ICP 社区中频频出现“代币已死”的言论,包含着早期支持者的失望、心酸和不甘。是啊,Internet Computer 在主网上线的两年中的表现的确让人大跌眼镜,让那些一开始就将手中的 ICP 质押了长达 8 年之久的支持者苦不堪言。

如今,基于 PoS 代币的叙事 LSD 已经在以太坊(及 Layer2)、Cosmos、Solana、波卡、Polygon 等主流公链上全面开花。像 Cosmos 生态有 pSTAKE、Stride 等,波卡生态有 Acala、Bifrost 等,Solana 生态有 Marinade、Jito 等。现在,这股风也吹到了 Internet Computer 上,毕竟持有者可以将 ICP 质押在治理系统 NNS 中,参与网络治理,这也为 LSD 的发展提供了基础和空间。本文要聊的 ICP 生态项目正是一个 LSD 协议——StakedICP。

快速回顾 LSD

LSD 的全称是“Liquid Staking Derivatives”,即流动性质押衍生品,是 Crypto 行业今年最热门的赛道。LSD 是一种流动代币,相当于所质押 PoS 代币的替身。本质是为了释放已质押 PoS 代币的流动性,在随时赎回的情况下获得质押收益,并且还可以用于交易、提供流动性、借贷,获得额外的 DeFi 收益。

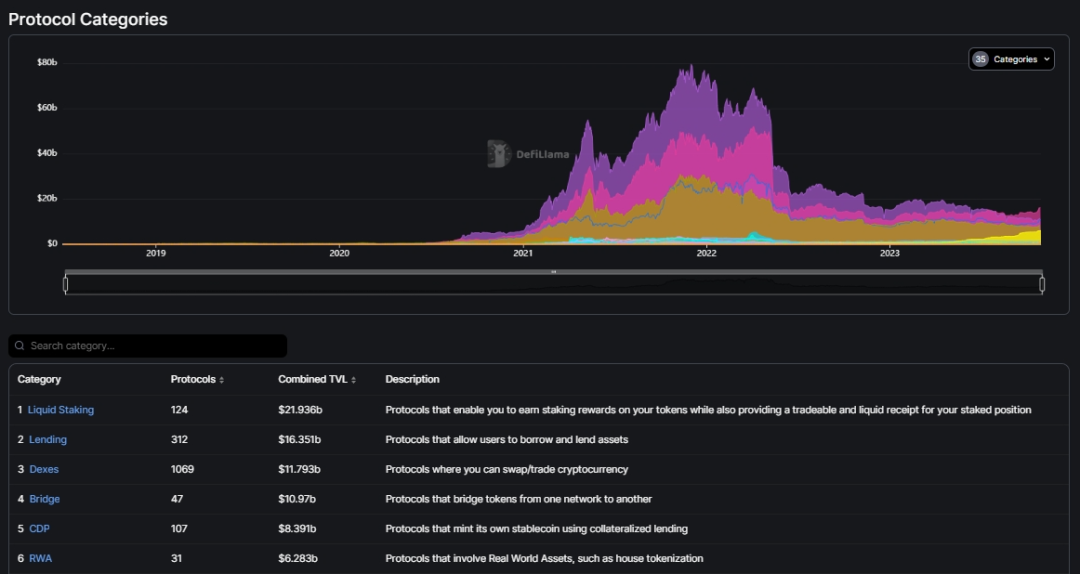

根据 DefiLlama 的数据,LSD 赛道的 TVL 接近 220 亿美元,自今年 3 月初超过借贷以来一直稳居 DeFi 的头把交椅。

LSD 协议不仅可以增强 PoS 区块链网络的安全性和稳定性,还能保持持有者管理其代币的灵活性,以激励更多的人质押他们的代币并参与 DeFi,最终使所有相关人员受益。

StakedICP 如何释放 NNS 的流动性?

