Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

Stablecoins, as the backbone of the cryptocurrency market, not only serve as a medium of exchange with stable value but also play a crucial role in various fields such as DeFi, cross-border payments, and asset management. Between 2024 and 2025, the cryptocurrency market welcomed a batch of emerging stablecoin projects that quickly became the focus of the market due to their differentiated technological architectures and precise business positioning.

Stablecoins, as the backbone of the cryptocurrency market, not only serve as a medium of exchange with stable value but also play a crucial role in various fields such as DeFi, cross-border payments, and asset management. Between 2024 and 2025, the cryptocurrency market welcomed a batch of emerging stablecoin projects that quickly became the focus of the market due to their differentiated technological architectures and precise business positioning.

In this article, Odaily Planet Daily focuses on six notable new stablecoin projects: Ripple's RLUSD, WLFI's USD1, Usual's USD0, Ethena's USDe, SKY's USDS, and PayPal's PYUSD. We conduct an in-depth analysis from various dimensions including the background of their release, core technologies, market performance, revenue models, and user participation opportunities, providing readers with a clear observation guide to industry changes.

1. Ripple RLUSD

Ripple officially announced the launch of its stablecoin RLUSD, pegged 1:1 to the US dollar, in April 2024, marking a key step in the stablecoin sector. Its reserve assets consist of US dollar deposits, US short-term government bonds, and cash equivalents, providing a solid guarantee for price stability. In August of the same year, RLUSD began testing on the XRP Ledger and Ethereum mainnet, subsequently expanding its support to Chainlink's The Root Network, establishing a tri-chain parallel structure that supports cross-chain and bridging operations, greatly enhancing the flexibility of asset circulation.

On December 17, 2024, RLUSD received authoritative approval from the New York Department of Financial Services (NYDFS) and officially launched on global trading platforms such as Uphold, Bitso, and MoonPay, marking a significant breakthrough in its compliance process. Entering 2025, RLUSD's application scenarios continued to expand: in January, it was integrated into Ripple Payments, empowering real-time cross-border payment services; in April, Aave V3's Ethereum market provided support for it, successfully opening the door to the DeFi sector and further expanding its user base and market influence.

Standard Chartered Bank predicts that the stablecoin market will reach a scale of $2 trillion by 2028, and the launch of RLUSD is Ripple's strategic layout in this blue ocean market. On one hand, RLUSD helps Ripple consolidate its competitiveness in the global cross-border payment market, meeting the liquidity needs of the XRP ecosystem; on the other hand, RLUSD is highly aligned with Ripple's core business, becoming an ideal tool for corporate clients' cross-border payments by providing instant settlement services and reducing foreign exchange volatility risks.

Ripple has significant advantages in promoting RLUSD, with its global payment network covering over 90 markets and processing more than 90% of daily foreign exchange trading volume; compliance qualifications such as NYDFS licensing, along with cooperation experience with global exchanges like Bitstamp and Kraken, create a high market entry barrier. In terms of market positioning, RLUSD primarily targets B2B payment scenarios, serving financial institutions and corporate clients, while also extending its reach to retail investors and the DeFi market through platforms like Aave, striving to capture a larger share in the rapidly growing stablecoin market.

Classification

Mechanism: Non-algorithmic, relying on traditional financial asset reserves, emphasizing compliance and transparency, with monthly reserve reports published by third-party auditing firms (such as BPM).

Profitability: RLUSD itself does not provide direct returns but can participate in lending through DeFi protocols (such as Aave) to generate income.

