Powell did not signal a rate cut at yesterday's Chicago Economic Club event. The most anxious person is none other than Trump. The president, who has been fidgeting with tariffs for over a month, is clearly furious about the Federal Reserve's decision not to cut rates, launching a series of attacks on Powell: "If I wanted to, Federal Reserve Chairman Powell would be out. I am not satisfied with him (Powell). I think Powell has not done a good job." "Powell is slow to react and slow to act." "Powell is playing politics; interest rates should be lowered now." "The people at the Federal Reserve are not very smart; Powell is terrible." Powell is "someone I have never really liked." Meanwhile, Powell firmly defends the independence of the Federal Reserve, rebutting political interference and stating that the Fed will make decisions solely based on what is most beneficial for the American people.

Trump Challenges the Independence of the Federal Reserve

Trump never hides his disappointment with Powell. On April 17, 2025, he told reporters in the Oval Office: "If I want him out, believe me, he will be out soon!" He then posted again on Truth Social urging Federal Reserve Chairman Powell to cut rates, "The European Central Bank is about to cut rates for the seventh time, while the Federal Reserve's 'Mr. Always Late' Powell has messed everything up again. Yesterday he threw out a typical chaotic report—oil prices are falling, food prices are dropping, even egg prices are down, and America is making a fortune through tariffs. This 'slowpoke' should have cut rates like the European Central Bank a long time ago; now it is urgent, and the countdown for Powell's departure should be accelerated!"

Trump's anger largely stems from Powell's "conservative" stance on monetary policy. He believes that Powell failed to cut rates significantly and in a timely manner, missing the window to stimulate economic growth. What frustrates Trump even more is that the Fed's high-interest rate policy conflicts with the tariff plan he implemented after taking office. Trump's tariff policy aims to protect American industries but may raise the prices of imported goods, thereby exacerbating inflationary pressures. The Yale University Budget Lab estimates that these tariffs amount to an additional tax burden of $4,900 for each American household. In this context, Trump hopes the Federal Reserve will ease economic pressures through rate cuts to support his policies.

As for whether Trump wants to fire Powell, although he publicly stated to reporters that he "does not regret nominating Powell," reports from WSJ may provide some clues. Sources say Trump has privately discussed with former Federal Reserve Governor Kevin Warsh about replacing Powell.

What Obstacles Are There to Firing Powell?

Can Trump really "fire" Powell as he wishes? The answer is not simple.

According to the Federal Reserve Act, the Chairman and members of the Board of Governors can only be removed "for cause," typically referring to misconduct, malfeasance, or loss of capacity to perform duties, rather than policy disagreements. Historically, no Federal Reserve Chairman has ever been directly dismissed by a president, and this legal framework provides a solid guarantee for the Fed's independence. Powell himself has made his stance clear. In November 2024, when asked if he would comply if Trump asked him to resign, he firmly replied, "No."

Additionally, Powell's term also provides him with protection. He was initially nominated by Trump in 2017 to serve as Chairman of the Federal Reserve and was re-nominated by Biden in 2022, with his term lasting until May 2026. Sarah Binder, a senior fellow at Brookings, points out that courts typically do not view disagreements over interest rate setting as "just cause," so if Trump were to forcibly dismiss Powell, he could face legal challenges.

Even if the law allows it, firing Powell would also be politically risky. The independence of the Federal Reserve is not only a legal issue but also a cornerstone of market confidence. Binder warns that a president's attempt to oust Powell would increase market uncertainty and undermine public trust in the Federal Reserve. This could lead to significant volatility in the stock and bond markets, and even affect the cryptocurrency market. After all, while crypto assets tout "decentralization," their prices are still strongly influenced by the macroeconomic environment and investor sentiment.

Trump's aggressive stance has even caused concern among some critics of Powell. Senior Democratic Senator Warren stated that undermining the independence of the Federal Reserve could trigger a market collapse.

Although there are legal and market "protective shields," this does not mean Powell's position is without threat. Recently, the U.S. Supreme Court is hearing a case involving the president's power to dismiss senior officials of independent agencies. Although the case does not target the Federal Reserve, but rather the National Labor Relations Board and the Merit Systems Protection Board, the ruling could provide Trump with a legal basis. While the 1935 "Humphrey's Executor v. United States" case established a precedent limiting the president's ability to dismiss leaders of independent agencies without cause, today's conservative Supreme Court may reconsider this ruling. If the court leans towards expanding presidential power, Powell's position could indeed be in jeopardy.

Furthermore, Powell's support is not unshakeable. Compared to Trump's first term, Powell faces more scrutiny now. Some believe that the Federal Reserve's actions to curb inflation in 2022-2023 were too slow, leading to policy missteps. Allies within the White House believe that Trump's post on Thursday morning was more an attempt to disrupt Powell's position and frame him as a future "scapegoat for economic issues," potentially undermining his public support and increasing the risk of replacement.

How Will This Affect the Cryptocurrency Market?

Perhaps firing Powell is not the most critical issue; for Trump, the goal seems to be to pressure the Federal Reserve to "open the floodgates" and stimulate economic growth through significant rate cuts.