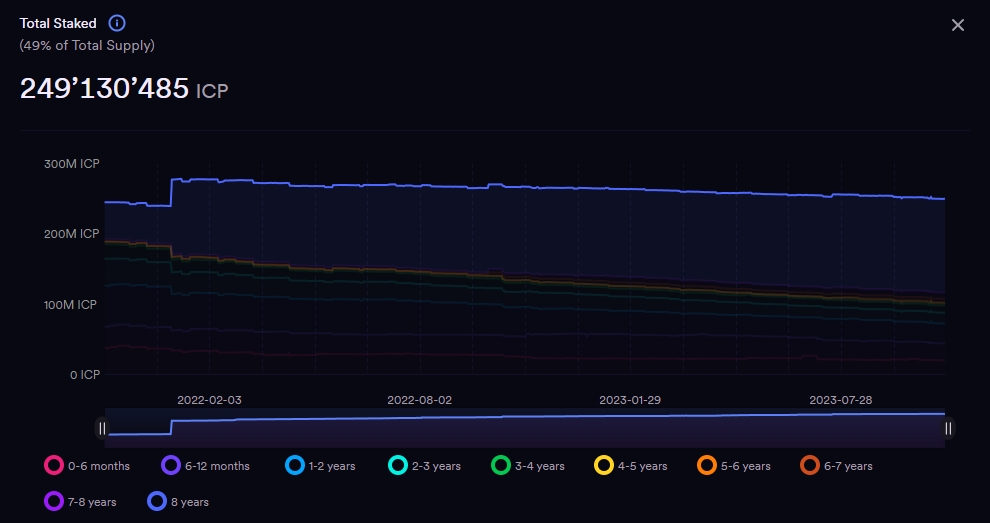

NNS(Network Nervous System)是 Internet Computer 的治理系统,负责调控网络升级、代币经济、增减子网。每一个质押 ICP 的人都会成为「神经元」,进而参与链上治理,又因参与治理而获得奖励。有些类似于 PoS 中的 Staking 行为。目前,有 2.49 亿枚 ICP 正在质押中,约占总供应量的 49%,按当前价格计算 TVL 约为 8.21 亿美元。

StakedICP 是第一个专为 NNS 神经元构建的 LSD 协议,允许用户在其上质押 ICP 后立即获得流动代币 stICP。stICP 是用户赎回 ICP 的唯一凭证,且能够捕获质押 ICP 产生的每日收益。一句话来概括:持有流动的 stICP,就是持有正在质押中的 ICP。