Market Data and Performance

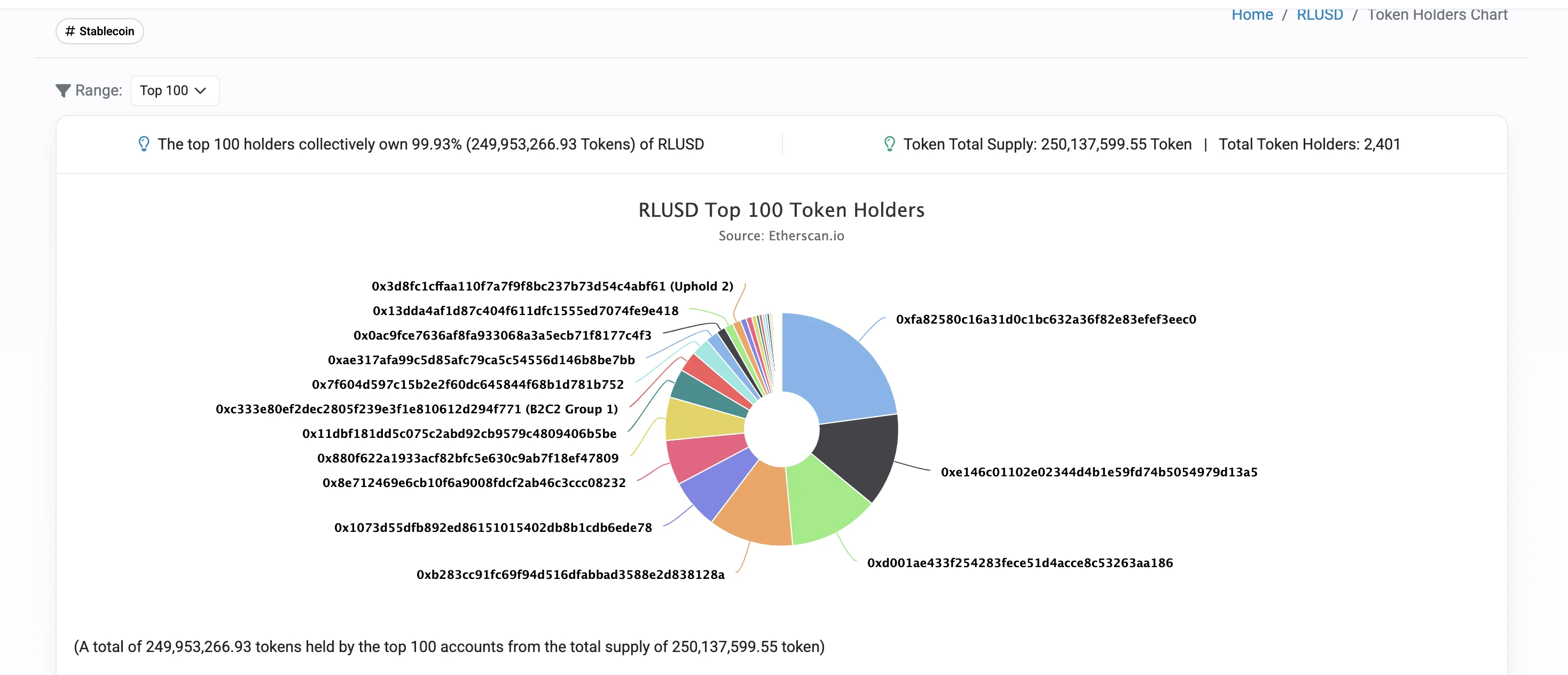

As of now, RLUSD's market capitalization and circulating supply are both around 317 million tokens (due to slight discrepancies in data across platforms), with a 24-hour trading volume of approximately $23 million, demonstrating active market liquidity. On-chain data shows that RLUSD is most concentrated on the Ethereum chain, with approximately 250 million tokens held by 2,401 addresses, and the top 100 wallets control 99.93% of the supply, indicating a highly concentrated distribution.

After RLUSD was launched on Aave V3 on the Ethereum mainnet, it supported the opening of lending functions, setting a supply cap of 50 million tokens and a borrowing cap of 5 million tokens. In the initial launch phase, the market response was enthusiastic, with deposits exceeding $76 million in just four days. Although affected by market fluctuations, the current deposit amount has fallen to $67.13 million, but it still maintains a high level, continuously providing stable liquidity support to the market.

User Participation Opportunities

Currently, RLUSD has not launched direct liquidity mining or staking reward mechanisms. Users wishing to earn returns can deposit RLUSD into the Aave V3 market on the Ethereum mainnet to participate in lending activities, with the annualized yield dynamically adjusted based on market conditions; additionally, users can also trade RLUSD against other stablecoins (such as RLUSD/USDC) on supported trading platforms like Curve and Kraken to participate in market trading for potential returns.

