作者:0xJeff

编译:深潮TechFlow

加密货币对我来说一直充满了刺激,总有新的东西可以学习。我天生好奇,喜欢向技术人员问很多看似愚蠢的问题,以便一窥他们的见解并从他们宝贵的经验中学习。人工智能也不例外,事实上,随着Web2科技巨头不断改进他们的模型,大型应用程序利用人工智能推出AI驱动的用例,进展速度非常快。

@canva推出了AI工具,让非技术背景的艺术家和创作者可以轻松构建互动体验,并通过AI增强他们的创作;

@YouTube引入了一种新的AI工具,允许创作者为视频生成背景音乐;

像Grab这样的网约车公司正在部署代理AI以支持商家和司机合作伙伴;

电商公司如Lazada则帮助引入生成式AI工具来帮助卖家进行销售、营销和客户服务。

类似的例子不胜枚举。利用生成式AI和代理AI改善工作流程的实际应用场景,正不断被企业和零售用户所采用。这些技术的好处在于它们易于获取——你可以在任何地方找到免费或低成本的解决方案,其收益远远超过了财务成本。

但人们往往忽略了使用这些AI产品时隐藏的利弊权衡,比如:

-

谁拥有你的数据?

-

是否有人可以窃取你的想法并创造一个竞争产品?

-

平台是否安全?你的数据会泄露吗?

-

如果平台宕机(如AWS曾经发生的情况),会不会中断你的业务?客户资金是否会有风险?

-

你能否始终访问你的平台?是否需要验证你的身份?如果平台关闭,你是否仍然拥有你的产品或业务?

还有很多其他问题(如果你还没有读过,我在之前的文章中更详细地讨论过这个话题)。

中心化的参与者拥有集中化的权力,可以做出可能(无意中)对你的生活产生重大影响的决策。你可能会认为这无关紧要——也许你不会经常使用这些工具,或者你信任这些公司会为了用户的最佳利益行事。这都没问题。你甚至可能想投资这些AI初创公司,因为它们正在进入巨大的可触达市场。但问题是——你无法投资。除非你在@ycombinator或顶级风投公司,否则你无法接触到这些交易。

另一方面,在Web3 AI领域,有许多可投资的AI生态系统,这些团队正在努力将去中心化的AI产品和服务带给用户。其中一个顶级的可投资去中心化AI生态系统是@opentensor(Bittensor)。

Bittensor:达尔文式 AI

Bittensor属于“达尔文式AI”范畴——通过自然选择演化的AI。可以把它想象成AI版的《饥饿游戏》,每个子网都有自己的“饥饿游戏”,其中“矿工”是贡品(或参与者)。他们用自己的模型和数据在特定任务上进行竞争。只有最强的模型(表现最佳的)才会得到奖励。较弱的模型要么被替换,要么进化(通过训练、调整或向他人学习)。随着时间的推移,这会形成一个更强大、多样化和高性能的AI生态系统。

Bittensor特别令人兴奋之处在于其设计的竞争和激励机制,旨在使不同利益相关者之间的激励保持一致。我在下面的推文中概述了Web3 AI代理团队面临的挑战……

简而言之,目前的代理代币对投机者和团队来说是有利的,可以作为炒作的工具,但在用代币获取和留住用户方面效果不佳,也因为价格下跌时无法用作留住人才(开发者、创始人等)的激励,这一点尤其糟糕。

Bittensor通过市场驱动的机制解决这个问题,该机制将$TAO的发行分配给子网,从而激励和支持团队的运营。市场通过在这些子网上质押$TAO来决定哪些子网获得更多的发行量。一旦质押,$TAO将转换为Alpha子网代币。质押的人越多,Alpha代币的价格就越高,您将获得的发行量(以Alpha代币的形式)也就越多。

$TAO的发行计划与BTC非常相似,具有固定的2100万代币供应量,并且每四年减半一次(每天有7,200个$TAO发放给子网)。预计第一次$TAO减半将在2026年1月5日左右发生,届时流通供应量将达到1050万代币。

为什么这对投资者很重要

这里不深入探讨技术问题——只是想分享为什么我认为从交易/投资的角度来看,Bittensor是最令人兴奋的生态系统之一。

除了上述动态之外,当你交易Alpha子网代币时,就像是在同时进行交易和“挖矿”。

这是因为每当Alpha代币价格上涨时,你不仅享受价格上涨的收益,同时还会获得$TAO的发行(以Alpha代币的形式)。

如果子网表现优异并排名上升,你最初的$TAO持仓将经历剧烈的价格上涨和大量的发行增加。越早将你的$TAO质押到子网中,你的年化收益率(APY)就越高(因为市场尚未注意到,所以质押在子网中的人和$TAO较少)。

