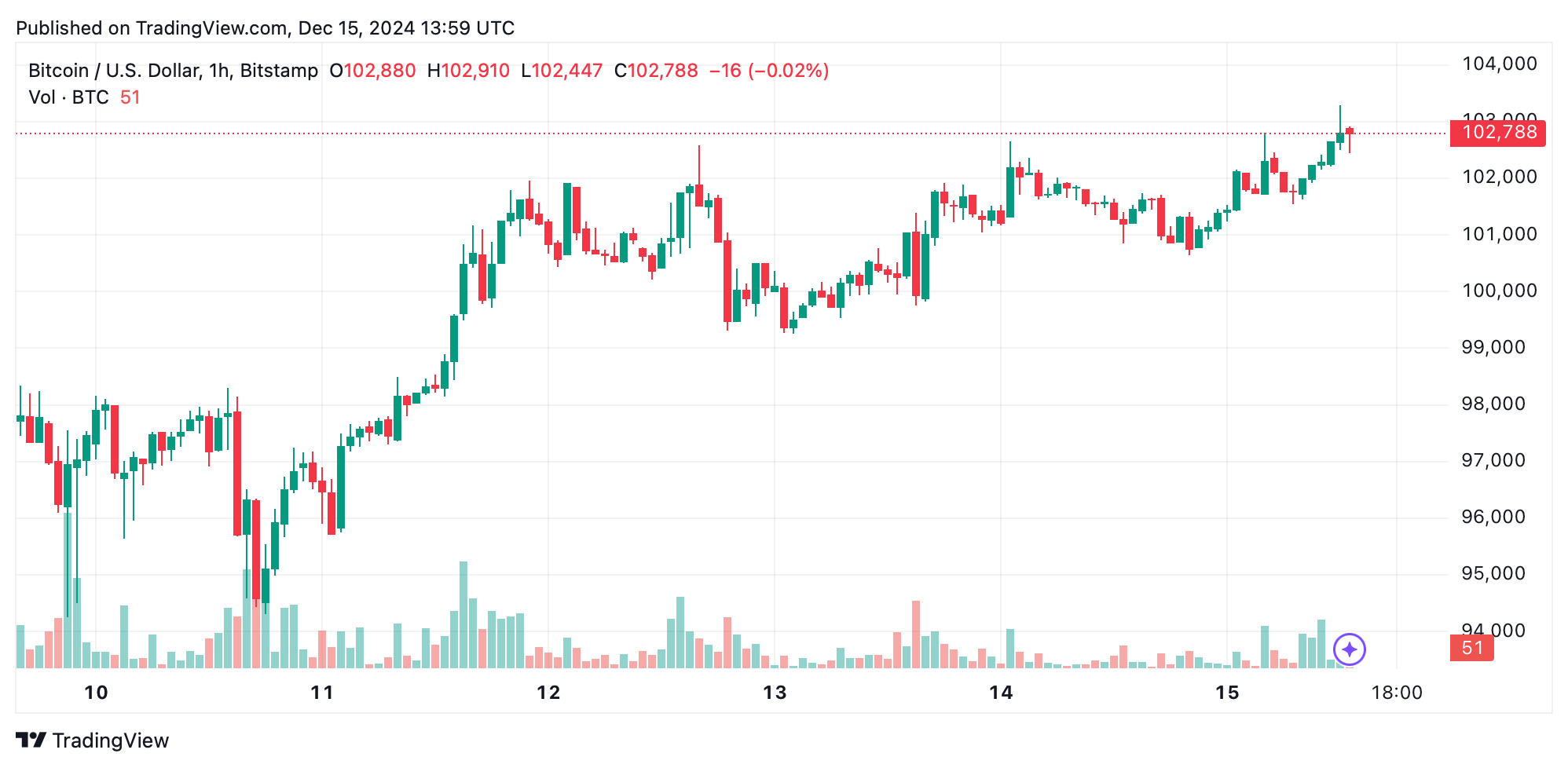

在小时图上,比特币表现良好,最近在$100,600附近徘徊,然后突破至$102,500。支撑位在$101,500到$101,700之间,而阻力位在$103,000到$103,300,正好在最新的高点附近。

BTC/USD 1小时图,日期为12月15日,星期日。

指标让我们保持警觉:相对强弱指数(RSI)在65,表现冷静,中性,而动量振荡器在5,518给出了买入信号,表示积极。然而,移动平均收敛发散(MACD)在3,347发出了一点警告,暗示可能会有回调。

