Source: Pantera Capital Blockchain Letter April 2025

Author: Cosmo Jiang, Partner at Pantera Capital; Translated by AIMan@Golden Finance

In 2025, a series of events in the cryptocurrency space and the broader macro environment have impacted the market. Large macro forces are clearly dominating, with risk appetite across most industries and asset classes continuing to decline. While digital assets are leading in growth-oriented investments, they are far from immune to these influences.

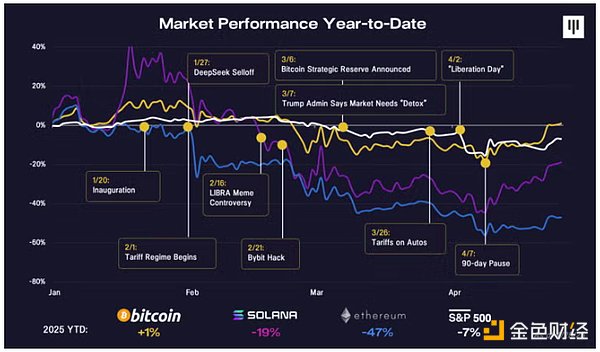

The year 2025 started optimistically, with a political shift towards cryptocurrency driving prices up from last November's election through January of this year. However, after Bitcoin and Solana hit all-time highs in January, Trump's inauguration turned into a classic "buy the rumor, sell the news" scenario. The S&P 500 and Bitcoin both fell by 15-20% (though Bitcoin has since recovered somewhat). But looking internally, high-growth and small-cap stocks performed even worse. For example, Ethereum, the second-largest token by market cap, dropped by 47%. This pullback can primarily be attributed to macro factors, as well as some issues unique to digital assets.

From a macro perspective, the market is concerned about increased policy uncertainty and stagflation, which is a combination of slowing economic growth and rising inflation. Trump continues to push his tariff agenda (currently, "reciprocal" tariffs above a 10% baseline rate are paused for 90 days, excluding China), which has already dampened consumer confidence, corporate earnings, and GDP forecasts. This began with his first executive order at the inauguration, but it wasn't until February 1 when the first round of tariffs targeting Mexico, Canada, and China took effect that the market truly paid attention to him. Since then, every major tariff announcement has led to market declines, culminating in the "Liberation Day" on April 2.

While tariffs have been the biggest driver of price movements, other adverse factors have also emerged, such as the Department of Government Efficiency (DOGE). The impact of DOGE is difficult to quantify, but qualitatively, it has significantly affected the mindset of government employees and businesses serving the government. Given that government spending has accounted for 23% of GDP in recent years and 25% of new jobs, any spending cuts driven by DOGE will have a tangible short-term impact on the economy. Regardless of whether these policies are good or bad, the speed and magnitude of their changes are starkly different from previous administrations. The market is worried about uncertainty, and we have already seen the default reaction: selling off and taking more defensive positions.

Additionally, from a fundamental growth perspective, the stock market was once supported by optimism about unlimited demand for AI hardware. However, this optimism was hit hard as the market began to digest the impact of DeepSeek's achievements. All publicly traded stocks related to AI—and AI-related tokens—suffered significant sell-offs, with many dropping over 50%.

The digital asset industry also faces some unique challenges. The first is the burst of the memecoin bubble. This wave of decline began after Trump launched his own memecoin, and the fallout from Argentine President Javier Milei's manipulated LIBRA memecoin incident accelerated the drop.

There has been much debate about whether these events are good or bad—perhaps both. On the positive side, high-profile figures like Trump are bringing attention and new users to the space, inspiring imitators from the Web2 world. Tokens are the most disruptive form of capital formation we have seen, and I hope this will inspire more creative and effective token launches in the future.

On the other hand, memecoins reinforce the perception of cryptocurrency among casual observers: that it is rife with scams and a joke, damaging the reputation of developers who are seriously building in the space. They also siphon off liquidity and attention from other tokens. Moreover, because memecoins are often extractive, once the frenzy subsides, it becomes difficult for other tokens to recover.

The second major event this quarter was the hacking of Bybit, the world's second-largest exchange. Although there was no loss of customer funds—Bybit successfully covered the losses—this still undermined confidence in the overall market structure.

