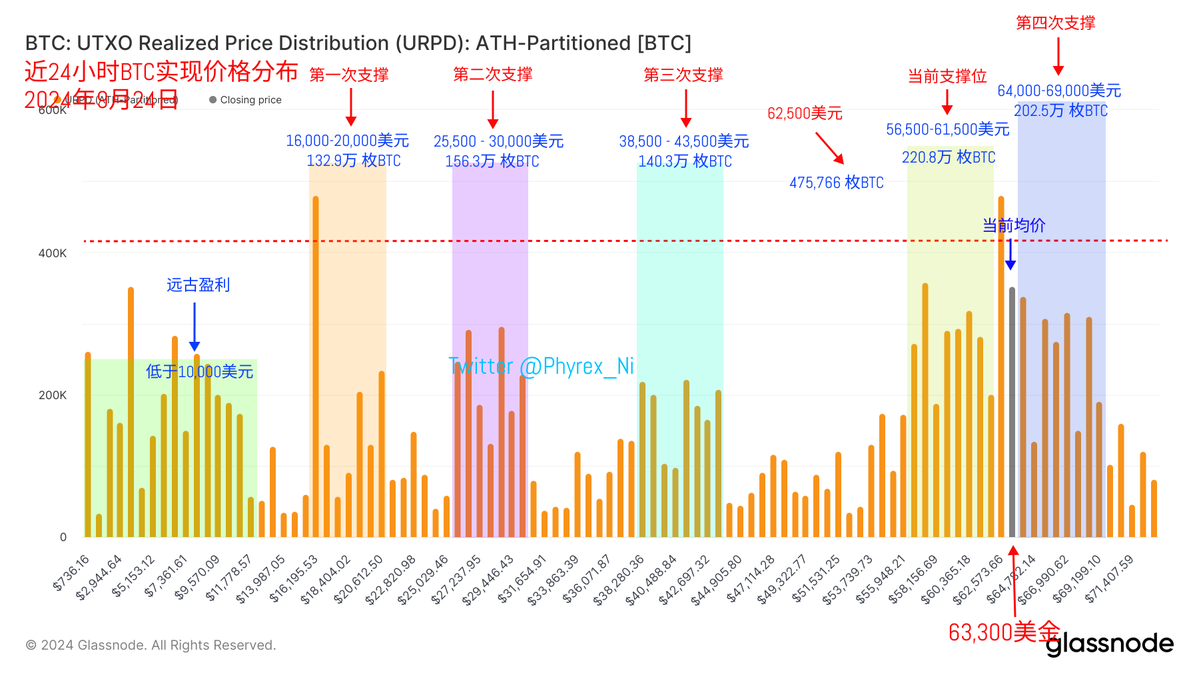

就不长篇大论了,简短的说就是如果某个 Bitcoin 区间的投资者没有出现大幅离场的迹象,就不会给BTC的价格带来很大的压力,而且通过 URPD 的数据我们能看到每天换手的都是短期投资者,这就说明了更多的投资者不愿意参与换手。

说人话就是,链上大量筹码的聚集区如果不形成突破或者崩溃,那么很有可能会以这个位置作为核心而震荡,当初19,000美元,26,000美元,38,000美元,63,000美元的时候都是这么过来的,比如去年即便是跌到 56,000 美元的时候,支撑没有破,结果还是回到了 63,000 美元的上方。

这是当时的一张图,看上去结构和现在非常相似,但因为当时震荡的时间太长了,所以重新整合后,就变成了 61,000 美元到 66,000 美元之间的筑底,也就是现在的样子。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。