I don't know if everyone has recently heard the latest news from the crypto world, which lawyer Mankun is willing to call the "Bitget VOXEL Contract Incident."

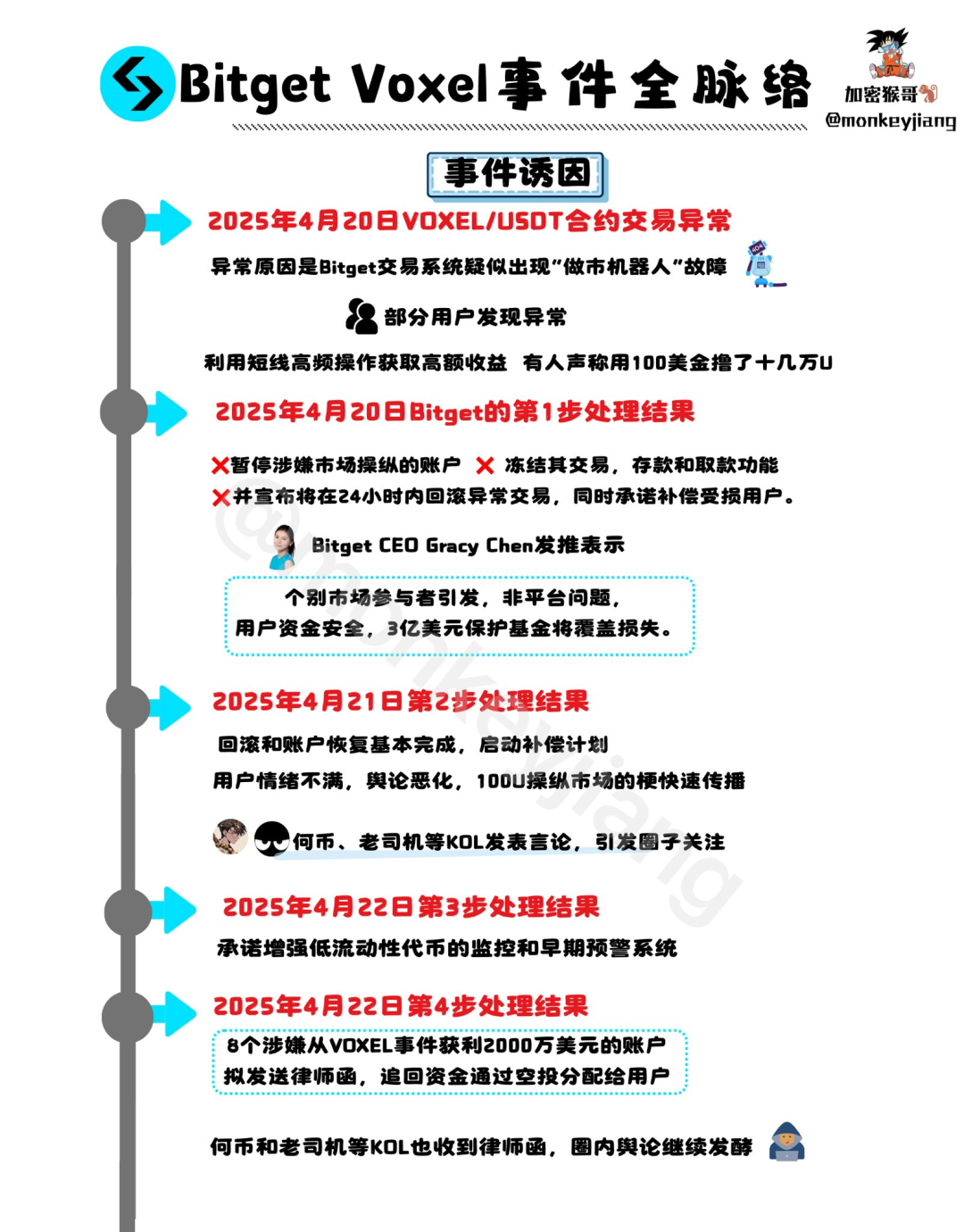

Here, I will borrow the timeline from X platform user Crypto Monkey (@monkeyjiang) (the graphic is well done).

