A predicament of complete failure regarding contract validity, liquidity control, and exit mechanisms.

Written by: ChandlerZ, Foresight News

Dai Shan, a partner at Waterdrop Capital, recently admitted in a Space that all four projects he invested in have gone live on Binance, yet none have issued tokens to investors as per the original investment agreements. Although the contract clearly states the token issuance terms, the agreements can be arbitrarily modified after the project goes live, leaving investors with almost no effective means of counteraction.

He stated that the modification of agreements is not the project parties' intention, but rather an unspoken rule of Binance, so he does not blame the project parties, as they are also in a weak position before Binance. The current strategy is very clear: to persuade and help truly high-quality project parties not to issue tokens, but to go directly to listing, seeking a relatively clean and regulated market to reflect their value.

The rights protection based on contracts in traditional VC investments does not have the same practical binding force in the structure of cryptocurrency token investments. Since the circulation rules after token launch are dominated by exchanges, on-chain asset distribution is not immediately constrained by traditional legal systems, and investment agreements often lose their enforceability at critical junctures. In the current market environment, whether a project can gain access to top exchanges directly relates to its overall survival, and the importance of contractual terms is marginalized in the face of actual interests. To achieve listing, project parties have no choice but to cooperate with exchanges on the redesign of release schedules, lock-up rules, token ratios, etc., while investors, lacking on-chain governance rights and circulation voice, find themselves in a de facto position of weakened rights.

This statement reveals a deep-seated crisis currently facing the cryptocurrency VC investment system, namely a predicament of complete failure regarding contract validity, liquidity control, and exit mechanisms.

The Imbalance of Power: The New Relationship Between VCs, Projects, and Exchanges

In the development of the industry over the past few years, the model of "project narrative construction - multiple rounds of VC financing - major exchange token generation events (TGE)/listing" has gradually become mainstream. The characteristics of this model include that early projects rely on professional VC institutions for capital injection, resource connection, and credibility endorsement, completing financing through gradually increasing valuations, with the ultimate goal usually being the initial issuance and circulation of tokens on large centralized exchanges, providing exit channels for early investors.

In previous bull markets, crypto VCs, as core resources, held significant power over early financing and token design, playing an important role in driving rapid industry expansion and project incubation. In the last bull market, the status of project parties improved, but VCs still maintained a degree of dominance due to their large capital and liquidity empowerment through platforms like Launchpad.

However, as the market enters a new adjustment cycle, the liquidity of altcoins has dried up, and the interest structure between investors and project parties has changed accordingly. The power of exchanges has risen unprecedentedly, becoming the absolute controllers of liquidity switches, with key processes such as listing approval, token distribution, and circulation strategies concentrated in the hands of exchanges, placing project parties in an extremely weak negotiating position. Even if detailed investment agreements are signed, project parties find it difficult to refuse adjustments to circulation conditions proposed by exchanges, ultimately having to violate the original agreements made with investors.

Exchanges have become controllers of scarce resources, while VCs are gradually marginalized, significantly reducing their actual control capabilities.

The "Prisoner's Dilemma" Under Liquidity Tightening

The current predicament faced by "VC tokens" is not caused by a single factor.

After multiple rounds of financing, the public market valuation of projects at TGE is often at a high level. This directly leads to a higher initial buying cost for secondary market investors, while also meaning that early investors, including VCs, teams, and early supporters, hold a large number of low-cost tokens, creating a strong potential selling motive.

This expectation gap creates natural selling pressure after the token goes live, leading market participants to potentially form a consensus that "selling is the optimal strategy," thus triggering a negative feedback loop.

Furthermore, the token economy itself exacerbates the predicament of VC tokens.

During bull markets, many projects' token issuance models rely on high-growth assumptions from the bull market, such as continuously rising market caps and sufficient liquidity to support gradual unlocking. However, in practice, many projects lack real income support, with DeFi relying on Ponzi schemes, GameFi depending on subsidies, and NFTs driven by FOMO, causing tokens to completely lose their intrinsic growth momentum.

