Source: Cointelegraph

Original: “BONK Surges 60% in a Week, Solana Ecosystem Memecoins Make a Comeback”

Main Summary:

Bonk (BONK) is the second-largest memecoin based on Solana by market capitalization, expected to continue its recovery that began on April 22. Since hitting a low of approximately $0.00001247 on April 22, BONK has surged about 73%, reaching an intraday high of $0.00002167 on April 28.

Data from Cointelegraph Markets Pro and TradingView shows that BONK is trading at $0.00001923, up 3% in the past 24 hours and 60% over the past week.

BONK/USD Daily Chart Source: Cointelegraph/TradingView

BONK's trading volume surged 98% in the past 24 hours to $478 million, and its market capitalization also increased, briefly touching $1.7 billion on April 28 before retreating to the current level of $1.5 billion.

Let’s explore the factors driving BONK's price surge over the past week.

Memecoins' Overall Recovery

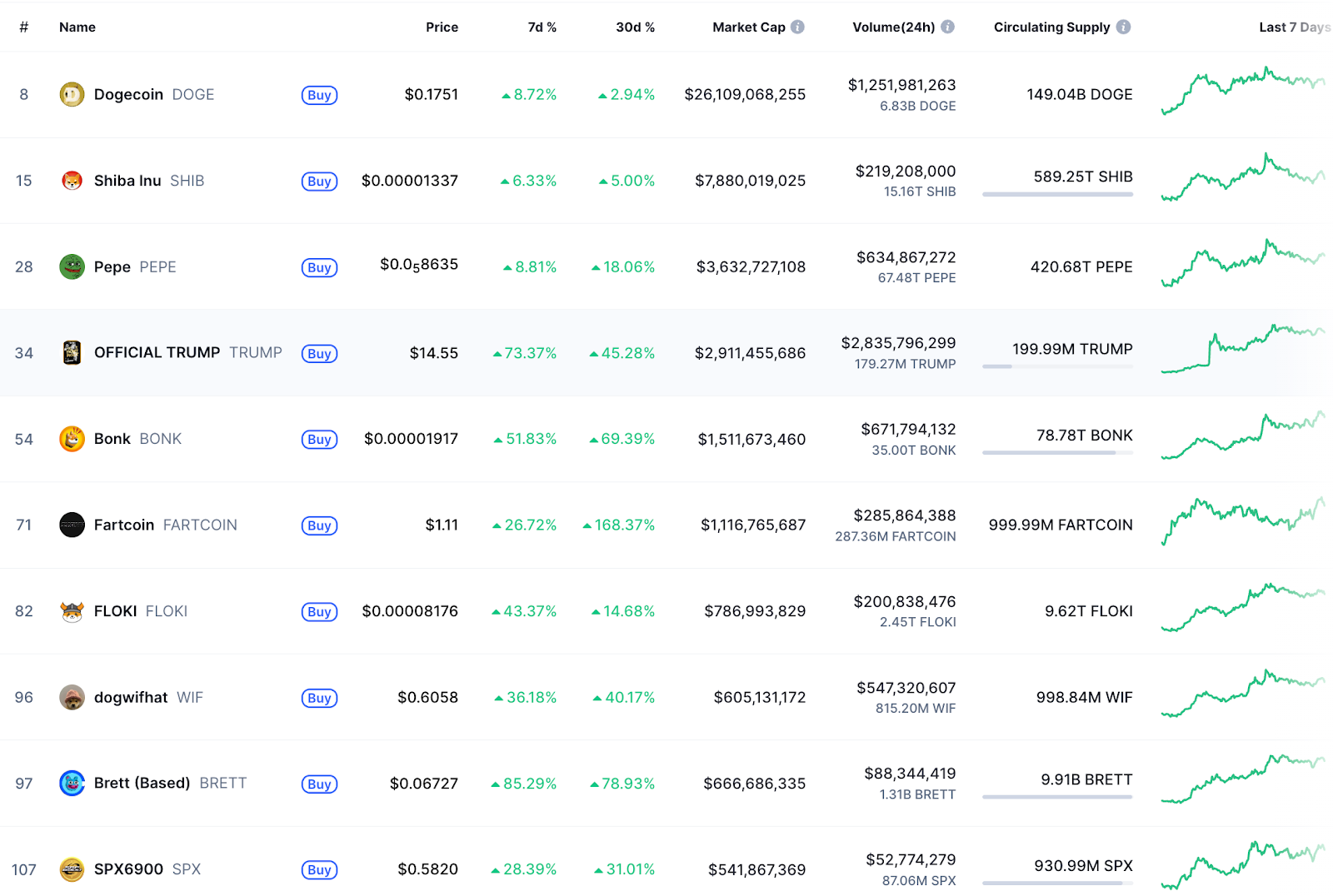

BONK's rebound over the past week reflects a bullish price trend across the entire cryptocurrency market, including the memecoin sector. Most memecoins have achieved double-digit gains over the past week. Leading memecoins DOGE and Shiba Inu (SHIB) rose 3% and 5%, respectively, in the past seven days.

