Core Points

–SIGN combines decentralized identity, on-chain proof, and full-chain distribution protocols, providing over 6 million proofs and $4 billion in token distribution in 2024, unlocking global-scale verifiability and trust in digital credentials.

–Its tokenomics allocates 40% of the signatures to community initiatives and rewards (including 10% for TGE airdrop), with the remaining 60% distributed to supporters (20%), early team members (10%), the foundation (10%), and ecosystem development (10%).

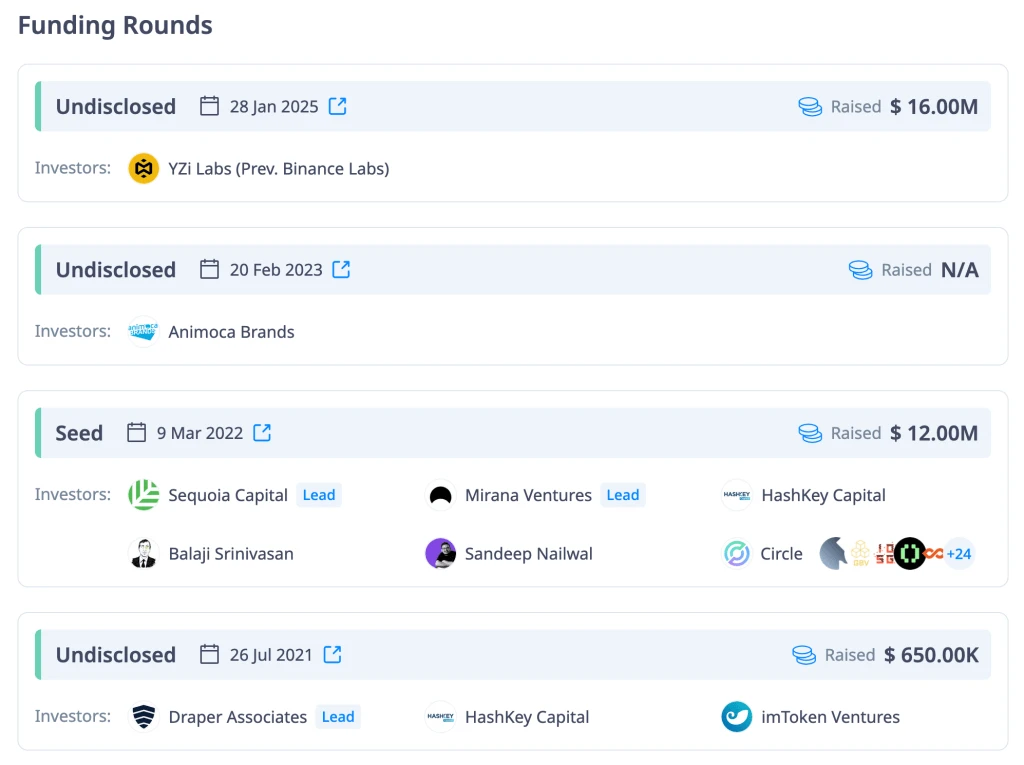

–The project raised $14 million in a seed round led by Sequoia Capital in 2022, followed by $16 million in a Series A round led by YZiLabs in 2025, and then conducted a token generation event (TGE) through Binance HODLer airdrop on April 28, 2025, with spot trading on Binance starting the same day at 11:00 UTC.

–SIGN's roadmap includes launching the SIGN super app in Q2 2025, government-grade product adoption in Q3 2025, and the launch of the SIGN media network in Q4 2025, while preparing for sovereign Layer 2 stacks and memorandums of understanding with Barbados and Thailand.

SIGN Token is pioneering a new infrastructure for global credential verification and token distribution by integrating a full-chain certification protocol with a smart contract-based distribution suite.

Its vision is to bring trust to a trustless network, enabling governments, enterprises, and developers to verify identities, proof of ownership, and contracts on-chain, while providing a transparent, scalable verification framework and large-scale token distribution solutions.

Table of Contents

Sign Fundraising and Launch Activities

How to Participate and Acquire SIGN Tokens

SIGN Token Overview

SIGN Token is a project that combines a full-chain proof protocol with an automated token distribution platform, now deployed on Ethereum, BNB Smart Chain, Base, StarkNet, Solana, TON, and mobile networks.