When you put all these events together, you can see how they have dragged down the market.

Cryptocurrency Price Performance

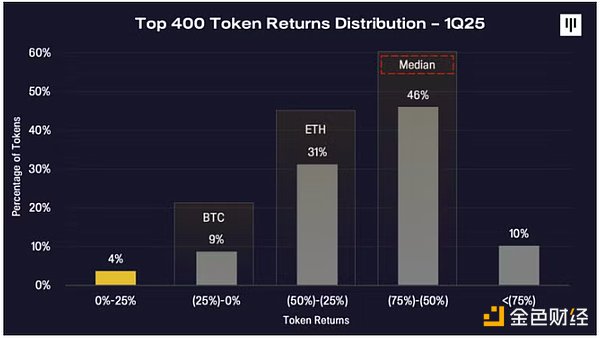

The sell-off was widespread. In the first quarter, the median token price fell by over 50%, and nearly 100% of token prices have declined this year. It is noteworthy that this price movement resembles the trends of the S&P 500 index and its underlying components.

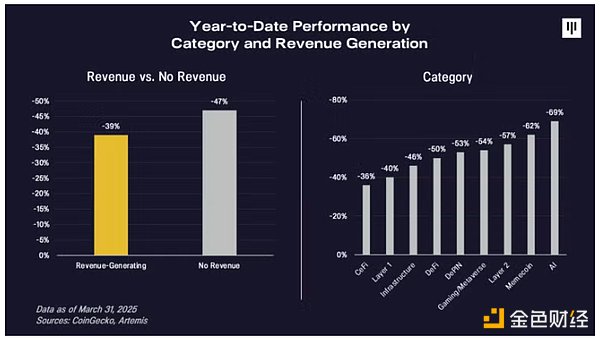

We believe the market is increasingly focusing on tokens with solid fundamentals, and we see this trend reflected in relative performance. Year-to-date, tokens with solid fundamentals (i.e., those with revenue and cash flow) have outperformed tokens without revenue by 8 percentage points. Memecoins and AI-related tokens have also underperformed compared to other tokens.

While this may be painful, we believe that capital destruction of fundamentally worthless tokens is healthy.

Price Performance in Historical Context

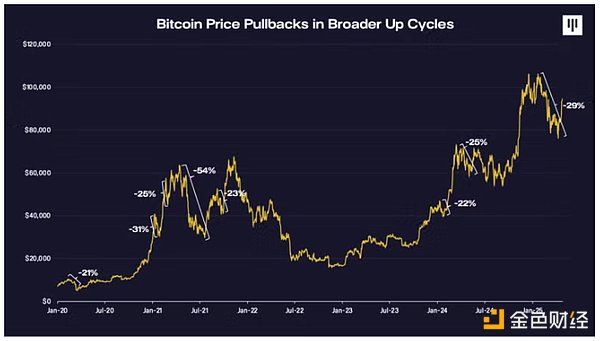

We have experienced many similar pullbacks before. This is common in broader bull markets.

During the last upward trend from 2020 to 2022, BTC experienced five significant pullbacks of over 20%. Other tokens saw pullbacks of 40% to 50%. Even in strong markets, such situations occur.

In the current long-term upward trend, we have experienced three such pullbacks—including the one we are currently in. Each time, being shaken out has been a mistake. In fact, over the past week, Bitcoin's price has risen to $95,000, with most of the increase occurring on Wednesday. For those with a long-term investment perspective, being able to withstand this volatility is a significant advantage.

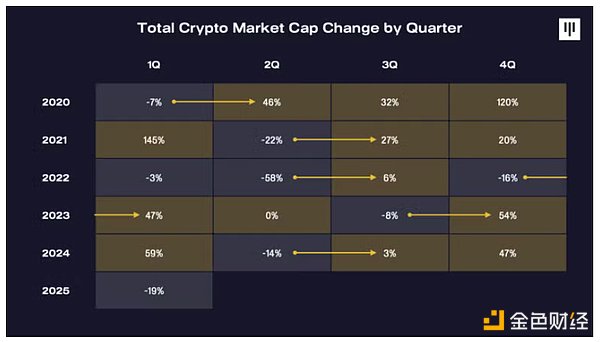

When analyzing the quarterly changes in cryptocurrency market capitalization, strong rebounds typically follow significant declines, as indicated by the arrows.