The memecoin Official Trump (TRUMP), associated with former U.S. President Donald Trump, saw a weekly gain of 73%, while Base's Brett (BRETT) increased by 83% during the same period.

Performance of High Market Cap Memecoins Source: CoinMarketCap

This widespread rebound has pushed the total market capitalization of memecoins to $55.51 billion, a 17.5% increase over the past week, according to CoinMarketCap.

Memecoin Market Cap and Trading Volume Source: CoinMarketCap

In just the past seven days, the trading volume of memecoins exceeded $7.96 billion, marking an 85% week-over-week increase. This recovery is driven by investors once again favoring risk assets like memecoins.

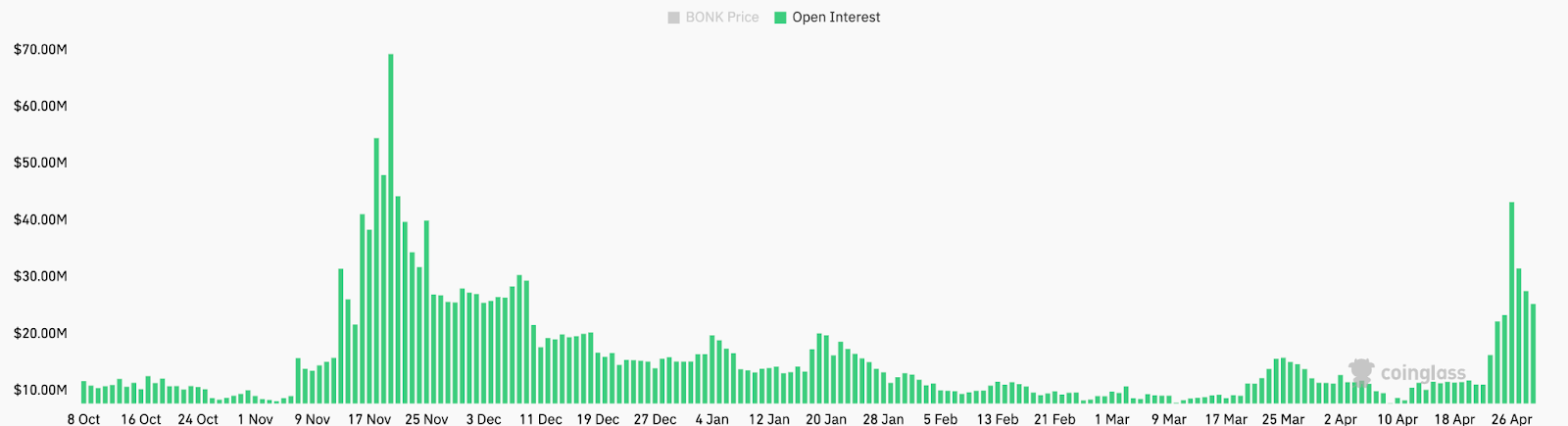

Increase in Open Interest Supports BONK's Rebound

The surge in BONK's price over the past seven days followed a significant increase in its open interest (OI).

The total OI for BONK across all exchanges skyrocketed from $11 million on April 22 to $43.2 million on April 26, a 290% increase. Although this metric has since dropped to $28 million as of the time of writing, it remains significantly higher than OI levels since December 2024.

The increase in open interest reflects greater trader participation in BONK futures, indicating enhanced speculative activity.

