以下客座文章来自 Bitcoinminingstock.io,这是一个关于比特币挖矿股票、教育工具和行业见解的一站式中心。最初于 2024 年 12 月 13 日发布,作者为 Bitcoinminingstock.io 的 Cindy Feng。

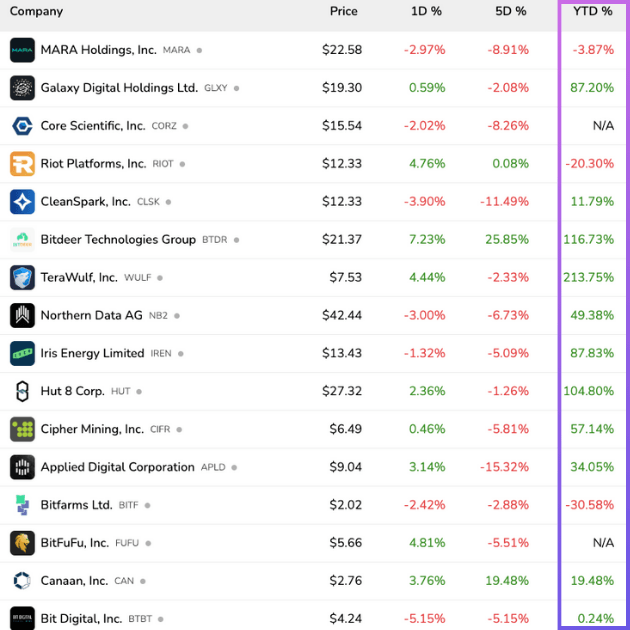

在准备上周的 TWTW(由 D.R. Lewis 和 Matt Case 主持的每周播客)时,我注意到 Bitfarms 在按市值排名的前 15 家上市矿工中,YTD 股票表现是最大的输家。曾经是比特币挖矿行业的热门股票,Bitfarms 引起了竞争对手 Riot Platforms 的关注,后者试图进行一项有利可图的收购。Bitfarms 通过高管重组和收购 Stronghold Digital Mining 等防御性举措登上了媒体头条。然而,尘埃落定后,Bitfarms 的股价依然令人失望。这引发了一个问题:反弹是否已经逾期,还是 Bitfarms 正在逐渐失去市场地位?

比特币挖矿股票表现(截至 2024 年 12 月 13 日)

