Today's Headlines:

- CFTC Sues Voyager Co-Founder for Fraud

- G20 Joint Communique: Adopting the Roadmap Proposed in the Comprehensive Document as the G20 Cryptocurrency Roadmap

- Stars Arena: Obtaining Loans from Private Investors to Offset Losses

- Caroline Ellison: Zhao Changpeng's Tweet "Triggered" FTX's Collapse, No Real "Internal Control and Isolation System" Between FTX and Alameda

- Arbitrum's Short-Term Incentive First Round of Voting Has Ended, 29 Projects Including Jones and GMX Have Won

- Tether's Current CTO Paolo Ardoino to Assume CEO Role in December

- Ethereum Validator Queue Situation Has Significantly Slowed, Wait Time for New Validators Deployment is Only Half an Hour

- Total Locked Value of DeFi Protocols at the Lowest Point Since February 2021 Due to Yields Lower Than Traditional Financial Products

Regulatory News

CFTC Sues Voyager Co-Founder for Fraud

According to The Block, the U.S. Commodity Futures Trading Commission (CFTC) has accused Voyager Digital co-founder Stephen Ehrlich of committing fraud. The CFTC stated that Ehrlich and his company lied to customers. When Voyager began to collapse, they concealed the true financial condition of this cryptocurrency lending institution. CFTC enforcement director Ian McGinley stated in a statement on Thursday, "While they claimed to safely and responsibly handle customers' digital asset commodities, they behind the scenes exposed customer assets to shocking risks, leading to Voyager's bankruptcy and huge customer losses."

The CFTC stated that Ehrlich promised customers high returns, sometimes as high as 12%. To pay the high returns, Ehrlich and Voyager transferred "billions of dollars' worth of customer digital assets as 'loans' to high-risk third parties."

Meanwhile, the U.S. Federal Trade Commission announced on Thursday that it has reached a settlement with Voyager, permanently banning it from handling consumer assets. The commission also accused Ehrlich of lying about whether customer accounts were insured by the Federal Deposit Insurance Corporation. Ehrlich did not agree to a settlement with the Federal Trade Commission, so the case against him will continue in federal court.

The G20 Finance Ministers and Central Bank Governors (FMCBG), chaired by India, issued a joint communique in Marrakech, Morocco on Friday, deciding to adopt the roadmap proposed in the comprehensive document as the G20 cryptocurrency roadmap, and to jointly mobilize more space and favorable financing to enhance the World Bank's support for low- and middle-income countries to address global challenges. The roadmap aims to enhance global financial stability and ensure effective management of cryptocurrencies within the international economic framework.

Last month's comprehensive report emphasized the need for clear tax treatment of cryptocurrency assets and recommended that countries maintain monetary sovereignty. The report stated that a comprehensive ban on cryptocurrencies is not an "easy choice," while also adding that temporary restrictions should not replace strong macroeconomic policies. Finance ministers and central bank governors' statements also called on the International Monetary Fund and the Financial Stability Board to provide regular structured updates on the progress of the G20 cryptocurrency roadmap.

Approved by UK Regulatory Agency, Microsoft Completes Acquisition of Activision Blizzard

The UK's Competition and Markets Authority (CMA) officially approved Microsoft's acquisition of Activision Blizzard, the developer of "Call of Duty," after the transaction was modified to address the agency's concerns. Under the new agreement, Microsoft will not purchase the cloud gaming rights held by Activision Blizzard, but will sell them to independent third-party Ubisoft Entertainment before the transaction is completed. The CMA believes that the restructuring of the transaction has made significant changes, essentially addressing the concerns raised earlier this year about the original transaction.

NFT & AI

The National Information Security Standardization Technical Committee has released the "Basic Security Requirements for Generative AI Services" (draft for comments) on its official website, and is currently seeking public comments. The deadline for collecting opinions/suggestions is 24:00 on October 25, 2023. This is the first domestic normative draft specifically for the security field of generative AI, and it is also a support for the "Interim Measures for the Management of Generative AI Services" launched by the Cyberspace Administration and six other departments in July.

The draft for comments first proposes the security basic requirements that generative AI service providers need to follow, involving aspects such as corpus security, model security, security measures, and security assessment.

In terms of corpus security requirements, the draft for comments puts forward requirements from three aspects: source security, content security, and annotation security. Providers are required to establish a blacklist of corpus sources, and if more than 5% of the content from a single source contains illegal or harmful information, it should be "blacklisted."

