a16z crypto 一直是加密行业最前沿、最知名的顶级投资机构,拥有超过 70 亿美元的资金用于投资加密项目和技术。截止撰写本文时,a16z crypto 已在今年投资了跨不同领域的 26 个项目,包括 DeFi、基础设施、游戏、L3、互操作性等。

最近,a16z crypto 发布了博客文章《我们对加密技术感到兴奋的几件事(2024)》,展望了 2024 年加密行业值得关注的 9 个关键叙事。

迈入去中心化新时代 → DAO 的治理水平将进一步提高

重构未来的用户体验 → 告别繁琐的界面,简化用户体验,让每个人都可以轻松访问 dApp

模块化技术堆栈的兴起 → 开发者将拥有比以往更大的灵活性,能够使用可互操作的组件构建自定义应用程序

AI+区块链 → 人工智能与区块链技术将进一步融合,释放创新新可能

“为赚而玩”变成“边赚边玩” → Web3 游戏的重心将从赚取奖励转向简单地享受玩游戏的乐趣

当 AI 成为游戏制造者时,用加密货币提供保障 → 加密货币将为由 AI 驱动的游戏提供安全性和透明性

正式验证变得不那么正式 → 新的工具和技术将使验证智能合约的安全性变得更加容易

NFT 成为无处不在的品牌资产 → 品牌将越来越多地利用 NFT 与客户建立联系和忠诚度

SNARKs 成为主流 → 零知识证明将变得普遍,实现私密且安全的交易。

细思这些叙事,除了有 2 点是 AI 与区块链、加密货币的结合外,其余都是围绕一个目标,那就是在目前可能已来的牛市周期中获取主流用户,实现 Web3 的 Mass Adoption。就像 2021 年 NFT 出圈一样,下一个牛市将取决于新用户的采用。不论是模块化区块链、零知识证明这种提升链性能和扩展创新的新基础设施,还是重构用户体验(UX)、品牌采用 NFT、转变 Web3 游戏内核这些具体手段。而在这其中,重构用户体验是获取主流受众的最快路径。

简化用户体验是 Web3 实现大规模采用的基石

对于加密原生用户而言,将钱包连接到 Uniswap 进行代币交换,然后将目标代币转移到 dApp 上进行质押、Farm,很简单。但对于第一次涉足 Web3 的主流用户而言,情况就不同了。

什么是 Gas?在哪里买原生代币用于支付 Gas?交易批准?最终确认?

如果想要在多条链上使用不同的 dApp,新的问题也会接踵而至,什么是 Polygon?怎么把代币从以太坊跨链到它上?

如果新用户想与链上dApp交互,这些相当深奥和高度技术性的概念/术语是必须涉及到的,因此他们需要先学习和了解。

目前账户抽象中的智能合约钱包,为用户提供社交媒体登录、社交恢复等接近 Web2 产品体验的服务,既摆脱了私钥/助记词的束缚又提高了安全性。而其拥有的批量交易、Gas 代付等功能,又一定程度上降低了用户使用 dApp 的门槛。