基本概况

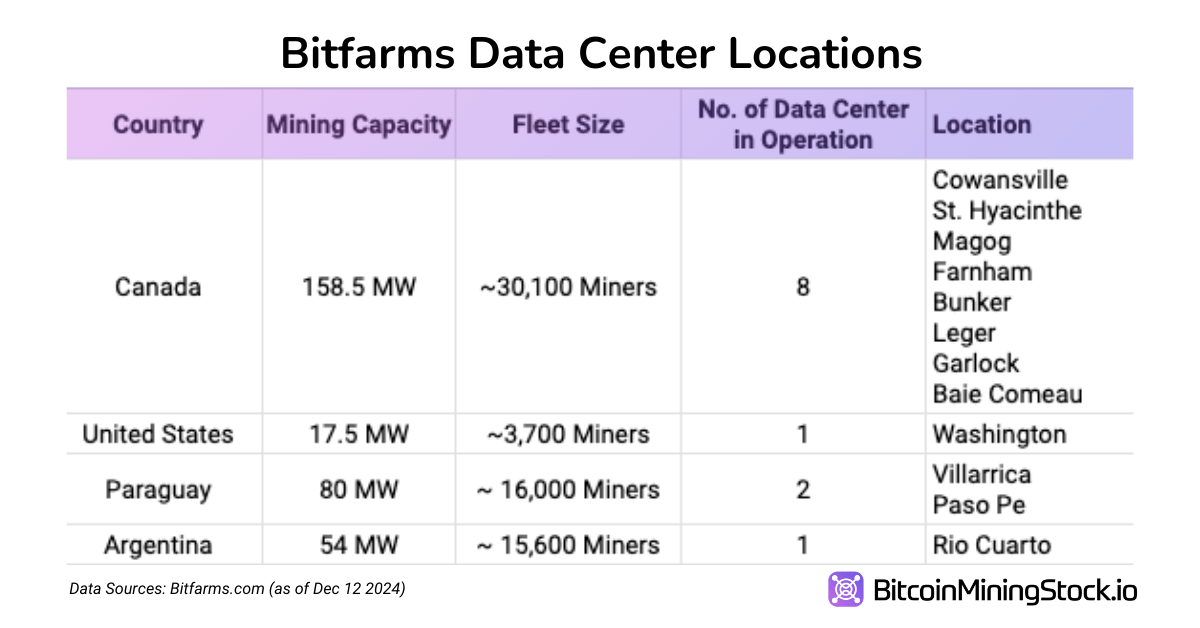

Bitfarms(BITF)成立于 2017 年,是一家在多伦多证券交易所和纳斯达克上市的加拿大比特币挖矿公司。Bitfarms 在加拿大、美国、巴拉圭和阿根廷开展业务,拥有 12 个运营数据中心和两个正在开发的设施。截至 2024 年 11 月 30 日,该公司的算力为 12.8 EH/s。

Bitfarms 数据中心概况

关于 Bitfarms,有两个显著的细节。首先,该公司在其网站上突出其 ESG(环境、社会和治理)倡议。虽然这些努力是提高意识的良好尝试,但与更全面的 ESG 策略相比,缺乏深度。其次,Bitfarms 声称是“唯一一家由四大会计师事务所审计的上市加密挖矿公司”,展示了其对公司级透明度和财务诚信的承诺——这是投资者的重要信任因素。然而,关于独特审计的声明尚未得到独立验证。

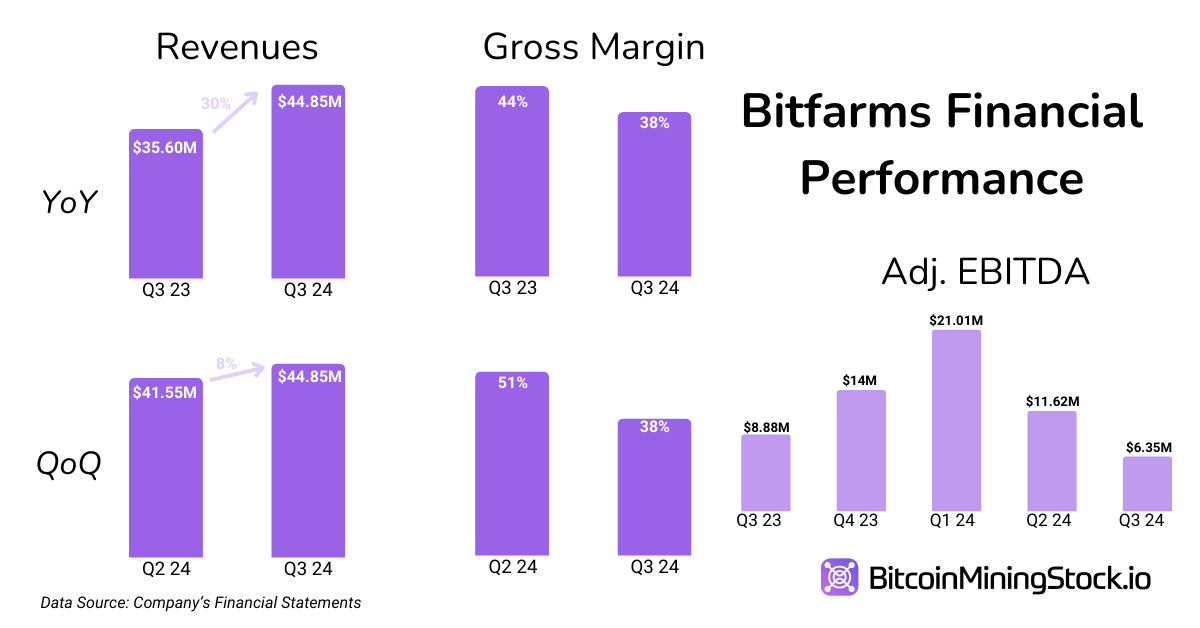

财务表现

Bitfarms 在 2024 年第三季度的财务结果喜忧参半。公司报告的 收入 为 4490 万美元,同比增长 30%,主要得益于运营扩张和战略投资。然而,毛利率下降至 38%,比 2023 年第三季度下降了 6%,原因是电力成本上升和网络难度增加。调整后 EBITDA 同比下降 28%,降至 640 万美元。