dTAO vs Solidly

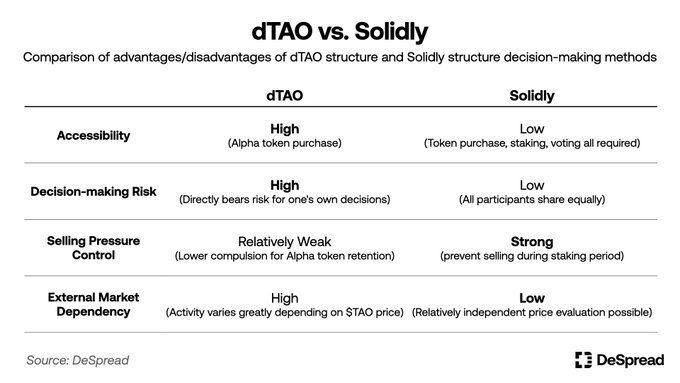

Solidly的ve(3,3)机制要求长期锁定和持续参与。不合理的发行(对错误的流动性池投票)带来的损失由所有持有者共同承担(发行被抛售,所有代币持有者的价格下跌)。

而dTAO不需要长期锁定,因此任何人都可以随时进出,但进入(在子网上质押)需要大量的尽职调查/自我研究。投资错误的子网可能导致巨大损失(因为人们可以很容易地退出,没有锁定期或其他限制)。

但是,Jeff,完全稀释估值(FDV)这么高!我们如何投资市值超过5亿美元的子网?

FDV可能不是在这里考量的合适指标,因为子网仍处于早期阶段,因此市值(MC)可能更适合(如果你是短期到中期交易)。如果你担心通胀,值得了解18%/41%/41%的比例——这些是分别分配给子网所有者、验证者和矿工的发行(以Alpha代币的形式)。作为质押者/Alpha代币持有者,你从验证者部分的41%中获益,因为你在质押时将$TAO委托给他们。

许多子网所有者继续持有他们从发行中获得的Alpha代币以显示信心,许多人与验证者和矿工进行积极对话,以鼓励他们看好市场而不大量抛售代币(你可以在taostats上探索这些信息)。

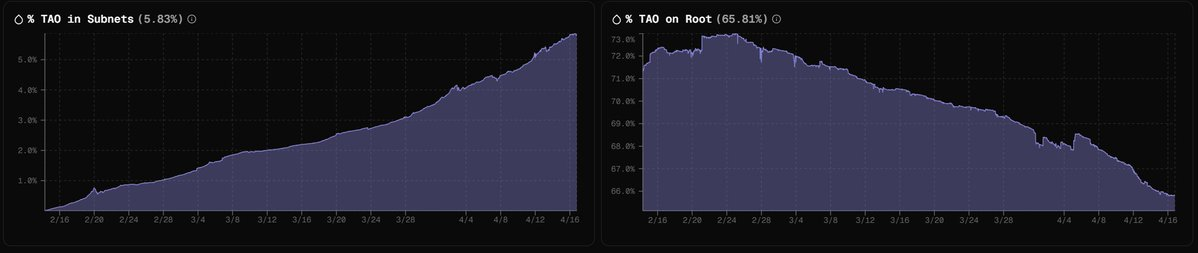

放眼全局,以下图表是展示Bittensor生态系统趋势的最佳图表之一。

来源:taoapp

自从二月份dTAO上线以来,Roots(管理Bittensor激励系统的OG子网)中的%TAO持续下降,而子网中的%TAO则持续上升。这意味着质押者/投资者变得更加冒险(在Root网络上质押将产生约20-25%的保守年化收益率,并且Root上没有Alpha子网代币的价格上涨)。这种趋势与子网团队推出产品的速度一致。自dTAO上线以来,团队需要公开构建,开发用户想要的产品,快速迭代并找到产品市场契合度,吸引用户并迅速产生具有实际收入的现实世界效用。自从我进入这个生态系统以来,我能感受到团队推出产品的速度比其他生态系统快得多(由于竞争和激励分配)。