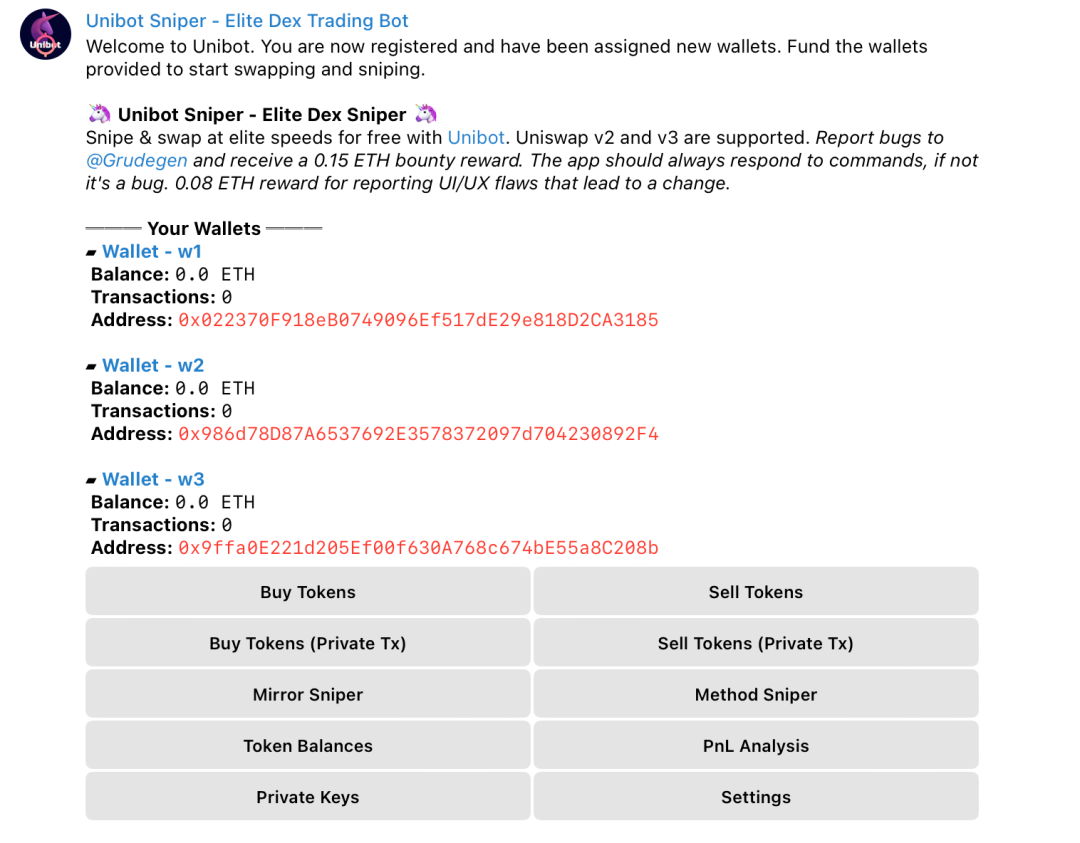

今年非常流行的 Telegram 交易机器人则为用户提供了一种交互 Web3 的新方式,被广为看好是转化 8 亿 Telegram 用户进入 Web3 的重要渠道。通过 Telegram 交易机器人,用户不需要在各个 dApp 之间来回切换,就可以一站式甚至一键体验交易、分析、自动刷空投交易、资产跨链等服务。为简化交易体验而生的 Telegram 交易机器人,实则是为用户提供了一个核心优势—— Intent(意图)。用户只需表明他们想要交易什么,怎么做的问题由机器人自动处理。

