本报告所提及市场、项目、币种等信息、观点及判断,仅供参考,不构成任何投资建议。

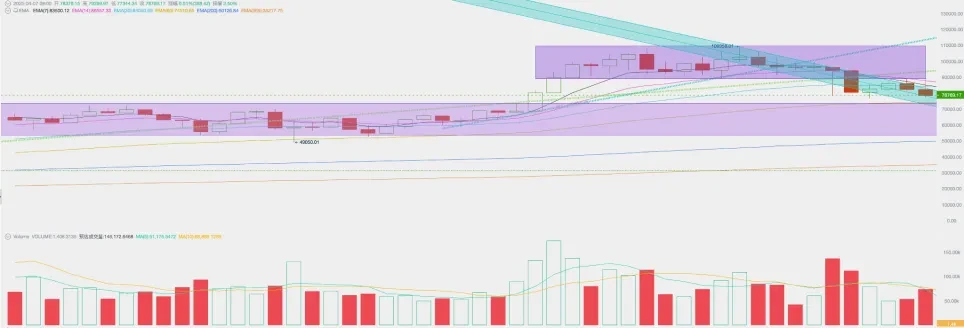

本周BTC开于82379.98美元,收于78370.75美元,全周下跌4.87%,振幅13.92%,成交量有明显放大。BTC价格运行于下降通道中,逼近通道上沿后受美国拖累于周末破位下跌,目前于年线(365日)附近暂时企稳。

4月2日,美国总统宣布远超预期的“对等关税”条款,震惊全球。随后,中国政府宣布反制措施。资本市场风声鹤唳,美三大股指本周以大幅剧烈下跌回应“对等关税”冲击,长短端美债收益率均大幅下降。

“对等关税”战覆盖了一切其他消息,市场忙着抛售资产并为远超预期政策进行向下定价。

全球资本市场目前处于剧烈调整完成定价过程中,最大变量来自美国总统和美联储后继应对举措。

宏观金融及经济数据

4月2日,美国总统特朗普在白宫签署行政令,宣布对全球贸易伙伴实施“对等关税”,设立10%的最低基准关税,并对部分国家(如中国)加征更高税率(例如34%)。其中基准关税4月5日起生效,高关税措施自2025年4月9日起生效。

美财长贝森特在采访中呼吁各国保持克制,并称如果没有反制这将是上限。

4月3日中国强硬回击,将对原产于美国的所有进口商品加征34%的关税,生效时间同样在4月9日。

虽然经济小国大都退让承受,但后市料将欧盟和英国将继续出台一定的反制措施。

因大幅超乎预期,美三大股指在周四周五两个交易日迅速暴跌,以对此进行定价。纳斯达克、标普500和道琼斯全周分别下跌10.02%、9.08%和7.86%。受“对等关税”直接影响的Apple和Nvidia更是全周下跌13.55%和14.01%。全周美股损失了超过5万亿美元的市值。

4月4日,美国劳工部发布3月份美国非农就业数据,就业人数增加了228,000人,远超市场预期的135,000至140,000人,失业率小幅上升至4.2%,略高于市场预期的4.1%。美联储主席在演讲中表态:美国经济依然强劲,关税将拖累经济和通胀。其发言堪称非常“鹰派”。

特朗普在社交媒体上敦促美联储尽快降息,而及至周末Fed Watch看板显示随着美股暴跌,交易员们对于今年降息的次数已经提升至4次,其中6月降息概率超过90%。

对等关税冲突将继续,但可能最恶劣的时刻正在过去,市场需要在未来一段时间里逐步确认定价是否充分,以及会否发生更恶劣的情形。

而更关键的是“以税促谈”是否存在,以及美国与诸国谈判的结果到底如何。

资金流动

加密市场全周流出资金达到3.33亿美元,其中BTC Spot ETF通道1.78亿,稳定币1.08亿。连续四周的资金净流入趋势被打破。

考虑美股的剧烈波动,这一流出规模并不严重,但有可能后继会追加杀跌,不可不防。

抛压与抛售

伴随美股动荡,市场抛压也小幅增加,链上流入交易所的规模达到188614.7枚,短手加剧抛售,而长手抛售则较上周略有减少。据eMerge Engine数据显示,在连续3周流出之后,CEX持有BTC规模本周增加了3116.1枚,显示出抛压出现了一定堆积。

2月下旬以来,短手群体大部分时间均处于浮亏状态,最近的浮亏比例达到16%,录得本周期以来最大浮亏记录。短手群体当前仍然承受着巨大压力,这一群体的崩溃将导致价格进一步杀跌。

长手群体继续担任市场的稳定工作,本周增加5.33万枚持仓。

除非美股反弹,或美联储出台降息类增持,否则买力难以大幅收付,市场将难以获得向上的动力。

周期指标

据eMerge引擎,EMC BTC Cycle Metrics 指标为0.375 ,市场处于上升中继期。

EMC Labs

EMC Labs(涌现实验室)由加密资产投资人和数据科学家于2023年4月创建。专注区块链产业研究及Crypto二级市场投资,以产业前瞻、洞察及数据挖掘为核心竞争力,致力于以研究和投资方式参与蓬勃发展的区块链产业,推动区块链及加密资产为人类带来福祉。

更多信息请访问:https://www.emc.fund

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。