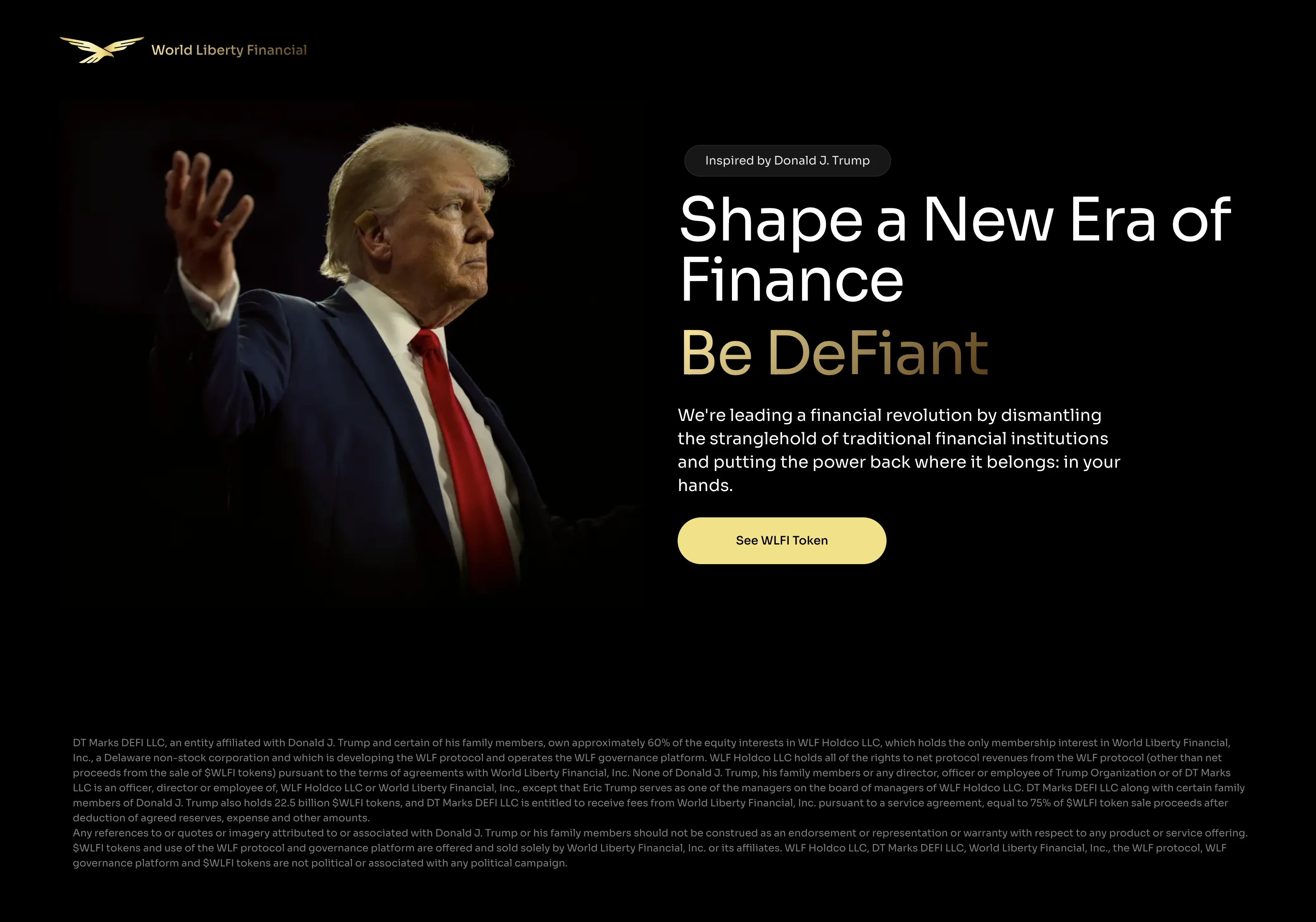

2. WLFI USD1

On March 25, 2025, World Liberty Financial (WLFI) officially launched the stablecoin USD1. This stablecoin claims to have the support of Trump and adopts a 1:1 peg to the US dollar mechanism, with 100% reserve support provided by US short-term government bonds, US dollar deposits, and other cash equivalents. Initially, USD1 was issued on Ethereum and Binance Smart Chain (BSC), with plans to expand to more blockchain networks in the future. In terms of asset security and transparency, its reserves are institutionally held by BitGo, regularly audited by third-party accounting firms, and incorporate Chainlink's Proof of Reserve (PoR) mechanism to ensure asset status is publicly verifiable.