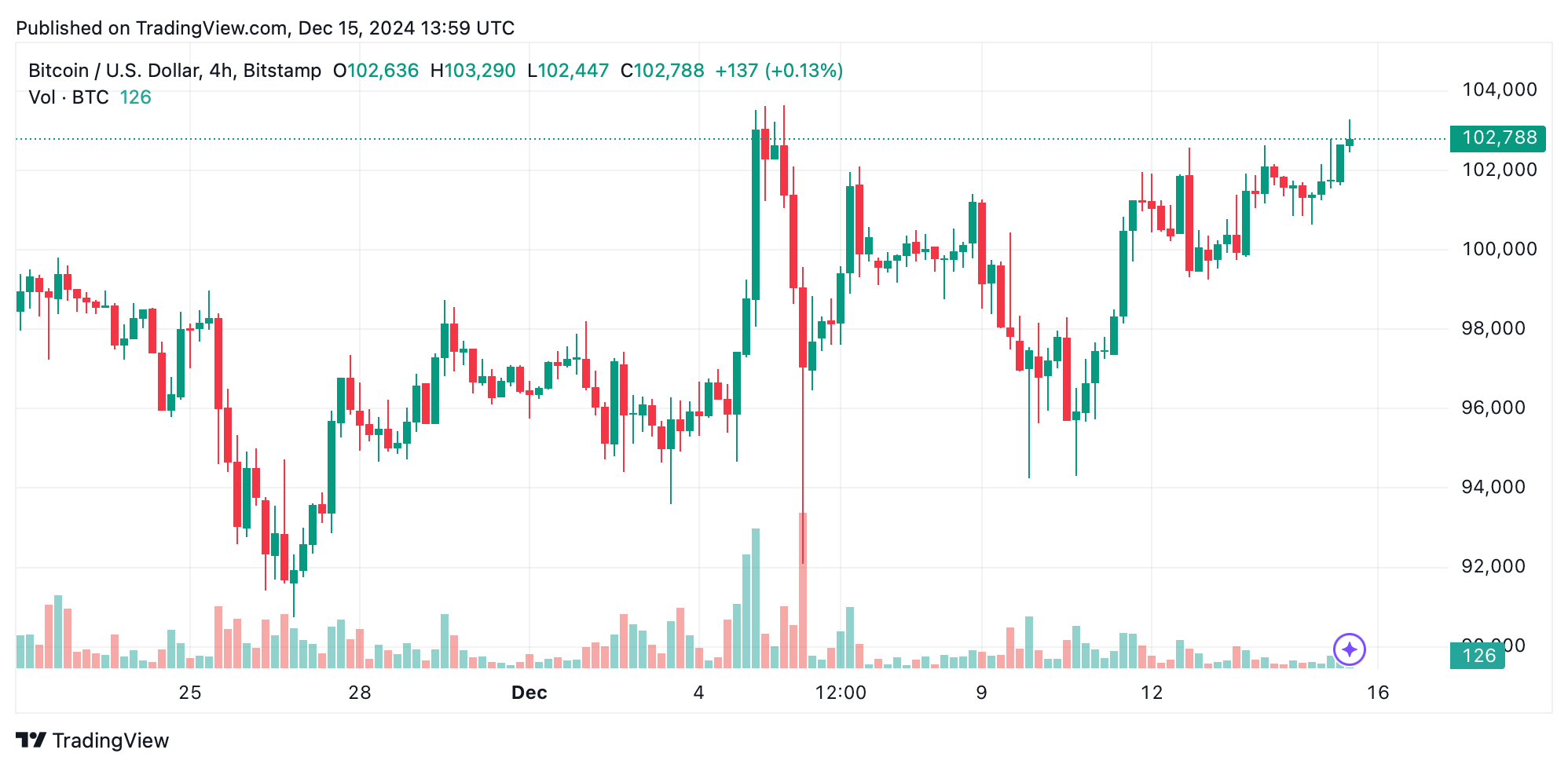

切换到4小时图,你会看到比特币走出了一条清晰的上升路径,从接近$94,249的低点反弹,形成更高的低点。保持在$100,000这个大整数之上,传递出强烈的看涨信号。

BTC/USD 4小时图,日期为12月15日,星期日。

支撑区间在$99,500到$100,500之间,阻力位在$103,500到$104,000之间。成交量模式显示人们渴望购买,但要注意顶部的卖压可能会导致一些波动。

