市场最近因未解决的关税问题而变得混乱,但股指、加密市场和比特币在周二早上都出现了积极的涨幅,主导加密货币比特币飙升至9万美元以上。

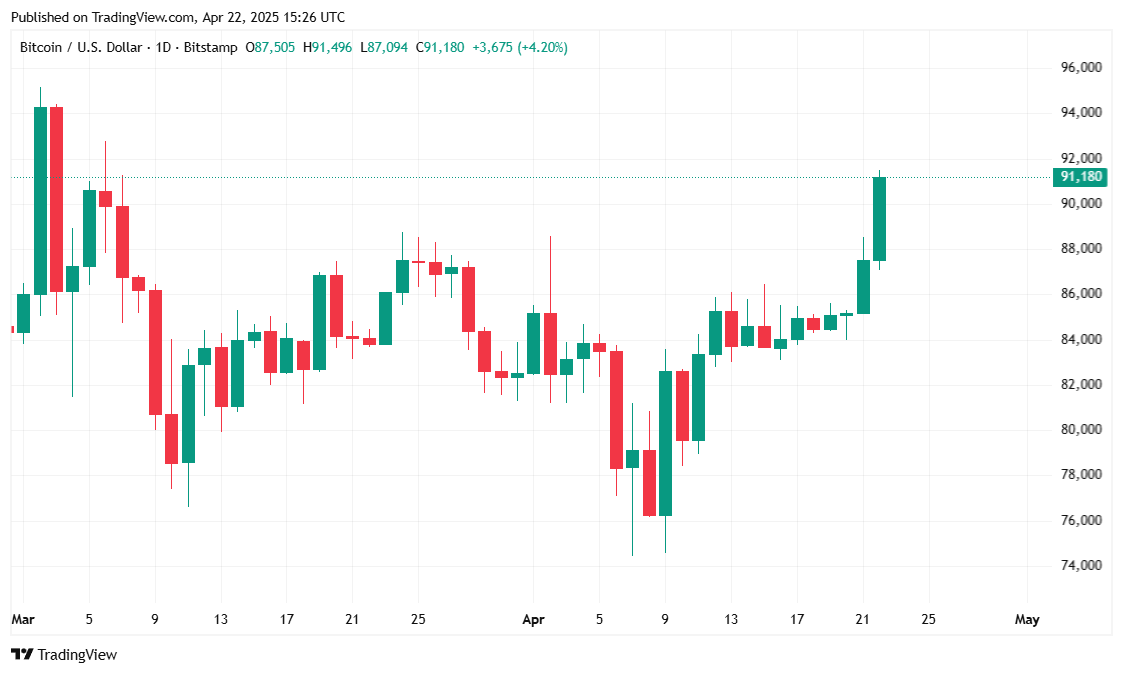

比特币在周二飙升至新的本地高点,在24小时内触及91,463.81美元,并在报道时定格在91,245.60美元。这标志着过去一天上涨了3.47%,一周内上涨了6.86%,继续从上周大约83K的低点上升。

( BTC价格 / Trading View)

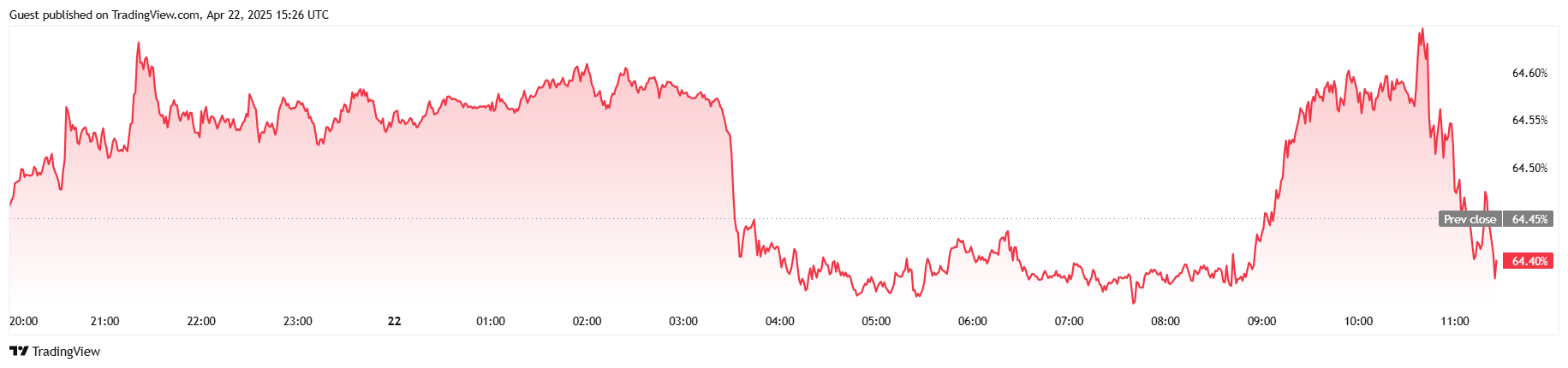

过去24小时内,交易量激增25.20%,达到432.7亿美元,比特币的市值攀升至1.8万亿美元,比前一天上涨了3.18%。有趣的是,比特币的主导地位略微下降0.12%,降至64.40%,这表明尽管比特币继续引领市场,但山寨币领域也有适度的增长。

