The role of Core is similar to that of a "chief maintainer," but it is not irreplaceable.

Written by: Liu Jiao Lian

Bitcoin developer Jimmy Song posed a thought-provoking question: Can Bitcoin survive without Core (note: referring to the Bitcoin Core client software, considered the "orthodox" inheritor of Satoshi Nakamoto's original codebase)? Another well-known Bitcoin developer, Luke Dashjr, replied that, at present, the likelihood of Bitcoin continuing to survive without Core is much higher than if it were to rely on Core.

As is well known, since its inception in 2009, Bitcoin's underlying protocol and operational mechanism have always revolved around "decentralization." As its initial reference implementation, Bitcoin Core is responsible for maintaining protocol rules, fixing bugs, and upgrading the network. However, does Bitcoin's survival necessarily depend on Core?

From a technical architecture perspective, the protocol takes precedence over the implementation. The core of Bitcoin is not a specific software but a protocol defined by mathematical rules and cryptographic algorithms.

Bitcoin Core, as the first implementation of the protocol, provides a standardized node program, but its code is not irreplaceable.

Theoretically, any client that adheres to Bitcoin's consensus rules can connect to the network, as long as the new implementation is compatible with the existing network's transaction verification rules and block generation logic, the Bitcoin network can continue to operate.

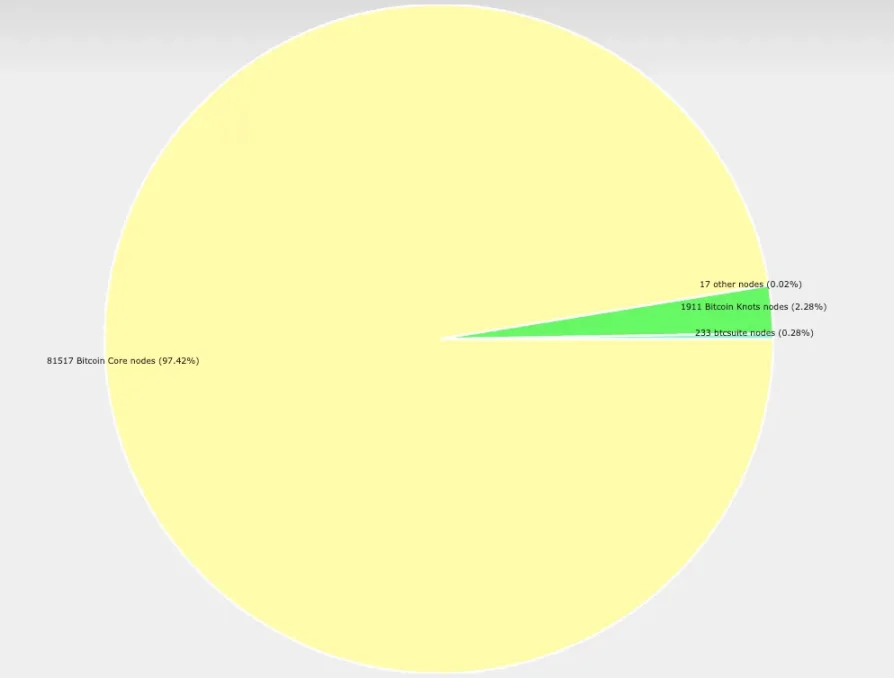

However, according to statistics from Luke Dashjr, the Bitcoin Core client software currently holds an absolute dominant position, with a market share exceeding 97%.

As for the reason, Jiao Lian believes it may be because the so-called consensus of the majority needs a carrier. Choosing the most "orthodox" codebase as the carrier of this consensus seems to be the simplest option.

Similar to miners' choice of the longest chain, the choice of Core software also appears to be a "Schelling Point" in game theory.

This is why, after 16 years since Bitcoin's birth, there are still many other client software options outside of Core, yet they have never been able to achieve a significant market share.

The second-largest client in the above chart, Bitcoin Knots, is actually also Core, a modified version of Core produced by Luke Dashjr.

In the history of Bitcoin's development, during the most significant and intense community divide over block size expansion from 2017 to 2018, large block advocates attempted to seize Core's orthodox status and even utilized nearly Core's computing power, but ultimately they were defeated. This undoubtedly greatly reinforced Core's unshakable leadership position.

Without Core and the steadfast principles and relentless coordination of its then-chief maintainer Wladimir van der Laan (who served as chief maintainer from 2014 to 2022), it is hard to imagine how intense community disputes could have escalated, and whether miner groups would have gained reverse control over the development team, forming a "military government."

The difference between Core and miner groups is that miner groups control computing power; once they gain code modification rights (legislative power), they can do as they please, changing the rules however they want; whereas Core seeks to change the rules through code modifications, relying on the community's voluntary acceptance of new code rules; otherwise, if the code is written but no one uses it, the decree cannot be published on GitHub, rendering it worthless.

Currently, Bitcoin's protocol updates rely on the BIP (Bitcoin Improvement Proposal) process, where any developer can submit proposals, but they must go through coordination of interests among miners, nodes, exchanges, and others to take effect. The Bitcoin Core codebase is publicly available on GitHub, allowing global developers to review, modify, or propose alternatives.

The evolution mechanism of the protocol is essentially a social experiment. If the interests of the miner community are not taken into account, successful upgrades are impossible. If the interests of a broader group of coin holders are not considered, the situation could be worse; users may vote with their feet, selling off BTC and completely abandoning it, leading to a final outcome of zero.

Bitcoin without Core may face two types of risks. The first is protocol fragmentation. If multiple clients have differing interpretations of the rules (such as block size, script opcodes), it could lead to network splits. The fork wave of 2017 has already shown such risks, but history indicates that the market usually chooses the chain with the strongest network effects and stability as the "main chain." The second is the dispersion of development resources. Core has accumulated over a decade of technical debt and optimization experience, and new implementations would need to rebuild code robustness at the same level, which places higher demands on community collaboration efficiency.

However, as long as the core rules such as the proof-of-work mechanism, the 21 million cap, and the UTXO model remain unchanged, any compatible implementation can inherit its value storage properties.

In extreme cases where Core disappears, miners would still have the motivation to switch to other clients to maintain the value of their assets, and exchanges and wallet service providers would also adapt to new protocols to ensure business continuity.

The vitality of Bitcoin is rooted in its social consensus at the protocol layer and decentralized architecture, rather than a specific development team or software implementation. The role of Core is similar to that of a "chief maintainer," but it is not irreplaceable.

At this stage, the existence of Core serves as a "ghostwriter" for the global consensus, effectively writing the rules of Bitcoin on behalf of all coin holders, which is the most natural choice that human society has reached to date.

As for the "decentralization" of Core itself, splitting into numerous client software and code maintenance teams, no longer relying on traditional collaboration methods for coordination, is indeed another milestone in exploring, pioneering, and innovating new ways of decentralized governance and self-organized collaboration in an era where humanity is still accustomed to state rule and corporate governance.

Perhaps we should remain optimistic about this.

Historical crises have proven that when code defects threaten the system, the community can quickly collaborate to fix them; when there are disagreements in development direction, the market chooses the main chain through computing power voting. This governance model based on rules and dynamic balance may allow Bitcoin to continue its network effects even if it separates from Core, relying on the open-source ecosystem and global participants.

Perhaps its true survival bottom line lies in whether the majority of participants still believe in mathematical rules rather than human authority, and whether they are willing to bear the costs and sacrifices to maintain this belief.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。