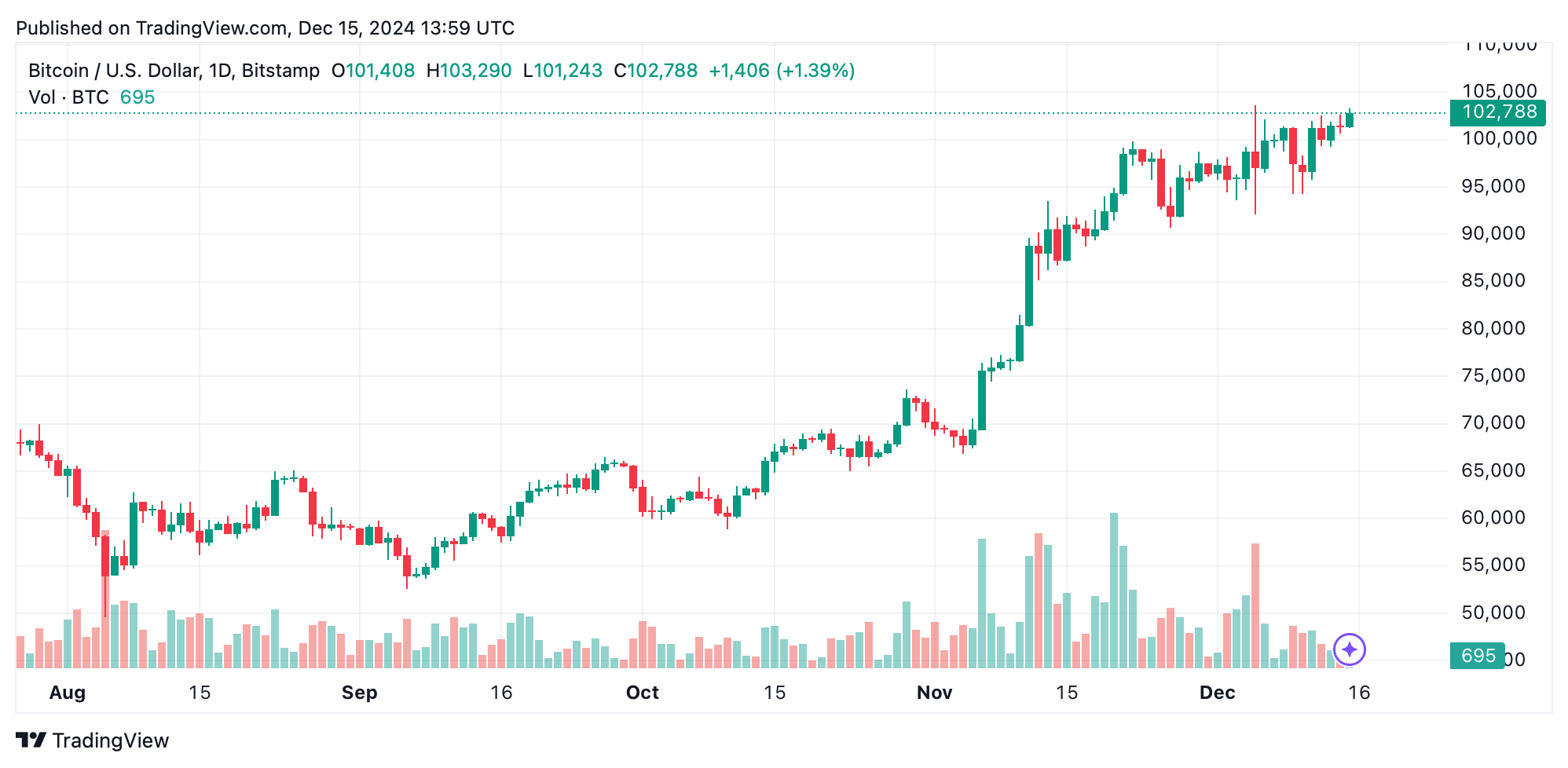

日线图讲述了比特币从$80,280的低点反弹到现在的故事。那些绿色蜡烛正在闪耀,成交量上升,表明大玩家正在参与,尤其是在突破$100,000之后。

BTC/USD 日线图,日期为12月15日,星期日。

支撑位在$98,000到$100,000之间,铺垫了更多的上升空间。$103,500到$105,000的阻力可能是下一个大障碍;突破可能会导致新高。寻找在20日简单移动平均线($98,212)附近或那个神奇的$100,000的入场点,目标利润在$104,000-$105,000区间。

在所有这些时间框架中,移动平均线都给出了强烈的积极信号,10到200日的指数移动平均线(EMA)和简单移动平均线(SMA)都在为上升欢呼。像随机指标(Stochastic)在84和平均方向指数(ADX)在40的振荡器保持平衡,而超强振荡器在5,050则完全支持看涨趋势。

但交易者应关注MACD——其在小时图和4小时图上的看跌信号暗示短期内可能会有一些波动。

看涨判决:

比特币在所有主要时间框架上的上升动能,得到了强大的移动平均线和持续的购买量的支持,描绘出强劲的看涨图景。这种加密货币似乎准备挑战其历史高点$103,647,并可能在成交量持续的情况下突破$105,000的阻力。交易者应保持乐观,目标是进一步获利,同时在$100,000附近的关键支撑位管理风险。

看跌判决:

尽管比特币强劲反弹,但MACD的看跌信号和$103,500-$105,000附近的阻力暗示潜在的疲软。在这些水平上的卖家可能会引发回调,价格可能会回到$98,000-$100,000区间。如果未能保持这一支撑,可能会导致更深的修正,使短期前景对交易者变得谨慎。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。