Most critically, tokens invested in by VCs in the past could ultimately be sold to new retail investors in the secondary market, forming a complete exit path. However, currently, there are very few new retail investors on-chain and on exchanges, with incremental funds drying up, leading to a norm of VCs undercutting each other.

Essentially, early investors, project parties, market makers, and early users have turned into a zero-sum game within a closed loop, making exit increasingly difficult.

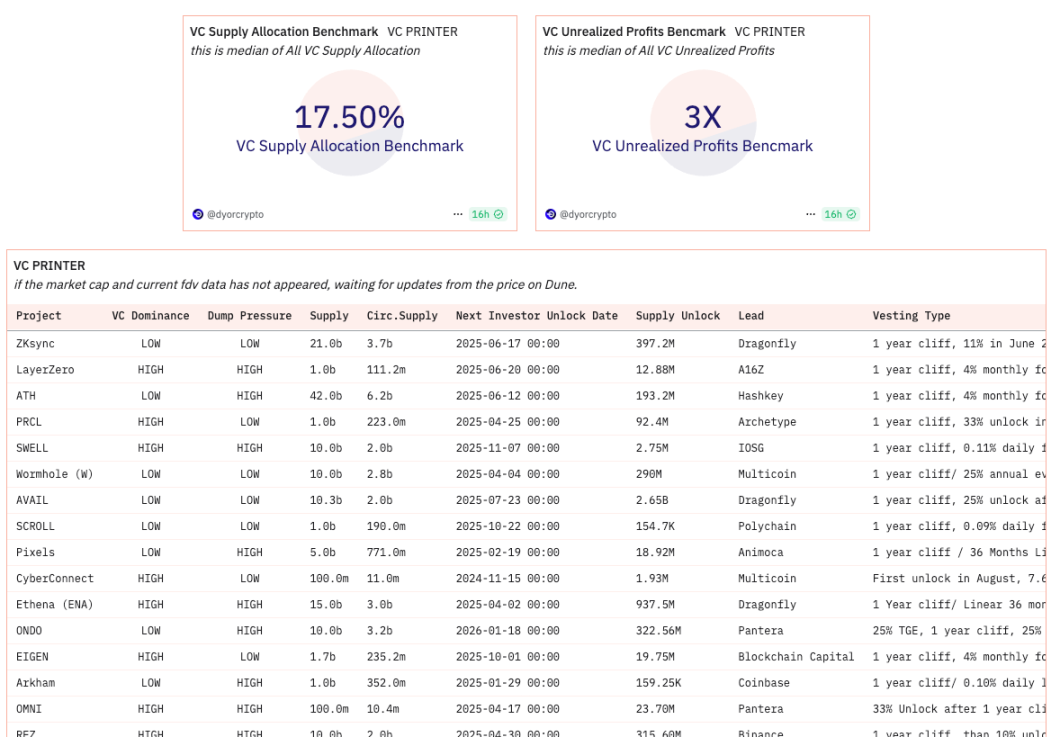

VC Returns in the Last Bull Market Cycle

VC Returns in the Current Cycle

For VC institutions, the traditional strategy of relying on rapid TGE for high multiple exits faces challenges, and the realization period for investment returns may be extended, increasing uncertainty. This may prompt VCs to pay more attention to the long-term fundamentals of projects, sustainable business models, reasonable valuations, and healthier token economic models in their investment decisions. Their role may also need to shift from focusing on early investments and promoting listings to deeper post-investment management, strategic empowerment, and ecosystem building.

For project parties, there is a need to reassess their token issuance strategies and community relationships. After the high-profile model has come under scrutiny, starting with lower valuations, implementing fairer issuance mechanisms, designing token economics that better incentivize long-term holders, and increasing operational transparency and accountability may be more worth exploring.

From a more macro perspective on industry development, the current challenges can be seen as an adjustment in the process of market maturation. It exposes the problems accumulated during the previous rapid development and may promote the formation of a more balanced and sustainable financing and development ecosystem. This requires all market participants, including VCs, project parties, exchanges, investors, and even regulatory bodies, to adapt to changes and seek to establish new balance points between innovation incentives and risk control, efficiency and fairness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。