这将我们引向子网及其独特的可投资去中心化AI(DeAI)用例。

领先的子网和用例

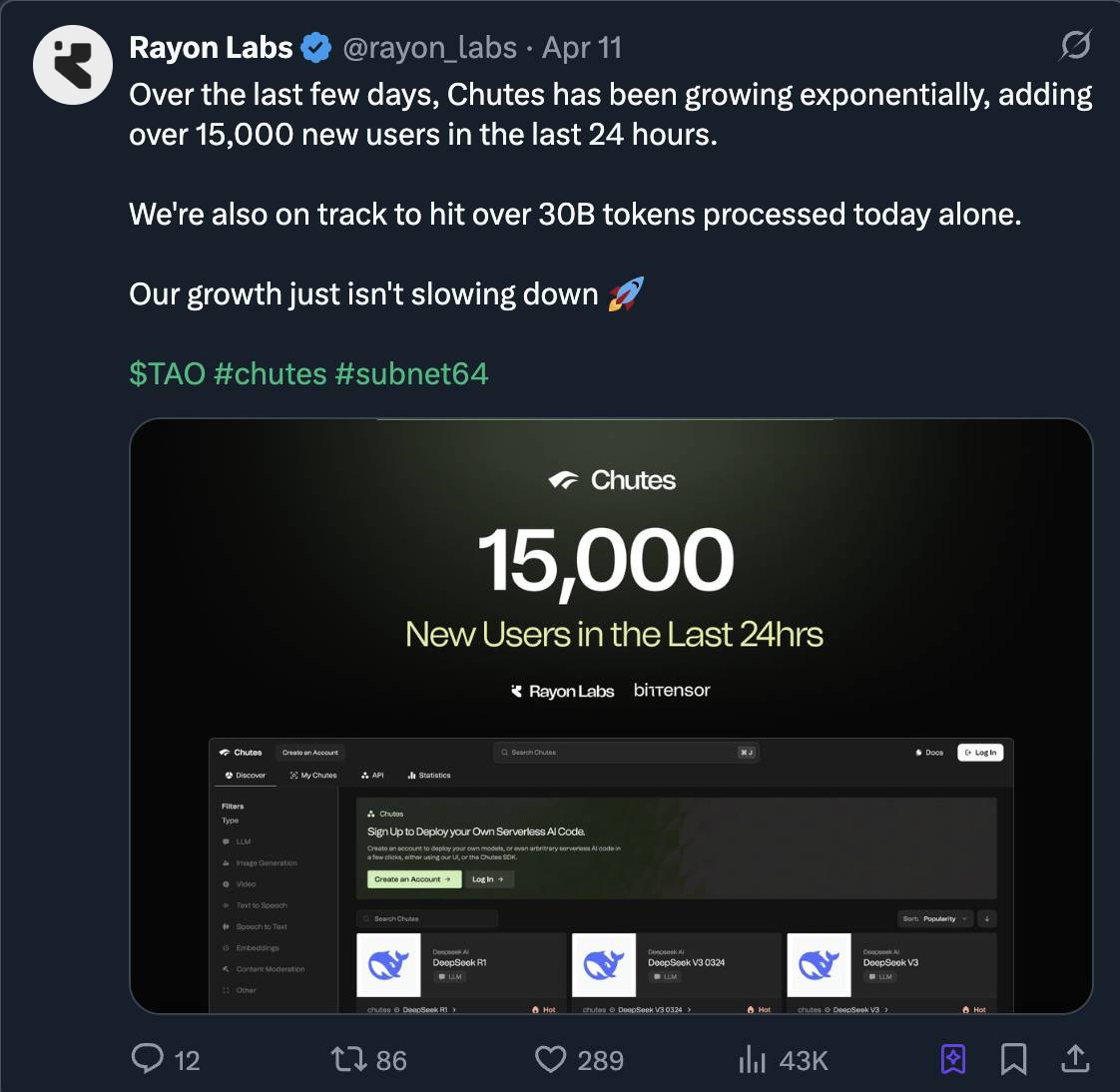

被认为在产品市场契合度(PMF)方面排名第一的团队是@rayon_labs,他们专注于为日常用户提供服务,团队执行专业并持续展示公开构建的能力,包括SN64(Chutes)、SN56(Gradients)、SN19(Nineteen)。

Chutes——提供基础设施,以无服务器的方式轻松部署你的AI。最近的AWS宕机事件是我们需要这种服务的最佳案例,如果你依赖于中心化供应商,宕机可能因为单点故障导致你的AI应用程序停机(导致潜在的资金损失/漏洞利用)。

Gradients——任何人(即使没有编程知识)都可以在Gradients上训练自己的AI模型(用于专业用例、图像生成、定制LLM)。最近推出的v3版本比同行更便宜。

