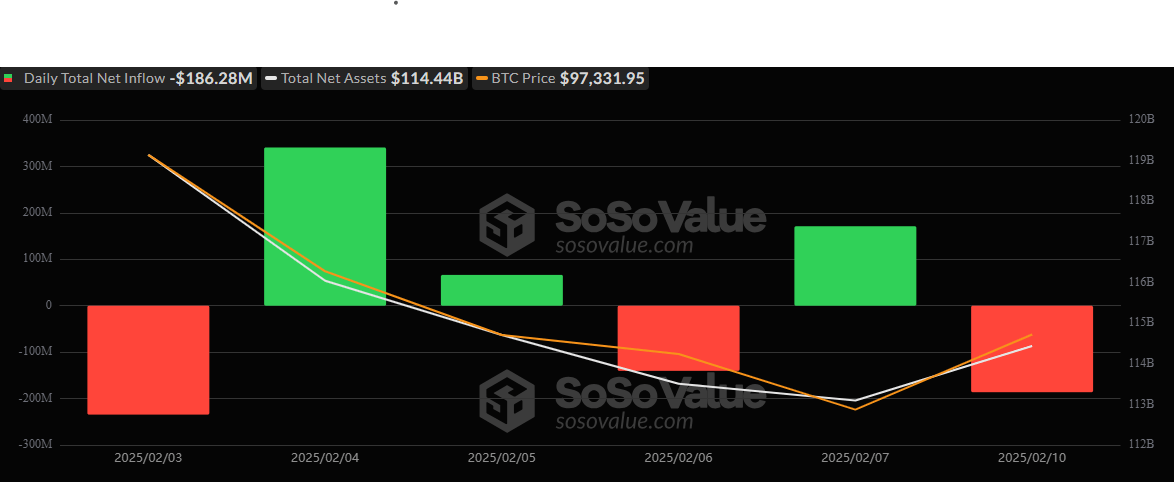

本周的开始为加密货币交易所交易基金(ETF)带来了情绪的变化。根据Sosovalue的数据,2月10日星期一,比特币ETF记录了1.8628亿美元的净流出,而以太坊ETF则有2246万美元流出市场。

这一变化与前一周的趋势相反,当时比特币和以太坊ETF经历了大量的资金流入,而当前的流出则表明投资者情绪或获利了结活动的变化。

富达的FBTC引领了流出,资金流出达到1.3609亿美元,而灰度的GBTC则有高达4626万美元的提款。Invesco的BTCO、富兰克林的EZBC和Vaneck的HODL也都有相应的流出,分别为3403万美元、1975万美元和551万美元。当天唯一的资金流入来自黑石的IBIT,该基金吸引了5536万美元。

在以太坊ETF方面,唯一的流出记录在灰度的ETHE,该基金当天结束时亏损2246万美元。其他以太坊ETF没有资金流入或流出。

尽管出现了这些流出,整体加密市场仍然活跃。截至2月10日,比特币的交易价格约为98,100美元,较前一天的收盘价略有上涨,而以太坊的价格约为2,701美元。

虽然单日的数据可能无法确立明确的趋势,但持续的流出可能表明市场情绪的更广泛变化。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。