Haedal's innovative products and strong data make it one of the preferred investment targets in DeFi.

Written by: nicoleliu.eth

Translated by: Tim, PANews

PANews Editor's Note: The Sui ecosystem's liquid staking protocol Haedal will conduct its TGE on April 29, allowing users to claim airdrops. The author of this article is a founding partner of Comma3 Ventures, which participated in the seed round investment of Haedal Protocol. Haedal Protocol is a hidden gem project in the liquid staking field within the Sui ecosystem. As the Sui staking market is poised for growth, Haedal's innovative products and strong data make it one of the preferred investment targets in DeFi.

Here are the reasons worth investing and the key points you need to pay attention to 👇 (All data as of April 15)

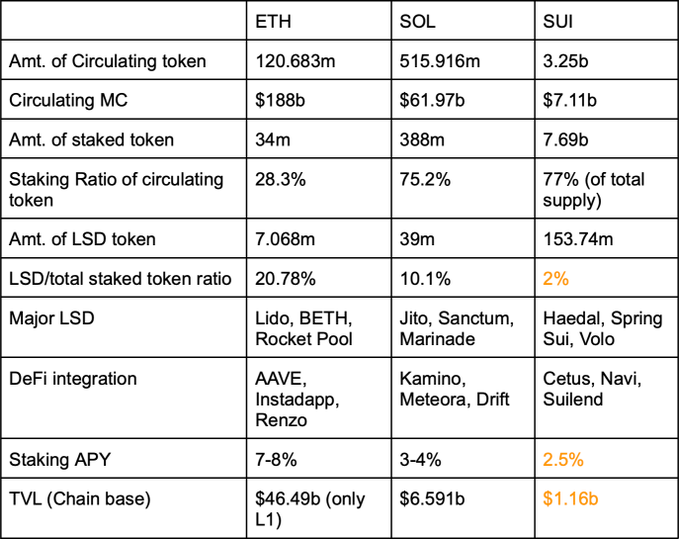

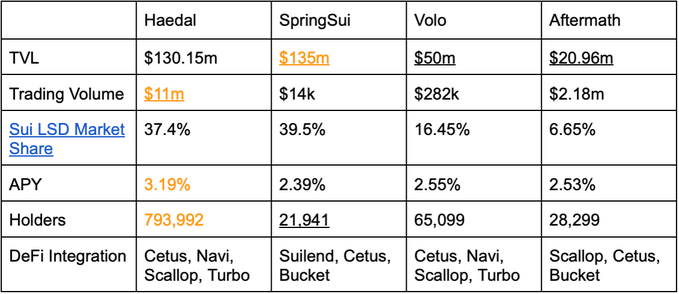

The liquid staking market on the Sui network is not yet thriving, with a total value of staked SUI at $307.48 million, of which only 2% is liquid. In comparison: on the Solana network, 10.1% of the total value of staked SOL at $4.29 billion is liquid; on the Ethereum network, 30.5% of the total value of staked ETH at $10.25 billion is liquid. As the Sui ecosystem develops, Haedal's staking protocol, currently with a TVL of $120 million, is expected to become the leader in liquid staking within the ecosystem.

A major issue in the liquid staking derivatives market on Sui is its low annualized yield, approximately 2.5%, while Solana's APY is 7-8% and Ethereum's is 3-4%.

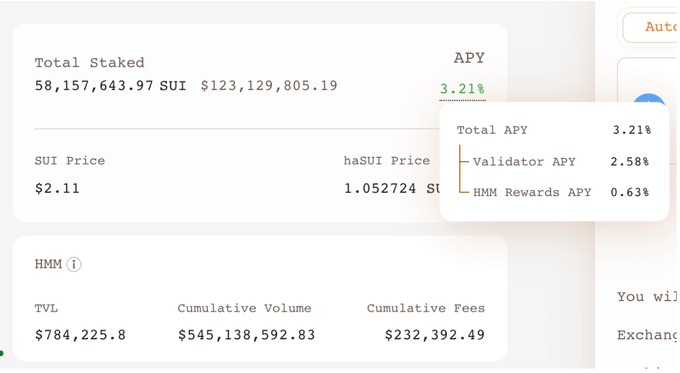

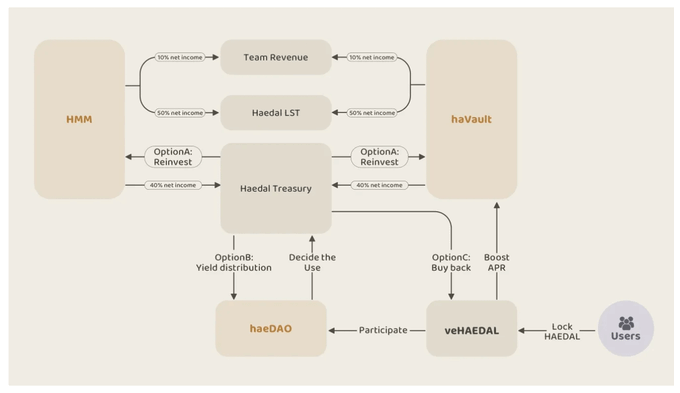

Haedal significantly enhances the staking performance on the Sui network by adopting a dynamic validator selection mechanism and the innovative Hae3 framework, which includes three main components: HMM, HaeVault, and HaeDAO, outperforming other LSD protocols.