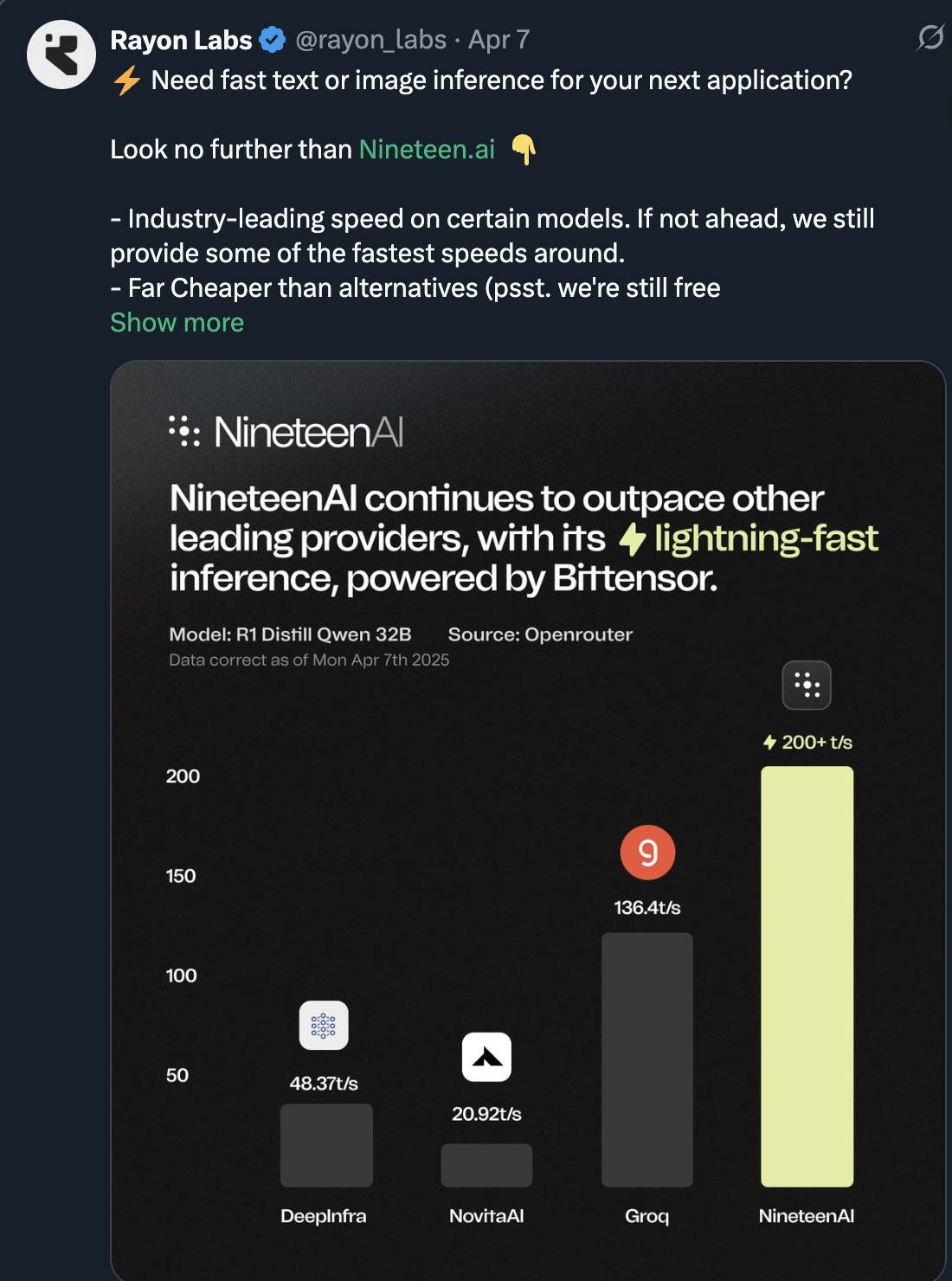

Nineteen — 提供一个快速、可扩展且去中心化的AI推理平台(任何人都可以使用它进行文本和图像生成,因为它比同类产品快得多)。

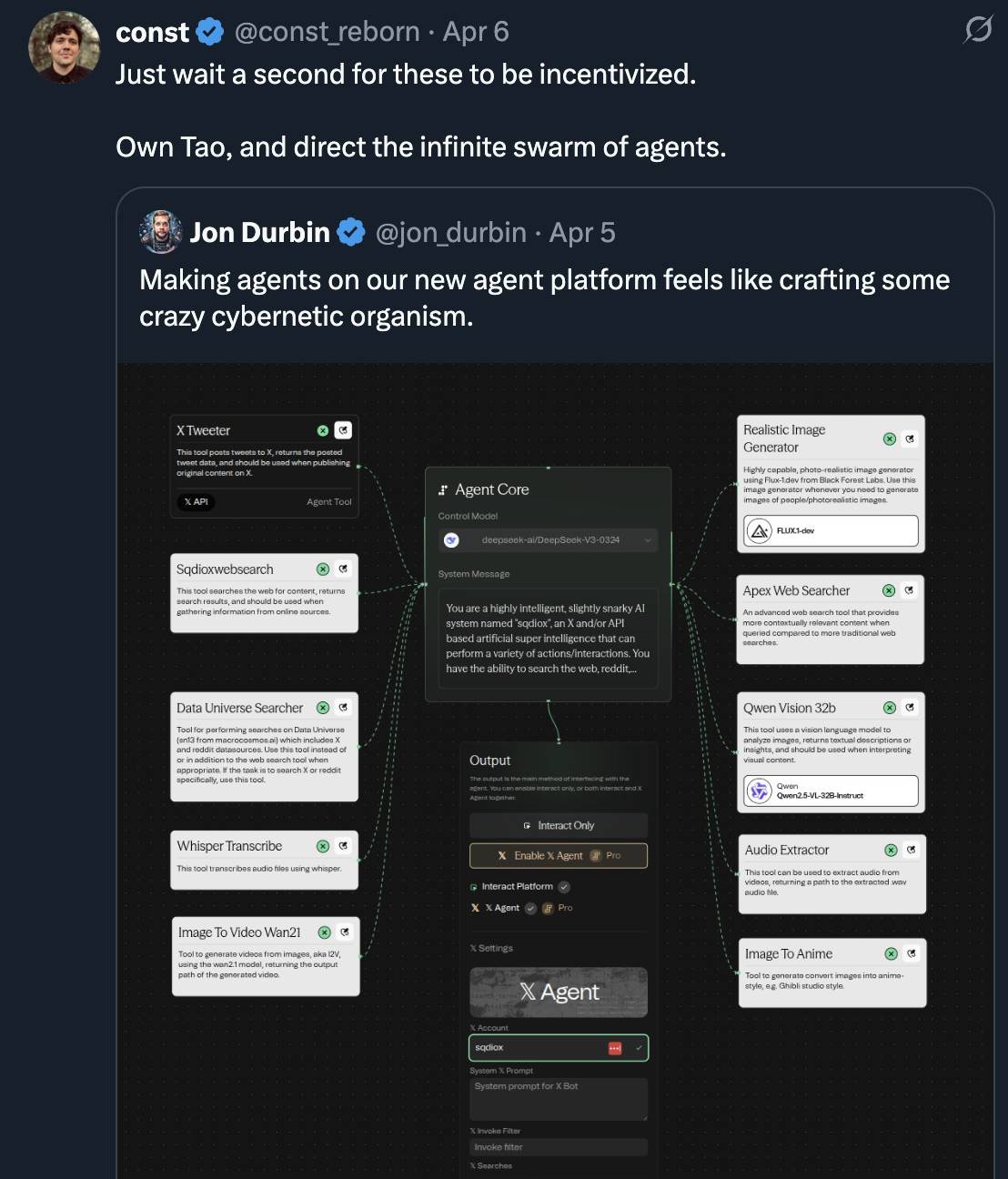

此外,Rayon正在推出Squad AI代理平台,这是一款易于使用的拖放式节点风格AI代理构建平台,已经在社区中引起了广泛关注。

三个子网合计拥有超过三分之一的$TAO发行量——这证明了团队公开构建并交付用户所需优质产品的能力(Rayon被许多子网所有者誉为第一团队)。

-

Gradients在一个月内增长了13倍(当前市值为3200万美元)

-

Chutes增长了2.3倍(市值6300万美元)

-

Nineteen增长了3倍(市值1800万美元)

这种趋势似乎不会很快停止,尤其是随着Chutes的采用率(目前排名第一的子网)不断提高。

除了Rayon Labs的子网,还有许多有趣的团队——包括蛋白质折叠、深度伪造/AI内容检测、3D模型、交易策略、角色扮演LLM。我还没有深入研究所有内容,我认为最相关的是“预测系统”(taopill)下的子网。

SN41 @sportstensor