WLFI's core business focuses on digital asset financial services, aiming to build a seamless bridge for users to engage in cross-border transactions and DeFi participation. The launch of USD1 aims to break down the barriers between TradFi and DeFi, leveraging Trump's influence to attract investors interested in related projects while enhancing its political and commercial influence in the crypto market, attempting to secure a place in the competitive stablecoin market through brand advantages and compliant operations.

The association of USD1's issuance with the Trump family creates a unique brand effect, bringing it significant market attention. This advantage not only attracts a large number of retail investors but also generates interest among institutional clients, becoming an important driving force for its market expansion.

Classification

Type: Fiat-backed.

Mechanism: Non-algorithmic, relying on traditional financial assets, emphasizing institutional-level custody (such as BitGo).

Market Data and Performance

On April 12, 2025, WLFI announced an airdrop proposal for early supporters of USD1, which sparked a strong market reaction. Although USD1 has not officially launched, its 24-hour trading volume on the Binance Smart Chain (BSC) and Ethereum platforms quickly climbed to nearly 44 million dollars. On April 16, leading crypto market maker DWF Labs announced a $25 million investment in WLFI and committed to providing liquidity support for USD1. This investment significantly enhanced USD1's market credibility, especially on the DEX PancakeSwap (BSC), where the activity of USD1 against trading pairs like BSC-USD saw a noticeable increase.

As of now, the total market capitalization of the USD1 token has reached $127 million, with circulating supply and market cap both at 127 million tokens. On-chain data shows that on the BSC chain, the total supply of USD1 is 113,479,585 tokens, with 1,812 holders, and the token's market cap on this chain accounts for a high 88.97%; while on the Ethereum chain, the total supply of USD1 is only 14,491,580 tokens, with just 322 holders, indicating that the circulating scale and user participation on the Ethereum chain are significantly lower.

User Participation Opportunities

Users can trade through DEXs (such as PancakeSwap) or wait for more DeFi protocols to integrate and launch. Additionally, it is recommended that users follow the official WLFI X account (@worldlibertyfi) to stay updated on the latest developments regarding USD1, airdrop plans, launch arrangements, and other important announcements, ensuring they grasp project progress in real-time.

3. Usual USD0

Launched by Usual Labs, USD0 is positioned as a yield-bearing stablecoin, pegged 1:1 to the US dollar. The project's core feature is the use of RWA for collateral, particularly short-term US government bonds or other low-risk assets, to ensure the stability of USD0. In this way, USD0 can circulate within the DeFi ecosystem while providing users with a low-risk, predictable stablecoin option.

Currently, USD0 is primarily issued and circulated across multiple blockchain platforms, including Ethereum, BNB Chain, and Base. The project offers a simple collateral mechanism, allowing users to mint USD0 by collateralizing USDC or other stable assets, thereby providing liquidity to the DeFi market. Additionally, Usual has launched USD0++, a special bond-type stablecoin (based on USD0's LST, similar to Lido's stETH). USD0++ offers approximately 4% annualized returns by locking in 4-year government bond assets, while also supporting liquidity mining and lending on DEXs like Uniswap V3 and Curve Finance.

Usual Labs launched USD0 to fill the market gap for high-quality and diversified stablecoins, especially in the DeFi sector. Through the deep integration of RWA and DeFi protocols, USD0 aims to enhance total value locked (TVL) and increase user participation. In the DeFi ecosystem, the high liquidity and price stability of stablecoins are crucial, but traditional fiat-backed stablecoins like USDT and USDC are often managed by centralized institutions, facing regulatory uncertainties and trust risks. In contrast, USD0, with its decentralized characteristics, provides a more attractive option for DeFi users.