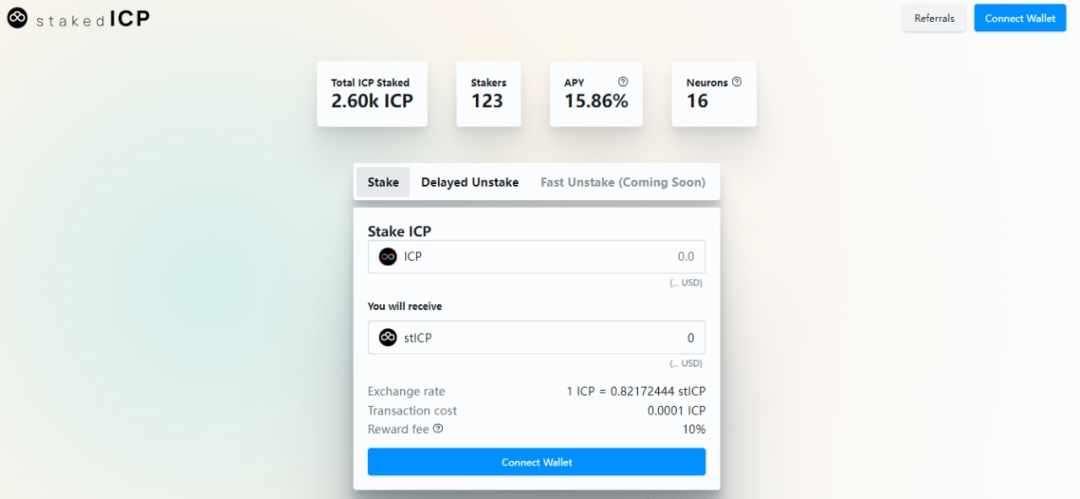

该协议目前处于测试阶段,仅有 123 名用户及质押在其中的 2600 ICP,APY 约为 15.8%。

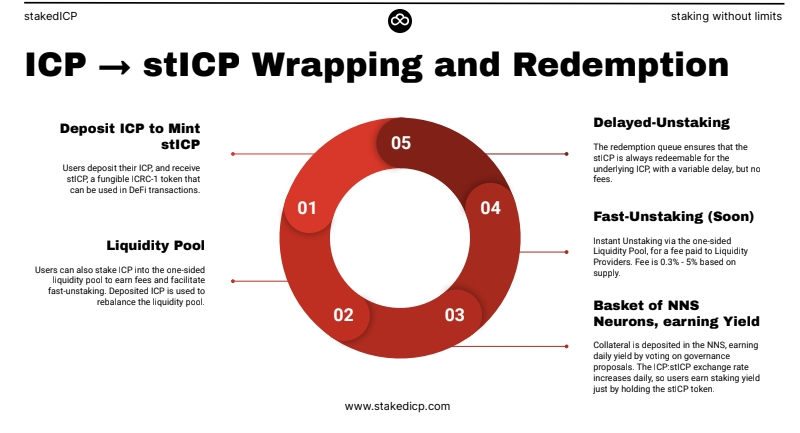

当用户使用 StakedICP 进行质押时,ICP 会通过该协议的神经元被质押在 NNS 上,同时收到用于代表质押 ICP 份额的 stICP 代币。也就是说,持有 stICP 一样可以获得 NNS 收益奖励。这是如何做到的呢?

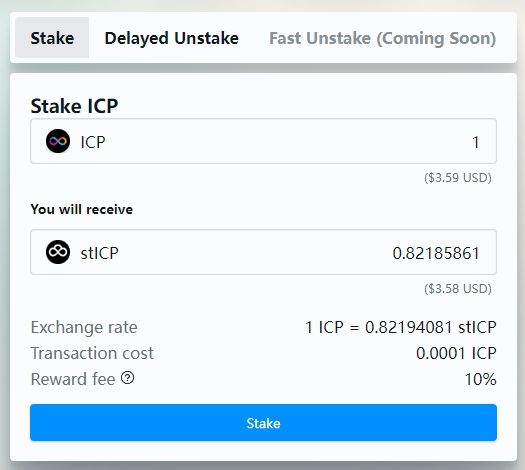

由于 StakedICP 的神经元在 NNS 的投票奖励会不断累积,这意味着 1 stICP>1 ICP,stICP 的价值相比 ICP 总是在增加。

假设我在最开始 1 ICP = 1 stICP 的比例时质押了 10 ICP,此时我收到了 10 stICP。

几年后,由于神经元在 NNS 上投票会获得奖励,因此 StakedICP 神经元中 ICP 的数量会不断增长。假设有 128 ICP 已被质押到 StakedICP,此时 StakedICP 神经元的 ICP 总和为 160 ICP。那么 1 ICP 的价值为 0.8 stICP (128/160) ;反之,1 stICP 的价值为 1.25 ICP (160/128) 。

此时,如果我选择将 10 stICP 赎回为 ICP,那么实际上可以获得 12.5 ICP,这其中包含了 NNS 投票奖励。

细细品味,StakedICP 其实可以帮助 IC 链将代币质押率拉到新的高度。

目前 IC 链正在围绕项目治理系统 SNS(Service Nervous System)发展生态,ICP 除了在 NNS 上质押以外, 还可以用于投资上线 SNS 的生态项目。但质押中的 ICP,肯定赶不上在 SNS 上打新。不少 ICP 持有者因此而放弃质押。StakedICP 实际上相当于一种更灵活的质押解决方案,通过质押 ICP 获得并持有 stICP,可随时赎回为 ICP,再去投 SNS。质押、打新两不误。

此外,当 IC 链的 DeFi 生态发展起来后,有机会为 stICP 提供更多的应用场景,这就是 LSDfi。届时 stICP 可以被交易,甚至是借贷、理财。在获得质押收益的同时,还能获得流动性参与到 DeFi 中获得额外收益,用户会怎么做?冲?可以预见 ICP 的质押率会大幅上涨,IC DeFi 生态的规模也将进一步增长。

StakedICP 如何使用?