In terms of model security requirements, the draft for comments makes strict requirements from five aspects: basic model usage, generated content security, service transparency, content generation accuracy, and content generation reliability. Unregistered basic models should not be used, and information about the use of third-party basic models should be publicly disclosed in a prominent position on the website homepage.

In terms of security measures requirements, the draft for comments puts forward requirements in seven aspects: model applicable population, occasions, purposes, handling of personal information, use of user input for training, identification of images, videos, and other content, acceptance of public or user complaints, provision of generated content to users, model updates, and upgrades.

In terms of security assessment requirements, the draft for comments provides very specific references from four aspects: evaluation methods, corpus security assessment, generated content security assessment, and content rejection assessment. For example, in the corpus security assessment, when the provider evaluates the security of the corpus, manual sampling should be used to randomly sample no less than 4000 pieces of corpus from the entire training corpus, and the pass rate should not be less than 96%.

In addition, the draft for comments also puts forward some other requirements, involving aspects such as keyword libraries, classification models, generated content test banks, and rejection test banks.

Project Updates

Uniswap Launches Android Test Wallet

According to official sources, Uniswap has announced the launch of an Android test wallet application. The application was previously only available for desktop and iOS mobile devices. According to the announcement on October 12, the new Android test wallet allows users to select tokens on different chains without switching networks. It will automatically detect the network where the token is located and switch to that network. It currently supports Polygon, Arbitrum, Optimism, Base, and BNBChain, and will be compatible with more blockchains in the future.

According to Cointelegraph, Caroline Ellison, former CEO of Alameda Research, testified in court that SBF created a memo on November 6, 2022, listing potential investors who might seek relief. According to the document, SBF claimed that Binance had been "engaged in a PR campaign against us" and "leaked Alameda's balance sheet to Coindesk."

Ellison stated that a tweet by Binance CEO Zhao Changpeng triggered the collapse of FTX. Zhao Changpeng announced in a tweet on November 6, 2022, that Binance would liquidate its holdings of FTT, leading retail investors to withdraw funds from FTX in imitation of Binance. The run on the bank caused FTX to halt withdrawals and file for bankruptcy on November 11. Ellison stated that while Zhao Changpeng's tweet "triggered" FTX's collapse, the main reason was that Alameda had borrowed $10 billion from the exchange and "could not repay it."

Regarding the business mix between FTX and Alameda, Ellison admitted that the two companies did not have a real "internal control and isolation system" to separate their businesses. From 2019 to November 2022, she considered resigning from Alameda multiple times.

Ellison also stated in her testimony that she had worked with some accountants from 2021 to 2022, but after reviewing Alameda's books, "they found themselves unable or unwilling to conduct an audit." Former CEO of FTX Digital Markets, Ryan Salame, testified that he initially prepared Alameda's balance sheet, but at some point, Ellison took over this task.

Platypus: Successfully Recovers Approximately 50,000 sAVAX and 7,000 AVAX

Stablecoin trading project Finance tweeted that a security incident occurred between 11:29 and 14:17 on October 12, Beijing time, resulting in a loss of approximately $2.2 million in the sAVAX-AVAX pool. The team suspended the fund pool at 14:50 for investigation. With the help of the security platform Supremacy, they have successfully recovered approximately 50,000 sAVAX and 7,000 AVAX from one of the attackers. The team is closely collaborating with security experts to identify and rectify vulnerabilities. The fund pool will not be restarted until these issues are fully resolved and security measures are strengthened.

Parity Technologies, the Parent Company of Polkadot, Denies Layoffs

Earlier this week, there were rumors that the company had laid off about 300 employees. Parity Technologies, the parent company of Polkadot, denied this and stated that it is seeking to transfer some existing listing functions to multiple decentralized teams within the Polkadot ecosystem, which will affect the company's personnel configuration in the coming months. It emphasized that any personnel changes related to the transition to various ecosystem-funded entities will occur over the next few months.

Stars Arena: Obtaining Loans from Private Investors to Offset Losses

Stars Arena tweeted that they are using recovered funds to offset losses. The total amount of losses to be offset is 274,333 AVAX, and 239,493 AVAX has been recovered. All expenses incurred to date will be added to the recovered funds, and the team will also obtain loans from private investors to cover the difference.