因此 Telegram 交易机器人可以算作是第一波落地的 Intent-Centric 产品。

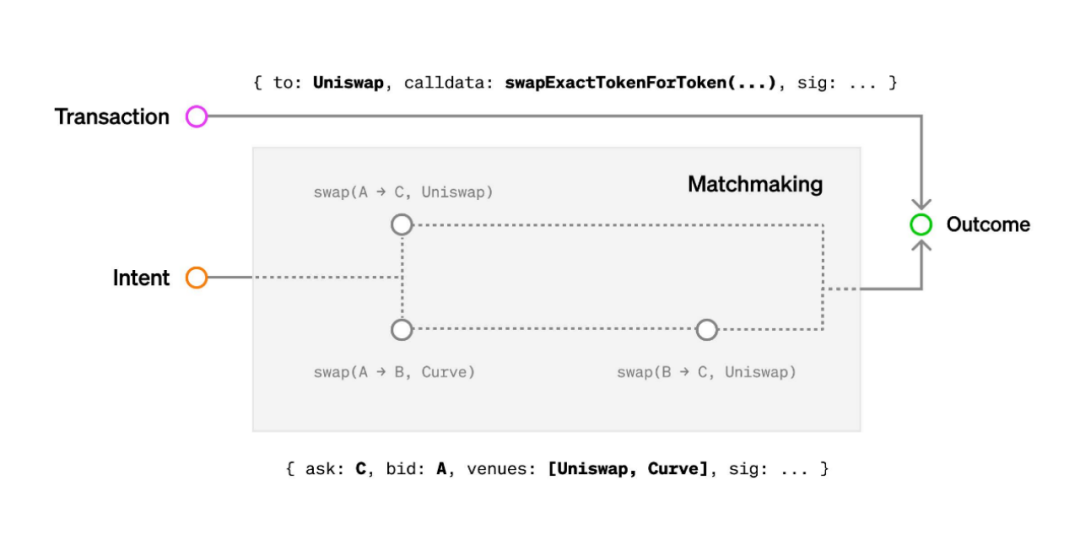

今年 7 月,Paradigm 提出的 Intent-Centric(以意图为中心)概念一炮而红,相关产品如雨后春笋般涌现,不乏各种 L1、DeFi 和基础设施。Intent-Centric 强调用户的「意图」,即用户只需表达他们想要什么结果,而无需关心实现结果的过程是怎样的。如果把 Intent-Centric 产品想象成一个大盒子,大家把各自的「需求」都投进去,solver(求解器)相互匹配这些「需求」,为每一个「需求」制定最优交易路由,然后将「需求」实现的结果还给每一个人。相同的是结果,不同的是实现交易过程的人。

如果说账户抽象消除了“账户”这个概念,那么 Intent-Centric 可以说是一种更高阶的抽象,消除了用户交互区块链和 Web3 所面临的主要障碍。下面我们以 Intent-Centric 项目 dappOS 为例,深入理解简化用户体验对于 Web3 新用户来说的便捷性和重要性。

dappOS:重构 Web3 操作体验

dappOS 是一个以用户意图为中心的操作协议。通过成为用户与公链、跨链桥等加密基础设施中间的「意图层」,为用户提供一键友好的交互体验。

当 Intent-Centric 概念爆火后,dappOS 因曾获得 Binance Labs 的种子前融资以及紧接而至红杉中国、IDG Capital 领投的种子轮融资而迅速成为中文 Crypto 社区最热门的项目之一。其他参投方还包括 OKX Ventures、HashKey Capital、KuCoin Ventures 等。

笔者认为 dappOS 的 Intent-Centric 叙事可以从两个层面来理解。

- 一个以用户意图位中心的操作协议,实现了链抽象,不用切换钱包和网络,一键交互不同链的热门 dApp,无缝衔接公链热点

- 一个全新的链上流量分发端,帮助新公链快速建设生态,抹平用户参与新生态时的门槛

一个以用户意图为中心的操作协议

目前,服务能力和响应速度更优秀的新公链成倍增长,伴随着特定应用场景,例如实现灵活扩展的 Avalanche、做隐私保护的 Manta Network,亦或是已有将近50款游戏的链游专用链Oasys,用户不得不为使用每一条公链创建一个又一个的钱包,而且也面临着资产碎片化的困扰。与其经常将资产从 A 链跨链至 B 链,倒不如在 A 链和 B 链都放上一部分资产。