BONK Open Interest Across All Exchanges. Source: CoinGlass

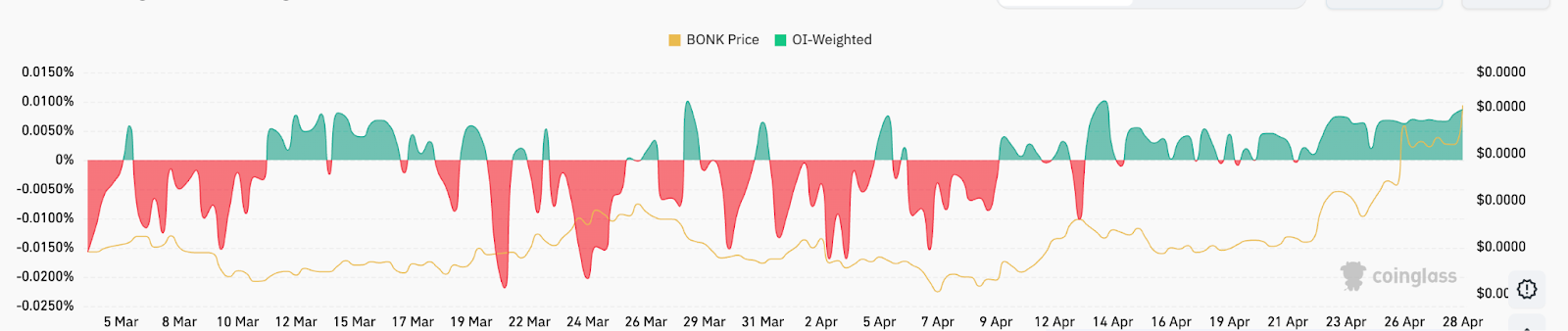

Data from CoinGlass shows that demand for leveraged long positions in BONK has been rising in recent days, as evidenced by the OI-weighted funding rates for futures.

Average 8-Hour Funding Rate for BONK Perpetual Contracts Source: CoinGlass

An increase in funding rates typically indicates that futures traders are bullish, expecting future price increases, which may signal a continuation of the upward trend.

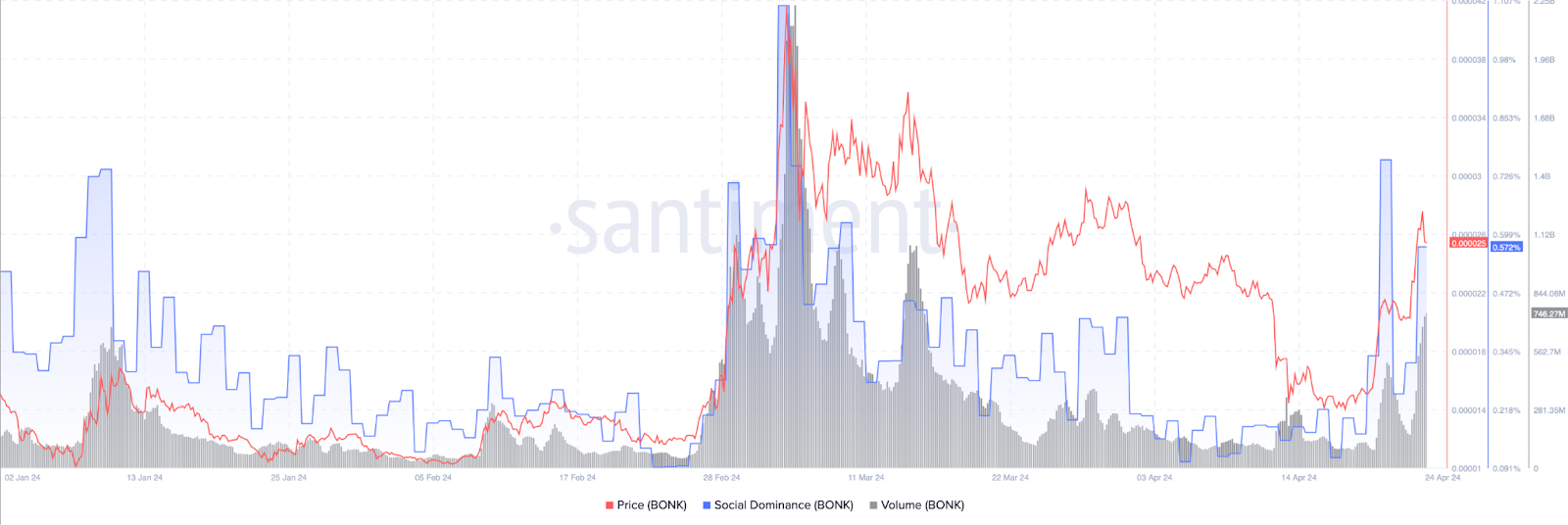

BONK's social dominance remains high, indicating active social engagement. Data from Santiment shows that driven by ecosystem enthusiasm, BONK's social dominance surged from 0.091% to 0.572% between April 20 and April 26.