In December 2024, Usual Labs partnered with Ethena, announcing that USDtb and sUSDe would be core to their future business strategy. The two parties plan to accept USDtb as collateral and gradually migrate some of USD0's supporting assets to USDtb, with Usual Labs also planning to become one of the main holders of USDtb.

Classification

Type: RWA-backed, reserves include short-term government bonds and some of Ethena's USDtb.

Mechanism: Non-algorithmic, relying on RWA and USDtb assets.

Market Data and Performance

On January 9, 2025, Usual Labs suddenly announced significant adjustments to the redemption mechanism of USD0++, drastically lowering the previously fixed 1:1 exchange rate to a minimum of 0.87 USD0. This move quickly triggered market turbulence, with the market price of USD0++ plummeting to $0.89, significantly deviating from parity with the US dollar. As many DeFi protocols had previously regarded USD0 and USD0++ as equivalent assets, this adjustment directly caused widespread chaos in the market, leading to rising dissatisfaction among users.

Looking back to early 2025, USD0's market capitalization had soared to a historical peak of approximately $1.9 billion. However, within just two months after the adjustment of the redemption mechanism, its market cap evaporated by about $1.2 billion, sharply declining to around $662 million, severely damaging market confidence in the protocol.

In response to the criticism, Usual Labs stated that this adjustment was part of a predetermined strategy aimed at repositioning USD0++ as a zero-interest bond-type product, distinguishing it from traditional stablecoins. However, due to the lack of prior notice and sufficient transparent communication, many users were unprepared for the change, leading to a trust crisis and a significant decline in liquidity within the USD0 ecosystem.

Related Articles:

“USD0++ Continues to ‘Depeg’, Should You Hold or Run?”

“In-Depth Analysis of Usual: The ‘Hidden Agenda’ Behind USD0++ Depeg and Cycle Loan Liquidation”

Also recommended is a memoir on the depeg of the stablecoin sUSD: “Synthetix Introduces Repair Measures, Can sUSD Repeg?”.

User Participation Opportunities

Users can stake USD0 on the Usual platform to obtain USD0++, earning an annualized return of 50% (Risk Warning: USUAL token rewards are linked to TVL). Alternatively, they can provide liquidity on protocols like Uniswap to earn returns.

4. Ethena USDe

USDe, launched by Ethena, is an innovative stablecoin whose collateral assets include both crypto assets like ETH and BTC, as well as RWAs like BUIDL, maintaining price stability through a diversified asset portfolio. Unlike traditional fiat-backed stablecoins, USDe uses crypto assets as its collateral foundation, leveraging smart contracts and algorithmic mechanisms to automatically and dynamically adjust the collateral ratio based on market fluctuations, ensuring price stability. This unique design grants it higher flexibility and transparency within the DeFi ecosystem. USDe is issued and managed by Ethena Labs, which has extensive experience in the blockchain and DeFi fields, and primarily circulates on mainstream blockchain platforms like Ethereum. Users can mint USDe by collateralizing various assets such as ETH, BTC, and USDC.

Ethena launched USDe to create a native trading and lending solution for the DeFi space, building a high-yield, decentralized stablecoin ecosystem that breaks the traditional stablecoin dependency on the banking system. In this process, Ethena collaborates with financial giant BlackRock to introduce RWA support, providing solid institutional-grade asset backing for USDe. At the same time, USDe is deeply integrated with well-known DeFi protocols like Aave and Morpho, effectively enhancing its liquidity; leveraging LayerZero's cross-chain strategy further expands its ecosystem coverage. The target audience for USDe focuses on DeFi-native users and institutional investors, primarily serving core scenarios such as lending, trading, and yield generation.

Classification

Type: Synthetic dollar stablecoin, combining crypto assets (like ETH) and RWAs (like BUIDL) for backing.

Mechanism: A combination of algorithmic and yield-bearing, generating returns through futures arbitrage and staking to maintain the dollar peg.