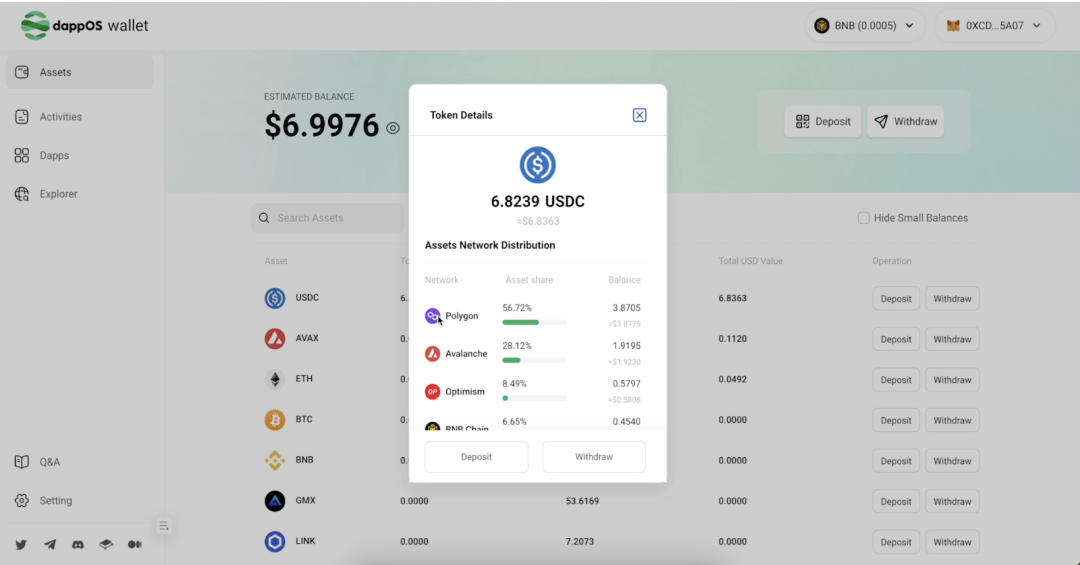

从这个角度入手,受操作系统启发,dappOS 致力于成为 Web3 操作协议,或者说是 dApp Store,将公链、跨链等这些复杂且繁琐的概念和流程全面抽象,用户仅在这个“中央枢纽”中就可以轻松访问多条链的 dApps,使用任何链的资产参与到另一条链的 dApp 中。即,A 链资产可以直接在 B 链的 dApp 中使用。

在目前的 V2 版本中,dappOS 已集成的热门项目包括 Perpetual、BENQI、QuickSwap 和 Stader。根据路线图,待集成的热门项目包括 SyncSwap、Curve、DeFi Kingdom、Frax Finance、GMX、Lido 等。

dappOS 依托于 dappOS Account,即“统一账户”(智能合约账户)。统一账户允许用户直接管理所有链的资产总额,像 ETH、USDT、USDC、DAI 这样的常用代币可以在任何链上的任何 dApp 中通用,例如一键使用 BNB Chain 的 USDT 在 Optimism 的 Perpetual 上做永续合约。

我们以 dappOS 最早集成的 Perpetual 为例,这是一个基于 Optimism 的永续 DEX。

首先让我们看看用户在 Optimism 上使用 Perpetual 和在 dappOS 上使用 Perpetual 有什么区别?

在 Optimism 上:

1. 将 $ETH 在 Uniswap 上交换为 $USDT

2. 将 $USDT 从以太坊跨链至 Optimism

3. 将少量 $ETH 跨链至 Optimism,用于支付交互所产生的 Gas 费用

4. 在 Perpetual 中存入 $USDT 或 $USDC,开始使用

这套资产转移流程操作下来几乎需要花费半个小时的时间,新用户往往会半途而废。

在 dappOS 上:

将以太坊、BNB Chain、Avalanche、Polygon 等链上的 $USDT 或 $USDC 直接存入 Perpetual,开始使用

一次操作,仅花费 5 分钟。

综上,dappOS 通过统一账户、dappOS Network 实现了 Intent-Centric,大大简化了用户体验。

一个全新的链上流量分发端

dappOS 在过去几周一直都是 Manta Network 按交易量排名前三的 dApp,每周带来超过10万笔交易量。大家应该不会对 Manta 感到陌生,明星 ZK 模块化区块链,拿到过 PolyChain Capital、Spartan 等顶级投资机构的融资。笔者相信 Manta Network 与 dappOS 的官方合作起了大作用,因为从其他链上而来的 dappOS 用户也是一股不可小觑的力量。