By integrating an on-chain credential verification system (SignPass) with a flexible distribution engine (TokenTable), SIGN enables governments, enterprises, and dApp teams to issue verifiable proofs and achieve large-scale token distribution.

As of 2024, Sign has processed over 6 million proofs and distributed over $4 billion in tokens to 40 million wallets. Its main application scenarios include:

Digital identity management and KYC/AML compliance in the public sector and financial services;

Loyalty programs, community incentives, and Web3 project reward distribution;

Supply chain credential verification, academic and professional certification.

Looking ahead, Sign aims to double the annual number of proofs by the end of 2025 and complete token distribution to over 100 million wallets.

Protocol governance is managed by a decentralized long-term holder and ecosystem contributor committee. The SIGN token serves as a funding source for protocol operations, playing a crucial role in incentivizing community growth and ensuring on-chain governance voting rights.

Technology and Architecture

Sign's infrastructure is built around three modular components—each designed to work seamlessly across multiple blockchains—and a set of ambitious performance goals.

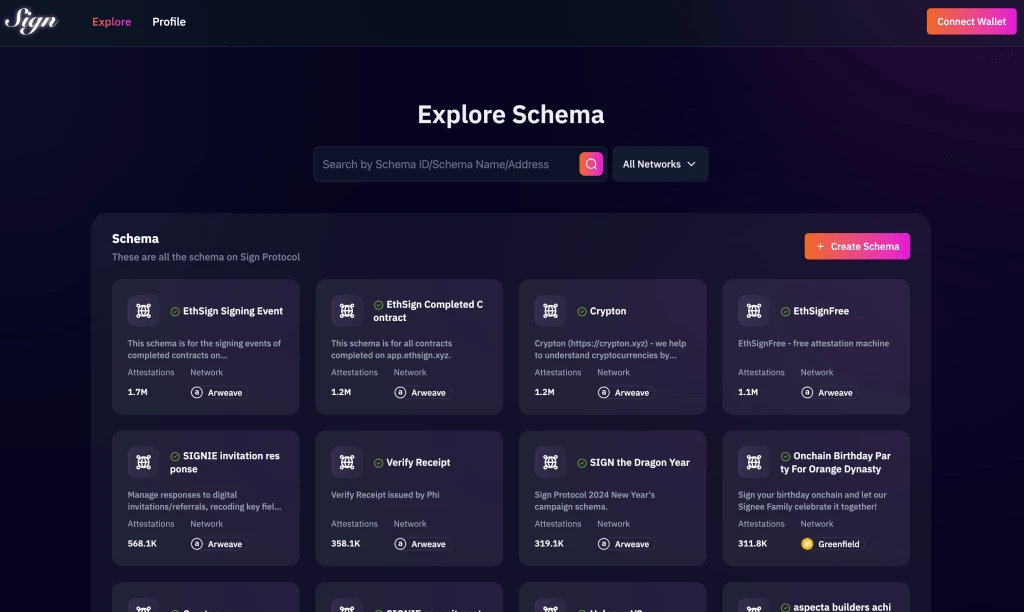

Signing Protocol

As the full-chain foundation for creating and verifying proofs. It connects Ethereum, BNB Smart Chain, Base, Starknet, Solana, TON, and Move-based networks, allowing developers to issue tamper-proof credentials (identity proofs, ownership records, contract verifications) that any application can query on-chain.