Terraform Labs Claims Potential Connection Between Citadel Securities and UST Unpegging

According to Blockworks, Terraform Labs has filed a motion in court requesting Citadel Securities to "provide certain data pursuant to a third-party subpoena," stating that this is "crucial" for its defense in a lawsuit filed by the U.S. SEC. The motion states that Terraform Labs issued subpoenas to Citadel Securities and Citadel Enterprise Americas for transaction data related to the "UST unpegging in May 2022." Terraform pointed out that public evidence indicates that Ken Griffin, the head of Citadel entities, intended to short UST around the time of the unpegging in May 2022. Terraform stated that Nansen's data helped them identify "seven so-called 'whales' who have the ability and determination to go long or short on an asset or financial instrument." Additionally, the data also showed that "a few participants discovered vulnerabilities in UST unpegging early on."

Mastercard is participating in a pilot project for central bank digital currencies (CBDC) with the Reserve Bank of Australia (RBA) and the Digital Finance Cooperative Research Centre (DFCRC) to explore potential use cases for CBDC in Australia. They have released a new solution developed in collaboration with Cuscal and Mintable, which enables CBDC to be tokenized (or "wrapped") on different blockchains. Mastercard demonstrated how this solution allows holders of the pilot CBDC to purchase NFTs listed on the Ethereum public blockchain. The process "locks" the required amount of pilot CBDC on the pilot CBDC platform of the Reserve Bank of Australia and mints an equivalent amount of wrapped pilot CBDC tokens on Ethereum. The prerequisite for the test transaction is that the buyer's and seller's Ethereum wallets and the NFT marketplace smart contract are all "allowed to list" on the platform. It successfully demonstrated the platform's ability to implement controls, even on public blockchains, as all other transfers of wrapped pilot CBDC were blocked.

The pilot project utilizes the two pillars of the Multi-Token Network launched by Mastercard in June 2023. The Mastercard Multi-Token (Multi-Token) network is currently in the testing phase.

The Ethereum modular execution layer Fuel has announced the opening of a native bridge between the Beta-4 test network and Ethereum Sepolia. The Fuel native bridge can transfer assets between L1 and L2 and utilize message portals to handle token standards such as ERC-20 and ERC-721. On L2, there are dedicated contracts for message handling and minting on Fuel. Assets deposited into Fuel may take up to 6 hours to be withdrawn back to Ethereum. The Fuel native bridge is still in the testing phase and will iterate in appearance and functionality over time.

The first round of voting for the 50 million ARB Short-Term Incentive Plan (STIP) launched by Arbitrum has been completed. According to Arbitrum rules, 29 projects out of 97 proposals will be able to participate in this incentive plan, including Camelot, Jones, Dopex, GMX, Galxe, LODESTAR, Socket, Timeswap, RADIANT, Pendle, MUX, Frax, Tally, Rysk, Silo, Stella, Good, Gamma, Umami, Abracadabra, KyberSwap, OpenOcean, Angle, Trader, Dolomite, Premia, Vertex, Perennial, and Balancer.

Previously, Arbitrum launched the Short-Term Incentive Plan (STIP) first round of voting to allocate 50 million ARB to drive network development. If the requested grants exceed 50 million ARB, they will be allocated based on the number of votes in favor of the proposal and the time the proposal was posted on the forum.

According to CoinDesk, the previously congested queue of new validators on the Ethereum blockchain has almost been completely cleared. Blockchain data shows that there are currently only 57 validators waiting to enter the network, lower than the peak of over 96,000 in early June. Meanwhile, the wait time for deploying new validators to the Ethereum network has also shortened from a peak of 45 days in early June to just 28 minutes.

Binance Leveraged Adds NTRN Asset and Opens NTRN Cross-Margin and Isolated Margin Trading Pairs

Binance Leveraged has added the NTRN asset and opened NTRN cross-margin and isolated margin trading pairs: NTRN/USDT.

Flare Network to Burn 2.1 Billion FLR to Support Ecosystem Health

According to CoinDesk, the development team of Flare Network has announced that they will burn 2.1 billion FLR tokens, which is 2% of the total supply, to support the development and overall health of the ecosystem, prevent dilution of community token holdings, and incentivize new users to join the network.

A portion of the tokens planned for burning has been allocated to early supporters of Flare. After reaching an agreement with these entities on how the first Flare Improvement Proposal FIP.01 should affect the distribution of tokens to shareholders, these tokens will no longer be distributed. Approximately 198 million FLR will be burned immediately, and an additional 66 million FLR will be burned monthly until January 2026. At the time of writing, the trading price of FLR is $0.0094, and the total value of the burned tokens is approximately $20 million.

