尽管价值120亿美元的比特币期权合约将在明天到期——这是衍生品交易所Deribit所见的最大季度到期之一——首席执行官Luuk Strijers表示,他预计波动性将会受到抑制。

在Deribit平台上,3月28日的到期影响了该平台上45%的未平仓期权合约。该交易所目前在比特币合约中有270亿美元的未平仓合约,认沽/认购比率略显悲观,为0.52。

认购期权赋予买方在期权到期之前以设定价格购买资产的权利,但并不强制其购买。通常,当交易者预期价格上涨时,他们会开设这些合约。认沽期权允许交易者在到期之前以设定价格出售资产。当交易者预期资产价格会下降时,他们倾向于使用认沽期权。

总部位于新加坡的加密货币交易公司QCP Capital的分析师指出,85,000美元是最大痛点。根据数据提供商CoinGecko的数据显示,比特币最近的交易价格为87,016美元,过去24小时上涨了0.4%。

但到目前为止,指标显示衍生品交易者面临最大痛点的可能性不大。

“Deribit DVOL目前为47,相对较低——与2024年2月底和8月的水平相当——这表明隐含波动性低,对剧烈价格波动的预期有限,”Deribit的Strijers在一封电子邮件中告诉Decrypt。

来源:Deribit

Deribit隐含波动率指数(DVOL)利用期权市场的当前活动来预测未来30天的价格波动。

它是比特币和以太坊的等价物,类似于Cboe波动率指数(VIX),后者根据标准普尔500指数期权衡量股市对波动性的预期。

Strijers在本周早些时候向Decrypt发送了他的评论,此前美国总统唐纳德·特朗普宣布对汽车征收25%的关税。但即使在这一意外的宏观经济新闻之后,DVOL仍然滑向46。

“在更广泛的市场中,美国关税的不确定性仍然很高,缺乏清晰度导致股市紧张,”Strijers补充道,“而美元和黄金价格仍然很高。”

他还指出,Mt. Gox本月已经三次转移了“大量”比特币,其中一些转移到了Kraken。尽管Glassnode分析师告诉Decrypt几乎没有链上证据表明债权人还款将重新开始,但仍然存在可能性。

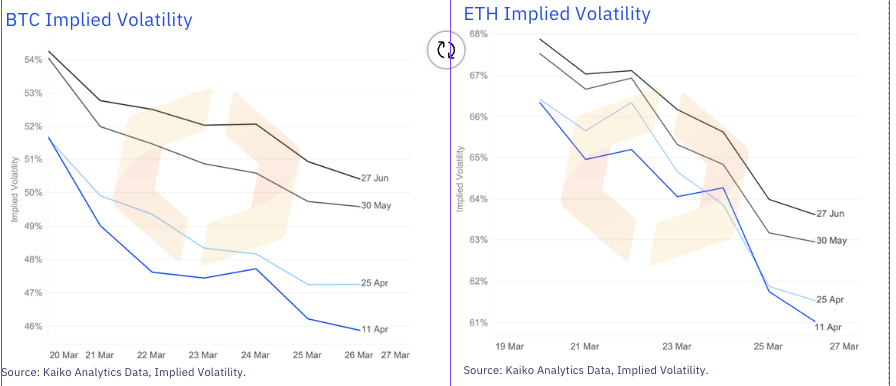

Kaiko的研究分析师Adam McCarthy同意,尽管明天的比特币期权到期规模庞大,但他并不预期在价格或波动性方面会出现极端情况。

来源:Kaiko

“在过去一年中,我们首次进入一个几乎没有明确风险事件的季度,”他告诉Decrypt。

McCarthy表示,2024年充满了隐含波动率的期限结构倒置,例如比特币和以太坊现货ETF的推出,第四次比特币减半以及11月美国总统选举。

通常,长期到期的期权具有更高的隐含波动性,因为它们留有更多的不确定性空间。但在倒置的情况下,短期期权的隐含波动性高于长期期权。

“随着我们进入第二季度,两个主要资产的结构是正常的,目前没有重大风险事件被定价,”McCarthy补充道。

编辑注:此帖子已更新以添加Kaiko的评论。

编辑:James Rubin

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。