BONK Social Dominance and Trading Volume Source: Santiment

The surge in discussions on social media platforms reflects rising retail and institutional interest, amplifying fear of missing out (FOMO) and driving demand.

BONK Breaks Months-Long Downtrend

On April 13, BONK's price broke out of a descending parallel channel, demonstrating strength by turning the 50-day and 100-day exponential moving averages (EMA) into support.

In the short term, bulls may continue to rebound towards the significant resistance level of $0.00002410 (200-day SMA). If the daily closing price exceeds this level with high trading volume, BONK could rise towards the range high of nearly $0.000040 from January 19, representing a 104% increase from the current price.

BONK/USD Daily Chart Source: Cointelegraph/TradingView

The sharp rise in the relative strength index and its position in the overbought zone at 71 reinforces the dominance of buyers in the market.

However, overbought conditions may prompt profit-taking, leading to a slight pullback in BONK before continuing the upward trend.

“$BONK's downtrend line has been broken,” noted prominent analyst World of Charts in a post on X on April 28, “Expecting a doubling in the coming days.”

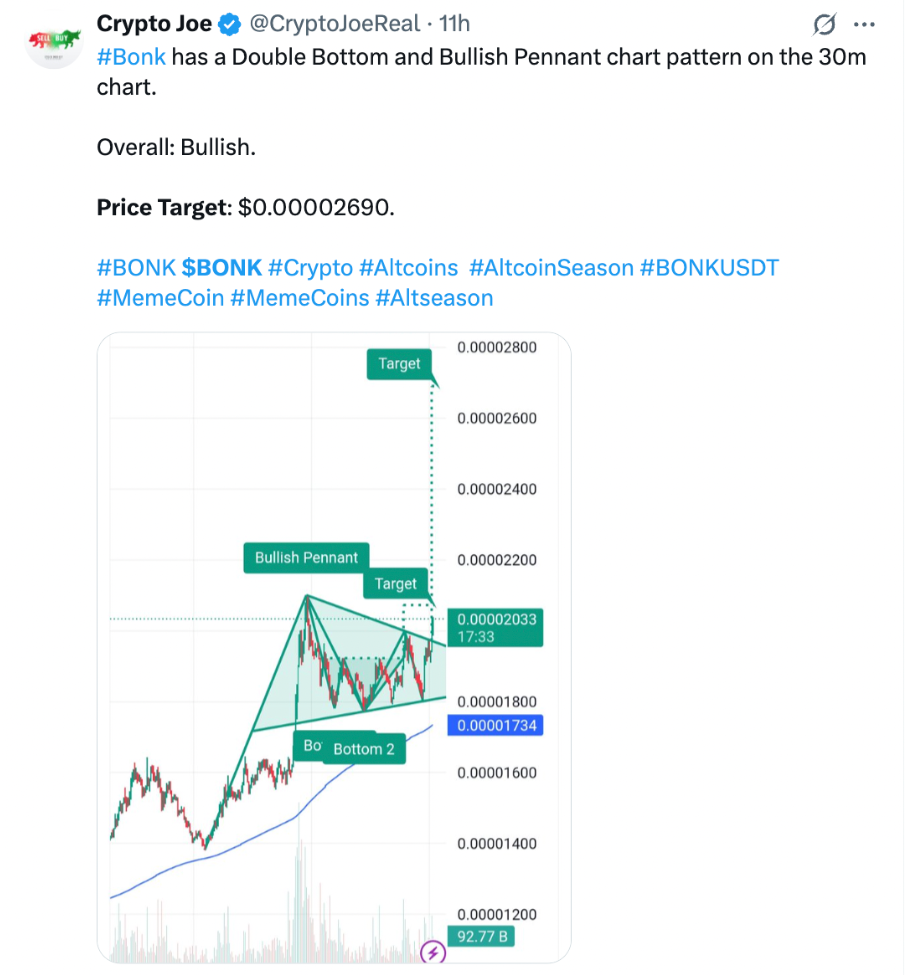

Meanwhile, Crypto Joe observed that BONK broke out of a bullish flag pattern on the 30-minute timeframe, with a target price of $0.00002690.

Source: Crypto Joe

This article does not contain investment advice or recommendations. Every investment and trade involves risk, and readers should conduct their own research before making decisions.

Related Articles: December Sees $1 Billion Surge in Solana (SOL) Stablecoin Scale

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。