小时图显示XRP在$2.30和$2.40之间波动,形成一系列上升的低点,预示着突破的可能性。$2.45的障碍迫在眉睫,$2.50附近的阻力更为强劲。$2.30的支撑抵挡住了多次抛售,显示出韧性。交易活动略有减弱,暗示市场趋于平静,处于潜在的聚集阶段。突破$2.42可能会激发向$2.48或$2.55的上行动能,而跌破$2.35则可能引发下行动能。

XRP/USDT通过Binance于2025年2月8日的1小时图。

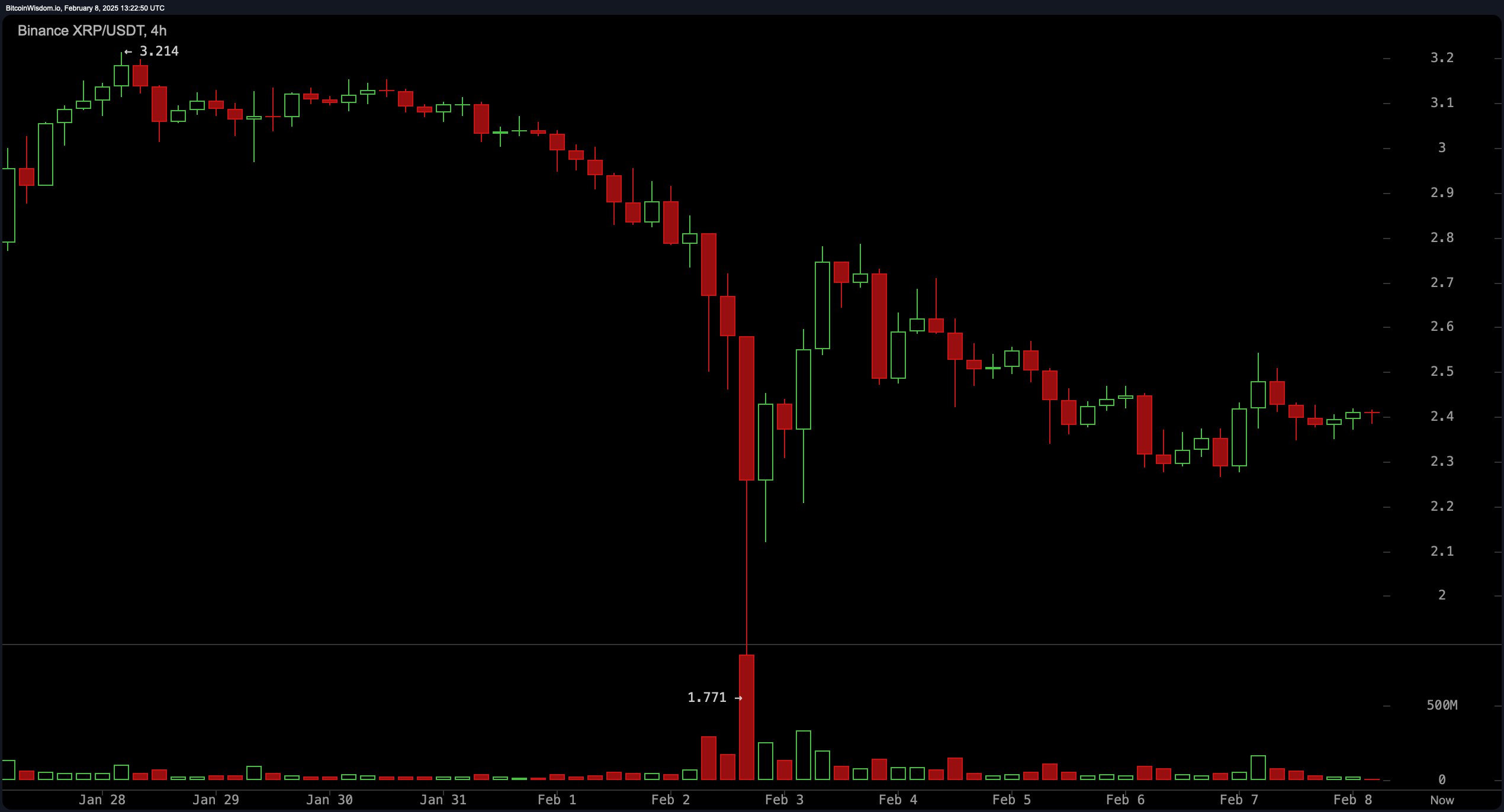

放大四小时图,显示从$3.20下跌至$1.77后反弹。$2.20的基础坚如磐石,而$2.60仍然是一个关键的阻力位。$2.40附近的稳定性,加上温和的波动性,表明市场处于平衡状态。若买方在$2.40以上持续占优,可能会再次挑战$2.60,但在此处失利可能会回落至$2.20。

XRP/USDT通过Binance于2025年2月8日的4小时图。

更广泛的日线图捕捉到从$3.40到$2.40的明显回撤,伴随着加剧的抛售。$2.20和$2.40之间的支撑抵御下跌,而$3.00–$3.20形成了一个强大的障碍。尽管近期看跌情绪浓厚,但持续的稳定性可能会孕育反转。交易模式暗示在低价位的战略性积累,可能推动反弹。

XRP/USDT通过Binance于2025年2月8日的日线图。

动量指标出现分歧:RSI为37.57,反映中性,而随机指标(42.09)没有提供方向性清晰度。CCI为-111.83发出买入信号,但ADX为32.75则显示出温和的趋势强度。强势振荡器(-0.33)呼应谨慎,MACD(-0.09)和动量指标(-0.66)则倾向看跌,反映出持续的悲观情绪。

短期的EMA和SMA(10–50周期)描绘出悲观的图景,而较长的时间范围则注入乐观:100周期EMA(2.18)和SMA(2.09)暗示买入兴趣,200周期EMA(1.64)和SMA(1.33)也是如此。若能维持在$2.40以上,可能会恢复上行潜力,但突破关键支撑位则有风险重新下跌。

看涨判断:

XRP的价格走势暗示可能从整合中突破,$2.30有强支撑,积累迹象日益明显。如果买方在$2.40以上维持动能并突破$2.50的阻力,下一目标区间在$2.60到$2.80之间。振荡器信号混合,但长期移动平均线显示出潜在的看涨力量,如果关键支撑位保持,短期反弹的可能性较大。

看跌判断:

尽管暂时稳定,XRP仍处于修正阶段,看跌信号主导短期和中期移动平均线。卖压依然存在,动量指标如移动平均收敛发散(MACD)和动量指标发出卖出信号。若跌破$2.35,可能加速向$2.20或更低的损失,而没有明确突破$2.50的推动,下行风险依然显著。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。