Performance Goals

- Throughput: 500+ TPS for base layer certification calls

- Finality: Sub-second confirmation for supported chains

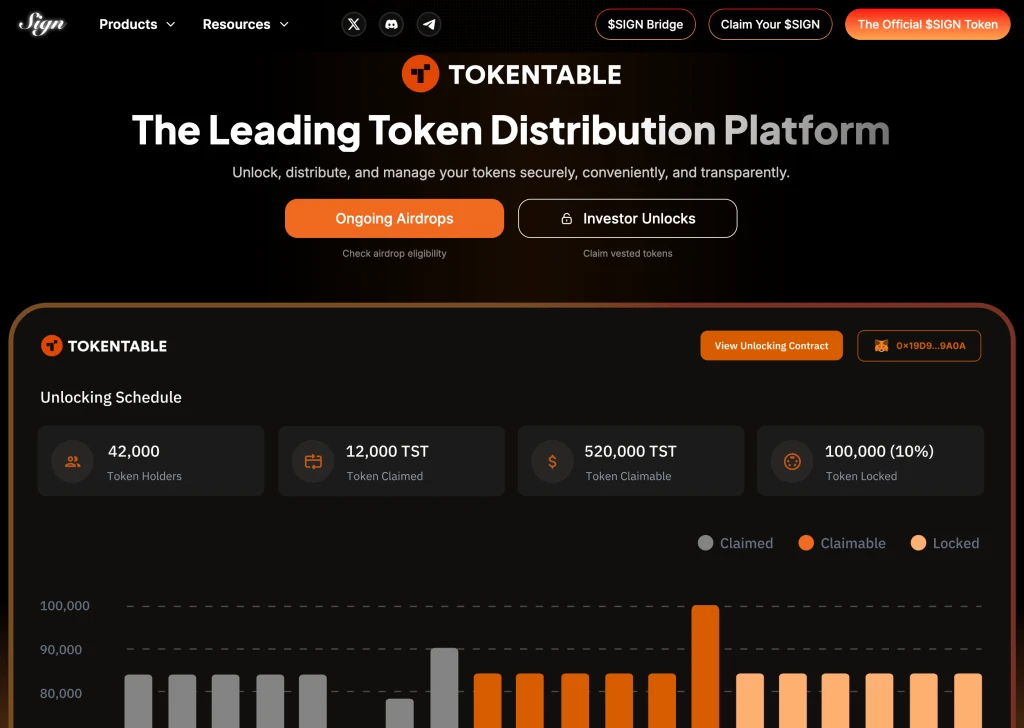

TokenTable

A highly configurable smart contract-driven engine for large-scale token distribution. Projects can use Merkle trees, signature-based or on-chain parameters (across EVM chains, Starknet, Solana, TON, and MoveVM networks) to launch airdrops, set vesting schedules, and automate unlocks.

Image Source: TokenTable Interface

- Certification Capability: Processing 6 million+ certifications in 2024, 12 million in 2025

Image Source: Signing Protocol Interface

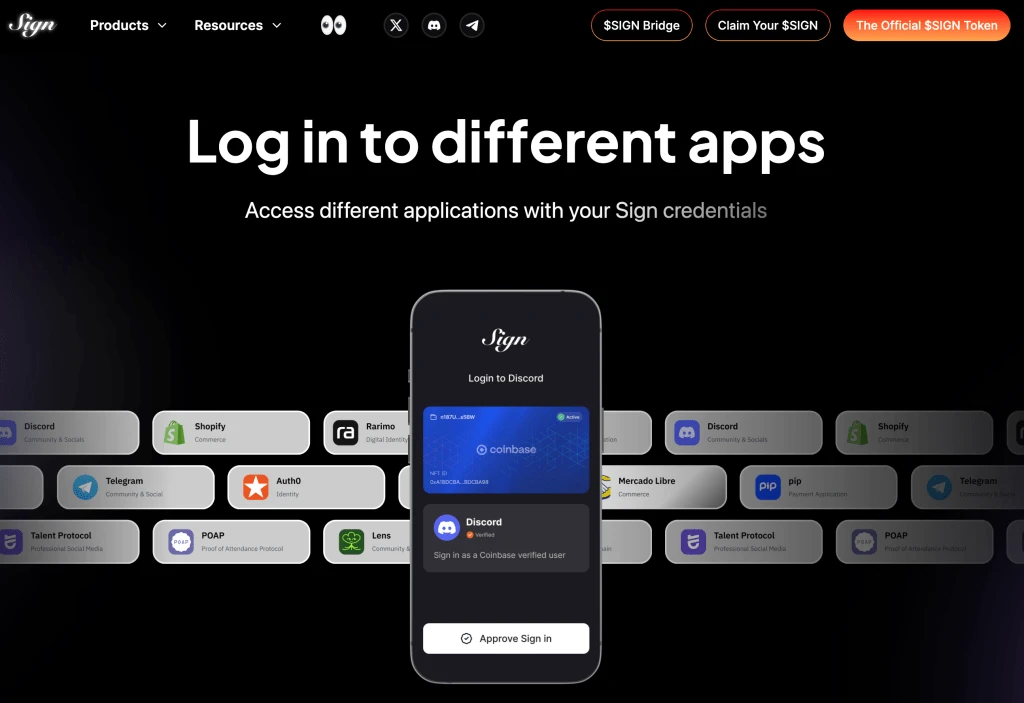

SignPass

An on-chain identity registry for storing and managing user credentials. SignPass allows individuals and organizations to register official documents, KYC/AML results, or custom proofs, all anchored to their wallet addresses for instant verification.