Bitfarms:财务表现一览

在底线方面,净亏损从 2023 年第三季度的 1650 万美元扩大至 3660 万美元。这主要是由于运营费用、非现金减值和与机队升级及美国扩张计划相关的折旧成本上升所致。运营费用同比激增 230%,突显了 Bitfarms 运营的资本密集型特性。尽管面临这些挑战,公司仍保持 总资产 基础为 5.866 亿美元,支持 7260 万美元的比特币持有,在成本上升的情况下提供了流动性缓冲(总流动性为 1.46 亿美元)。

运营进展与 ASIC 升级

Bitfarms 继续专注于通过 ASIC 机队升级来提高运营效率。在 2024 年第三季度,它在加拿大、美国和巴拉圭部署了 5400 台矿机。此外,Bitfarms 计划将 18853 台 Bitmain T21 矿机升级为最新的 S21 Pro 型号。这些升级定于 2024 年 12 月和 2025 年 1 月交付,承诺实现 20% 的能源效率提升(15 w/TH)和更高的算力(234 TH/s)。

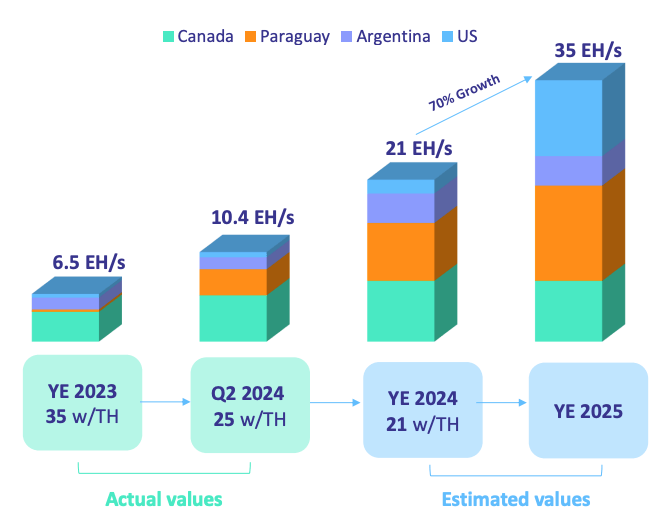

根据公司说法,这些升级预计将使 Bitfarms 在 2025 年 3 月 31 日之前实现 18 EH/s 的运营能力,并在 2025 年 6 月 30 日之前达到 21 EH/s。这比公司在 9 月的演示中早先的指导推迟了六个月,后者预计在 2024 年底前达到 21 EH/s。

Bitfarms 增长指导方针(来自其 9 月演示文稿的截图)

*截至撰写时(2024 年 12 月 13 日), Bitfarms 的网站 仍显示预计在 2024 年底前实现 21 EH/s 的运营能力。简而言之,关于实现 21 EH/s 能力的交付时间框架似乎存在不一致。

数据中心扩展:收购 Stronghold

作为其扩展战略的一部分,Bitfarms 宣布以 1.25 亿美元的股权加 5000 万美元的债务收购 Stronghold Digital Mining。该交易包括位于宾夕法尼亚州的两个二级替代能源商用电厂(Scrubgrass 和 Panther Creek),其总电力容量为 165 MW,并具有 扩展潜力,以支持 2025 年的 10 EH/s 算力。

