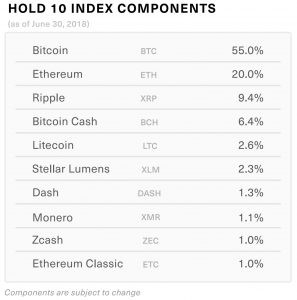

The top five components of the Hold 10 Index as of the end of June is 55% BTC, 20% ETH, 9.4% XRP, 6.4% BCH, 2.6% LTC.

“The Hold 10 Index captures approximately 80% of the total market capitalization of the cryptocurrency market,” the crypto asset manager further elaborated. The index “uses a 5-year-diluted market cap and other eligibility criteria meant to address challenges of the crypto space such as continuously changing supply, liquidity, trade volume concentration, and custody limitations.”

Founded in 2017, Bitwise is backed by institutional and individual investors, including Khosla Ventures, General Catalyst, Blockchain Capital, Naval Ravikant, Alison Davis, David Sacks, Elad Gil, Adam Nash, Adam Ludwin, Suna Said, and Avichal Garg.

Index-Tracking Basket of Multiple Cryptocurrencies

In its Tuesday announcement, the company revealed that “A registration statement relating to the shares of the Bitwise Hold 10 Cryptocurrency Index Fund ETF has been filed with the Securities and Exchange Commission (SEC) but has not yet been declared effective.”

Bitwise’s Global Head of Research Matt Hougan commented:

Our research shows that an index-tracking basket of multiple cryptocurrencies behaves differently than a single coin. As such, we think both sorts of exposure need to be looked at by investors when considering the growing cryptocurrency space. Our view is that this new area has many similarities to the introduction 10 to 15 years ago of commodity ETFs.

He noted that “at that time, we saw the launch of single-commodity ETFs tracking gold, silver, crude oil, and other commodities, as well as ETFs tracking diversified commodity index baskets. We see a lot of similarities here.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。