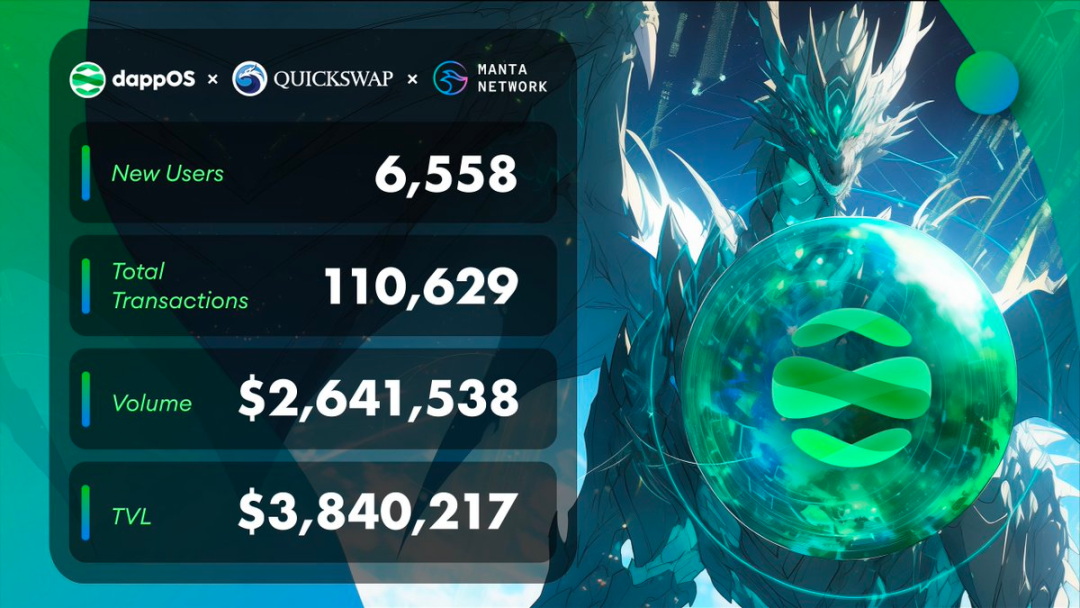

另外,QuickSwap 集成 dappOS V2 后,两周 TVL 增长超 384 万美元,交易笔数增长 110,629 笔,新增用户 6558 名。此外,dappOS 用户在 QuickSwap 上添加的流动性总金额达到 3,840,217 美元,占 QuickSwap 在 Manta 上 TVL 的 41.02%,交易量达到 2,641,538 美元。

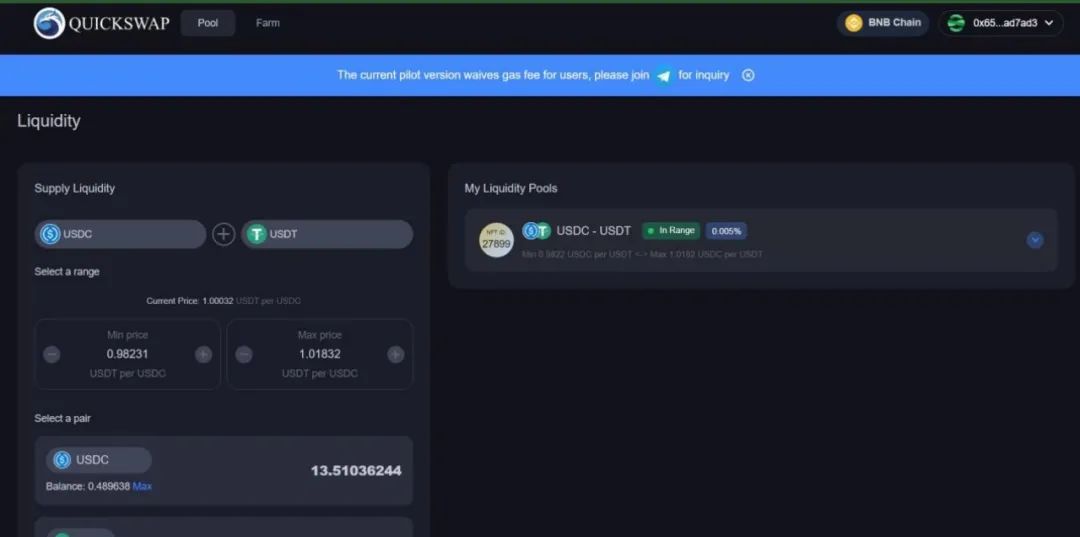

笔者也是第一时间在 QuickSwap 上进行了体验,几次 Swap 和组 LP 下来,感觉在 dappOS 上使用 QuickSwap 的 Gas 很低,全程损耗不超过 1 美元。dappOS 支持用户从以太坊、Arbitrium、Avalanche 等链无缝交互 Manta 网络的 QuickSwap,而且整体费率最高可以下降 85%。即便是新用户,在 Intent-Centric将交易化繁为简的基础上,只需理解简单的 Swap 和流动性挖矿,也能参与空投交互。