Q1 2025 was the worst quarter for cryptocurrencies since the summer of 2022, when the market experienced a broad crash. While past experiences may not predict the future, strong rebounds almost always follow significant declines—though the magnitude of the rebound depends on the current market conditions and, crucially, whether the overall trend can maintain an upward trajectory.

Be greedy when others are fearful?

On April 15, 2025, I hosted a call to discuss the outlook for the cryptocurrency market. I talked about some indicators that track market sentiment, which we believe have reached historical highs, indicating that some of the worst phases of selling are over. While the market has indeed rebounded from the bottom, I want to share how I was monitoring market sentiment at that time:

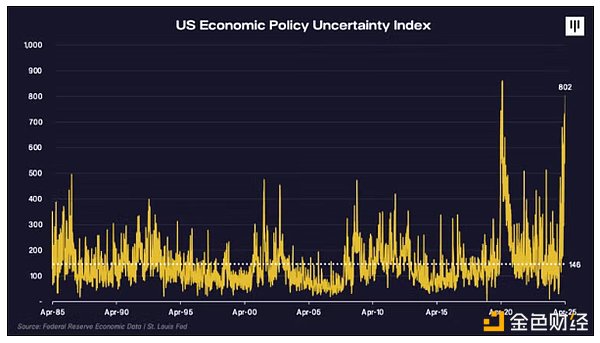

"The U.S. Economic Policy Uncertainty Index is at its highest level in 40 years, similar to levels during the COVID-19 pandemic, and higher than at any time since the survey began in the 1980s, including above levels during the 9/11 events and the 2008 financial crisis.

Uncertainty has caused risk allocators to retreat. At this critical moment, you need to ask yourself whether the environment is likely to become more uncertain. From a historical perspective, this seems unlikely; rather, we should be returning to the mean.

Uncertainty has caused risk allocators to retreat. At this critical moment, you need to ask yourself whether the environment is likely to become more uncertain. From a historical perspective, this seems unlikely; rather, we should be returning to the mean.

"The Crypto Fear and Greed Index considers various factors such as technical momentum and social media sentiment to calculate an overall index score reflecting the levels of greed and fear among market participants.

"During the sell-off, we again fell into extreme fear levels not seen since the bear market lows and the FTX collapse at the end of 2022. Whenever the market reaches such extreme levels, negative sentiment typically signals local price bottoms and good points for future returns.

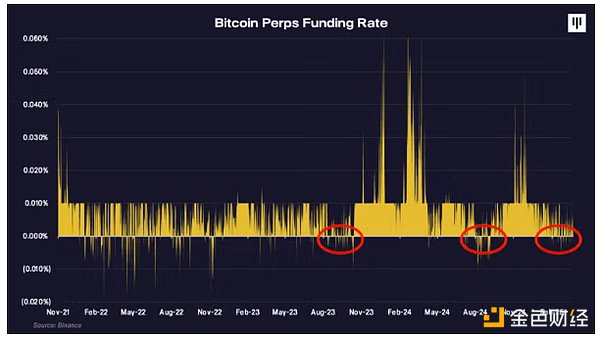

Next is the Bitcoin futures funding rate, which shows the ratio of long to short participants in the futures market. The funding rate for Binance Bitcoin futures indicates that there are more short positions than long positions in this market. This situation only occurs during market downturns in previous cycles, typically preceding significant rebounds, as seen at the end of 2023 and the end of 2024.

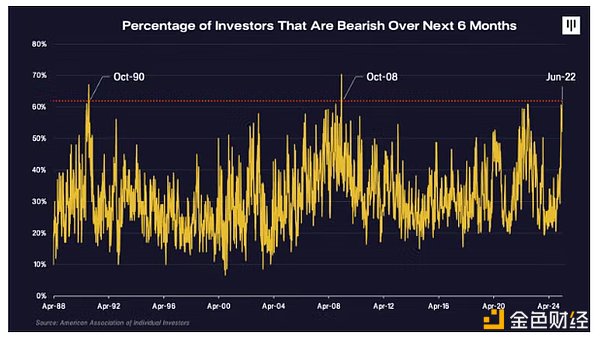

The final indicator is the American Association of Individual Investors (AAII) Investor Sentiment Survey—a weekly survey conducted by the AAII showing that over 60% of investors are pessimistic about the next six months. This has only occurred three times since the survey began in the 1980s, during significant market pullbacks in 1990, 2008, and 2022.

