What is Sun Yuchen's Next Big Move?

Author: Bob | Blockchain in Plain Language

In the past month, the cryptocurrency market has been turbulent due to the many uncertainties brought about by Trump's presidency. Meanwhile, TRON has welcomed its annual highlight moment, with multiple positive developments coming in.

TRON founder Sun Yuchen has remained active on the front lines of the crypto industry, recently gracing the cover of Forbes Global, and will soon participate in a highly anticipated "Fireside Chat" at the Token2049 conference in Dubai alongside Eric Trump (representative of the Trump family) and Zach Witkoff, co-founder of WLFI.

Behind the global upheaval, the regulation and development of the crypto industry have become more certain. Is Sun Yuchen about to "win big" again?

01

TRON Welcomes Its 2025 Annual Highlight Moment

On March 29, 2025, Sun Yuchen appeared on the cover of Forbes Global. It is reported that the selection of cover figures for the English version of Forbes follows two main criteria: "quantifiable business dominance" and "irreplaceable rule-defining power." Sun Yuchen's appearance on the cover may be due to his contributions to advancing crypto technology and his personal business acumen, receiving high praise from influential figures in the industry such as Tether CEO Paolo Ardoino.

Some media have commented that he is the third Chinese entrepreneur to appear on the cover of the English version of Forbes after Jack Ma, and the fourth leader of a crypto industry platform to receive this honor—previously, only Binance's Zhao Changpeng (CZ) and Coinbase's Brian Armstrong had appeared in this position.

Sun Yuchen's appearance on the Forbes cover signifies recognition of his contributions to business, finance, and the crypto industry, while also helping the public better understand the crypto industry. Under the media spotlight, it enhances Sun Yuchen's influence and the visibility of the mainstream public blockchain TRON.

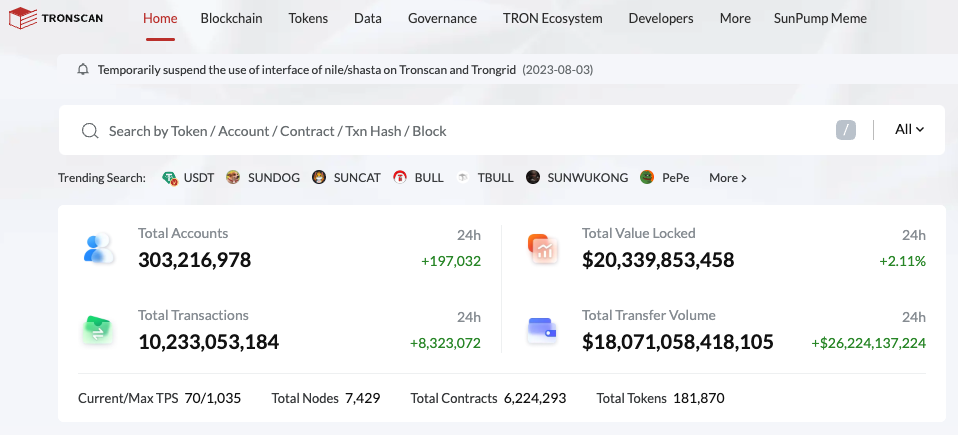

The positive effects of the "Forbes" global cover story have yet to be fully digested, and in the past month, the TRON community has received a series of good news: the total number of TRON accounts has officially surpassed 300 million, Canary Capital has submitted an application for a TRX ETF, and the TRON version of USDT has surpassed 70 billion.

The crypto market was "turbulent" in the first quarter for well-known reasons, but TRON's on-chain data performed impressively. According to on-chain data analysis, the total number of TRON accounts has officially surpassed 300 million, with daily active accounts exceeding 2 million in the quarter. Notably, in February 2025, the TRON network processed over 14 million USDT transactions weekly, accounting for 69% of global USDT activity.

Thanks to TRON's core position in the global payment and settlement network and Sun Yuchen's influence, Canary Capital submitted application documents to the SEC for a Tron ETF with staking functionality, becoming the first TRX ETF in the application process.