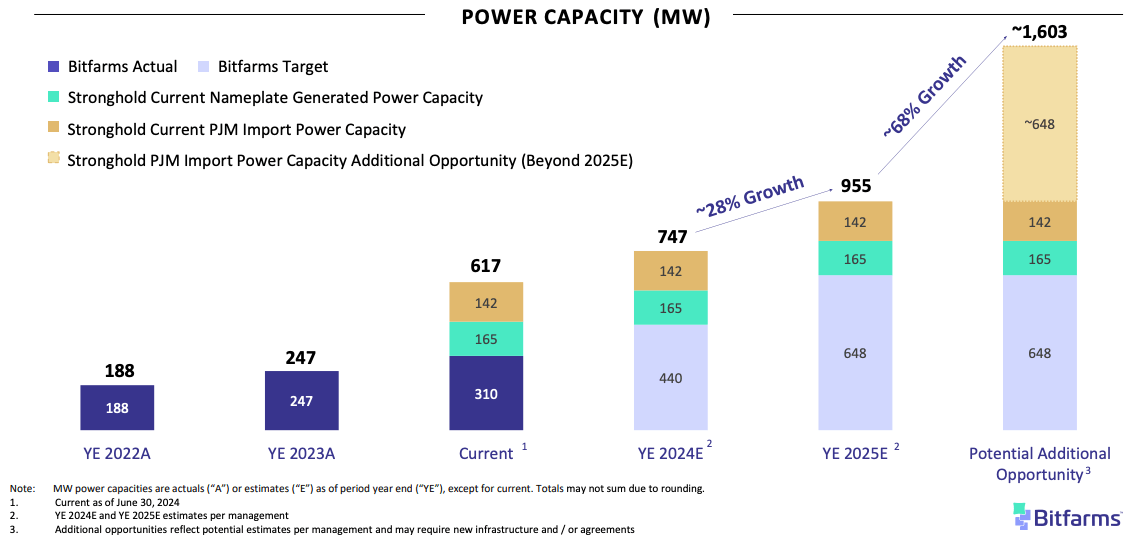

Bitfarms 电力容量路径(来自其收购演示文稿的截图)

通过这次收购,Bitfarms 旨在 多元化其运营并加强其在美国的存在,通过整合发电和能源交易能力。此外,该交易包括 142 MW 的 PJM 互联容量,具有增量潜力可达 790 MW。虽然收购可能巩固 Bitfarms 作为比特币挖矿主导者的地位,但它也带来了整合挑战和来自重大资本支出的财务压力。此外,收购 Stronghold 所支付的 71% 溢价 引发了对预期协同效应是否值得这一价格的担忧。

注意:虽然收购尚未完成,但 Bitfarms 与 Stronghold Digital Mining 的子公司签订了两份 托管协议(10 月 31 日 和 9 月 13 日)。这些协议使 Bitfarms 能够在 Stronghold 的两个地点部署 20000 台矿机,支持约 4 EH/s 的总算力。一旦收购完成,这些托管协议将转为自挖矿操作。

与 Riot Platforms 的尘埃落定

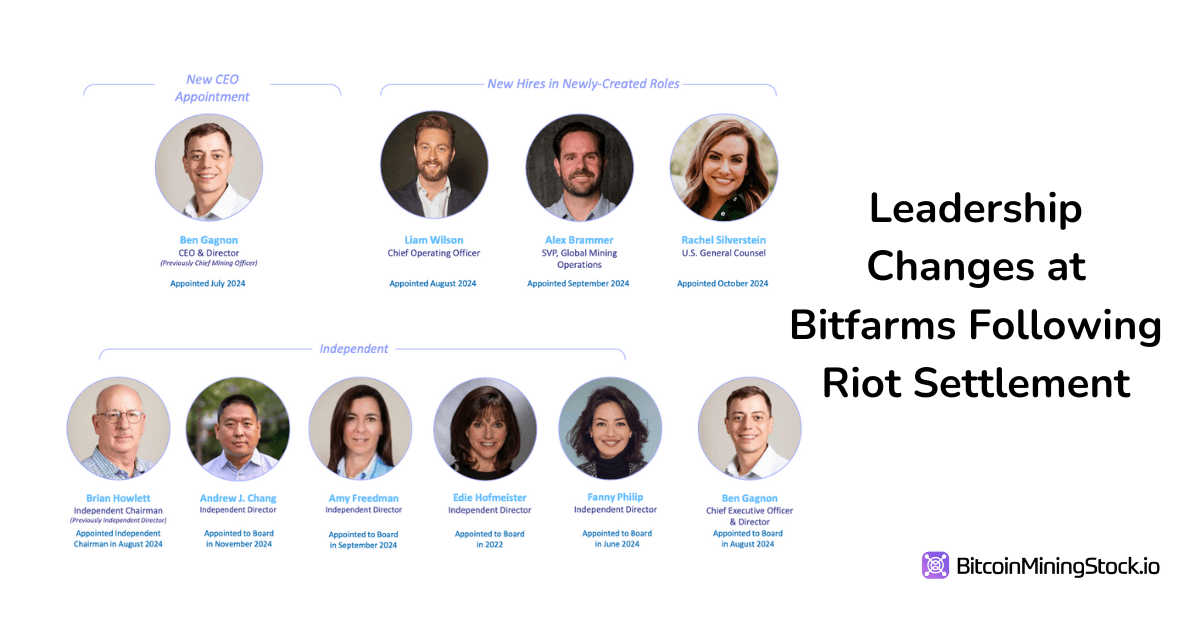

经过几个月的不确定性,Bitfarms 在 2024 年 9 月与 Riot Platforms 达成和解。作为最大股东,Riot 拥有超过 15% 的股份,将不再追求收购,但仍对 Bitfarms 的战略方向保持重大影响。该协议包括在 Riot 的影响下进行董事会重组,这可能增强治理,但也可能引发对独立性的担忧。

