今夜美联储会议纪要,历史文件面对关税战新局面,鲍威尔转鹰,BTC何去何从?

宏观解读:美联储会议纪要将于UTC+8时间周四凌晨2点发布,这份纪要详细记录了3月19-20日美联储利率决议的讨论内容——当时美联储将基准利率维持在4.25%-4.50%区间,并释放年内降息三次、每次25个基点的政策信号。

但目前市场格局已发生剧变,自特朗普4月2日抛出全球关税计划后,美股应声大跌,多位经济学家预警年内可能出现经济衰退。鲍威尔在4月4日的讲话中明显转向鹰派,警告称“我们正面临高度不确定的前景,同时承受失业率与通胀双双攀升的风险”。最新期货市场数据显示,交易员已将年内降息预期上调至四次。

Coinank研究院认为,从宏观经济政策与市场预期错位的视角观察,美联储即将发布的3月会议纪要对加密市场影响可从以下维度解读: 1. 政策信号滞后性与市场预期重构:3月会议纪要反映的是“前关税时代”的政策立场(维持利率4.25%-4.5%、年内降息3次),但当前市场已因特朗普关税计划与鲍威尔鹰派转向(4月4日警告失业率与通胀双升风险)调整预期至年内降息4次。这种预期差可能导致纪要发布后市场波动加剧,若纪要显示决策层内部分歧显著(如沃勒反对放缓缩表),或强化对美联储政策灵活性的质疑,进而压制风险资产偏好。

2. 流动性预期分化与加密市场联动:美联储3月决定放缓缩表(国债减持速度从250亿降至50亿美元/月)本意是缓解流动性压力,但关税冲击与衰退预警可能削弱其效果。加密市场对流动性敏感,若纪要透露更多金融稳定性担忧(如债务可持续性风险),比特币或再现与传统风险资产(美股)的正相关性,而非发挥避险属性。当前BTC与标普500的30日相关性系数0.72,若流动性预期恶化,高贝塔山寨币或面临更大抛压。

3. 降息路径博弈与加密资产定位:尽管市场已将降息预期上调至4次,但3月纪要中“依赖硬数据”的表述(如失业率4.1%、核心PCE通胀2.8%)可能暗示美联储对过早宽松持谨慎态度。加密市场需警惕两种情景:一是若纪要显示通胀担忧高于预期,美元指数反弹或压制BTC突破关键阻力位;二是若经济衰退信号强化(如失业率超预期攀升),机构可能优先减持加密资产以补充传统市场保证金,引发流动性虹吸效应。

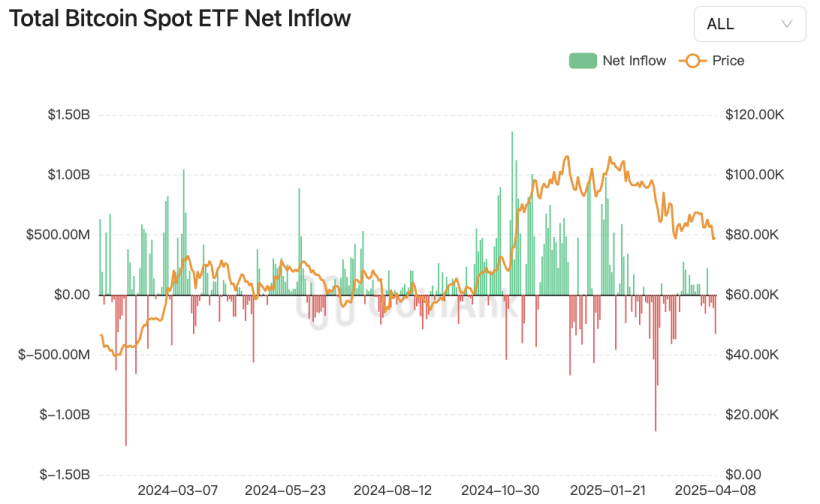

综上,会议纪要或将加剧“政策不确定性溢价”,短期加密市场波动率(BTC 30日波动率当前34%)可能攀升。中长期看,若降息预期落地与ETF资金回流形成共振,比特币或重获“抗滞胀”叙事主导权,但需突破重要压力位空单清算密集区以确认趋势。

BTC数据分析:

Coinank最新数据显示,昨日#BTC 现货 ETF 总净流出 3.26 亿美元,已连续四日净流出状态。昨日单日净流出最多的比特币现货 ETF 为贝莱德比特币 ETF IBIT,单日净流出为 2.53 亿美元。 比特币现货 ETF 总资产净值为 857.56 亿美元,ETF 净资产比率(市值较比特币总市值占比)达 5.6%,历史累计净流入已达 356.37 亿美元。

我们认为,比特币现货ETF单日净流出3.26亿美元,尤其贝莱德IBIT创纪录流出2.53亿美元,折射出机构投资者在宏观政策不确定期的再平衡策略升级。这一异动可拆解为三重动因:

流动性再定价逻辑:IBIT作为最大ETF产品(历史净流入396.6亿)首现大额流出,或与美债收益率攀升至4.5%触发机构降低风险敞口相关。数据显示,对冲基金正通过做空CME比特币期货(未平仓合约增12%)对冲现货抛压,形成跨市场套利闭环。

资金迁移效应:ETF总资产净值缩至857.6亿美元,但净资产比率持稳5.6%,表明抛售压力被比特币市值同步调整(周内-8.7%)部分抵消。当前流出规模占历史累计净流入仅0.9%,核心配置型资金(占比约82%)尚未松动,暗示短期扰动为主。

结构性警示信号:Bitwise BITB等中小ETF同步流出,反映市场流动性分层加剧——前三大ETF掌控87%份额,尾部产品或面临清盘压力。但链上巨鲸在6.8万美元附近增持1.8万枚BTC,形成筹码沉淀缓冲带。

未来路径或取决于两大变量:一是美联储6月降息预期能否从当前42%概率回升,驱动风险偏好修复;二是比特币能否在6.5万美元(矿工平均成本线)构筑技术支撑。若宏观流动性边际改善,ETF资金流或随波动率触底反弹,但短期需警惕“机构减仓-散户杠杆清算”的负反馈传导。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。