Image Source: Sign Global Official Website

Team and Governance

The core team of Sign was established in 2020 and includes:

- Yan Xin (Co-founder & CEO)

- Potter Li (Co-founder)

- Jack Xu (Co-founder and CTO)

- Mikema (Founding Team)

- Claire Ma (Product Lead)

Oversight is provided by a decentralized governance committee composed of elected community representatives, long-term holders, and strategic advisors. Council members serve staggered terms to ensure continuity and fresh perspectives when approving protocol upgrades, budget allocations, and ecosystem grants.

All SIGN Token holders can participate in governance by submitting proposals, voting, or delegating their voting rights to trusted representatives by staking their tokens. Voting weight is correlated with stake, and active participants receive on-chain alignment rewards for helping guide the development of Sign.

SIGN Tokenomics

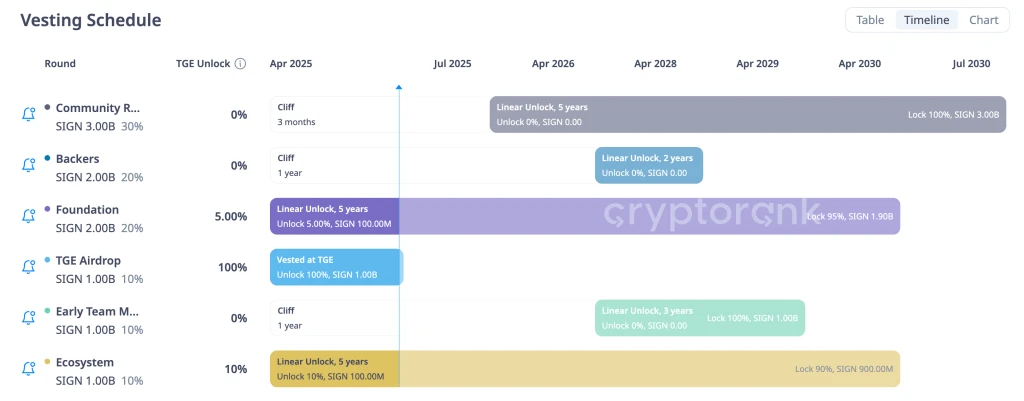

Sign limits its supply to 10 billion SIGN, with 1.2 billion (12%) released at the token generation event (TGE). The remaining 8.8 billion is allocated as follows:

- Community and Rewards (40%/4 billion SIGN)

Including 10% for TGE airdrop. The balance funds ongoing staking incentives, community grants, and ecosystem activities. Staking: 25% unlocked at TGE, then released monthly over 12 months.

- Supporters (20%/2 billion SIGN)

Reserved for seed and Series A investors. Vesting: 24-month linear release, 6-month cliff.

- Early Team (10%/1 billion SIGN)

Rewards for founding contributors and engineers. Vesting: 48-month linear release, 12-month cliff.

- Foundation Reserve (10%/1 billion SIGN)

Supports long-term protocol development and partnerships. Plans for multi-year allocations.

- Ecosystem Development (10%/1 billion SIGN)

Allocated for developer incentives, hackathons, and integration bounties. Released quarterly based on ecosystem milestones.