Haedal selects the nodes with the highest APR when staking by monitoring the status of all network validator nodes. When unstaking, Haedal prioritizes withdrawing funds from nodes with lower APR, a strategy that continuously ensures that liquid staking tokens maintain a high annualized yield.

HMM (Haedal Market Maker) optimizes liquidity across various DEXs on the Sui blockchain by combining oracle pricing and real-time market data, charging a 0.04% trading fee.

From February to March, trading volume grew from $59.13 million to $284.15 million, generating $236,000 in fees, with an average TVL of $800,000 during this period. After allocating 50% of the revenue for incentives, the annualized yield of haSUI increased by 24.4%, rising from 2.58% to 3.21%.

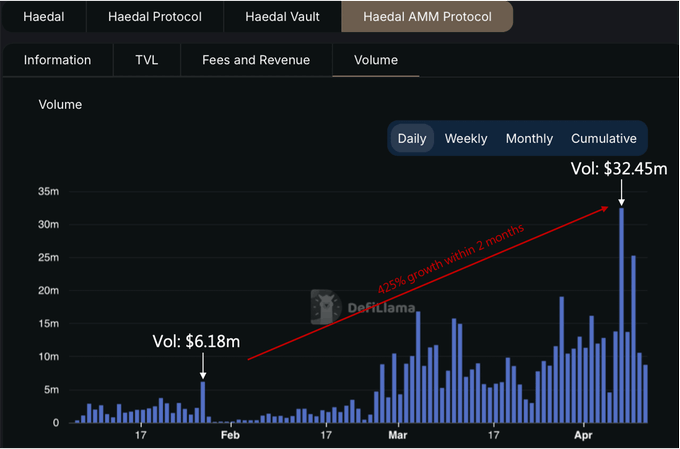

Cetus Protocol is the largest DEX in the Sui ecosystem, with a daily trading volume of $92 million. Haedal launched on January 6, 2025, and currently has a daily trading volume of $5.69 million, equivalent to 6.12% of Cetus's trading volume. By adopting an oracle pricing mechanism, HMM is poised for rapid revenue growth by capturing arbitrage trading volume.

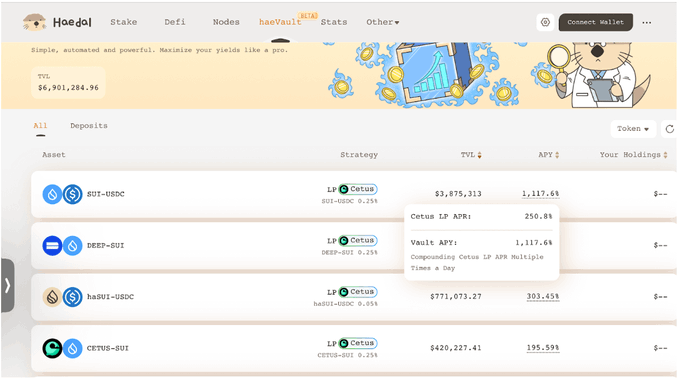

Haedal Vault simplifies the liquidity provision process for users with idle funds, eliminating the cumbersome management of LP positions, allowing users to easily deposit funds and earn higher returns.

HaeVault enhances returns through ultra-narrow rebalancing strategies. For example, for the SUI-USDC trading pair, the annualized yield provided by the Cetus platform is 250.8% (based on Cetus data), while HaeVault achieves an annualized yield of 1117%, with a net yield of 938% after deducting 16% in fees.

Hae3 is deeply integrated into the Sui DeFi ecosystem (with a TVL exceeding $1 billion). Among them, the HMM protocol captures DEX fee revenues, the Haedal treasury optimizes liquidity provider returns, and HaeDAO grants governance decision-making power.

Volo and Suilend, which focus on basic staking and lending services, lack this synergistic effect, making Haedal a superior yield optimizer.

The use case of the HAEDAL token further solidifies its application value. Locking it as a veToken allows participation in HaeDAO governance or enhances the treasury's annualized yield. Additionally, the potential airdrop opportunities (which are quite common in the Sui ecosystem) add extra advantages.

Haedal's core metrics are strong: TVL reaches $117.36 million (compared to Suilend's $117.4 million and Volo's $50 million), with over 44,000 daily active wallets and 794,000 holders. Currently, Haedal is temporarily leading in three key metrics: trading volume, annualized yield, and holder scale.

Support from VC institutions such as Hashed, Comma3, OKX Ventures, and Animoca Brands further demonstrates its potential.

Haedal stands out with a high-growth market (LSD penetration rate is only 2%, with 10 times the upside potential), innovative products, and solid fundamentals. As the Sui ecosystem expands, the protocol is well-positioned in the liquid staking field and is expected to become an industry leader.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。