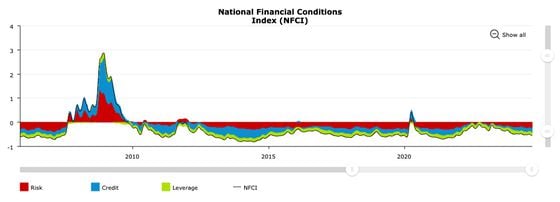

芝加哥联邦储备银行国家金融状况指数(NFCI)每周更新美国货币市场、债务和股票市场、传统和影子银行系统的金融状况。NFCI是评估金融市场健康状况的有价值工具,提供流动性、信贷可用性和市场风险的见解。该指数结构化设计,负NFCI值表示宽松于平均水平的金融状况,表明流动性更容易获得的环境。相反,正值表示严于平均水平的条件,资本获取变得更加受限。

截至9月13日的一周内,NFCI为-0.56,表明金融状况进一步放松,甚至比上周的平均水平更宽松。这种金融宽松程度自2021年11月以来就没有出现过,当时比特币(BTC)达到了2021年的高点69,000美元。

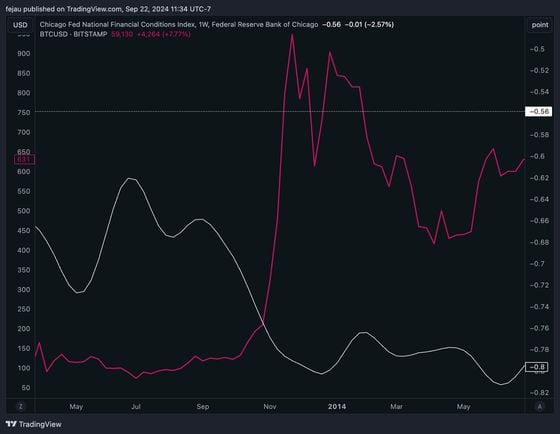

最近,Forward Guidance Podcast的主持人Fejau分享了一项关于NFCI与比特币关系的值得注意的分析。在X社区中,Fejau指出了NFCI与比特币之间的负相关性,认为金融宽松往往作为风险资产的助推力。据Fejau称,当金融状况放松时,宽松程度增加,导致风险偏好环境,包括比特币在内的投机性资产往往会上涨。

Fejau的分析跨越了几个市场周期,2013年,随着金融状况放松,比特币从7月的约100美元飙升至11月的1,000美元以上。这与NFCI指数达到约-0.80的低点相吻合,表明金融状况明显宽松于平均水平。

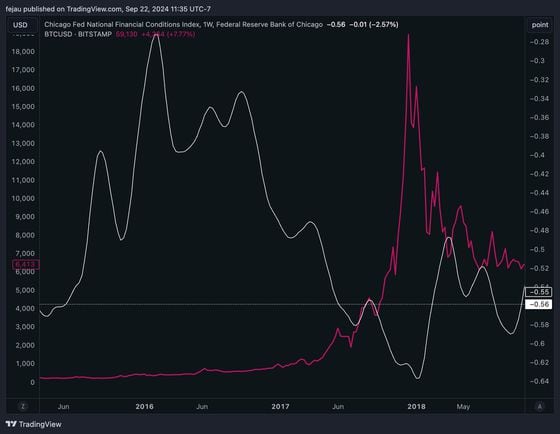

同样地,在2017-2018年,金融状况放松与比特币在2017年底短短六个月内从2,000美元飙升至20,000美元的戏剧性上涨相吻合。然而,在COVID-19大流行期间,金融状况显著收紧,是自2009年以来最严格的,导致传统风险资产和比特币的崩盘。

最近,Fejau指出,在过去的十二个月里,随着金融状况的放松,比特币再次飙升,甚至在全球央行开始降息之前,比特币就已经从25,000美元上涨至73,000美元以上。这表明过去十二个月金融状况一直很宽松。

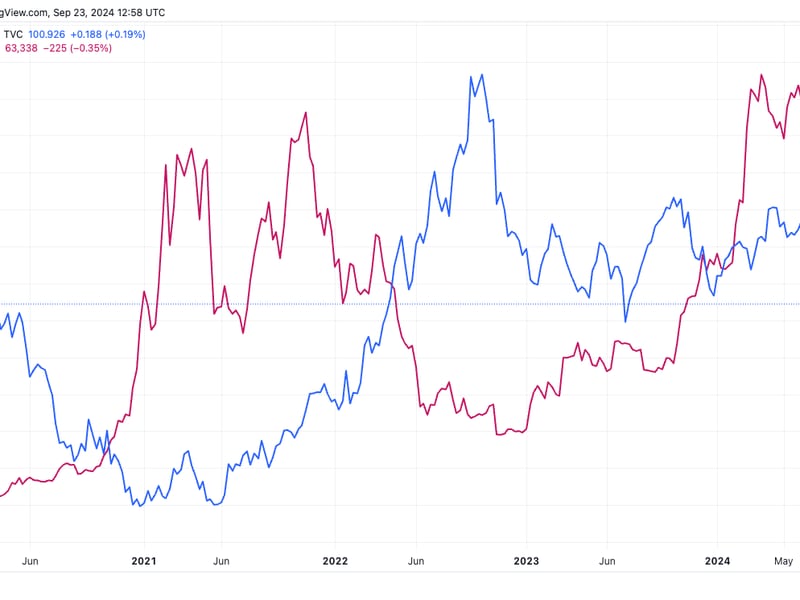

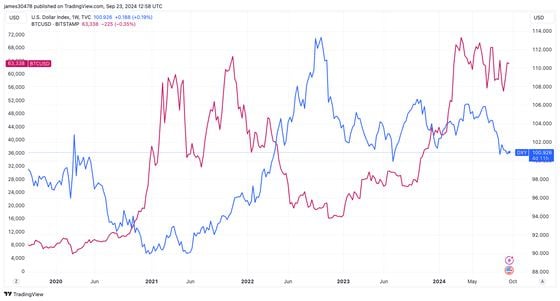

这种关系并不完全简单,其他因素如DXY指数(衡量美元强度的指标)也会影响比特币的走势。DXY指数上升往往对比特币产生负面影响,因为美元走强会使投机性资产变得不那么吸引人。

随着金融状况继续放松,对比特币和其他投机性投资的前景可能仍然积极,前提是其他经济因素保持支持性。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。