在多链发展已成定局的今天,一个 dApp 自身很难把现有用户和流量分发到所部署的新公链上,原因就在于前文提到的资产碎片化问题。就以 QuickSwap 为例,dappOS 可以让 Polygon 的用户一键使用现有资产交互零资产的 Manta Network,或者其他任何支持的公链。通过化解资产碎片化窘境,来实现 QuickSwap 的流量分发。

同样的,当前一个新公链想要快速引入新用户,分取公链之争中的一块蛋糕,都在做的是经济激励,不论是引人遐想的代币空投,还是秀色可餐的生态交互基金。最典型的例子就是拥有 230 万独特用户的 zkSync 和短短十天吸引 7 亿 TVL 的 Blast。为什么要这么做?也是资产碎片化的原因,用户资产不跨链,就无法使用新公链。就以 Manta Network 为例,在 Intent-Centric 的基础上,dappOS 允许不论是哪条链的用户,都可以使用现有资产在 QuickSwap 中交互。

根据 dappOS 与 Manta 的合作公告,双方将共同提供 1000 万美元的资金,以支持 Manta 的 dApp 生态建设。预计很快 Manta 生态系统中会出现更多集成 dappOS 的新应用。随着 Manta 生态的繁荣发展,将会有更多用户通过 dappOS 快速融入 Manta,成为长期用户。

因此,从这个层面来看,dappOS 可以成为一个全新的链上流量分发端,能够支持 dApp 和公链快速吸引用户。

dappOS 的三重空投预期,顺便埋伏一下

简单来说,在 dappOS 上交互 Manta Network 生态中的 dApp(现在只有 QuickSwap),有很大机会博 Manta Network 的空投。因为使用其他链资产实际交互时,资金存入和交易确实存在(由求解器来处理)。同样,还有两个围绕 dappOS 的空投预期值得关注。

一个是 dappOS 官推暗示会在 12 月会举行新一期的 Rewards 空投。Rewards 可以理解为是“交易赚取”,对持续在 dappOS 上交互某个 dApp 的用户进行 USDT 奖励。上一期 Rewards 的 dApp 是 Perpetual,为期一个月。笔者在 Twitter 上观察了一下,一般交互几笔的用户都能拿到 80 USDT 空投,交互多的能拿到最高 1000 USDT。

另一个当然就是 dappOS 的原生代币,虽然没有明确提到或暗示过会有,但豪华投资阵容还是值得我们去埋伏一下。这个不必刻意去刷交互,跟着官方的活动或者 Rewards 去做,不仅能拿 USDT 空投,而且不论是在什么时候快照都不必担心被落下。

关于如何使用 dappOS,我在 Google doc 上制作了一个简单的教程,以还在热门的 Manta 网络QuickSwap 为例:

https://docs.google.com/document/d/1hBu1bsTWrCE2Fs3FzTL1bjDNqG8gQ_VbPZV_IlVDacM/edit?usp=sharing

结语

Web3 代表了应用程序信任属性的范式转变,将权力从中心化中介机构下放给用户社区。但与任何创新技术一样,在实现全球大规模采用之前,Web3 必须先克服掉种种障碍。简化用户体验是其中最重要的一点。

就像 dappOS 解决了我们常常自嘲的一个问题,“怎么教你的长辈快速上手 Web3?”打开 dappOS,创建一个“统一账户”,存入一些 USDT。打开就像微信小程序一样的 dApp 聚合界面,开始交易。像中心化交易所一样,多链资产互通,操作丝滑,简单。

先易用,再常用。

2021年,NFT 的出圈让 Web3 获得了全球瞩目,彼时的简化用户体验不过是纸上谈兵。大量涌入的新用户对学习技术术语的需求,催生了一大批加密教育博客。

随着账户抽象、Intent-Centric 的出现,a16z的重点关注,简化用户体验再次回到台前。Web3 新用户可以不用学习复杂的术语就使用 dApp 吗?Web3 新用户可以在不查资料的情况下,只需五分钟就可以完成一次交互吗?当全世界的注意力再次转向 Web3 时,整个行业能够准备好以更低的准入门槛吸引下一个十亿用户吗?我们拭目以待。

注:

由于公众号改版,文章不再定时推文

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。