许多人可能通过@AskBillyBets了解他们,Sportstensor是支持Billy决策的智能系统(Billy的主要团队是@ContangoDigital,这是一家投资于去中心化AI(DeAI)以及Bittensor子网验证者/矿工的风险投资公司)。

SN41的产品——Sportstensor模型非常有趣。它是矿工之间的一场竞争,目标是拥有最佳模型和数据集来预测体育比赛的结果。

例如:在最新的NBA联赛中,如果你跟随大众下注(押注于大众热门),你将体验到约68%的准确率/胜率。这是否意味着所有押注大众热门的人都赚了很多钱呢?并不是,事实上他们亏了钱。如果你在每个大众热门上下注100美元,最终你会得到负的投资回报率,损失约1700美元。

虽然大众热门往往有更好的胜率,但它们的赔率较低,这意味着即使你正确押注,你赢的钱也少。人们常常集中在他们的热门上,导致冷门的获胜赔率很低,这意味着如果你押对了冷门,就有很多钱可以赚。

这就是Sportstensor模型的作用所在。矿工使用自己的机器学习模型(如蒙特卡洛、随机森林、线性回归等)和自己的数据(免费或专有)来获得最佳结果。Sportstensor然后取这些结果的平均值/中位数,并用作识别市场优势的智能。

市场中的实际赔率是25:75。模型可能显示赔率为45:55。这个15的差距就是优势。如果模型发现了许多这样的优势,你不需要很高的胜率就可以在长期内开始积累正的投资回报率。