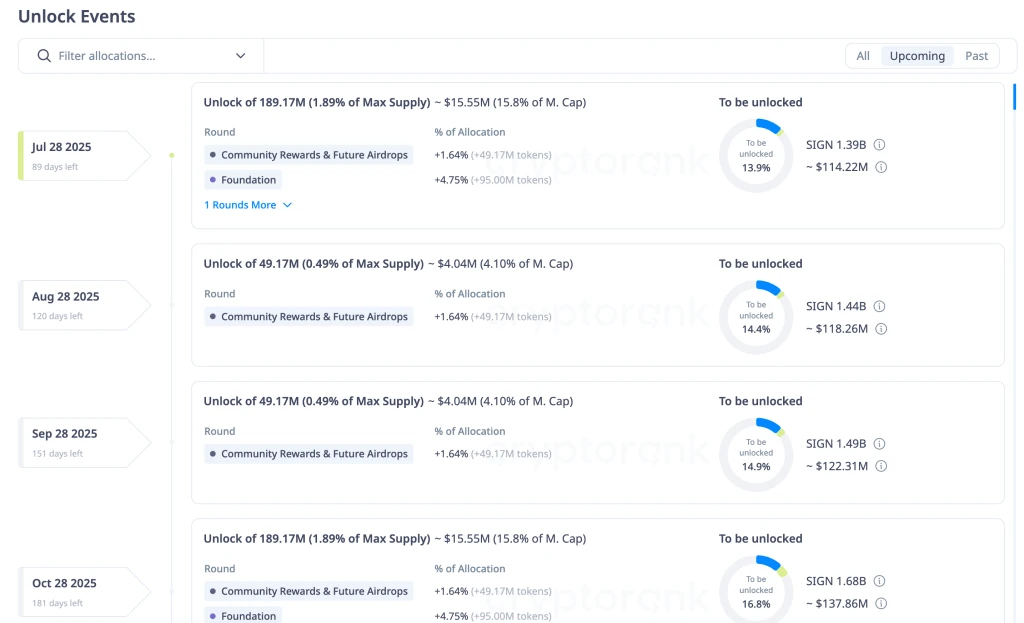

Image Source: CryptoRanks

Sign Fundraising and Launch Activities

SIGN's fundraising began in June 2022, with a $12 million seed round led by Sequoia Capital, supported by top venture capital firms from the US, China, India, and Southeast Asia. Building on this, the team completed a $16 million Series A round in March 2025, led by YZiLabs, with strategic ecosystem partners joining.

The token generation event (TGE) took place on April 28, 2025, at 10:00 UTC, when 350 million SIGN tokens were distributed to eligible BNB holders through the Binance HODLer airdrop.

Image Source: CryptoRanks

Market Status and Performance

At launch, 1.2 billion SIGN tokens (12% of the total supply) entered circulation on Binance, establishing deep liquidity from day one. Market makers and early supporters seeded the order book, ensuring tight spreads and high on-chain depth.

The first-day trading volume exceeded $200 million, indicating strong market demand. Price discovery stabilized around $0.05 per SIGN, with intraday volatility of ±15%, and then stabilized as buy-and-hold demand emerged.

To expand access, Sign secured additional listings in Q2 2025:

- Centralized Exchanges: XT.com, OKX, KuCoin, Bybit

- Decentralized Exchanges: Uniswap (v3), SushiSwap, PancakeSwap

- Cross-Chain Bridges: Integration with Hop Protocol and AnySwap

These launches will deepen liquidity, reduce trading friction, and drive Sign's adoption across different markets.