(来自 Bitfarms 12 月演示文稿的截图)

虽然这一解决方案提供了稳定性,但它突显了在高度竞争的市场中平衡利益相关者利益的复杂性。Riot 的既得利益确保了一致性,但这种影响是否会限制 Bitfarms 的自主权还有待观察。

向 HPC 和 AI 的多元化

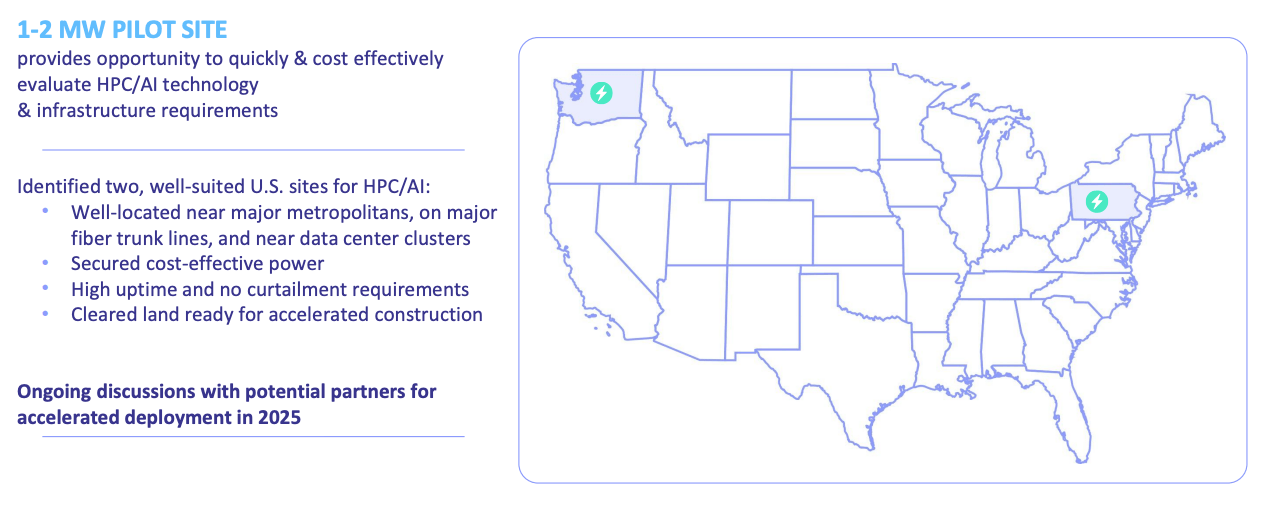

Bitfarms 正在积极探索高性能计算(HPC)和人工智能(AI)以多元化其收入来源。该公司已选择美国的两个地点进行 1-2 MW 的试点项目,确保了土地和电力。与潜在合作伙伴和供应商的讨论仍在进行中,目标是在 2025 年部署。这一举措与行业趋势相一致,因为比特币矿工越来越多地利用其基础设施进行 AI 和 HPC 应用。Bitfarms 在这一领域的战略举措可能会开启新的增长机会,但由于处于早期阶段且缺乏明确的财务预测,评估其长期可行性变得困难。

Bitfarms 的 HPC/AI 试点项目(来自其演示文稿的截图)

最终思考

在收购混乱和市场波动中,Bitfarms 仍然专注于扩展、运营效率和为多元化奠定基础。尽管公司的财务和运营战略与 行业趋势相一致,但我认为它由于 缺乏明确的独特竞争优势 而难以脱颖而出。这使得市场难以确定一个有吸引力的投资论点。

展望未来,Bitfarms 向美国的战略转变,计划在 2025 年将运营电力从 6% 提高到 66%,反映了对监管稳定性和能源发展的大胆押注。这一举措是否会取得成功取决于执行情况和不断变化的竞争格局。为 Stronghold 支付的高额溢价和雄心勃勃的效率目标引发了关于战略优先级和财务纪律的更多问题。接下来几个季度,密切关注这些地理位置的变化和合并如何展开将会很有趣。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。