According to Decrypt, THORSwap has resumed trading of its native token RUNE and updated its "Terms of Service," adding "some additional protective measures" to prevent illicit fund flows and comply with legal requirements, and blocking users from sanctioned countries.

Some users quickly expressed concerns about the new rules, stating that they contradict the principles of decentralization. Cryptocurrency researcher Matt Ahlborg replied to THORSwap, stating that blanket bans are unethical as they would negatively impact "hundreds of millions of innocent people." A THORChain supporter responded, saying that users from sanctioned countries can use other applications instead of THORSwap, as it is built by a "U.S. team" and "must legally comply."

Last Friday, THORSwap announced that it would temporarily transition to maintenance mode due to illicit funds using THORChain. Since THORSwap suspended trading, RUNE has been on a downward trend, with a 27% decrease over 7 days, dropping from $2.03 to a low of $1.48. Following the announcement, THOR also rose by 11.5%.

Big Time: Fixing Blind Box System Bug, Temporarily Freezing Some Player Accounts

PANews reported on October 13 that the official personnel of the blockchain game Big Time stated in the community that the server overload recently caused a bug in the blind box system that allowed for repeated openings. To avoid issues, the technical team temporarily froze some player accounts (accounts that did not view the blind box may also be affected). The accounts will be unfrozen after the bug is fixed.

Tether's Current CTO Paolo Ardoino to Assume CEO Role in December

PANews reported on October 13, according to The Block, that Tether's current Chief Technology Officer Paolo Ardoino will be appointed as CEO in December. Tether's current CEO Jean-Louis van der Velde will become an advisor to the company and retain his position as CEO of Bitfinex. Ardoino will continue to serve as Chief Technology Officer of Bitfinex and Chief Strategy Officer of Holepunch.

Funding News

Singapore Wallet Provider Account Labs Raises $7.7 Million, Led by Amber Group

According to Decrypt, Singapore wallet provider Account Labs has announced the completion of a $7.7 million funding round, with leading investors including Amber Group, MixMarvel DAO Ventures, and Sequoia Capital. This strategic investment comes alongside the launch of the consumer-centric application UniPass Wallet, which is a self-service wallet focused on peer-to-peer (P2P) stablecoin transfers. The wallet will also utilize account abstraction to improve the user experience.

Key Data

Whale Long on WBTC, ETH, LINK, and Other Assets on Aave Starts Selling WBTC to Repay Debt

Lookonchain tweeted that a whale long on WBTC, ETH, LINK, UNI, and MKR on Aave has started selling WBTC to repay debt. They have deposited $11 million in assets on Aave and borrowed $8.45 million in stablecoins. The health factor is 1.08, close to the liquidation risk.

Data: BTC and ETH Options Contracts Worth $640 Million and $290 Million Set to Expire Today

Greeks.live macro researcher Adam stated that on October 13, 24,000 BTC options are set to expire, with a Put Call ratio of 1.23 and a maximum pain point of $27,000, with a nominal value of $640 million. Additionally, 190,000 ETH options are also set to expire today, with a Put Call ratio of 0.71, a maximum pain point of $1600, and a nominal value of $290 million. According to their analysis, BTC continues to maintain market leadership, with a nearly 70% increase in BTC options open interest this week, with BTC put options accounting for 60% of the total, a relatively rare occurrence, while ETH continues to struggle.

Merit Circle Burns Over 35% of Total Supply of MC Tokens

Blockchain gaming guild Merit Circle announced that Merit Circle DAO has burned 368,707,273 MC tokens, accounting for over 35% of the total supply.

Suspected Upbit Wallet Currently Holds 653 Million LOOM, 50% of Total Supply

Lookonchain tweeted that the price of LOOM has surged by about 30% today. A suspected Upbit wallet has accumulated 21.42 million LOOM ($5.83 million) today. The wallet currently holds 653 million LOOM (approximately $181 million), accounting for 50% of the total supply.

DWF Labs Deposits 50 Million ORBS to Bithumb, Equivalent to $1.3 Million

According to Lookonchain monitoring, DWF Labs has just deposited 50 million ORBS to Bithumb, equivalent to $1.3 million.

According to CoinDesk, the total funds locked in DeFi protocols dropped to $36 billion on Thursday, the lowest point since February 2021, after reaching $163.5 billion in April 2022. This is due to traders withdrawing liquidity to seek lower-risk higher yields. Currently, Vanguard's money market fund offers a yield of 5.28% for clients, while the yield for staking Ethereum on Lido is only 3.3%. The risk-return ratio is extremely low compared to traditional financial products.