质押

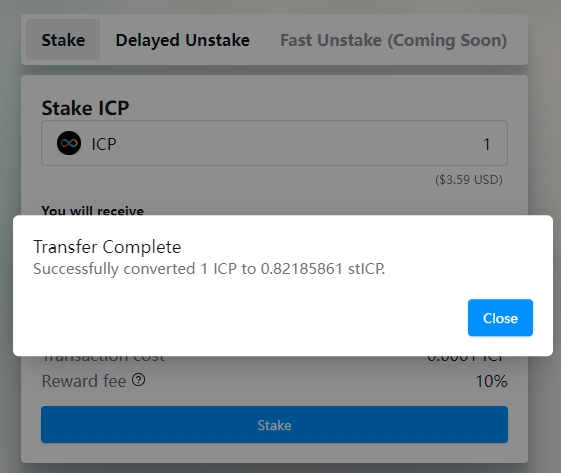

目前 StakedICP 的质押功能已可用。用户可以在 StakedICP 上质押 ICP,获得 stICP。

赎回

目前 StakedICP 只能 Delayed Unstake,延迟解除质押。当用户使用此方法赎回 ICP 时,StakedICP 会销毁 stICP,找出要分裂的神经元并开始溶解以尽快完成 ICP 的赎回。这可能需要花费一些时间(取决于神经元)。StakedICP 共有 16 个神经元,质押时长从 6 个月、1 年、1.5 年到 8 年不等,以维持赎回功能的流动性。

还有一种快速赎回的功能正在开发当中,叫做 Fast Unstake,快速解除质押。简而言之,StakedICP 会为 stICP/ICP 构建一个单边流动性池,LP 可以将他们的 ICP 添加到流动性池中赚取交易手续费奖励。当用户想要用 stICP 赎回 ICP 时,只需要在池子里交换即可。

风险

StakedICP 还在早期开发阶段,存在中心化风险。在 2022 年上线的 StakedICP v1 中,为了更快地测试产品,神经元和智能合约都由开发团队直接控制。在 2023 年 5 月启动的 StakedICP v2 版中,用于质押 ICP 的 16 个神经元不再由开发团队直接控制,而是由智能合约本身控制(投票跟随公开神经元 Synapse)。然而,由于需要继续构建,智能合约仍然由开发团队管理。这一缺点有望在最终产品正式上线后得到解决,StakedICP 将上线 SNS 公募,由 SNS 接管智能合约,社区参与治理。

StakedICP 创始人:迫不及待看到 IC 上的 LSDfi

最近,白泽研究院在线上简单采访了 StakedICP 的创始人 0xAegir,与他聊了聊对 StakedICP 的未来、IC 链上的 LSD 和 LSDfi 的看法。

请向大家介绍一下自己

我是 StakedICP 的创始人 0xAegir,拥有 15 年开发经验。

您做 StakedICP 的初衷是什么?

最初,我只想获得将 ICP 质押在 NNS 的 8 年高额收益,但却不想感受因代币锁定 8 年而会遭受的痛苦。但是,随着 StakedICP 的发展,我预想到了 stICP 这种又可以产生收益又可流通的资产会为 IC 生态系统带来巨大的好处。所以我真的很期待看到 IC 生态系统中的 DeFi 开发者在 stICP 之上构建一些新的用例。stICP 只是 LSD,但最新的 Crypto 叙事焦点是 LSDfi。

请向大家讲解一下 StakedICP 的运行原理

当你将 ICP 存入 StakedICP 时,你会收到 stICP。ICP 被抵押在 NNS 中,并随着时间的推移通过投票奖励而增长。只需持有stICP,你就可以从投票奖励中获得不断增长的 ICP 收益。stICP 是一种“ICRC-1”代币(正如以太坊代币标准 ERC-20),因此可以被集成在 DeFi 中交易、出售和使用。当你想要取消质押时,你目前可以使用“延迟取消质押”功能,或者等几个月后使用新开发的“快速取消质押”功能。

下图为 StakedICP 最终的核心功能:

目前你们是如何管理被锁定在 StakeICP 中的 ICP 的?