Market Data and Performance

USDe employs a delta-neutral strategy to maintain price stability, specifically using ETH as collateral while opening equivalent short perpetual futures contracts on derivatives exchanges. With this strategy, USDe can offer users annualized returns (APY) of over 25%, attracting significant attention and participation from DeFi users. This has made USDe the fastest-growing asset on Aave, with lending and staking demand far exceeding that of traditional stablecoins USDT and USDC. Additionally, within the Ethena protocol's ecosystem, $200 million in fees were generated in 2024, part of which was distributed to ENA token holders, enhancing user stickiness to the protocol and driving explosive growth in ENA token prices.

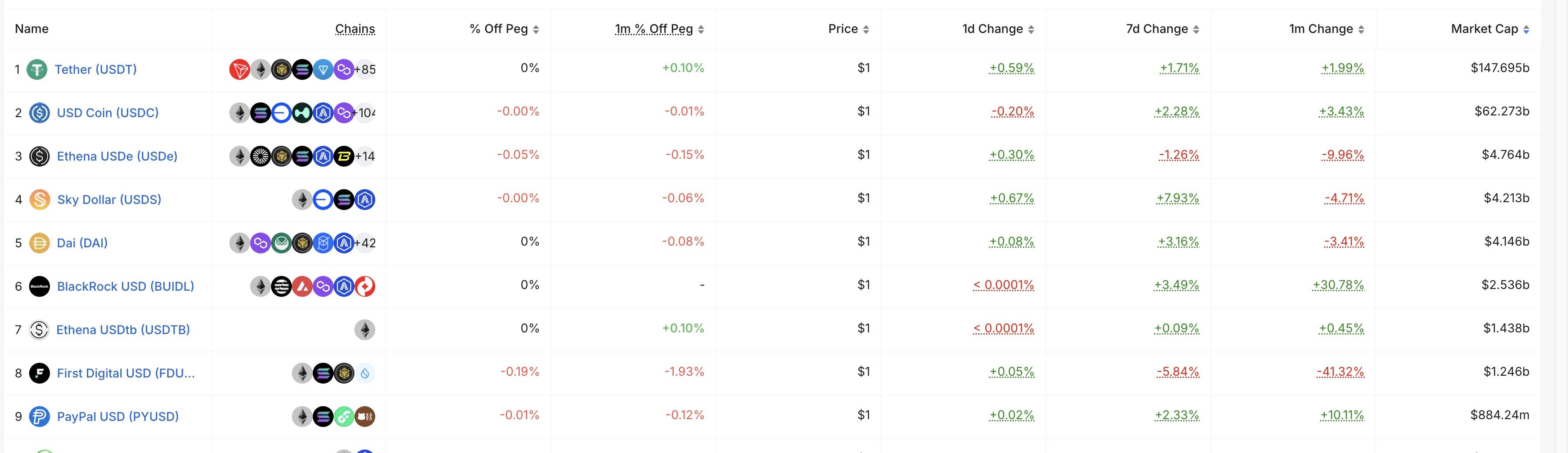

Market conditions are ever-changing, and USDe's total market capitalization has also been affected, declining from a peak of $5.9 billion in March this year. Nevertheless, USDe's total market cap currently stands at $4.7 billion. With its high-yield characteristics and the backing of financial giant BlackRock, USDe has successfully attracted widespread market attention, surpassing SKY's USDS to become the third-largest stablecoin in the market.

User Participation Opportunities

Users can stake USDe on the Ethena platform to achieve an annualized yield (APY) of approximately 27% with sUSDe, realizing asset appreciation; they can also choose to engage in arbitrage operations based on lending rate differentials on DeFi protocols like Aave and Morpho to earn returns. It is advisable to closely monitor market dynamics and carefully assess risks before proceeding with operations.

5. SKY USDS (Formerly Maker DAI Upgrade)

USDS, launched by Sky, is derived from the original MakerDAO protocol and also adopts a 1:1 peg to the US dollar, using crypto assets like ETH as the primary collateral. It is positioned as a decentralized stablecoin with a soft peg to the US dollar. As the successor to MakerDAO, Sky has comprehensively restructured and upgraded the original system, launching USDS and SKY as two native tokens, which serve the functions of stablecoin and ecosystem governance, respectively.