Vyomesh Dua, DeFi trading head at Folkvang, stated, "Yields are definitely down across the board now. But even in this low TVL situation, we are seeing a lot of activity and opportunities around developing new products. Whenever a new DeFi product gains a lot of attention, there is increased activity around the entire ecosystem, and there are exciting but short-lived opportunities to make money. But the scale of opportunities is limited given the capital that can be deployed in this space today."

PANews APP Points Mall Officially Launched

Free redemption of hardcore prizes: imKeyPro hardware wallet, First Class Cabin research report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections, first come, first served, experience now!

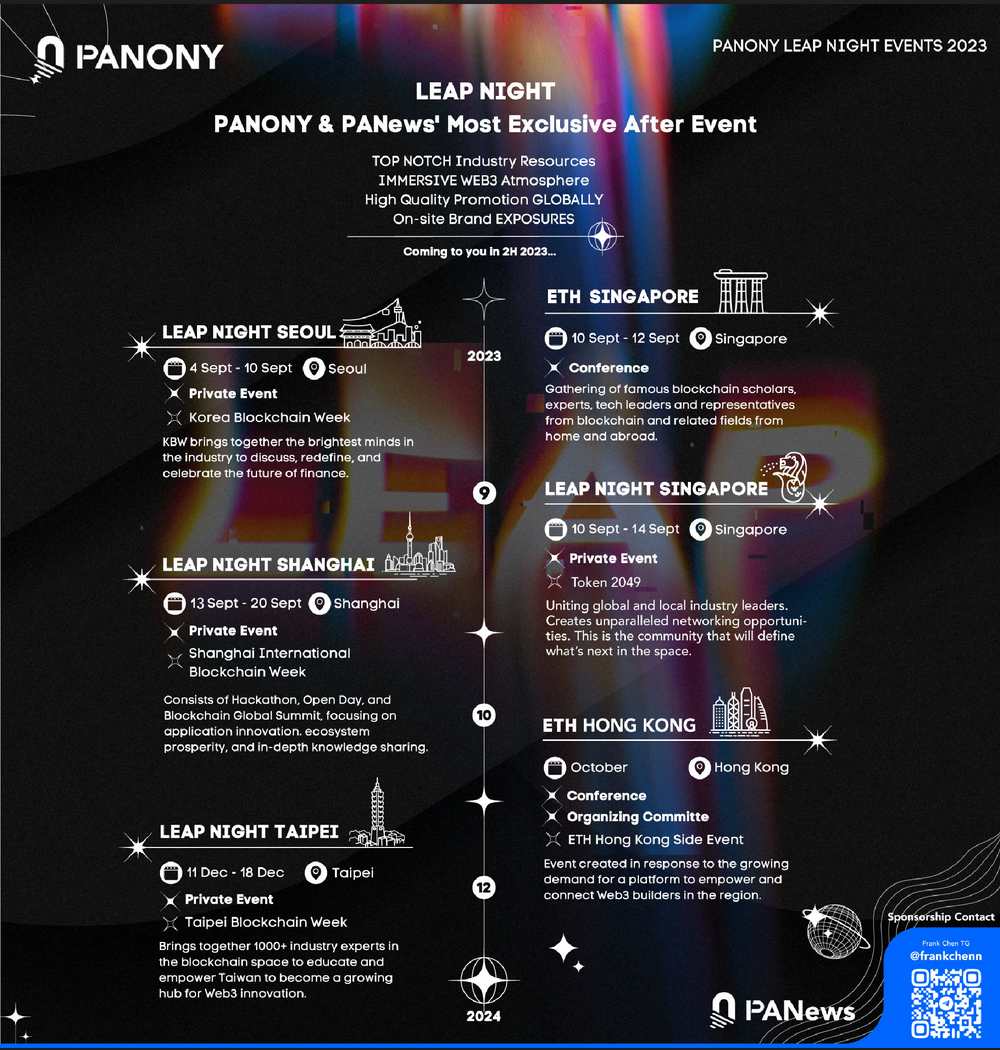

PANews Launches Global LEAP Tour!

South Korea, Singapore, Shanghai, Taipei, multiple locations will gather from September to December to witness a new chapter in globalization!

?Events in multiple locations are being built together, welcome to communicate!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。