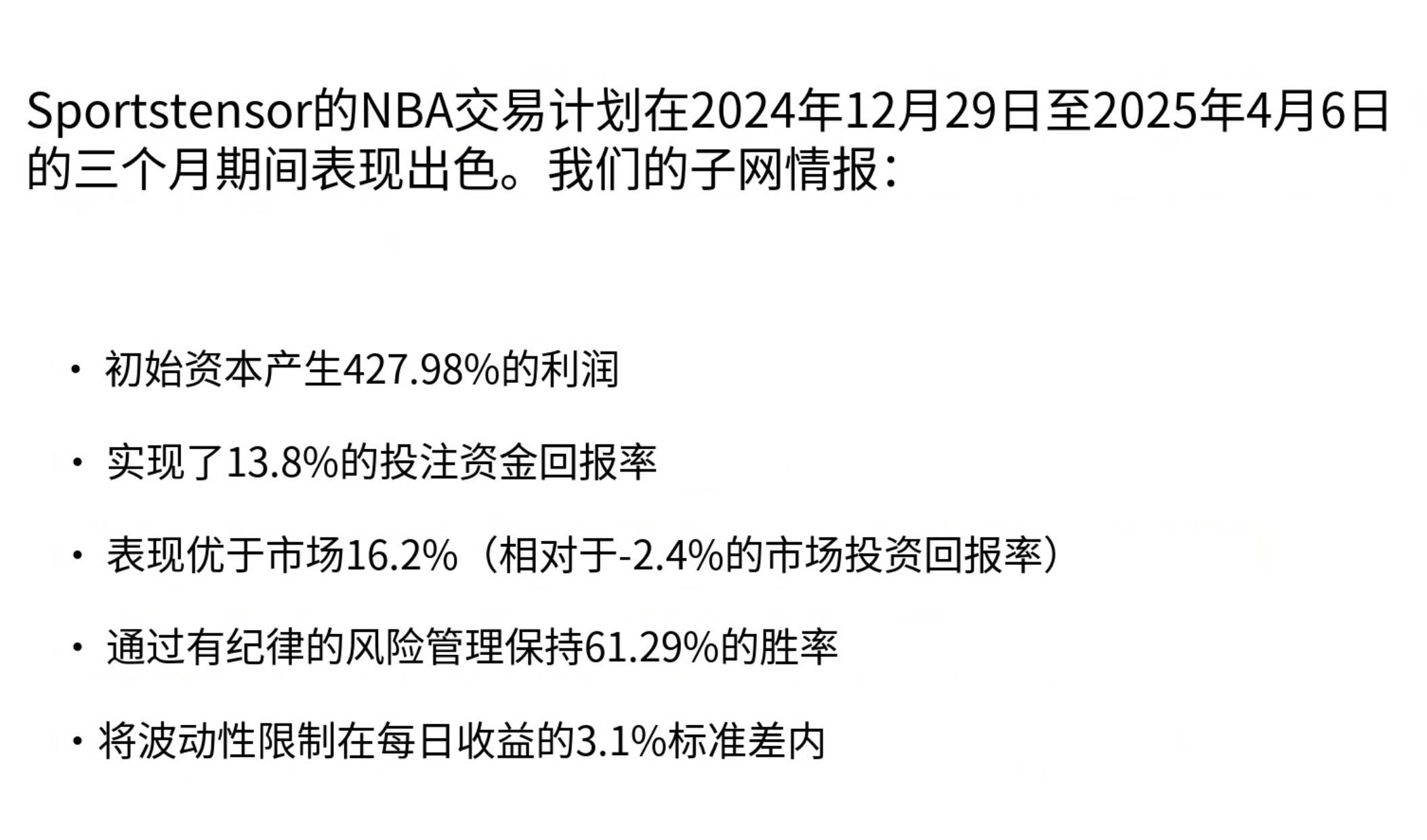

来源:Sportstensor,由深潮 TechFlow翻译

查看他们的完整交易报告(如果你想深入研究):这是他们在最新报告中分享的模型结果。数字相当令人印象深刻。团队还每月运营一个投注基金,起始资金为1万美元作为缓冲,利用利润继续进行智能投注。月底,他们将用利润回购他们的Alpha代币。团队在三月份赚了约1.8万美元的利润。

根据你使用智能系统的方式不同,结果也可能会有很大差异。例如,智能系统显示的赔率为35:65,而市场中的实际赔率可能是40:60。有人可能会在这种情况下下注,而你可能不会,因为差距较小,没有足够的优势。Billy对智能系统的使用方式与Sportstensor的使用方式不同。(目前还没有人知道如何持续获得正的投资回报率,因为这个领域还处于非常早期的阶段。)

Sportstensor计划通过创建一个仪表板来进一步货币化他们的智能系统,让用户可以轻松理解其中的洞察,并据此做出投注决策。

我个人喜欢这个团队,因为他们的产品有很多发展方向。我们已经看到Billy通过这种方式吸引了大量关注,并让体育迷们在与Billy一起投注时感到兴奋。由于团队覆盖了许多体育项目,代理可以在多种方式上改变人们的氛围、互动和投注方式。