SKY launched USDS to consolidate its leading position in the DeFi space, creating a fully decentralized stablecoin solution that continues the successful legacy of MakerDAO. USDS is deeply integrated into SKY's core business, supporting decentralized lending and payment scenarios, and serves as an important part of the governance system, becoming a trusted medium of value storage and transaction for DeFi users. SKY possesses significant resource advantages: on one hand, it inherits the long-accumulated decentralized governance experience of MakerDAO, and on the other hand, it achieves extensive integration with mainstream DeFi protocols such as Aave and Compound. Additionally, through the governance token SKY, it builds a community-driven model that incentivizes users to actively participate in ecosystem development.

In terms of yield mechanism, USDS offers users an annualized yield of 6.25% through the Sky Protocol. Although this yield is lower than that of USDe, its more stable performance continues to attract users seeking steady returns.

Classification

Type: Crypto asset-backed, reserves include assets such as Ethereum and USDC.

Mechanism: A combination of algorithmic and collateralized, maintaining the peg through over-collateralization and dynamic stability fees.

Market Data and Performance

Total Market Cap: According to Defillama, the current total market cap of this token is approximately $4.22 billion.

Supported Blockchains: Primarily Ethereum, with Base, Solana, and Arbitrum.

Circulation Status: USDS has a low circulation volume, with a 24-hour trading volume of $2.78 million, which contrasts sharply with its total market cap.

User Participation Opportunities

Users can deposit USDS into the Sky Protocol to earn approximately 6.25% annualized yield (APY) while also earning additional SKY token rewards; they can also choose to participate in lending operations on DeFi protocols like Aave for profit. It is worth noting that since USDS primarily uses crypto assets as collateral, market fluctuations may lead to changes in the value of the collateral assets, thereby affecting yield stability. Users are also advised to fully assess risks before proceeding with operations.

6. PayPal PYUSD

PayPal USD (PYUSD) is a dollar stablecoin launched by PayPal in August 2023, strictly pegged 1:1 to the US dollar, fully backed by dollar deposits, short-term US government bonds, and cash equivalents. This stablecoin is issued by Paxos Trust Company and is available on the Ethereum and Solana blockchains. Users can conveniently purchase, sell, hold, and transfer PYUSD through the PayPal app, with use cases covering peer-to-peer payments, online shopping settlements, cryptocurrency exchanges, and more.

In April 2025, PayPal launched a PYUSD Deposit Program for US users, offering an annualized yield of 3.7%. Users only need to deposit PYUSD into their PayPal or Venmo wallets to receive rewards distributed in PYUSD, which can be flexibly used for daily payments, exchanged for fiat currency, or other cryptocurrencies, further promoting the adoption of PYUSD in the payment ecosystem.

PayPal's launch of PYUSD aims to expand its global payment ecosystem into the cryptocurrency space, optimizing user payment and transfer experiences in digital asset scenarios through the characteristics of stablecoins. As an extension of PayPal's core online payment and cross-border transfer business, PYUSD is committed to deeply integrating cryptocurrencies with existing payment networks to enhance user engagement and platform transaction volume. With over 400 million global users, a mature payment infrastructure, and close cooperation with Paxos, PayPal lays a solid foundation for the development of PYUSD while ensuring compliance and asset security. Its target market focuses on retail payment users and Web2 enterprises, attracting traditional financial users with low-risk returns while gradually penetrating the DeFi space to reach crypto-native user groups.

Classification

Type: Fiat-backed, 1:1 pegged to the US dollar, reserves consist of short-term government bonds and dollar deposits.

Mechanism: Non-algorithmic, relying on Paxos' custody and regulation.

Market Data and Performance

With PayPal's strong brand influence, PYUSD has successfully attracted many traditional financial users. However, compared to the average yield in the DeFi market, PYUSD's yield level is significantly lower, making it relatively weak in competitiveness within the DeFi space. Looking back at its market cap performance, PYUSD reached a historical peak of approximately $1 billion in August 2024, but due to fluctuations in the cryptocurrency market, its market cap gradually declined and is currently around $880 million, ranking ninth in the overall stablecoin market.