Summarizing the current market sentiment, these charts show that whether focusing specifically on cryptocurrency sentiment, native cryptocurrency positions and leverage, or broader retail investor sentiment and policy uncertainty, all have reached historically extreme levels. It is expected that we may have passed the initial phase of aggressive selling based on this sentiment.

– Cosmo Jiang, General Partner at Pantera Capital, Cryptocurrency Market Outlook Call

The Impact of Macroeconomic Events on Cryptocurrency

Favorable Interest Rates and Liquidity Conditions for Risk Assets

At the same time, favorable interest rate and liquidity conditions are beneficial for risk assets.

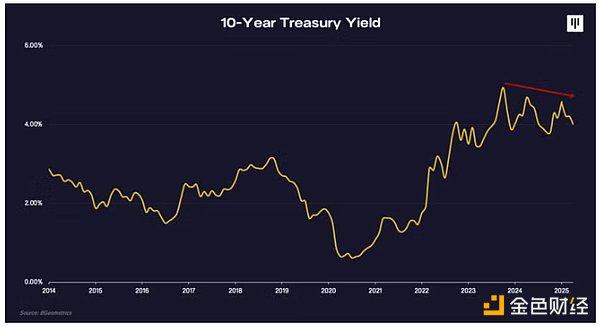

The yield on the 10-year U.S. Treasury bond has steadily declined after peaking in 2023, with a rapid drop in recent days. Interest rates may remain elevated for a longer period in the context of high inflation, but more importantly, the overall trend is downward. The Trump administration—especially Treasury Secretary Basant—has discussed the importance of lowering long-term interest rates, and their policy actions aim to achieve this. Lower long-term interest rates are crucial for the U.S. to maintain spending financing and are also beneficial for the valuation of risk assets.

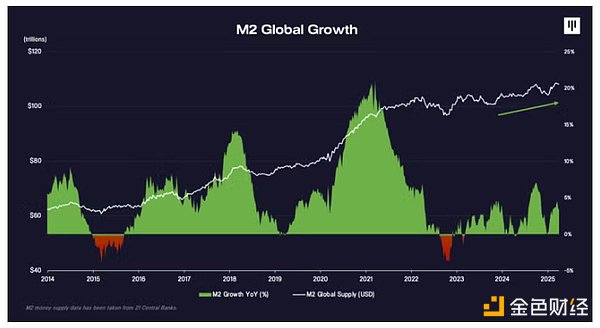

Global liquidity conditions are also continuing to increase. After a period of tightening, Europe and China are currently implementing stimulus measures. We may be on the verge of quantitative easing. In recent weeks, Treasury Secretary Basant and Federal Reserve Governor Collins have spoken on this matter to address the turmoil in the bond market caused by soaring long-term bond yields. Their natural response will be to provide liquidity support, with the largest global economies working together. The increase in liquidity is favorable for risk assets.

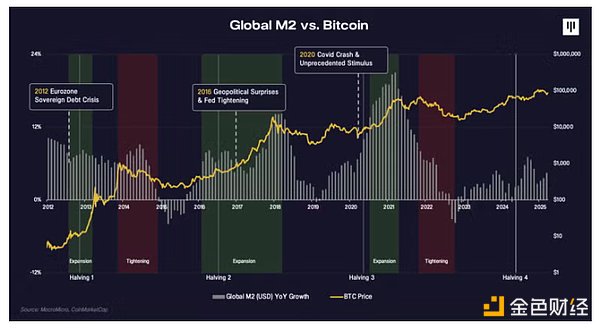

If we compare global liquidity with Bitcoin prices, it is clear that the major upward trend in Bitcoin prices occurs during periods of increasing liquidity. Conversely, during periods of pressure typically caused by tightening liquidity, Bitcoin tends to decline along with all other assets. Therefore, we believe that the rise in global liquidity is an important indicator to monitor.