In simple terms, this incident occurred on April 20, when the VOXEL/USDT contract trading was abnormal, leading some users to earn a total of over 40 million USD through short-term operations. Notably, one team, namely Bitget (hereinafter referred to as BG), which sent the lawyer's letter, made over 20 million USD (BG claims they suspect a professional arbitrage team, while the other party claims to be professional market makers; we don't know who is telling the truth).

After the incident, BG began to take measures to mitigate losses through transaction rollbacks, account freezes, and sending lawyer's letters. This series of actions has pushed the incident into the spotlight of public opinion.

Crypto players have taken sides, with Web3 KOLs like Hebi (@hebi555) and Crypto Veteran (@SEFATUBA3) accusing BG: "I made money through operations, and you BG lost and are acting like a rogue; can't you handle it?" A small number of KOLs believe BG is right; profiting from a bug is wrong; moreover, BG mentioned that the recovered 20 million USD would be airdropped to users, which is good.

Meanwhile, bystanders, like lawyer Mankun, have been quietly observing the situation while eating popcorn.

However, while enjoying the drama, lawyer Mankun also noticed the popular doubts on social media. Today, let's discuss the five hottest and most controversial questions from the perspective of Chinese law.

Q1: Users profiting from arbitrage, does Bitget's claim of "theft" hold water?

From the lawyer's letter issued by BG, the platform or the lawyer's stance is: users exploited a system bug for arbitrage, which is suspected theft, hence the warning letter.

So, the question arises: does exploiting a system loophole for arbitrage constitute theft?

First, in the Criminal Law, theft is defined as "the act of secretly taking public or private property for the purpose of illegal possession, and the amount is relatively large." A simple understanding is sneaking away someone else's money without their knowledge.

Arbitrage, on the other hand, involves seeing price discrepancies in the open market and making a profit from the price difference; it is essentially a market activity, not done behind anyone's back, but rather openly trading. It is far from theft.

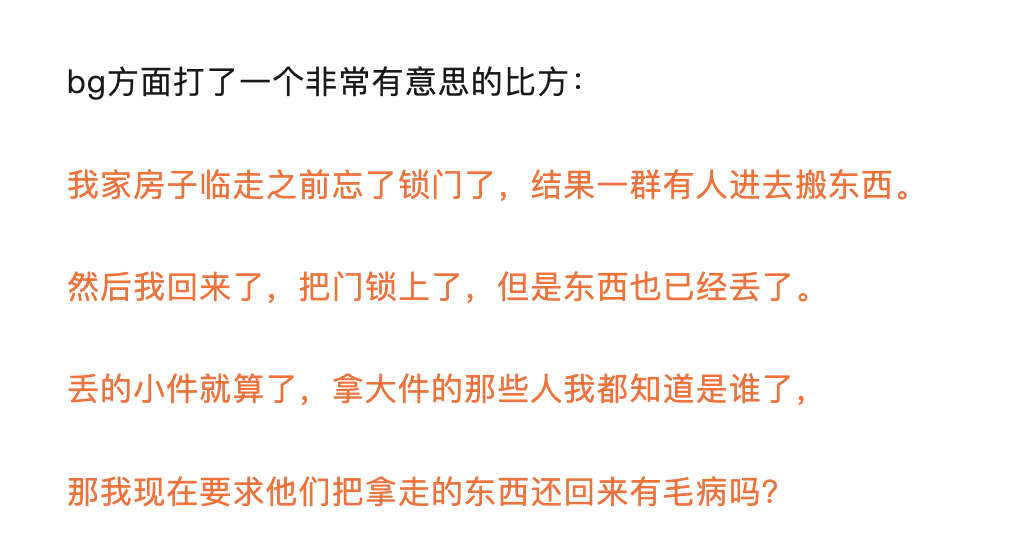

However, note that if you are fully aware that the other party's system has issues and exploit the bug for arbitrage, it is no longer as simple as arbitrage. The content from the Orange Seat public account shows—BG made this analogy:

In fact, in traditional criminal cases, we lawyers often encounter external parties exploiting system bugs in the Web2 industry to profit, which courts ultimately classify as theft or even fraud; when internal personnel exploit system vulnerabilities for profit, it is classified as embezzlement.

Therefore, this behavior needs to be examined based on evidence, specifically whether these individuals knowingly exploited the system bug and caused BG a loss of property.