As of the time of writing, among the previously approved crypto asset spot ETFs, the market value of the Bitcoin spot ETF is $111.3 billion, while the total market value of the Ethereum spot ETF is $6.4 billion. Referring to the significant inflow of funds into these ETFs, the TRX ETF is also expected to bring certain benefits. Just as the market anticipates an Ethereum ETF with staking functionality, the Tron ETF with staking functionality may also have added appeal.

On April 21, we saw two pieces of news from the crypto industry on the same day: the first was that Tether Treasury issued an additional 1 billion USDT on the TRON network, and the second was that Tether Treasury destroyed 1.5 billion USDT on the Ethereum network at 16:45 that day. Both pieces of data came from WhaleAlert, one indicating inflow of funds and the other outflow, which may be coincidental but more so reflects the strong demand and frequent activity of stablecoins on the TRON network.

As expected, recently, several well-known overseas media reported that the total issuance of Tether (USDT) on the TRON blockchain has surpassed the $70 billion mark. This means that the USDT issued on the TRON network accounts for nearly 50% of the total global USDT issuance (over $140 billion). This achievement not only solidifies TRON's global leadership position in the stablecoin sector but also highlights its key role in promoting financial inclusion and decentralization, as well as the success of TRON's strategic layout in global financial payment infrastructure.

02

Sun Yuchen's Stablecoin Strategy

According to a report by Coingecko, as of March 2025, the total market value of the global stablecoin market reached $242 billion, an increase of about 50% from $161.2 billion in 2024. The development of the crypto sector has made stablecoins one of the largest applications. Bernstein predicts that the stablecoin market is expected to exceed $2.8 trillion by 2030.

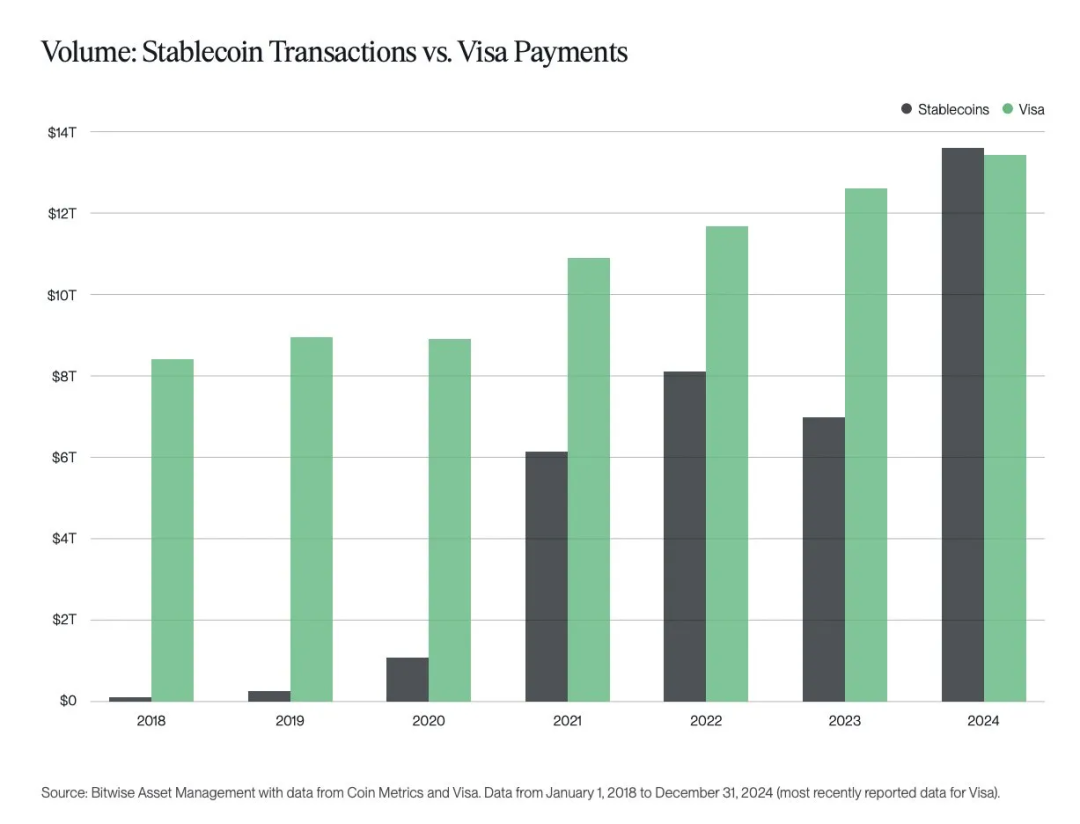

Not long ago, a report from Bitwise indicated that in 2024, the trading volume of stablecoins surpassed that of VISA for the first time in history, marking a milestone, and the scale of stablecoins continues to grow rapidly. Meanwhile, the stablecoin projects rank 17th globally in terms of U.S. Treasury holdings, surpassing countries like Saudi Arabia, South Korea, and Mexico.