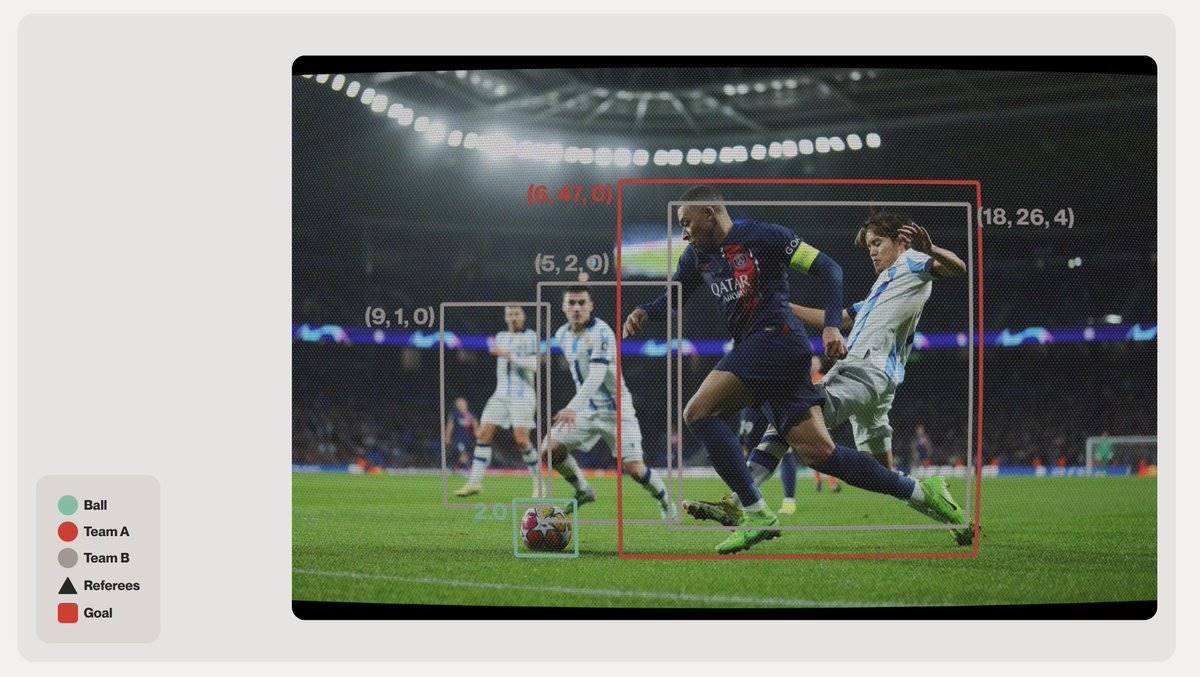

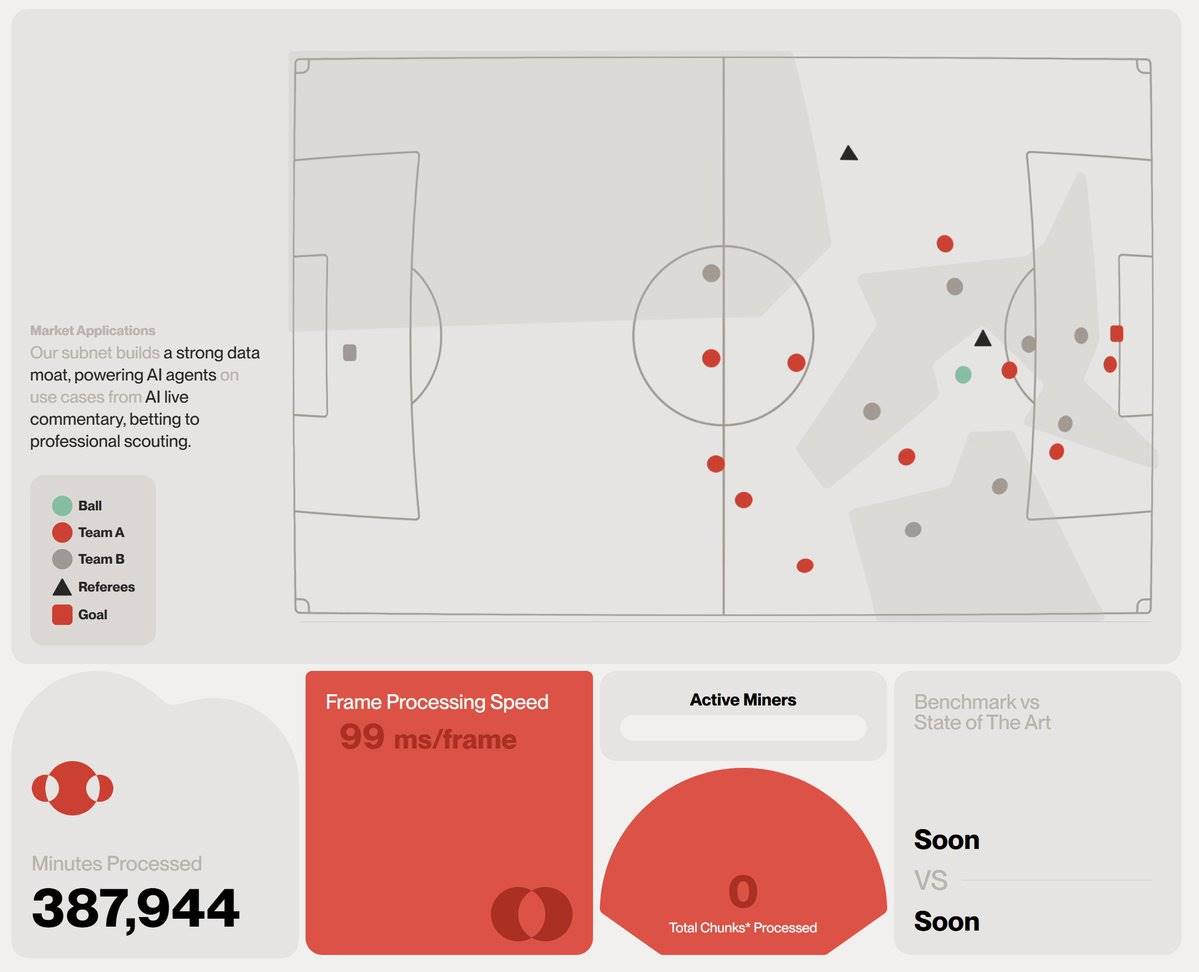

SN44 @webuildscore

Score曾尝试构建类似于Sportstensor的系统,但在意识到预测未来事件的能力具有更大价值后,转向了计算机视觉领域。为了理解这一点,你需要计算机视觉来分析屏幕上发生的事情,让AI理解屏幕上的物体、定位它们并标注数据,然后通过不同的算法得出结论(例如某个球员做出特定动作的概率),并将所有这些转化为一个通用评分,用于提升球员表现以及早期发掘人才。

矿工们竞争标注物体(这是矿工的首要目标)。Score目前使用他们的内部算法来得出结论。

当你给球员评分时(类似于为棋局或《英雄联盟》设置Elo,但更加细致和动态,会根据每场比赛中的球员决策及其影响动态变化),俱乐部老板可以做很多事情,例如在年轻时发现人才。如果你有孩子比赛的录像,可以用与职业比赛相同的方法。这是用同样的方法量化整个足球世界。

通过专有数据,Score可以将评分和洞察货币化,出售给数据经纪人、俱乐部老板、体育数据公司和博彩公司。

对于消费者应用,Score正采取不同的措施。

@thedkingdao是一个体育对冲基金DAO,是Score的客户之一,使用Score数据进行博彩模型的开发,并将其转化为可执行的投注决策。v2终端将于明天推出(用户将能够通过不同的订阅模式访问完整模型,从比赛分析、询问高级资金管理问题,即最佳投注伴侣,使用代理来制定自己的策略)。用户可以将资金锁定在Vault产品中,代理会自动下注,提供来自下注的收益,预计下个月或夏季前推出。

很快,人们将能够在Score的自助平台上上传视频,由矿工进行标注。通常足球比赛录像需要几个小时,而矿工只需10-12分钟即可标注90分钟的比赛,这比其他地方快得多。用户可以将标注的数据用于他们自己的模型和应用场景。

我个人喜欢Score,因为它可以应用于体育之外的其他领域,例如自动驾驶汽车、机器人等。在垃圾数据泛滥的世界中,高质量的专有数据备受追捧。