From the current public opinion, retail investors generally believe that if you made so much money before, why can't you open up the situation now that the system has issues? (Can't you learn from a certain well-known overseas e-commerce platform, where a price was misquoted and someone bought it, benefiting the customer?), while the platform claims that the other party intentionally caused the BOT issue and at times says it was exploiting the bug for extreme arbitrage.

Lawyer Mankun suggests that in the absence of sufficient evidence, everyone should wait a bit; didn't BG say they would soon release an incident report?

Q2: Bitget is an overseas entity; can it send lawyer letters and sue Chinese users?

Many people are questioning how BG, as an overseas entity, suddenly sent lawyer letters to Chinese users, claiming to seek accountability?

Lawyer Mankun has seen some legal analyses stating that it is possible because BG is an overseas entity, and theoretically, foreign companies can hold domestic individuals accountable. Article 265 of China's Civil Procedure Law also stipulates that in foreign-related contract disputes, if the place of dispute or the location of the defendant's property is in China, the court has jurisdiction.

This theory is not incorrect; years ago, Microsoft even sent letters to domestic piracy users. However, in the crypto space, we must also consider the domestic regulatory stance on cryptocurrency trading—classifying virtual currency trading as illegal financial activity.

This is the most discussed point: under such circumstances, is BG sending lawyer letters to users seeking protection under Chinese law?

In fact, a lawyer's letter is merely a form of delegation, essentially informing the recipient, "I have entrusted this lawyer to speak on my behalf." It is neither a notice of case filing nor a court judgment; even criminal suspects can entrust lawyers to send lawyer letters.

As for whether they can actually sue and win, that is a matter for subsequent judicial procedures.

So, based on this fact, the current lawyer letter may serve more as a psychological tactic; whether it can create a stir and what kind of stir remains to be seen.

Q3: Rumor has it that Bitget froze users' Binance accounts; how did they do it?

This rumor is even bigger, claiming that BG froze the arbitrage users' Binance accounts through the police, directly intervening across exchanges.

Can this be done?

Generally speaking, if the police freeze an account, it indicates that a case has been filed and that you are suspected of committing a crime, followed by a formal document notifying the relevant platform to cooperate. However, this step also requires approval from the investigating unit to execute.

Now, combining the first and second questions, lawyer Mankun boldly speculates that BG's lawyer letter and police freeze are actually coordinated actions aimed at pushing the matter in a criminal direction, locking the other party's funds, and increasing negotiation leverage.

From the feedback on X platform, some accounts have indeed been frozen, but how the case was filed, what entity and method were used, and since the details have not been made public, we can only cautiously observe and wait for further developments.

Q4: Is Bitget's transaction rollback reasonable and legal?

To say that the initial user dissatisfaction stemmed from BG freezing withdrawals and rolling back transactions to recover some losses after the incident.

Originally, users fought hard in the contract market and finally made some money, but the platform suddenly made a big move: "Sorry, system error, this order doesn't count; it's rolled back." Moreover, not only did they roll back, but they also wiped out fees and slippage, leaving some users with negative account balances.

As a result, many users vented their anger on social media: "You run a casino and gamble against users; can't you handle the loss?"

But the question arises: is rolling back legal?

