- Bitcoin surged to $95,490, as the market holds its breath for Trump's hundred-day governance speech. Over the past week, investors withdrew more than $4 billion in BTC from exchanges, signaling a strong bullish trend.

- Trump's policy mix—including a potential Bitcoin strategic reserve and the revival of tariff threats—is creating a scenario of both opportunities and risks. As the stock market faces pressure, Bitcoin is benefiting from increasing demand for safe-haven assets.

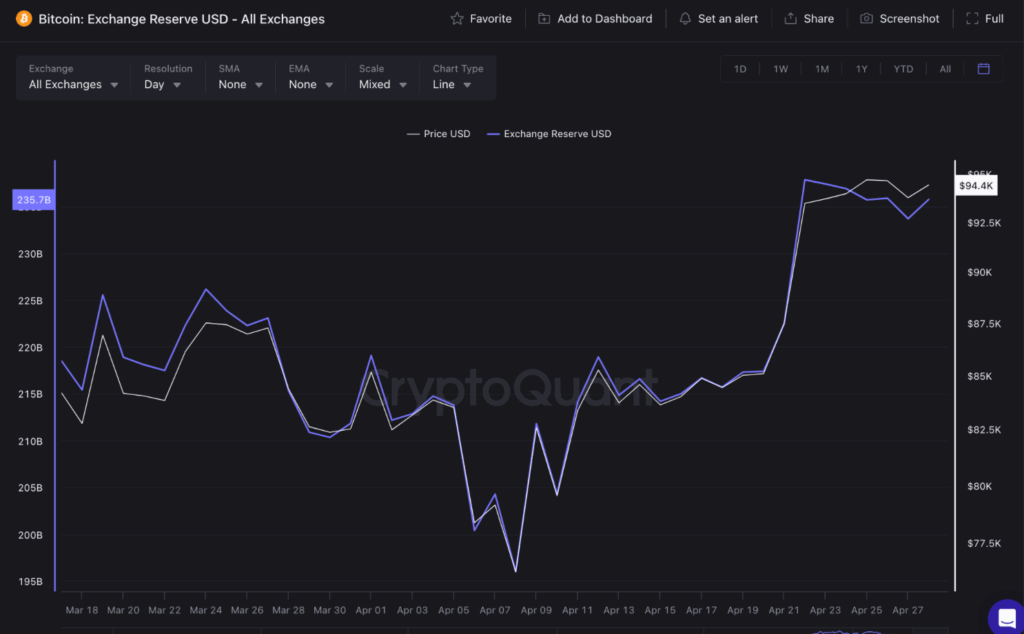

- On-chain data shows a sharp decline in Bitcoin reserves on exchanges. If market momentum and supply tightening continue, the conditions for breaking through the $100,000 mark are maturing.

Strong Rebound on Monday

Bitcoin (BTC) rebounded strongly to $95,490 on Monday, coinciding with the market's preparations for Trump's hundred-day speech. As the announcement of cryptocurrency-specific policies approaches, investors are beginning to adjust their positions—on-chain data has already shown early signs.

Drivers Above $95,000

According to CoinGecko, Bitcoin rose 0.8% in 24 hours, reaching $95,490. During Monday's trading session, BTC fluctuated between $92,953 and $95,490, maintaining recent upward momentum. The weekly performance is also robust, up 8.9% from last Monday, with a cumulative increase of about 15% over the past 30 days. The crypto market is closely watching whether Trump will provide a clear statement regarding the rumored Bitcoin strategic reserve proposal.

Major Capital Migration

Following Trump's controversial call for interest rate cuts, over $4 billion in Bitcoin has flowed out of exchanges in the past week alone. Investors are clearly moving tokens to cold wallets, which is typically a bullish sign.

The Crypto Effect of Trump's Hundred Days

This round of Bitcoin's rise is not an isolated event—it is moving in sync with U.S. stocks (especially tech giants), as the market attempts to predict the signals that Trump's speech may release. Analysts say that if Trump formally supports a Bitcoin reserve, it could trigger a parabolic rise towards $100,000. Conversely, if the focus shifts excessively to tariffs or severe budget cuts, it could impact the overall market and limit Bitcoin's short-term upside potential.

