As of April 2025, the overall market value of the gold RWA sector has reached $1.45 billion.

Written by: ChandlerZ, Foresight News

On April 28, Tether released its first official audit report for Tether Gold (XAU₮). The data shows that as of the end of the first quarter, the circulation of Tether Gold reached 246,523.33 ounces, equivalent to 7.7 tons of physical gold, with a total market value of $770 million, and each token valued at $3,123.57, hitting a historical high of $3,423 on April 21. Each XAU₮ is backed 1:1 by physical gold, stored in world-class vaults in Switzerland, certified by the London Bullion Market Association (LBMA), and subject to regular independent audits.

On the surface, this is just another compliant financial disclosure with solid data; but on a deeper level, it reveals the intersection of two trends: the return of gold as a cornerstone of global wealth and the on-chain world's desire for a trustworthy value anchor.

The Return of Gold: More Than Just Sentiment

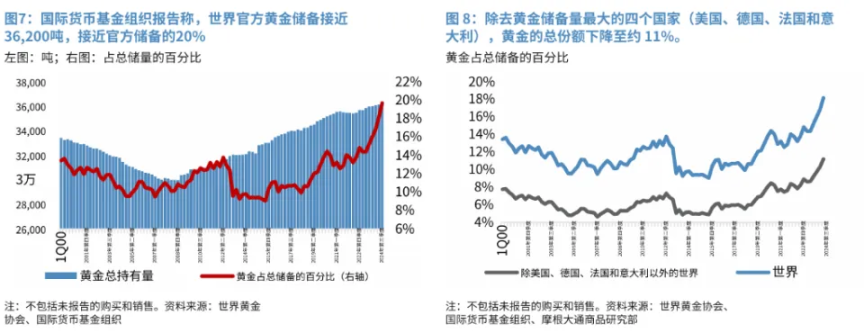

From the data, gold is experiencing a quiet structural return. In 2024, global central bank net gold purchases reached 1,044.6 tons, setting a record for the second consecutive year, with BRICS countries being particularly active. The continued accumulation of gold by central banks is not merely a reflection of short-term financial fluctuations but rather an instinctive response to changes in the future international monetary order.

In the private market, gold prices are also reshaping their presence with greater intensity. On April 22, COMEX gold futures prices peaked at $3,504.2 per ounce, while the Shanghai Gold Exchange's spot gold price soared to 832.42 yuan per gram, both setting historical records. The surge in gold prices is driven by a trifecta of factors: supply chain panic triggered by the tariff war, deepening cracks in the dollar credit system, and the re-emergence of stagflation risks.

International financial institutions such as Goldman Sachs and UBS have raised their gold price targets, with Goldman Sachs predicting that gold could rise to $3,700 by the end of 2025, and in extreme scenarios, even to $4,500. A more profound variable is the U.S. fiscal deficit rate exceeding 6.6%, the dollar index falling to its lowest level since 2023, and the gradual unfolding of de-dollarization trends. Gold, as a borderless credit asset, is regaining favor from all parties.

RWA Logic: On-Chain Restructuring of Real Assets

In this wave of gold revival, not only traditional gold bars and ETFs benefit, but digital gold assets are also beginning to grow rapidly. Tether Gold is just one of the frontrunners.

Data shows that as of April 2025, the overall market value of the gold RWA sector has reached $1.45 billion, a 13.28% increase from 30 days ago. Monthly on-chain transfer volume surged to $1.31 billion, a year-on-year increase of 127.37%. Although the number of monthly active addresses has declined, the total number of holding addresses remains at 69,660, indicating that on-chain gold is increasingly becoming a long-term holding rather than a short-term trading tool.

In terms of market structure, gold RWA exhibits a highly concentrated pattern. PAXG (issued by Paxos) and XAU₮ (issued by Tether) together account for over 95% of the market value share, far ahead of other projects. PAXG currently has a market value of approximately $460 million, while XAU₮ has a market value of about $380 million, with other projects like Cache Gold (CGO), TXAU, and WTGOLD being relatively small, with varying liquidity and compliance.

More critically, this sector is expanding in tandem with the spot gold price. Especially in the context of gold prices continuously breaking historical highs from 2024 to early 2025, the demand for on-chain gold has exploded, becoming a new phenomenon in the capital market that cannot be ignored.

However, such explosive growth also reminds the market that there are significant differences among projects in terms of the authenticity of underlying assets, audit transparency, and legal protections. Gold RWA that can truly stand out in turbulent cycles must possess strong physical backing and high compliance standards.

In the Midst of Change: The Strategic Significance of Gold RWA

From a macro perspective, Tether Gold represents not just a successful product experiment but also a reflection of deep changes in the global financial structure. The standardization, modularization, and tradability of gold in the digital world signify the birth of a new capital freedom: transcending sovereign systems, resisting fiat currency devaluation, and serving global capital flows.

It is also noteworthy that this trend is occurring at a time when U.S. interest rate policies are uncertain and global tariff barriers are re-emerging. In the context of the accelerating fragmentation of the global financial system and the continuous contraction of sovereign currency credit boundaries, gold is once again becoming part of a supranational trust system. Gold RWA provides a new technological carrier for this trust system.

However, the road for gold RWA is not without obstacles. The risks of pseudo RWA projects, the lag in legal governance, and the lack of standardized clearing systems may all become hidden barriers to the maturity of this sector. On-chain gold requires the reconstruction of trust systems, the establishment of rule frameworks, and the genuine integration of traditional finance and the digital world.

A more profound challenge lies in the fact that while gold possesses the characteristic of value storage, it inherently lacks a mechanism for "yield generation," which creates a certain tension with the capital logic of high turnover and high leverage pursued in the digital finance era. The success of gold RWA requires the exploration of application spaces that truly align with the new generation of global capital demands in terms of asset pricing, circulation scenarios, and cross-border settlement.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。