今年,由于关税升级、互惠贸易措施、商业信心减弱、就业增长放缓以及持续的通货膨胀,美国的衰退几率上升,这些因素都在侵蚀经济稳定性并暗淡了增长前景。

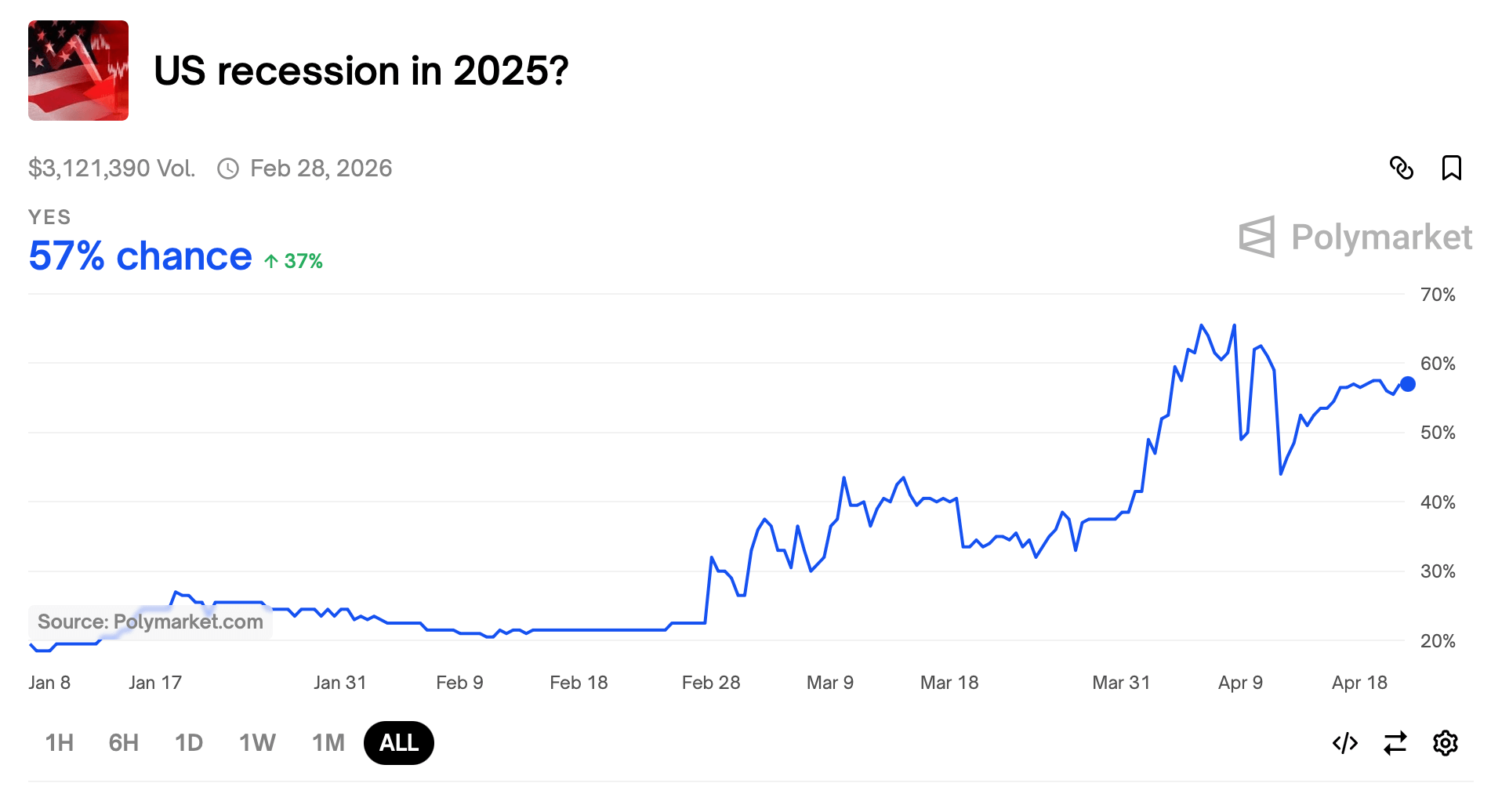

随着美国股市在周一收盘时下跌,Polymarket的预测市场将衰退的概率定为57%。截至发稿时,该合约的交易量已达到3,121,390美元,并在四月的前两周短暂达到了66%的概率。

在Kalshi,衰退的几率甚至更高,截至4月21日为61%。Kalshi的数据显示,在4月7日达到了66.2%的峰值,反映了交易者对经济前景的变化。

与此同时,一系列领先的美国公司——特别是在科技、零售和制造业——在其2025年第一季度的财报和电话会议中强调了特朗普新关税带来的影响和不确定性。

包括摩根大通、高盛、美国银行、德意志银行、巴克莱、花旗和汇丰在内的主要银行也指出,关税公告后衰退和市场动荡的风险加大。

Kalshi的交易者将2025年第二季度发生衰退的概率定为23%,而2025年第三季度则降至仅10%。这种悲观情绪似乎并非短暂的异常,而是更深层次的系统性转变的体现。

美国经济似乎正准备迎接一段动荡的旅程,随着增长预测的暗淡和稳定支柱的摇摆,Polymarket和Kalshi报告的高衰退几率暗示,这种阴郁的情绪可能会引发其自身的实现。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。