TradingEconomics data shows that the inflation rate has dropped from 9.1% in 2022 to 2.4% in March 2025. Trump quickly attributed this to himself, but economists warn that his pro-tariff policies could reignite inflationary pressures.

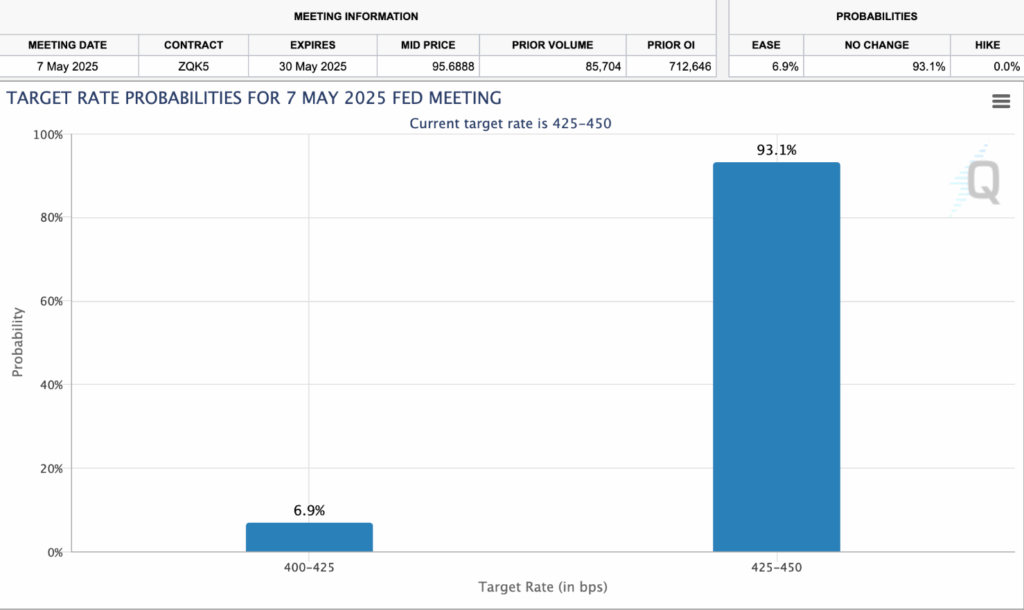

Cooling Expectations for Rate Cuts

Despite Trump's strong push for interest rate cuts and even threats to replace Federal Reserve Chairman Powell, the CME FedWatch tool indicates a 90.1% probability that rates will remain unchanged at the May 7 meeting. In short: the market has heard Trump's demands but has yet to buy into them.

Asset Rotation Under Tariff Clouds

Trump's ongoing tariff rhetoric continues to weigh on U.S. stocks (especially the so-called "Fabulous Seven" tech stocks), and this uncertainty is actually benefiting Bitcoin—its safe-haven properties as "digital gold" are being recognized.

In comparison, Bitcoin has risen 5.6% this year, while the Nasdaq, S&P 500, and Dow Jones indices have all fallen 5% during the same period. Investors fleeing the turbulent traditional financial markets are beginning to favor Bitcoin's relative strength.

Is $100,000 in Sight?

The geopolitical tensions and market anxieties during Trump's first hundred days have unexpectedly become a tailwind for Bitcoin. BTC's ability to hold the $90,000 level amidst the noise is significant, showcasing its resilience and retaining hopes of reaching $100,000.

CryptoQuant's on-chain data reveals key trends:

• Since April 22, Bitcoin reserves on exchanges have decreased by over $4 billion.

• Weekly deposit levels have plummeted from $237.8 billion to $233.8 billion.

• Potential supply tightening is forming.

If demand remains strong while available supply continues to shrink, the moment for Bitcoin to break through the six-figure mark may arrive sooner than most expect.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。