How to Participate and Acquire SIGN Tokens

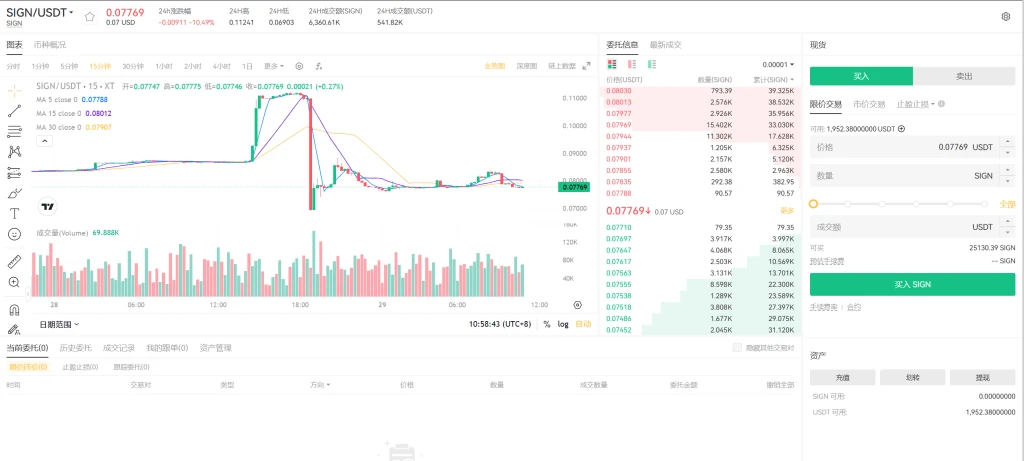

Spot Trading on XT.COM

- Launch Date: April 28, 2025, at 11:00 UTC

- Trading Pair: SIGN/USDT

XT.com SIGN/USDT Spot Trading Interface

DEX Listings and Bridges

- Direct swaps on Uniswap v3, SushiSwap, PancakeSwap

- Seamless transfers via cross-chain bridges through Hop Protocol or AnySwap

Community Programs and Rewards

- Referral Bonuses: Earn SIGN by inviting friends to trade

- Staking Pools: Lock SIGN to earn protocol fees and alignment rewards

- Developer Grants and Hackathons: Submit applications for bounties using the SIGN protocol

Join the conversation on X (Twitter) @ethsign and Telegram @orangedynasty for the latest contests, AMAs, and distribution events.

Image Source: Official SIGN X/Twitter

SIGN Competitive Landscape

Sign operates alongside several established identity and credential protocols, each with its own strengths.

A multi-chain identity solution that combines on-chain verifiable credentials with off-chain KYC/AML services. The Civic ecosystem supports a wide range of wallets and dApps, focusing on privacy-preserving identity verification.

An on-chain identity vault where users store and manage approved credentials (passports, driver's licenses, etc.) in a secure, self-custodied wallet. SelfKey emphasizes user ownership and granular sharing control.

A biometric uniqueness protocol that issues anti-Sybil persona proofs through a retinal scanning "Orb" device. World ID targets applications requiring high assurance human verification.

Each competitor addresses certain aspects of the identity puzzle—Sign's advantage lies in its combined full-chain proof layer and large-scale distribution engine.

Risks and Considerations

- Execution Risk: Rapid expansion of the product in certain jurisdictions may outpace adoption rates.

- Token Unlock Schedule: Significant allocations for supporters and team members unlock over several years.

- Competitive Landscape: Established identity and credential protocols may limit market share.

- Regulatory and Market Volatility: Biometric verification services face evolving global privacy regulations.

Vision

Sign (SIGN)'s unique combination of full-chain proof, large-scale distribution capabilities, and strong real-world adoption makes it a cornerstone of Web3 digital identity. Stakeholders should consider proof growth, token distribution volume, and government adoption milestones as leading indicators of ecosystem health.

Frequently Asked Questions

- What is SIGN?

The native utility token supporting the Sign Protocol, TokenTable, and SignPass for credential verification and token distribution.

- Where can I buy SIGN?

SIGN tokens are available for trading across multiple CEXs (e.g., Binance, Bybit, etc.). Alternatively, you can check spot trading under the SIGN/USDT trading pair on XT.COM.

- How do I stake or use SIGN?

At launch, SIGN supports on-chain verification, governance proposals, and distribution fees within the Sign ecosystem.

- Where can I find more information?

Sign Protocol Documentation: https://docs.ethsign.xyz/

- What is the total supply and distribution of SIGN?

Total supply is 10 billion; TGE 12% (1.2 billion), 40% to the community, 60% to supporters, team, foundation, and ecosystem.

- How can I participate in Sign's governance?

Holders of SIGN gain voting rights by staking and participating in on-chain proposals.

- Which wallets support SIGN?

Any wallet compatible with ERC-20 (e.g., MetaMask, Trust Wallet) and Binance Custody.

- Is there a vesting schedule for team and investor allocations?

Yes—unlocking schedules through TokenTable are configurable and span multiple years.

- How can I join the Sign community and get support?

Engage on X (Twitter) @ethsign and Telegram @orangedynasty

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with over 1 million monthly active users and user traffic exceeding 40 million within the ecosystem. We are a comprehensive trading platform supporting over 800 quality coins and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a rich variety of trading options including spot trading, margin trading, and futures trading. XT.COM also features a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。