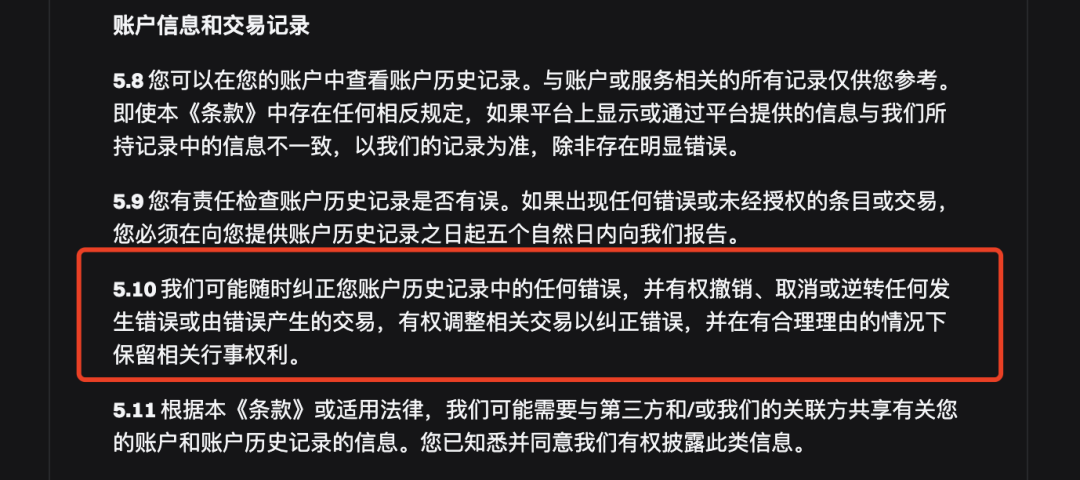

First, in the user agreements of most exchanges, there is usually a clause stating that if there is a system failure or technical anomaly, the platform has the right to adjust or roll back.

So, if you want to use BG, you have to agree. If you agree, then when something goes wrong, you must follow the agreement; if BG says to roll back, it can roll back.

In fact, other platforms have also had rollback histories. For example, in September 2021, FTX's SOL-PERP contract plummeted due to liquidity issues, causing some users with high leverage to be liquidated, and trading severely deviated from spot prices. Subsequently, FTX issued an announcement in advance, declaring that some trades would be rolled back. Previously, OKX also had a small-scale rollback, similarly issuing announcements throughout, explaining the rollback scope and standards, without generating negative public opinion.

Returning to this incident, is rolling back reasonable under the existence of a user agreement?

Clearly, this is similar to certain internet companies experiencing bugs and system rollbacks; while it may be reasonable, it lacks standards. Upon detailed examination of the aforementioned examples, we can see that before and after the rollback, other platforms issued announcements immediately, ensuring overall transparency, clear standards, and corresponding compensation plans.

In contrast, this time BG may have acted too hastily to cut off the flow of funds and prevent arbitrageurs from transferring their funds, leading to rushed actions and rough procedures. It is precisely because of this rough operation that an irreversible discount on the platform's credibility has occurred—when the system has issues, the platform's self-rescue is understandable; however, first operating behind closed doors, then following up with a lawyer's letter and cross-exchange freezes is indeed hard for users to accept.

Q5: Can users sue Bitget for operating a casino? Can they recover losses?

Now, public opinion on social media has escalated to "You BG sent me a lawyer letter, so I will counter-sue you for operating a casino."

Alright, are we preparing for a love-hate relationship? So, can this be done? Can users recover losses this way?

First, let's take a look at Article 303 of China's Criminal Law: the crime of operating a casino refers to organizing gambling or providing gambling conditions for profit.

On this basis, combined with lawyer Mankun's previous tweets, "Mankun Research | Are cryptocurrency perpetual contract trades gambling or financial derivatives? Mankun lawyer's horizontal comparison of global regulatory status" and "Mankun Legal Education | Why do virtual currency exchange contracts with commission rebates involve operating a casino?", there are indeed court cases in mainland China that classify cryptocurrency perpetual contracts as illegal gambling, and some players involved in commission rebates have been deemed accomplices in operating a casino.

Lawyer Mankun is currently defending several exchanges, hoping to deny the classification of perpetual contracts as gambling:

On one hand, from a global regulatory policy perspective, overseas jurisdictions classify contracts as financial derivatives, while mainland China uniquely classifies them as gambling; this is not merely a legal difference but may reflect a lag in understanding of the Web3 industry by some individuals.

On the other hand, from a social governance perspective, if investors truly want to uphold the mainland's classification of contracts as gambling, they should be prepared; these exchanges will be investigated, and records of contract trading and withdrawal will be available, leading to administrative penalties for gambling.

So, if you are willing to turn the table, you can report to regions that have issued "contracts are gambling" rulings, asking them to unify the judgment standards, and then those participating in contracts may face administrative penalties for gambling?

Summary by Lawyer Mankun

Having followed the situation, the VOXEL contract incident is essentially a public opinion battle in the market, with truths and falsehoods intertwined. We are not stakeholders, so we can only observe; it might be better to let the dust settle a bit longer. Anyway, BG has stated that they will soon release an incident report. Additionally, since the lawyer's letter and police account freezes have already begun, it won't simply end with words.

/ END.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。