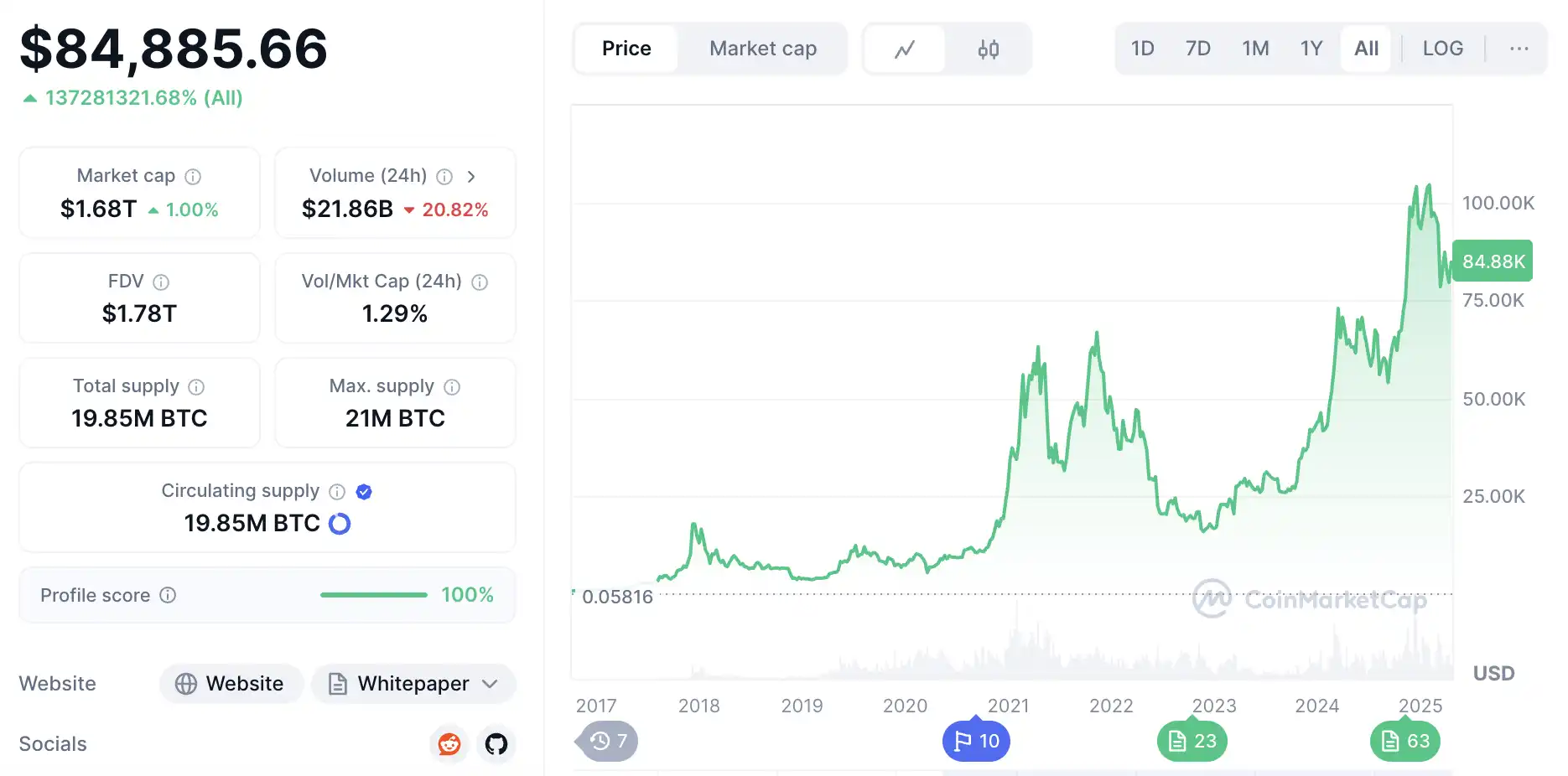

Rate cuts typically mean increased liquidity, decreased purchasing power of the dollar, and rising inflation expectations. In this environment, cryptocurrencies, especially Bitcoin, known as "digital gold," can attract capital inflows. Looking back to 2020, when the Federal Reserve cut rates to near zero in response to the pandemic, Bitcoin's price soared from under $10,000 to a record high of $67,000 by the end of 2021; a similar scenario may play out under Trump's pressure for rate cuts.

Additionally, Trump's tariff policy may further drive up inflation. According to Powell's warnings, tariffs could lead to higher prices for imported goods, squeezing household budgets and pushing up prices. Yale's estimates show that the inflation effect of tariffs amounts to an additional tax burden of $4,900 for each household. Under inflationary pressure, investors may shift their funds towards mainstream cryptocurrencies like Bitcoin or even chase high-risk altcoins, sparking a bull market.

Looking further, if the Federal Reserve loses its independence under political pressure, the credibility of U.S. monetary policy may be damaged. DeFi and blockchain technology serve as alternatives to the flaws of the traditional financial system. If the Federal Reserve becomes politicized, it could accelerate investors' disappointment with the dollar system, driving funds into ecosystems like DeFi.

However, rate cuts are not a panacea. Powell warned in his speech at the Chicago Economic Club yesterday that Trump's tariff policy could push the U.S. economy into a "stagflation" predicament—high inflation coexisting with slow economic growth. This environment would complicate the Fed's dual mandate (stabilizing prices and maximizing employment).

In a stagflation environment, the Federal Reserve may face a dilemma: cutting rates to stimulate the economy could exacerbate inflation, while maintaining high rates would suppress growth. For the cryptocurrency market, this means significant price volatility.

This game between Trump and Powell may ultimately evolve into a war of attrition with no winners, where market confidence and economic stability are the casualties. History tells us that the cost of political interference is often paid by the wallets of ordinary investors and their grocery bills.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。