SN18 @zeussubnet

这是一个最近获得大量关注的新子网。我还没有机会与团队交流,但产品非常有趣。

Zeus是一个基于机器学习的气候/天气预测子网,旨在通过更快、更准确的预测来超越传统模型。

这种智能备受对冲基金的青睐,因为准确预测天气可以更好地预测商品价格(对冲基金愿意支付数百万以获取这种智能,因为如果他们成功进行商品交易,可以赚取数亿美元)。

Zeus子网相对较新,因为他们最近收购了子网18。Alpha代币在过去7天内上涨了210%。

我感兴趣但尚未深入了解的其他子网包括:

-

@404gen_ SN17 — 用于生成AI生成的3D资产的基础设施。创建游戏、AI角色、虚拟主播等的3D模型。最近与@unity的集成可能实现无缝的3D模型生成,改变Unity的120万月活跃用户的创作流程。

-

@metanova_labs SN68 — DeSci药物发现子网,将药物发现转变为协作的高速竞争,解决传统挑战如成本和时间(传统过程需要十多年并可能耗资数十亿美元)。

还有许多其他子网,我会在有机会深入了解后分享更多。我从那些最容易理解的开始(因为我不是技术人员)。

总结

我尽量避免过于技术化。关于整个dTAO、排放、激励分配、所有利益相关者等技术解释,有很多优秀的资源可供参考。

根据我在代理季(10月24日至今)的学习,我认为保持灵活是非常重要的。我持有过太多项目的投资,而我认为dTAO提供了相当不错的机制,可以灵活转换并退出不同的可投资DeAI初创公司。

目前参与者还不多,因此用户可以体验到80%–150%+的年化收益率(APY),再加上子网价格上涨。这种动态可能会在未来六个月内发生变化,随着更多人加入以及TAO生态有了更好的桥梁、钱包和交易基础设施。

现在,我建议你享受TAO的PvE季,并与我一起了解更多关于酷炫的DeAI技术 :D

感谢阅读我的第一篇文章。期待在下一篇中再次见到大家!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。