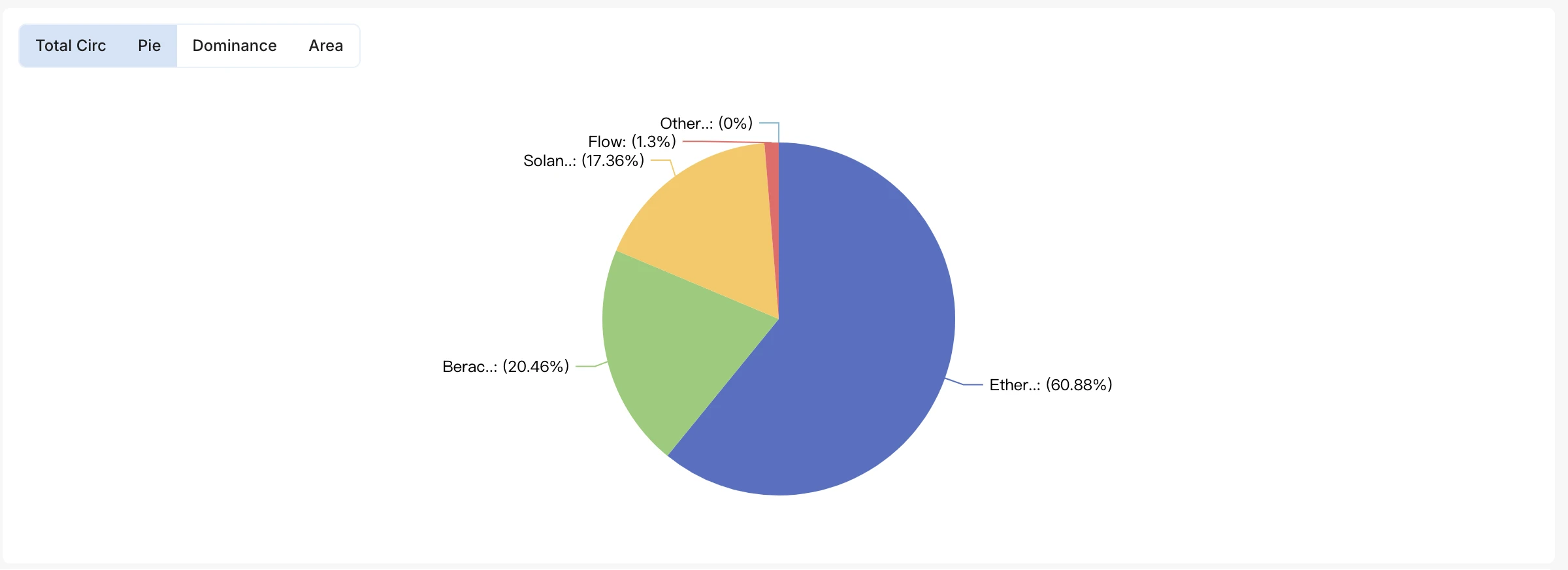

From a technical architecture perspective, PYUSD is primarily deployed on the Ethereum and Berachain blockchains, followed by Solana, supporting cross-chain payment functions that enhance asset circulation convenience. However, according to coinmarketcap data, its 24-hour trading volume is only $13.93 million, with a trading volume to total market cap ratio of 1.66%, reflecting that the current market circulation activity of PYUSD remains at a low level.

User Participation Opportunities

Users have two profit paths: on one hand, they can participate in the deposit program launched by PayPal, depositing PYUSD to enjoy an annualized yield of approximately 3.7% (APY), which is very friendly to traditional financial users; on the other hand, they can also trade PYUSD in DeFi protocols within the Solana ecosystem (such as Saber), capturing market opportunities through buying, selling, and exchanging.

Conclusion

Overall, these six stablecoins differ in target markets, yield models, collateral assets, and market performance. In the volatile sea of cryptocurrency stablecoins, some leverage traditional brand advantages, while others rely on innovative collateral models or yield strategies. However, the market is ever-changing, and no stablecoin can rest easy. In the future, those stablecoins that can balance yield and risk, continuously optimize product mechanisms, enhance user experience, and strengthen market expansion are more likely to stand out in this competition and lead the development trend of the stablecoin market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。