Just finished watching @Delphi_Digital’s "DeFi Year Ahead 2025" video on YT, and I was pumped to see them cover @0xfluid DEX! That said, I think there are a few things that could use a bit more clarity to give the full picture.

@DaftaryNeel mentioned users can borrow funds from Fluid lending and deploy them on the DEX. The real game-changer here is that the collateral and debt themselves act as trading liquidity—users don’t need to deploy anything on the DEX. The debt becomes trading liquidity, unlocking capital efficiency like no other DEX out there. That’s what makes Fluid the most capital-efficient DEX in existence.

Neel also said Fluid isn’t scalable because its liquidity is tied to the lending market. I’ve got to disagree there—lending markets ($73B market size) have far more liquidity than DEXes ($24B), so scalability shouldn’t be an issue.

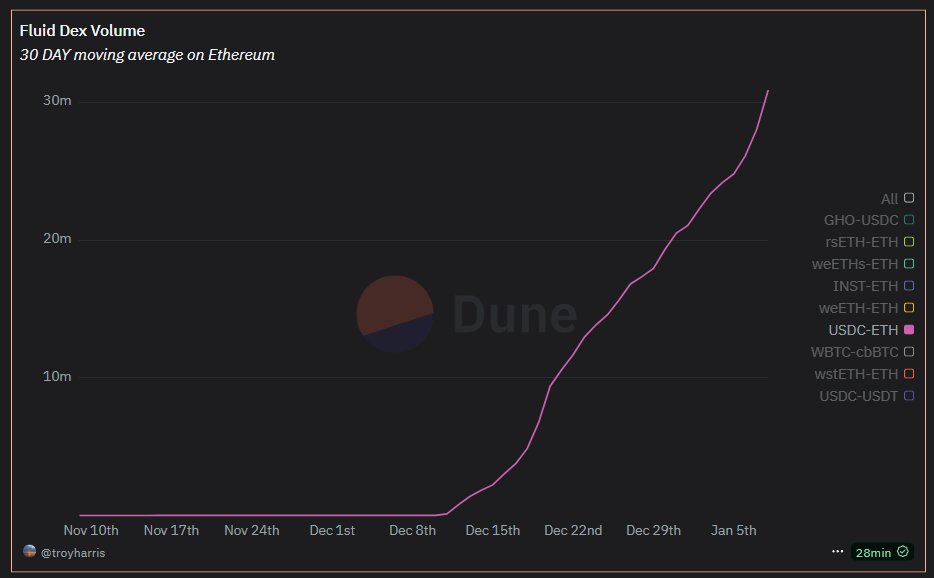

@yeak__ added that Fluid is a fantastic lending market but doesn’t see it competing on the DEX side. While I agree that Fluid has the best lending market design, I actually think it has the potential to become DeFi’s top DEX this year. Data suggests:

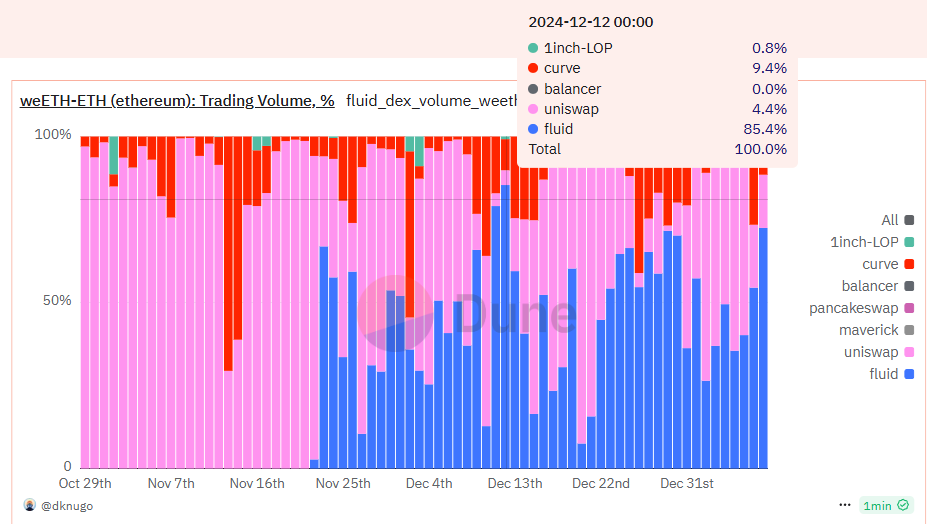

On the point about lending/borrowing demand for volatile pairs, Yeak might be right for now, but here’s why I think that’ll change. Financial markets run on efficiency, and Fluid offers unmatched capital efficiency for DEX LPs. For pegged assets, it enables up to $39 in liquidity per $1 in TVL—this is why big players like @LidoFinance and @ether_fi (look at 85% volume market share on the weETH) are moving liquidity from Uni to Fluid.

For volatile assets (like ETH-USDC), users can leverage 3x safely, get 5x liquidity (3x SC + 2x SD), and earn 5x trading fees per $1 invested.

There also seemed to be some confusion about out-of-range liquidity and Fluid’s setup. Fluid DEX LPs earn 100% of the lending APR—it’s not about inefficiently deploying DEX LPs to lending markets and then withdrawing them for swaps while eating up gas fees. That kind of inefficiency matters on Ethereum (and less on L2s), but Fluid avoids all of it.

@ceterispar1bus made a great point: “My ideal DEX is like a v2 style where I just deposit 2 assets, capture LVR, and earn a passive yield on out-of-range assets.” That’s basically Fluid DEX v1—except all liquidity earns lending APR, and there’s no specific LVR mitigation yet.

The real challenge now? Onboarding more traders—bots, MMs, CEX-DEX arbitrageurs, etc.—because DEXes only thrive when there’s active trading. We’re already working on this with players like @wintermute_t, and once they’re fully onboarded, we’ll increase caps and roll out more pairs.

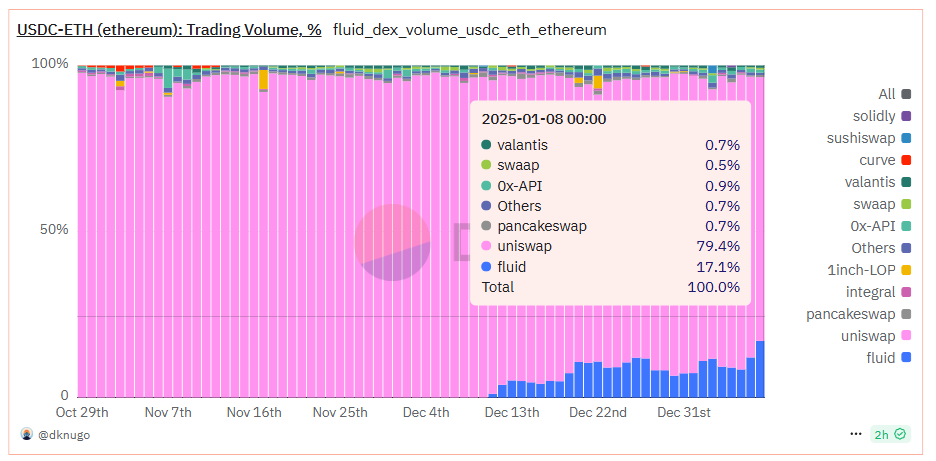

For instance, ETH-USDC currently has a 17% trading share on Ethereum but should be closer to ~30%. Once we integrate traders, we’re expecting to double or triple the volume. This will also allow LPs to earn more! The losses from rebalancing will remain the same but trading APR will double.

Now, here’s the big news: Fluid DEX v2 is on the way. Yeah, I know it sounds crazy since v1 just soft-launched, but we had v2 plans ready before v1 even went live.

Fluid DEX v2 will include everything Uni v4 offers and more. Think range orders on both debt and collateral sides, and capital efficiency that’s 10x better than Uni v4. The best part? DEX v2 is expected to launch this year, and we’re confident it’ll dominate EVM DEXes by volume.

Stay tuned—we’ll have some exciting announcements about DEX v2 soon (and probably some other new protocols on top of Fluid even earlier) 👀

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。