在 StakedICP 中质押的 ICP 又被质押在了 NNS 上的一组神经元中。去年五月,我在 IC 上推出了第一个可以托管神经元的智能合约(https://github.com/AegirFinance/canister-owned-neuron)。这意味着智能合约本身可以使用 IC 的阈值 ECDSA 技术来控制并完全拥有神经元。如果你是像我一样的书呆子,那就太酷了。因此,StakedICP 的神经元只能由智能合约控制,我们致力于在上线 SNS 后将智能合约的控制权转交给社区。

请向大家分享一下 StakedICP 的未来发展路线图吗?

2023 年 12 月 - 核心协议代码完成

我目前正在努力实现 Fast Unstake,这一核心功能为 IC 社区的广泛采用提供了巨大的可能性。

还有其他一些功能需要完成,但我的目标是在 12 月之前完成所有工作。

2024 年 1 月 —— Fast Unstake 功能进行内测

2024 年 4 月 —— 完成代码审计

为了准备上线 SNS,一旦 StakedICP 各项功能通过测试,那么将进行正式代码审计。

2024 年 6 月 —— 上线 SNS + 流动性激励

我希望 StakedICP 会成为 IC 链 DeFi 生态的重要组成部分。StakedICP 治理代币 STKD 的推出将使该协议能够充分发挥其潜力,并由社区直接治理。

我很感兴趣的一点是,能否在 stICP 的基础上实现 LSDfi,例如让 stICP 被更多 DeFi 借贷项目采用,基于 stICP 做稳定币等等。您是否已经有了一些想法或计划?

我对此也非常感兴趣。LSDfi 叙事才刚开始,我迫不及待地想看看人们会在 stICP 的基础之上提出什么想法。

就我个人而言,我最兴奋的是那些让人们“加倍努力”、“再投资”和发展 IC 生态系统的事情。我个人很乐意看到有人将 stICP 与 SNS 相结合,仅仅是一种简单的 stICP → ICP 兑换系统,可以让 ICP 忠实信徒不仅仅在平时持有 stICP 被动赚取收益,还可以在 SNS 上新后直接用 stICP(自动转换为 ICP)参与公募,而不必被迫选择。

稳定币也是一个有趣的维度,我曾与希望在 stICP 基础上构建稳定币的人进行了一些有希望的对话,但现在还处于早期阶段。尽请期待。

不妨让我们大胆想象,当 StakedICP 发展的足够大,能为 IC 链和 ICP 生态带来什么?

寻求为自己持有的 ICP 获得收益的方法,在 IC 链上最常见的就两种:

- NNS 质押

- 投资 SNS 项目

但是这两种方式却不能同时进行。

你是否将自己的 ICP 在 NNS 质押了 8 年,虽然获得了巨大的质押奖励,但却被排除在所有其他机会之外?还是自己保存 ICP,等待在 SNS 上打新,投资生态系统项目?

我认为 stICP 可以提供更灵活的收益替代方案,帮助人们以新的方式进行再投资并真正全面投入 ICP 生态系统。其次,从上个问题开始,我真的在很认真思考 LSDfi 的走向。由于 IC 链有着独特的技术属性,例如反向 Gas 和 HTTPS outcalls,ICP 有巨大的机会将 DeFi 引入被封锁的 Web2 世界。其他链上已经出现了一些有趣的 LSDfi 和 RWA 创新服务,例如自还贷款和零利率贷款,那么我们如何实现落地?或者说,我们如何以廉价、高效、轻松的方式向世界各地用户提供这些新服务呢?我想一切尽在 Internet Computer。

注:

由于公众号改版,文章不再定时推文

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。