( BTC主导地位 / Trading View)

在衍生品市场,总的比特币期货未平仓合约跃升10.82%,达到685.9亿美元,反映出日益增长的投机兴趣。根据Coinglass的数据,过去24小时内总清算额达到3800万美元,空头卖家吸收了绝大多数损失,达到3719万美元。多头清算则很少,表明空头再次处于交易的错误一方。

特朗普政府曾承诺在实施为期3个月的全球关税暂停后,在90天内达成90项贸易协议。日本是最早参与谈判的国家之一,特朗普总统曾夸耀谈判进展积极。

但现在,与日本的谈判已经破裂,该国经济复兴大臣对当地媒体表示:“我向美国明确表示,我们认为这些关税措施极其令人遗憾。我强烈敦促他们重新考虑这些政策。”

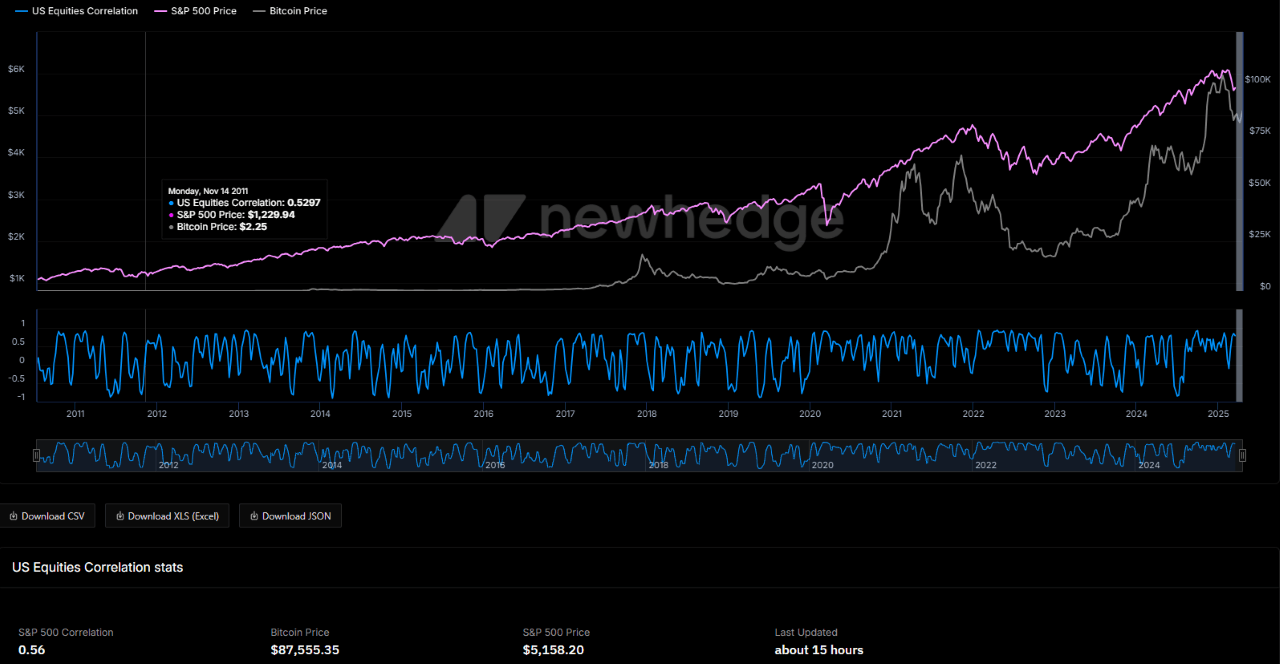

( BTC/S&P 500相关性降至0.56 / Newhedge)

尽管出现了这种后果,标准普尔500指数、道琼斯指数和纳斯达克在撰写时均上涨超过2%,比特币也飙升至91K以上。尽管根据Newhedge的数据,加密货币与股票的相关性仍约为56%,但这种相关性已显著下降,预计到年底可能会完全脱钩。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。