If past patterns continue, Bitcoin could rise in mid-July and is expected to reach $140,000 by October 2025.

Author: Marcel Pechman

Translation: Deep Tide TechFlow

Today's JOLTS (Job Openings and Labor Turnover Survey) report shows a sharp decline in job vacancies in the U.S., but this may not be bad news for Bitcoin.

Key Information:

Weak labor and consumer data typically signal a rise in Bitcoin, leading some analysts to predict potential economic stimulus plans in the future.

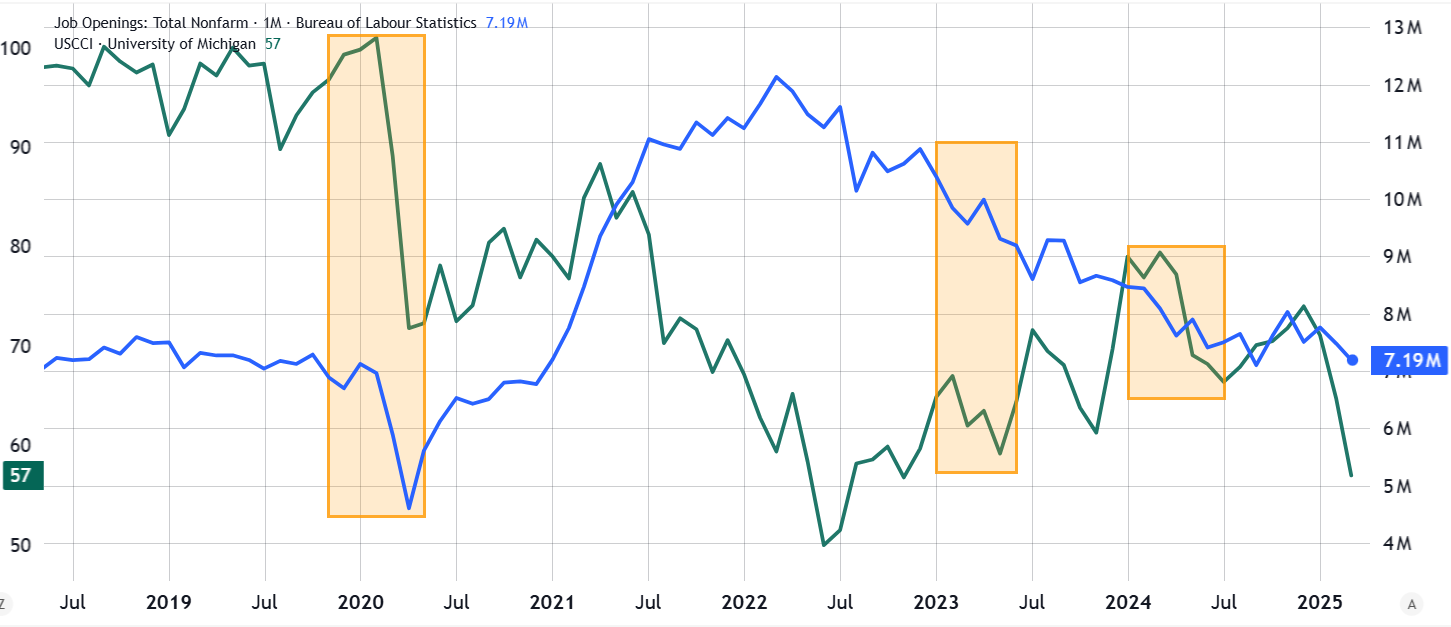

Job vacancies in March fell to 7.2 million, below the expected 7.5 million, while the consumer confidence index dropped to its lowest level since January 2021.

If past patterns continue, Bitcoin could rise in mid-July and is expected to reach $140,000 by October 2025.

Macroeconomic conditions have always been seen as significant factors influencing cryptocurrency prices. Generally, when investors are concerned about weak employment and consumer data, Bitcoin and other cryptocurrencies perform poorly.

According to the JOLTS report released by the U.S. Department of Labor on April 29, job vacancies in March were close to a four-year low. U.S. employers posted 7.2 million job openings in March, below economists' predictions of 7.5 million. Meanwhile, U.S. consumer confidence declined for the fifth consecutive month in April, reaching its lowest point since January 2021.

U.S. Consumer Confidence (left) vs. Total Non-Farm Job Openings in the U.S. (right)

Source: TradingView/Cointelegraph

The deteriorating situation increases the likelihood of central banks introducing economic stimulus measures, making the overall impact on the cryptocurrency market uncertain. Typically, additional liquidity encourages investment in risk assets like Bitcoin, as more funds flow into the economy.

Future expectations are more important than current weak economic data

The last time the U.S. experienced a decline in job vacancies and weakened consumer confidence was between January and June 2024. In the following three months, Bitcoin's price fluctuated between $53,000 and $66,000. Then, starting in mid-October, there was a 60% increase, pushing Bitcoin's price above $100,000. The final outcome was positive, but this impact took over 105 days to manifest in the cryptocurrency market.

Bitcoin/USD, logarithmic scale

Source: TradingView / Cointelegraph

Although these conditions may initially seem concerning, weak labor and consumer sentiment are often lagging indicators. Financial markets and companies make decisions based on expectations of future economic growth, not just past data. Additionally, improvements in sentiment among crypto investors often occur after confirmation of better macroeconomic conditions. This explains why a lag period of 105 days is not uncommon.

Before 2024, a similar situation occurred between January and June 2023, where both job market data and consumer confidence declined. The following four months were tough, with Bitcoin's price dropping 18% to $25,000. The price recovered to $30,500 after 115 days by the end of October. However, the next two months were very positive, with Bitcoin rising 45% to $43,900.

Bitcoin/USD in 2020, using logarithmic scale

Source: TradingView / Cointelegraph

In the past eight years, the last significant downturn in both the labor market and consumer confidence occurred between February and May 2020, right after the implementation of COVID-19 lockdown measures. During this period, Bitcoin briefly fell below $4,000 on March 13, 2020. Therefore, the market expects a long consolidation period before investors regain confidence in the crypto market.

Can Bitcoin reach $140,000 before October?

Looking back at macroeconomic data, from May 2020 to September 2020, Bitcoin was not significantly affected, with its price rising from $8,900 to $10,600, an increase of 20%. However, in the following 60 days, Bitcoin experienced an impressive 85% increase, reaching $19,700. This is the third time that weak labor and consumer sentiment data seem to signal a rise in Bitcoin's price.

While the time span from the economic conditions' low point to Bitcoin's rise ranges from 105 to 130 days, the outcome is clear in all three cases. Therefore, if U.S. job vacancies and consumer confidence improve starting in April 2025, Bitcoin's price could begin to rise in mid-July. If history repeats itself, this could mean a minimum target price of $140,000 for Bitcoin by October 2025, but further positive macroeconomic data is still needed to confirm this expectation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。