Another Perspective on Cryptocurrency's Four-Year Cycle

This is a historic moment for the global economy: the S&P 500 has just experienced the worst week and the best week back-to-back. Typically, Bitcoin's price experiences significant volatility due to major macro events, which often coincide with global liquidity cycles. The year 2012 marked the Eurozone sovereign debt crisis. The year 2016 was marked by Brexit. The year 2020 saw the economic collapse brought on by the COVID-19 pandemic. Many attribute Bitcoin's price cycles to halving events, but another explanation is that significant macroeconomic events occur every four years, which happen to support Bitcoin's bull markets. We are once again at such a moment.

Recent macroeconomic events are evolving into a trust crisis for the dollar. Many point out that rising long-term Treasury yields signal turmoil in the bond market or capital flight as foreign companies and entities divest their savings from the dollar. Bitcoin's primary function is as a non-sovereign store of value. This does not necessarily mean that its price must be stable, but it is seen as an attractive alternative and diversification investment tool in an increasingly uncertain world. This de-dollarization undoubtedly supports this argument.

Early Signs of Relative Strength in Cryptocurrency

We are beginning to see signs that digital assets are performing better in a short time frame. As of April, digital assets have outperformed stocks and the dollar. Solana and Bitcoin are up, while U.S. stocks are down. It is still too early to tell, but just as digital assets led the pullback, they may also lead the rebound.

Positive Industry Developments Being Overlooked

Additionally, we should keep in mind that many positive industry developments have been overlooked amid price volatility. In terms of policy actions, this includes the White House appointing a "crypto czar" and establishing a digital asset working group, creating a strategic Bitcoin reserve, rolling back strict regulations like SAB-121 and DeFi broker rules, and the U.S. SEC dismissing dozens of lawsuits against major companies. It can be said that the cryptocurrency industry has experienced some of the most positive headlines in its history, many of which are structural changes, yet it has gone through its worst quarter since 2018. We believe that this good news has certainly not been digested by the market, but rather overlooked due to market volatility.

Fundamentals are Improving

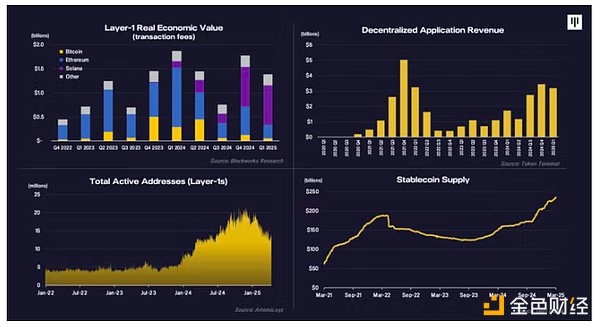

Most importantly, digital assets need real adoption and usage to sustain themselves. Blockchain companies are currently generating billions of dollars in revenue. The Real Economic Value—an indicator measuring total demand and value capture of L1 blockchains—was $1.5 billion last quarter, annualizing to $6 billion. During the same period, total revenue from on-chain applications was about $3 billion, annualizing to $10 billion. Daily active addresses (a measure of user activity) continue to hit new highs. As more people choose to use cryptocurrencies for payments and savings, the volume of stablecoin and on-chain stablecoin transfers has also reached all-time highs. In the early stages, innovation in key investment focus areas such as stablecoins, AI, DePIN, and DeFi remains strong. We expect these fundamental indicators to trend upward as more people discover the exciting applications and opportunities offered on-chain.

Conclusion

In summary, this has been a challenging quarter, with significant macro forces clearly dominating, leading to a substantial decline in risk appetite. The biggest risk remains the uncertainty surrounding tariffs and their impact on the global economy. The market outlook remains highly uncertain, as reflected in sentiment indicators that are at historical lows. However, these sentiment signals also suggest that we may have passed the most aggressive selling point.

As we move past this tariff-driven volatility, I believe investors will begin to appreciate all the long-term positive factors and strong fundamentals, and I still expect digital assets to perform strongly this year. As a pioneer of growth assets, cryptocurrencies are the first to pull back but may also be the first to rebound and rebound the fastest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。