It must be said that the success of USDT on the TRON network means that Sun Yuchen has once again seized the "key point." The significance of the stablecoin sector to the crypto industry and global financial transformation is self-evident. As an important cornerstone of the crypto industry, stablecoins connect traditional finance with the crypto world. They are not only a safe haven in the crypto world but also promote the development of applications such as payments, trading, and DeFi, enhancing market liquidity. At the same time, stablecoins accelerate the process of currency digitization, becoming an important force in global financial transformation.

In fact, as early as 2019, TRON began supporting USDT, marking an important starting point for Sun Yuchen's entry into the stablecoin strategy. At that time, the stablecoin market was growing rapidly, while the public chain infrastructure of Bitcoin, Ethereum, and others exposed issues of high fees and low speeds. TRON quickly attracted a large number of users and trading volume by providing a low-cost, high-speed transfer experience and collaborating with major CEX platforms for widespread adoption. It can be said that the stablecoin sector and crypto payments represent a strategic opportunity for TRON and Sun Yuchen, and similarly, TRON has also promoted the adoption of stablecoins and the progress of the crypto industry.

Additionally, TRON launched its decentralized stablecoin USDD in April 2022, and the current issuance of USDD has exceeded 400 million, with the number of USDD holding addresses continuing to grow. Data from April 2025 shows a significant increase in its adoption rate, especially among the 30 million users in the TRON ecosystem, where USDD has become one of the preferred stablecoins for DeFi and payments.

The launch of the decentralized stablecoin USDD by TRON is a key strategic layout in building a diverse stablecoin ecosystem, not only filling the gap of decentralized stable assets within the ecosystem but also reinforcing ecological autonomy through an over-collateralization model, forming a complementary synergy with centralized stablecoins (such as TRC20-USDT).

In November 2024, Sun Yuchen invested $30 million to purchase WLFI Token, becoming the largest holder of the project, and was appointed as an advisor the next day. Subsequently, his investment increased to $75 million, laying the foundation for deep cooperation between the WLFI project and the TRON network in the future.

World Liberty Financial (WLFI) is a DeFi project supported by the Trump family, with a vision to drive global financial transformation through stablecoins and DeFi protocols, which aligns with Sun Yuchen and TRON's stablecoin strategy. For the WLFI project, in addition to the initial capital injection, Sun Yuchen can also provide resources from the upstream and downstream of the crypto ecosystem and valuable experience from years of entrepreneurship in the crypto industry to boost market confidence. Through cooperation with the Trump family, Sun Yuchen helps TRON enter the mainstream financial landscape in the U.S., supporting its vision of a "global settlement layer."

From entering the stablecoin sector to serving as an advisor to WLFI, Sun Yuchen's global payment financial infrastructure strategy is coming to light. By supporting stablecoins and providing low-fee transactions through the TRON network, he quickly captures market share. The network's high throughput and low transaction costs are particularly suitable for emerging markets, such as Latin America and Africa, meeting the demand for stablecoin payments in these regions.

03

Conclusion

As the new U.S. Treasury Secretary said, "Dollar stablecoins will maintain the dollar's status as the international reserve currency," stablecoins play a crucial role in the global financial transformation process and have great potential. Whether it is Sun Yuchen appearing on the Forbes cover, the total number of accounts surpassing 300 million, the TRX ETF application, or USDT exceeding 70 billion, these positive developments, although concentrated in the short term, are rooted in the accumulation of the TRON ecosystem over the past years and Sun Yuchen's far-reaching strategic layout. Overall, in the upcoming global financial transformation, TRON has already secured a good start.

Source: WeChat Official Account

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。